Walmart (NYSE:WMT), JD.com

(NASDAQ:JD) – Walmart intends to raise up to $3.74 billion by

selling its 5.19% stake in the Chinese e-commerce company JD.com.

They are offering 144.5 million shares between $24.85 and $25.85

each, with Morgan Stanley as the broker. The sale aims to focus

resources on the company’s operations in China and other

priorities. JD.com shares fell 7.0% in pre-market trading, while

Walmart shares rose 0.1%.

Microchip Technology (NASDAQ:MCHP) – Microchip

Technology suffered a cyberattack that compromised servers and

operations, detected on August 17. The company isolated affected

systems and reduced operations to investigate, impacting its

ability to fulfill orders. The chipmaker, crucial for U.S. defense,

is still assessing the full financial impact of the incident.

Union Pacific (NYSE:UNP) – Union Pacific warned

that a potential rail strike in Canada would have “devastating

consequences” for the U.S. economy, with more than 2,500 railcars

affected daily. CEO Jim Vena highlighted that the impacts have

already begun and that the strike could increase costs for

industries and delay operations by up to five days.

Alphabet (NASDAQ:GOOGL), Energix

Renewables (USOTC:ENREF) – A U.S. appeals court ruled that

Google must face a lawsuit filed by Chrome users who allege

improper data collection, even after disabling synchronization with

their Google accounts. The court found that users may have been led

to believe their data wouldn’t be collected. Waymo, another

Alphabet subsidiary, doubled its paid rides to 100,000 per week in

three months, expanding its robotaxi services in areas like San

Francisco and Phoenix. The company, which operates 700 autonomous

vehicles, continues to grow despite skepticism and intense

regulation, with Alphabet planning a $5 billion investment.

Additionally, Energix Renewables announced a long-term agreement

with Google to supply electricity and renewable energy credits from

its solar projects, aiming to power the tech giant’s growing AI

data centers. Energix will initially provide 1.5 gigawatts by 2030,

with potential to expand the partnership. Alphabet shares rose 0.3%

in pre-market trading.

OpenAI – OpenAI has entered into a multi-year

partnership with Condé Nast to integrate content from brands like

Vogue and The New Yorker into its AI products, including ChatGPT

and SearchGPT. Financial terms were not disclosed. In recent

months, the company has also signed similar deals with other major

publications.

Texas Instruments (NASDAQ:TXN) – Texas

Instruments (TI) announced that its free cash flow (FCF) will

increase in 2026 as demand recovers and capital expenditures

decrease, following pressure from Elliott Investment Management.

TI, which expects revenue between $20 billion and $26 billion for

2026, estimates capital expenditures will range from $2 billion to

$5 billion, compared to initial plans of $5 billion per year

through 2026. Recently, TI said it expects to receive up to $1.6

billion to build new facilities under the U.S. CHIPS and Science

Act. The company has been expanding production to avoid chip

shortages but plans to reduce investments, boosting FCF per share

to $8 to $12 in 2026. Shares rose 0.9% in pre-market trading.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC inaugurated its first European factory in

Dresden, East Germany, with an $11 billion investment, half funded

by German government subsidies. The factory, focused on automotive

and industrial chips, will begin production in 2027. The initiative

is part of the EU’s strategy to produce 20% of global

semiconductors by 2030, reducing reliance on Asia amid geopolitical

tensions between the U.S. and China. TSMC holds 70% of the plant,

while Infineon, NXP, and Bosch each own 10%. Shares fell 1.3% in

pre-market trading.

Trump Media & Technology Group (NASDAQ:DJT)

– Shares of Trump Media & Technology Group closed down 3.71% to

$21.42 on Tuesday, marking the eighth consecutive session of

losses. The decline reflects Trump’s reduced chances in the

elections and his recent activity on the X platform. The company,

with a loss of $16.4 million in the quarter, saw its market value

fall to $3.776 billion. Shares rose 2.3% in pre-market trading.

Warner Bros Discovery (NASDAQ:WBD) – Warner

Bros Discovery announced plans to invest $8.5 billion in a new

studio in Las Vegas, provided the state grants promised tax

incentives. In partnership with the University of Nevada and

Birtcher Development, “Warner Bros. Studios Nevada” will be located

on a 34-acre campus, with complete facilities for film and TV

production.

