GameStop (NYSE:GME) – GameStop announced an

offering of up to 20 million shares. In Q2, GameStop reported

revenue of $798.3 million, compared to $1.16 billion in the same

period last year. Net income was $14.8 million (4 cents per share),

while the prior year showed a $2.8 million loss (1 cent per share).

Analysts expected $895.7 million in revenue, marking a significant

miss on estimates. Shares dropped 10.9% in pre-market trading after

closing down 3.3% on Tuesday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group shares rose for the second

consecutive day on Tuesday, closing up 3.3% ahead of the Trump vs.

Kamala Harris debate and amid expectations that Trump and other

insiders may soon sell their shares for the first time. In

pre-market trading, shares fell 16.3%.

GSK Plc (NYSE:GSK) – GSK’s experimental herpes

vaccine failed to achieve desired efficacy in an initial test,

although it did not present safety concerns. The immediate

financial impact is limited as the vaccine was not included in

revenue forecasts. GSK will continue analyzing the data for future

innovations. Shares fell 1.0% in pre-market trading, after closing

up 0.4% on Tuesday.

Alphabet (NASDAQ:GOOGL), News

Corp (NASDAQ:NWS) – News Corp estimated a $9 million loss

in advertising revenue in 2017 due to reliance on Google for ads,

as reported by a former executive during the second day of Google’s

antitrust trial. She alleged that Google manipulated the market to

favor its own tools, limiting options for publishers. The antitrust

case aims to prove that Google monopolized the ad market.

Nvidia (NASDAQ:NVDA) – Nvidia investors are

concerned about delays in the release of the Blackwell chip, which

has faced engineering issues. CEO Jensen Huang is expected to

provide updates at the Goldman Sachs conference today. Shares

dropped 0.6% in pre-market trading, after closing up 1.5% on

Tuesday.

Dell Technologies (NYSE:DELL) – Dell

Technologies will continue to reduce its workforce to control

costs, facing low demand for PCs and reduced margins in AI servers.

The company expects a continued reduction in employee numbers

through February 2025, despite stock appreciation and entry into

the S&P 500. Shares fell 0.6% in pre-market trading, after

closing up 0.7% on Tuesday.

Sony (NYSE:SONY) – Sony announced a PlayStation

5 Pro priced at $700, surpassing the Xbox Series X at $600. The PS5

Pro offers enhanced performance, targeting a loyal audience willing

to pay a premium. The strategy may increase Sony’s margins despite

high costs and competition with gaming PCs. Shares closed up 2.1%

on Tuesday.

Rubrik (NYSE:RBRK) – Rubrik shares closed down

1.5% on Tuesday as the end of its IPO lockup period approaches,

typically pressuring prices. Rubrik reported Q2 revenue of $205

million, beating the analyst consensus of $196.2 million. The

adjusted loss per share was 40 cents, better than the expected 49

cents per share.

Amazon (NASDAQ:AMZN) – Amazon Web Services

(AWS) announced a $10.45 billion investment in the UK over the next

five years to expand data centers. The project is expected to

contribute £14 billion to the UK GDP and create over 14,000 jobs,

driven by demand for cloud and AI services. Shares fell 0.2% in

pre-market trading after closing up 2.4% on Tuesday.

FedEx (NYSE:FDX) – FedEx announced that

collection and delivery services in Louisiana could be affected by

Tropical Storm Francine, which is intensifying into a hurricane.

Areas such as New Orleans and Lafayette may face disruptions, with

updates to be provided as the storm progresses.

Boeing (NYSE:BA) – Boeing and one of its

largest unions reached a tentative agreement that includes a 25%

wage increase and plans to build a new plane in Seattle. However,

the union expressed dissatisfaction, with many members seeking a

40% raise and pension plan restoration. If the agreement is

rejected, the new CEO, Kelly Ortberg, could face a strike that

would impact production. Shares fell 0.2% in pre-market trading,

after closing up 1.7% on Tuesday.

Ford Motor (NYSE:F) – Ford is negotiating with

the state of Tamil Nadu, India, to restart its local production

focused on exports. After halting manufacturing in India three

years ago due to weak sales, Ford is considering the Chennai plant

for electric vehicles and exports. Shares fell 0.1% in pre-market

trading after closing down 3.2% on Tuesday.

Honda Motor (NYSE:HMC) – Honda is cutting jobs

and pausing production at three plants in China to reduce

inventories and adjust its EV strategy. Over 2,000 employees will

receive redundancy packages. The company faces a 21.48% drop in

sales in China during the first half of 2024 and is adapting to the

growth of EVs in the Chinese market. Shares closed down 2.2% on

Tuesday.

Nikola (NASDAQ:NKLA) – A U.S. judge ruled that

Nikola founder Trevor Milton, convicted of fraud, must pay $167.7

million to the electric truck maker. The decision upholds an

arbitration award requiring Milton to cover most of a fine and

legal fees. Shares rose 2.1% in pre-market trading after closing

down 2.7% on Tuesday.

RTX (NYSE:RTX) – RTX CEO Greg Hayes warned of

ongoing global supply chain problems and a shortage of skilled

labor in the aerospace industry. Despite high demand, supply chain

recovery and shortages of parts and workers remain significant

challenges. Shares fell 0.7% on Tuesday.

Airlines – The Biden Administration is drafting

a rule that would require compensation for passengers on flights

delayed or canceled by more than three hours. Set for January 2025,

the measure would mandate cash compensation, meals, and lodging.

