Lingering Economic Concerns May Lead To Pullback On Wall Street

09 Agosto 2024 - 10:11AM

IH Market News

The major U.S. index futures are currently pointing to a lower

open on Friday, with stocks likely to give back ground after moving

sharply higher in the previous session.

Traders may look to cash in on yesterday’s rally, which saw the

S&P 500 post its biggest percentage gain since November

2022.

Lingering concerns about the outlook for the U.S. economy may

also weigh on Wall Street even after yesterday’s report showing a

bigger than expected pullback by weekly jobless claims.

Overall trading activity may be somewhat subdued, however, with

a lack of major U.S. economic data likely to keep some traders on

the sidelines.

Traders may also be reluctant to make significant moves ahead of

the release of key economic data next week, including closely

watched readings on inflation as well as reports on retail sales

and industrial production.

Among individual stocks, shares of Expedia (NASDAQ:EXPE) are

moving sharply higher in pre-market trading after the travel

technology company reported better than expected second quarter

results.

Cloud computing company Akamai Technologies (NASDAQ:AKAM) is

also likely to see initial strength after reporting second quarter

results that beat estimates and raising its full-year guidance.

On the other hand, shares of e.l.f. Beauty (NYSE:ELF) are seeing

significant pre-market weakness even though the company reported

better than expected fiscal first quarter results.

Stocks moved sharply higher during trading on Thursday, with the

major averages more than offsetting the downturn seen over the

course of the previous session. The major averages surged early in

the session and saw further upside as the day progressed.

The major averages moved roughly sideways going into the close,

hovering near their best levels of the day. The Nasdaq soared

464.22 points or 2.9 percent to 16,660.02, the Nasdaq spiked 119.81

points or 2.3 percent to 5,319.31 and the Dow jumped 683.04 points

or 1.8 percent to 39,446.49.

The rally on Wall Street came after the Labor Department

released a report showing first-time claims for U.S. unemployment

benefits pulled back by more than expected in the week ended August

3rd.

The report said initial jobless claims fell to 233,000, a

decrease of 17,000 from the previous week’s revised level of to

250,000.

Economists had expected jobless claims to edge down to 240,000

from the 249,000 originally reported for the previous week.

The bigger than expected decline came a week after jobless

claims reached their highest level since hitting 258,000 in the

week ended August 5, 2023.

The data helped ease concerns about the strength of the labor

market, which have contributed to recent selling on Wall

Street.

“Initial jobless claims are taking center stage as economists

and investors seek guidance from real-time indicators on the

economy’s health,” Nationwide Financial Markets Economist Oren

Klachkin.

“To us, the data suggest we’re on track for a cooldown – not a

recession,” he added. “However, risks are tilted to the downside

and the Fed should be vigilant for non-linearities as it maintains

a restrictive policy stance.”

Among individual stocks, athletic apparel company Under Armour

(NYSE:UAA) skyrocketed by 19.2 percent after reporting an

unexpected fiscal third quarter profit.

Eli Lilly (LLY) also moved sharply higher after the drug maker

reported better than expected second quarter results and raised its

full-year revenue guidance.

On the other hand, shares of Warner Bros. Discovery (NASDAQ:WBD)

slumped after the company reported disappointing second quarter

results and announced a $9.1 billion write down tied to its TV

networks.

Networking stocks turned in some of the market’s best

performances on the day, resulting in an 8.4 percent spike by the

NYSE Arca Networking Index.

Substantial strength was also visible among semiconductor

stocks, as reflected by the 6.9 percent surge by the Philadelphia

Semiconductor Index.

Shares of Lattice Semiconductor (NASDAQ:LSCC) soared by 13.3

percent after Raymond James upgraded its rating on the company’s

stock to Outperform from Market Perform.

Pharmaceutical stocks also saw considerable strength on the

upbeat results from Eli Lilly, with the NYSE Arca Pharmaceutical

Index jumping by 3.6 percent. Airline, computer hardware and

biotechnology stocks also moved notably higher, while telecom

stocks were among the few groups that bucked the upward trend.

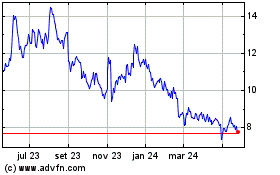

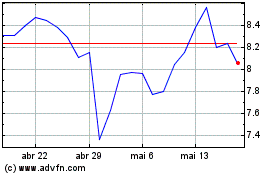

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024