Netflix (NASDAQ:NFLX) – Netflix shares reached

an intraday record on Tuesday before retreating to close up 1.43%.

The company reported more than 150% growth in advertising sales

commitments for 2024. Netflix’s advertising strategy, including

partnerships for upcoming releases and live events like “Squid

Game,” “WWE Raw,” and NFL games on Christmas, has generated

significant market excitement. Netflix launched an ad-supported

version in 2022, and this strategy has already reached 40 million

monthly active users globally as of May.

Walt Disney (NYSE:DIS) – India’s antitrust body

assessed on Tuesday that the $8.5 billion merger between Reliance

and Walt Disney could harm competition, especially due to control

over cricket broadcasting rights. The Competition Commission of

India (CCI) has asked the companies for explanations within 30

days, which could delay the deal’s approval. Shares rose 0.2% in

pre-market trading.

Hyatt Hotels (NYSE:H) – Hyatt Hotels will

purchase Standard International for up to $335 million, acquiring

brands like Standard and Bunkhouse Hotels. The deal includes 21

properties in global cities and over 30 new projects.

Kroger (NYSE:KR), Albertsons

(NYSE:ACI) – Kroger is offering $10.5 billion in bonds to finance

its $24.6 billion merger with Albertsons. The offering could be one

of the largest of the year. Citigroup and Wells Fargo are leading

the issuance. The merger faces regulatory and legal challenges.

Amazon (NASDAQ:AMZN) – Amazon’s heavy spending

on artificial intelligence, following a period focused on profits,

worries investors, fearing a negative impact on cash flow. Since

the August report, its shares have lagged behind other tech giants,

with the lack of dividends and share buybacks increasing pressure

on the company. Shares fell 0.1% in pre-market trading.

Lennox International (NYSE:LII),

Carrier Global (NYSE:CARR), Johnson

Controls (NYSE:JCI), Trane Technologies

(NYSE:TT) – HVAC companies are seeing growth due to increased

demand for air conditioning systems amid rising global

temperatures. The shift to new cooling systems and the need for

frequent replacements are also boosting their revenues. However,

these companies’ stocks have become more expensive, reflecting the

sector’s strong performance.

Uber Technologies (NYSE:UBER) – Uber hired

Rebecca Tinucci, a former Tesla executive, to lead its transition

to electric vehicles. Tinucci, who will start on September 16 as

the global head of sustainability, will be responsible for driving

Uber’s goal of fully electrifying its fleet by 2040, with a $800

million investment by 2025.

Tesla (NASDAQ:TSLA) – The European Union will

reduce import tariffs for Tesla’s China-made electric vehicles from

20.8% to 9%. Other electric vehicle companies will also see reduced

tariffs, but non-cooperating companies will face rates of 36.3%, up

from 37.6%. The decision follows a review of proposed measures.

Tesla received a lower tariff as Beijing offers fewer subsidies to

foreign companies. The measure is under consultation and could take

effect in November. Tesla shares fell 0.1% in pre-market

trading.

Rivian (NASDAQ:RIVN),

Stellantis (NYSE:STLA) – Rivian’s head of

manufacturing, Tim Fallon, is leaving the company to join

Stellantis as head of manufacturing in North America starting

September 2. His departure comes as Rivian expands its Normal,

Illinois, factory to produce the R2 SUV, a smaller and cheaper

model. Carlo Materazzo, a former Stellantis executive, will take

over production on an interim basis. Stellantis announced that its

investments in Belvidere, Illinois, will be delayed but stated that

it remains committed to the project and is not violating its union

contract. The United Auto Workers union, however, is considering

legal action and a possible strike, accusing the automaker of not

fulfilling its production commitments. Additionally, Stellantis CEO

Carlos Tavares will visit Detroit to develop a strategy to address

issues in the automaker’s North American operations, which are

facing declining sales and high inventories. He seeks to reassure

employees and investors and demonstrate his commitment to improving

the situation. Stellantis shares rose 1.2% in pre-market trading.

