US Futures Climb Following Thursday’s Rally, Oil Prices Steady

09 Agosto 2024 - 6:50AM

IH Market News

U.S. stock futures advanced in pre-market trading on Friday,

extending the recovery seen on Thursday after Monday’s selloff.

Despite recent gains, the S&P 500, Nasdaq, and Dow are still

down for the week.

At 5:07 AM ET, Dow Jones futures (DOWI:DJI) rose 70 points or

0.18%. S&P 500 futures gained 0.34%, and Nasdaq-100 futures

advanced 0.53%. The 10-year Treasury yield stood at 3.967%.

In the commodities market, U.S. job data eased concerns about

demand, alongside tensions in the Middle East. Prices are also

supported by positive Chinese inflation data and heightened

geopolitical risks, such as conflicts in Gaza.

Global oil demand needs to increase faster to absorb the supply

rise that OPEC+ plans starting in October. So far, demand from the

U.S. and China has not met expectations, and an economic slowdown

might prompt OPEC+ to adjust its production plans.

West Texas Intermediate crude for September fell 0.04% to $76.16

per barrel, while Brent crude for October fell 0.05% to $79.12 per

barrel.

Asia-Pacific markets ended Friday higher, following Wall

Street’s gains. Australia’s S&P/ASX 200 rose 1.25% to 7,777.7.

Japan’s Nikkei 225 advanced 0.56% to 35,025. South Korea’s Kospi

climbed 1.24% to 2,588.43, and the Kosdaq gained 2.57% to 764.43.

In Hong Kong, the Hang Seng increased by 1.42%, while Mainland

China’s CSI 300 fell 0.34% to close at 3,331.63.

In July, China’s consumer prices rose 0.5%, surpassing the

forecast of 0.3% and accelerating from a 0.2% increase in June. In

contrast, producer prices fell 0.8%, slightly above the expected

0.9%, remaining stable from the previous month.

New yuan loans plummeted in July to about 450 billion yuan, a

79% reduction from June, reflecting low credit demand and seasonal

factors, though the value is higher than last year.

China’s securities regulator ordered brokers to review their

bond trading operations to curb excessive purchases, aiming to

prevent a potential market bubble and protect investors amid

economic instability and low deposit rates.

European markets are trading higher, attempting to recover from

recent instability and following gains in Wall Street and

Asia-Pacific. Sectors like travel, leisure, and mining led the

gains. Hargreaves Lansdown (LSE:HL.) and Lanxess (TG:LXS) are set

to announce quarterly earnings.

In July, Germany’s inflation rose to 2.6%, as confirmed by the

federal statistics agency, up from 2.5% in June.

On Thursday night, Bitcoin (COIN:BTCUSD) crossed the $60,000

mark, benefiting from the recovery of risk assets. Bitcoin’s price

is at $60,780 at the time of writing. Ether (COIN:ETHUSD) is

trading at $2,664. However, both cryptocurrencies are still on

track to post weekly losses, with Bitcoin and Ether down -6.93% and

-16.7% over the past 7 days, respectively.

U.S. stocks surged on Thursday. The Dow Jones climbed 683.04

points (1.76%) to 39,446.49, the S&P 500 rose 119.81 points

(2.30%) to 5,319.31, and the Nasdaq jumped 464.22 points (2.87%) to

16,660.02. The rally was driven by a Labor Department report

showing initial jobless claims fell to 233,000, down 17,000 from

the previous week, beating the expectation of 240,000.

Among individual stocks, Under Armour

(NYSE:UAA) soared after reporting an unexpected profit in the

fiscal third quarter. Eli Lilly (NYSE:LLY) rose

after better-than-expected second-quarter results and an upward

revision of its annual revenue forecast. Lattice

Semiconductor (NASDAQ:LSCC) jumped 13.3% after Raymond

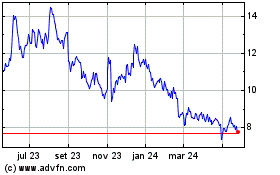

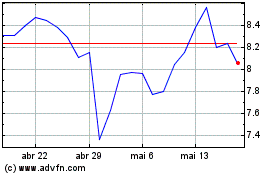

James upgraded its rating. In contrast, Warner Bros.

Discovery (NASDAQ:WBD) fell due to disappointing

second-quarter results and a $9.1 billion impairment charge.

On the earnings front, companies reporting before the market

opens include Canopy Growth

Corporation (NASDAQ:CGC), Nikola

Corporation (NASDAQ:NKLA), Embraer (NYSE:ERJ), New

Fortress Energy

LLC (NASDAQ:NFE), Construction

Partners (NASDAQ:ROAD), Berry

Corporation (NASDAQ:BRY), Legend

Biotech (NASDAQ:LEGN), Embecta (NASDAQ:EMBC), AMC

Networks (NASDAQ:AMCX),

and Algonquin (NYSE:AQN).

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024