Nubank expands services by partnering with Lightspark to integrate

Bitcoin Lightning Network

Nubank (NYSE:NU), the largest fintech bank in Latin America, has

partnered with Lightspark to integrate the Bitcoin Lightning

Network and Universal Money Addresses into its platform. This

collaboration aims to offer fast and low-cost transactions between

Bitcoin (COIN:BTCUSD) and fiat currencies. The initiative aligns

with Nubank’s goal to provide more efficient and economical

services to its customers through blockchain technology.

Solana launches “blinks” for crypto transactions on websites

The Solana Foundation (COIN:SOLUSD) unveiled a new feature

called Solana Actions and “blinks,” allowing direct transactions

via shareable links. This advancement enables any website to host

Solana transactions, facilitating everything from crowdfunding to

online purchases and on-chain voting. According to Jon Wong of the

Solana Foundation, websites and social media can distribute blinks

via physical QR codes or digital links. Security is emphasized with

trusted domain approvals to prevent fraud.

Crypto market recovers after significant declines

After hitting six-week lows, the price of Bitcoin (COIN:BTCUSD)

rebounded on Tuesday, reaching an intraday high of $62,130.84 and

is currently quoted at $61,684.33, up 2.36% in the last 24 hours.

This move comes amid a wave of massive sell-offs, with the RSI

hitting record low levels, indicating a possible reversal or

stabilization in future prices. Analysts point to a “massive

liquidity zone” around $65,000 as the next short-term target.

A tweet from Injective (COIN:INJUSD), hinting at a potential

collaboration with Fetch.AI (COIN:FETUSD), sparked speculation and

excitement in the crypto community on Tuesday, pushing the FET

price from an opening of $1.63 to an intraday high of $1.80. At the

time of writing, FET had reversed the gains and was down 1.23%,

quoted at $1.61.

The meme coin Bonk (COIN:BONKUST) also rose significantly on

Tuesday, from $0.000022 to $0.000024. The increase was driven by

expectations from technical and on-chain analyses, suggesting a

possible recovery in value after BONK lost nearly $2 billion in

less than two months. Additionally, a growth in social dominance

indicated increased interest and discussions about BONK, often

correlated with price hikes. Currently, the token is up 4.55%,

quoted at $0.000023.

Meanwhile, TonCoin (COIN:TONCOINUSD) and Ripple (COIN:XRPUSD)

rose up to 1%. Ethereum (COIN:ETHUSD) and Binance Coin

(COIN:BNBUSD) were up to 2%. Meanwhile, Solana (COIN:SOLUSD) and

Dogecoin (COIN:DOGEUSD) rose 5.12% and 7.53%, respectively.

German government sells $54 million in Bitcoin

The German government’s wallet made three transactions on June

25, selling a total of 900 Bitcoins, valued at over $54 million.

The transfers included 200 BTC to Coinbase, 200 BTC to Kraken, and

500 BTC to the unknown wallet “139Po”. This is not the first

interaction of the wallet with “139Po”, raising speculations about

its activities. With 46,359 Bitcoins remaining, the wallet could

influence the market, potentially affecting the Bitcoin price below

$60,000.

US Bitcoin funds see $174 million outflow

On June 24, US Bitcoin funds saw net outflows totaling $174.45

million, marking the seventh consecutive day of outflows. The

Grayscale ETF (AMEX:GBTC) led with outflows of $90 million,

followed by Fidelity’s ETF (AMEX:FBTC) with $35 million. Funds like

EZBC, HODL, BITB, Ark Invest, and others also recorded outflows,

while BlackRock’s IBIT (NASDAQ:IBIT) saw zero flow on Monday.

Bitcoin (COIN:BTCUSD) fell to its lowest level in six weeks,

briefly below $60,000, influenced by Mt. Gox’s announcement of

distributing $9 billion in bitcoins to creditors, raising investor

concerns about potential selling pressure.

VanEck advances with Ethereum ETF and expects quick launch

VanEck submitted Form 8-A for its Ethereum ETF to the SEC on

June 25, bringing the fund closer to direct trading. According to

Bloomberg analyst Eric Balchunas, based on the rapid progress of

the company’s Bitcoin ETF, the Ethereum ETF could begin trading by

July 2, 2024. The SEC’s lack of concerns about the process suggests

an accelerated approval and listing.

Optimistic outlook for US Ethereum ETFs according to Bitwise CIO

Matt Hougan, CIO of Bitwise, estimates that US spot Ethereum

ETFs will attract around $15 billion in the first 18 months after

launch. This expectation is based on Ethereum’s (COIN:ETHUSD)

relative market capitalization compared to Bitcoin and the dynamics

of the international exchange-traded product market.

Japanese institutional investor interest in cryptocurrencies grows

A survey by Nomura Holdings (NYSE:NMR) and Laser Digital

revealed that more than half of investment managers in Japan plan

to invest in cryptocurrencies over the next three years. The

survey, which included 547 managers, showed that 54% are inclined

to diversify their portfolios with digital assets. Managers cited

diversification, low correlation with other assets, and high return

potential as the main reasons, with many preferring to allocate

2-5% of their assets in crypto.