Rivian shares rose 0.5% after falling 2.4% on Tuesday.

Nio (NYSE:NIO) – Nio plans to install charging

stations in all 2,844 counties in China by June 2025 and expand its

battery swap stations to more than 2,300 counties by the end of

2025. The company already has over 23,000 charging stations and

2,480 battery swap stations. The swap stations promise to exchange

batteries in three minutes. Shares rose 2.1% in pre-market trading

after closing down 5.4% on Tuesday.

BP Plc (NYSE:BP) – Iraq has decided to share

profits with BP in developing the Kirkuk oil and gas fields,

abandoning low-margin service contracts to attract major Western

companies and boost production. BP, which returned after nearly

five years, signed a preliminary agreement to develop four fields

in Kirkuk. Shares rose 0.3% in pre-market trading after closing

down 2.2% on Tuesday.

Exxon Mobil (NYSE:XOM), Hess

(NYSE:HES), Chevron (NYSE:CVX) – An arbitration

panel will decide a dispute between Exxon Mobil and Chevron over

the value of Hess’s oil assets in Guyana after Chevron offered $53

billion to acquire Hess. Exxon argues that the deal with Chevron

should trigger a preemption right due to the high valuation of the

Guyana fields, while Chevron and Hess disagree, stating that no

change of control justifies the right. The outcome could impact the

merger and the economic benefits planned by Chevron. Both Exxon and

Chevron shares rose 0.3% in pre-market trading.

PayPal Holdings (NASDAQ:PYPL), Adyen

NV (EU:ADYEN) – Adyen NV will integrate PayPal’s FastLane

checkout, facilitating quick purchases for consumers and expanding

PayPal’s reach. This collaboration marks the first public

partnership between the rivals, benefiting both by leveraging

Adyen’s merchant network and consumer trust in PayPal. PayPal

shares closed up 3.5% on Tuesday and rose 0.2% in pre-market

trading.

Bank of America (NYSE:BAC) – BofA strategists

recommend caution with AI investments, suggesting a focus on more

stable assets. Despite impressive gains in tech stocks, enthusiasm

for AI may have peaked, with growth expectations for AI ETFs

declining. They indicate sectors like consumer goods and finance as

promising alternatives.

Wells Fargo (NYSE:WFC) – Wells Fargo decided to

sell its commercial mortgage servicing business to Trimont, making

it the largest commercial real estate debt servicer in the U.S.

With the deal, Trimont will manage $640 billion in loans. Wells

Fargo remains focused on its core operations, while Trimont

strengthens its leadership in the sector. The deal is likely to

close in early 2025.

Citigroup (NYSE:C) – Citigroup notes that the

carry trade is back, but now hedge funds are borrowing in U.S.

dollars instead of yen. This shift is due to expectations of U.S.

interest rate cuts, making the dollar more attractive for these

operations, especially in emerging markets.

KKR & Co. (NYSE:KKR) – KKR and Japanese

real estate company Hulic have made a $2 billion offer to buy the

Shiodome City Center, a skyscraper in Tokyo, from Singapore’s

sovereign wealth fund GIC. The sale, potentially one of the most

expensive in Japan, could be affected by ongoing discussions and

changes in the real estate market.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson announced the acquisition of V-Wave for up to $1.7

billion, aiming to expand its market for heart disease devices.

J&J will pay $600 million upfront, with up to $1.1 billion

additional contingent on regulatory and commercial milestones.

Eli Lilly (NYSE:LLY) – Eli Lilly shares closed

up 3.05% on Tuesday after the company announced that its

tirzepatide medication reduced the risk of type 2 diabetes by 94%

in adults with prediabetes and obesity. Tirzepatide also helped

patients lose an average of 22.9% of body weight, outperforming

semaglutide. Shares rose 0.2% in pre-market trading.

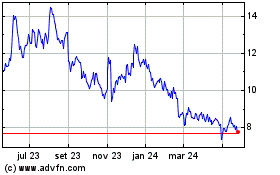

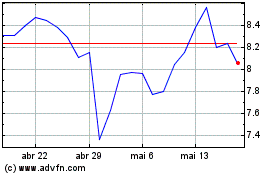

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025