Nvidia (NASDAQ:NVDA) – The AI chip manufacturer

is now the second most valuable company in the world after reaching

a record market value, surpassing $3 trillion and

Apple (NASDAQ:AAPL). With growing demand for its

AI chips, the company is also preparing for a ten-for-one stock

split, increasing interest from individual investors. This

valuation increase in Nvidia’s U.S. shares, which has been

concentrated among a few companies, raises concerns about market

reliance on these giants. This centralization in the S&P 500,

dominated by Nvidia and other megacaps, suggests the index’s

vulnerability to fluctuations in these few companies. Microsoft,

Nvidia, and Apple together have a combined market value of about

$9.2 trillion, surpassing the total $9 trillion of the Chinese

stock market, excluding Hong Kong.

ASML Holding NV (NASDAQ:ASML) – ASML is now the

second-largest listed company in Europe, surpassing LVMH in market

value after its shares jumped on Wednesday, valuing the company at

approximately €377 billion. This value is slightly higher than

LVMH’s, with ASML benefiting from the demand for its advanced

semiconductor manufacturing machines.

Microsoft (NASDAQ:MSFT) – The U.S. Department

of Justice and the FTC have agreed to investigate the antitrust

practices of Microsoft, OpenAI, and Nvidia in the AI industry. The

investigation is divided between Nvidia, led by the Department of

Justice, and OpenAI along with Microsoft, under the FTC’s

jurisdiction. The FTC is investigating the $650 million deal

between Microsoft and Inflection AI, suspecting it was structured

to avoid antitrust scrutiny. Documents have been requested to

ascertain whether the partnership was formed to give Microsoft

control over the startup without regulatory investigation.

Alphabet (NASDAQ:GOOGL) – A class-action

lawsuit accusing Google of abusing its dominance in the digital

advertising market can proceed in the UK after a favorable ruling

by the Competition Appeal Tribunal. The lawsuit, seeking up to

$17.4 billion (£13.6 billion) in damages, alleges that Alphabet

favored its own online advertising services from 2014 to 2022. In

other news, Gideon Yu, former CFO of YouTube and Facebook, is

leading an initiative to raise about $500 million for a fund

associated with Alphabet’s X lab. The fund, though independent,

will focus on investing in emerging startups from X, seeking

capital in a challenging venture capital environment.

Meta Platforms (NASDAQ:META) – Meta’s plan to

use personal data to train AI without explicit consent has been

criticized by the organization None of Your Business (NOYB), which

has called for action from European privacy regulators. NOYB

alleges that Meta intends to use users’ personal information in

ways that may violate EU privacy laws.

Salesforce (NYSE:CRM) – Salesforce, the

American enterprise software giant, is opening an artificial

intelligence center in London with over 40,000 square feet, capable

of accommodating more than 300 people. The company expects the

center to create 500,000 AI-related jobs in the UK. The official

opening will be on June 18, with an event to train more than 100

developers. This center is part of a $4 billion investment in the

UK over five years, including over $200 million in British

startups.

Amazon (NASDAQ:AMZN) – Zoox, Amazon’s robotaxi

unit, announced it will begin testing its autonomous vehicles in

Austin and Miami, marking its first test locations outside the

western U.S. The tests will include adapted Toyota Highlanders,

with safety drivers, in the commercial and entertainment areas of

the cities. Additionally, the Amazon Labor Union (ALU) agreed to

affiliate with the International Brotherhood of Teamsters,

expanding unionization efforts at Amazon. This decision follows the

ALU’s historic victory in April 2022, when workers at Amazon’s JFK8

warehouse in New York voted to unionize.

Walmart (NYSE:WMT) – Walmart will pay annual

bonuses of up to $1,000 to 700,000 hourly workers in the U.S., a

measure suggested by employee feedback. Both part-time and

full-time associates, after one year with the company and meeting

performance goals, are eligible.

Lockheed Martin (NYSE:LMT) – Lockheed Martin

has signed a contract with Firefly Aerospace for up to 25 launches

of the Alpha rocket by 2029. The launches, conducted from

facilities on the U.S. west and east coasts, will carry Lockheed

payloads and spacecraft to low Earth orbit.

Boeing (NYSE:BA) – After several technical

delays, Boeing’s new Starliner astronaut capsule, carrying two

astronauts, was successfully launched from Florida, marking its

first manned test flight. Additionally, Boeing CEO Dave Calhoun

will testify before a U.S. Senate panel about safety and quality

concerns that have limited 737 MAX production following incidents,

including a door failure during a flight. Calhoun will address the

measures the company has taken to improve safety.