Metaplanet launches subsidiary to bolster Bitcoin strategy and

global expansion

Metaplanet (TSX:3350), a prominent company in the Bitcoin

market, founded Metaplanet Capital Limited in the British Virgin

Islands to manage its Bitcoin investments and explore international

markets. The subsidiary, led by Simon Gerovich with a capital of

$10,000, will strengthen the company’s Bitcoin-focused strategy.

Recently, Metaplanet purchased 141 Bitcoins and announced the

issuance of new bonds to finance more acquisitions, consolidating

its position as a powerhouse in Bitcoin strategy in Asia.

Bybit surpasses Coinbase to become second largest cryptocurrency

exchange

Cryptocurrency exchange Bybit achieved significant growth,

surpassing Coinbase Global (NASDAQ:COIN) in trading volume and

establishing itself as the second-largest exchange in the sector,

according to Kaiko. Since October 2023, Bybit doubled its market

share from 8% to 16%. This increase coincides with the launch of

spot bitcoin ETFs in January, boosting trading volumes across the

market. Bybit’s competitive fee structure has been a decisive

factor in attracting traders.

CEO of Delio states deposits had no principal protection guarantee

Jung Sang-ho, CEO of the South Korean cryptocurrency platform

Delio, facing legal issues after the company’s bankruptcy, stated

that he never promised the protection of investors’ principal

deposits. During a trial, he mentioned that the terms of service,

in compliance with the requirements of the Financial Intelligence

Unit of Korea, clarified that deposits were not guaranteed.

Creditors and the prosecution question the practice, while the

defense argues that the company’s financial movements were

limited.

Couple claims second payment in Celsius bankruptcy after payout

disparity

According to Cointelegraph, a couple holding corporate accounts

in the bankrupt Celsius moved to court demanding a second payment.

They claim they received 35% less than non-corporate account

holders, alleging Celsius delayed payments and converted them into

cash instead of cryptocurrencies, resulting in significant losses.

Represented collectively as “Faller Creditors,” four IRAs — BFaller

RD, BFaller ROTH RD, SFaller TRD RD, and SFaller RD — which before

the bankruptcy held more than $1 million in cryptocurrencies, now

seek a court order to receive $634,337.93 in Bitcoin, as adjusted

by the bankruptcy plan. These accounts are owned by Sheri Anne

Faller and Bernard Jacob Faller, as registered in the State of

California. A hearing is scheduled for June 27.

Regulatory and technological challenges of generative AI and the

role of blockchain

The expansion of generative artificial intelligence raises

critical questions for governance, especially in validating the

authenticity of content and identities in a world where AI can

replicate almost any media. To combat this, the Coalition for

Content Provenance and Authenticity (C2PA) is developing technical

standards to verify content provenance. However, these methods have

limitations, such as the possibility of metadata alteration.

Blockchain technology, with its ability to maintain immutable

records, is seen as a promising solution to ensure the integrity of

information. If implemented effectively and integrated with global

standards, it could help establish a new standard of digital

authenticity.

Blockchain democratizes investment in renewable energy

Blockchain technology is revolutionizing the renewable energy

sector by enabling smaller-scale investments in clean energy

projects like wind and solar. Previously restricted to large

investors, blockchain now offers the public the opportunity to

participate, paving the way for a “stock market” of renewable

assets. Plural Energy, a US startup, is leading the integration

between blockchain technology and the renewable energy sector. The

company’s CEO, Adam Silver, highlights that Plural Energy’s mission

is to enable ordinary investors to participate in financing clean

energy projects. Using blockchain, the company facilitates secure

and decentralized small-scale investments, allowing access to a

market traditionally dominated by large institutional

investors.

Proposed law seeks acceptance of Bitcoin for federal tax payments

Representative Matt Gaetz has introduced a bill proposing the

acceptance of Bitcoin (COIN:BTCUSD) for federal tax payments,

aiming to modernize the tax system. The measure seeks to integrate

digital currencies into the US financial system, promoting

innovation and flexibility for taxpayers. The legislation suggests

that the Secretary of the Treasury develop a plan that would

include regulations on the immediate conversion of Bitcoin to

dollars and specifications on receiving these payments.

Colosseum raises $60 million to invest in Solana startups

Colosseum, a new accelerator for Solana-focused startups,

announced it has raised $60 million for an investment fund. The

fund will focus on early-stage startups emerging from Solana

hackathons, promoting cryptographic innovation. Co-founder Clay

Robbins highlighted the diverse support from investors, emphasizing

the potential of the Solana ecosystem. Colosseum sees hackathons as

crucial catalysts for new companies, evidenced by the success of

its first event with 8,000 participants. So far, Colosseum has

invested $2.75 million in 11 emerging companies.

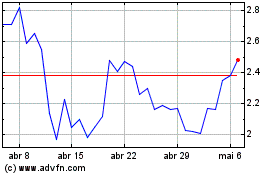

Fetch (COIN:FETUSD)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Fetch (COIN:FETUSD)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024