Spirit AeroSystems (NYSE:SPR) – Spirit

AeroSystems announced on Wednesday that its CFO, Mark Suchinski, is

leaving the company amid cash flow difficulties and during

negotiations of a possible merger with Boeing, its former owner.

Suchinski will be replaced by Irene Esteves, a former Time Warner

Cable executive, and will remain for a transition period.

Ryanair (NASDAQ:RYAAY) – The EU’s General Court

upheld the validity of Spain’s $10.9 billion bailout fund to

support companies affected by the pandemic, rejecting a challenge

from Ryanair. The decision is a boost for the European Commission,

which faces other legal challenges over state aid approvals during

the pandemic.

American Airlines (NASDAQ:AAL) – The

Association of Professional Flight Attendants (APFA) unanimously

rejected American Airlines’ proposal, which included an immediate

17% pay increase and new profit-sharing. The union demands a

comprehensive contract that meets all its needs after years without

significant pay increases.

Spirit Airlines (NYSE:SAVE) – S&P Global

Ratings downgraded Spirit Airlines’ debt to “junk,” moving from

CCC+ to CCC. The agency foresees liquidity issues for the company

over the next 12 months and indicated a negative outlook due to

ongoing operational challenges. Spirit is negotiating

restructurings to avoid bankruptcy after failing to merge with

JetBlue.

Tesla (NASDAQ:TSLA) – Prominent investor Ron

Baron publicly supported Elon Musk’s controversial $56 billion pay

package at Tesla, which will soon be voted on by shareholders.

Baron argues that Musk, who receives no fixed salary and is

compensated in stock, is essential for Tesla’s continued success

and growth. The annual meeting on Musk’s compensation is scheduled

for June 13.

Toyota Motor (NYSE:TM) – Toyota announced on

Wednesday it will invest $282 million in Huntsville, Alabama, to

create new production lines. This financial injection will result

in approximately 350 new job openings.

Exxon Mobil (NYSE:XOM) – Vanguard, one of the

world’s largest investment management firms, supported the

re-election of Exxon’s directors despite expressing concerns about

the company’s lawsuit against climate activists, which could deter

future shareholder proposals. All 12 directors, including Chairman

Darren Woods, were re-elected, despite controversies involving the

withdrawal of a climate measure.

KKR & Co (NYSE:KKR) – KKR, Global

Infrastructure Partners, and the Indo-Pacific Partnership for

Prosperity have formed a coalition to invest $25 billion in

infrastructure in the Indo-Pacific region, including green data

centers in Indonesia and renewable energy in the Philippines and

India, announced U.S. Commerce Secretary Gina Raimondo.

Bank of America (NYSE:BAC) – Kempton Dunn has

moved to Bank of America as managing director after working at

Perella Weinberg Partners. He will focus on software and be based

in Palo Alto, reporting to the co-heads of global technology

investment banking. Dunn has experience in large deals and IPOs in

the tech sector.

Novo Nordisk (NYSE:NVO) – Novo Nordisk faces

increasing competition in China, where local pharmaceutical

companies are developing 15 generics of its Ozempic and Wegovy

drugs. With the semaglutide patent set to expire in 2026 and an

ongoing lawsuit, Novo may lose exclusivity for these treatments in

this key market.

Nike (NYSE:NKE) – Following LeBron James, Kevin

Durant, and Steph Curry, the NBA is anticipating the rise of new

stars. The next two weeks of games are crucial as young talents

like Jayson Tatum and Luka Doncic have the chance to establish

themselves as the next basketball and sneaker market icons.

Additionally, Nike is cutting costs in its global operations,

including a 2% workforce reduction. The European headquarters in

the Netherlands is facing layoffs as part of this $2 billion

savings plan. Layoffs in Europe began recently due to differences

in local labor laws.

Dollar Tree (NASDAQ:DLTR) – Dollar Tree is

evaluating options for its struggling Family Dollar business,

including a possible sale or spin-off. The review follows an

attempt to revitalize the 2015 acquisition, valued at $8.9 billion,

which has yet to yield the expected returns.

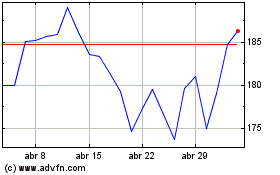

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024