The goal is to align U.S. practices with those of the EU and other

countries.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines announced board changes, with Chairman Gary Kelly retiring

while CEO Bob Jordan remains. The company is responding to activist

investor Elliott’s demands for substantial board reform. Six

directors will depart, with new ones potentially nominated by

Elliott. Shares closed down 1.6% on Tuesday.

Delta Air Lines (NYSE:DAL) – The FAA is

investigating a collision between two Delta planes on a taxiway in

Atlanta on Tuesday morning. An Airbus A350 hit the tail of a

smaller regional jet, damaging both, but no injuries occurred.

Delta re-accommodated passengers and expects no further operational

disruptions. Shares rose 0.9% in pre-market trading after closing

down 0.6% on Tuesday.

Walt Disney (NYSE:DIS) – DirecTV rejected Walt

Disney’s proposal to temporarily restore the ABC network to allow

subscribers to watch the presidential debate. DirecTV argued that

the three-hour restoration would cause confusion, and subscribers

could watch the debate on other networks.

Dave & Buster’s Entertainment (NASDAQ:PLAY)

– Dave & Buster’s reported adjusted earnings per share of

$1.12, beating estimates of $0.91. Revenue reached $557.1 million,

up 2.8% year-over-year, but below the $567.33 million forecast.

Despite a 6.3% drop in comparable sales, adjusted EBITDA margin

rose to 27.2%. The company expects continued growth in the coming

quarters. Shares surged 12.3% in pre-market trading after closing

down 0.8% on Tuesday.

Starbucks (NASDAQ:SBUX) – Starbucks’ new CEO,

Brian Niccol, focuses on revitalizing U.S. store culture, improving

customer service and experience, and optimizing the supply chain

and mobile app. Niccol plans to refresh stores, turning them into

welcoming environments again after digital orders reduced customer

space. He also plans to strengthen the brand in China and address

boycott issues in the Middle East. Shares fell 0.2% in pre-market

trading after closing up 1.2% on Tuesday.

Tapestry (NYSE:TPR), Capri

Holdings (NYSE:CPRI) – Tapestry argues that merging with

Capri would allow for price increases and fewer discounts,

according to an executive during the trial. The FTC opposes the

merger, claiming it would reduce competition and raise prices. The

trial, in New York, is expected to conclude soon.

Nike (NYSE:NKE) – At its annual meeting, Nike

shareholders rejected a proposal to form binding agreements with

workers to improve human rights in the supply chain. The proposal,

backed by the Domini Impact Equity Fund, also called for a

worker-led social responsibility report. Nike has stated it already

has robust labor issue controls. Additionally, Nike canceled its

large annual “Just Do It Day” in Oregon, opting for smaller events

at global offices. Instead of big celebrity parties, the company

will host themed events for sports tournaments and bring athletes

for local interactions, due to its significant presence at the

Paris Olympics.

Campbell Soup (NYSE:CPB) – Campbell Soup is

rebranding to “The Campbell’s Company” to reflect its

diversification beyond soups, including sauces and snacks like

Goldfish. CEO Mark Clouse emphasized the company’s focus on 16 core

brands and announced a $250 million cost-cutting program.

Petco (NASDAQ:WOOF) – Petco exceeded Q2

earnings expectations, reporting $0.06 per share instead of the

expected $0.02 loss. Revenue was $1.52 billion, in line with

forecasts. The company projects EPS between -$0.03 and -$0.04 next

quarter, with revenue of $1.5 billion, below expectations. Shares

fell 5.5% in pre-market trading after closing up 7.7% on

Tuesday.

Goldman Sachs (NYSE:GS) – Goldman Sachs is set

to sell its General Motors credit card business to Barclays in a

deal worth approximately $2 billion. The move is part of Goldman’s

strategy to focus more on consumer services, which could negatively

impact Q3 results. Additionally, the bank appointed Raghav Maliah,

Yoshihiko Yano, and Ed Wittig as co-heads of M&A for

Asia-Pacific, aiming to expand the region’s coverage. Maliah is

based in Hong Kong, Yano is in Japan, and Wittig will join the team

later this year. Shares fell 4.4% on Tuesday, following a revenue

decline forecast.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway reduced its stake in Bank of America by $229 million,

lowering it to under $34 billion. It now holds 11.1% of shares

after selling 5.8 million shares recently. Continued sales could

reduce the stake to 10% or less, eliminating frequent SEC

notifications. Regarding Occidental Petroleum, shares fell 15% in

2024, below the average price Berkshire paid. Buffett appears less

interested in Occidental, particularly after the company faced

financial struggles and maintained high debt.

Bank of America (NYSE:BAC) – Bank of America

CEO Brian Moynihan praised Warren Buffett for his investment but

mentioned that he didn’t ask for an explanation regarding the

recent stake reduction. Berkshire Hathaway has sold nearly $7

billion in BofA shares since July. Moynihan also noted that rising

capital requirements could limit the bank’s lending and said that

investment banking revenue is expected to remain stable at around

$1.2 billion in Q3. Shares fell 0.3% in pre-market trading after

closing down 1.7% on Tuesday.

Citigroup (NYSE:C) – Citigroup reported that

tech companies are considering IPOs in the U.S. during the last

quarter of the year. Paul Abrahimzadeh, co-head of Citigroup’s

North American equity capital markets, expects IPO growth to

accelerate in 2025, driven by a potential decrease in interest

rates. In other news, Citigroup’s chief accounting officer,

Johnbull Okpara, resigned to explore new opportunities. Robert

Walsh will serve as interim chief accounting officer, while Patrick

Scally will be the interim controller. Okpara will assist with the

Q3 close and transition, after nearly four years of helping

strengthen the bank’s financials.

UBS Group AG (NYSE:UBS) – UBS has developed an

AI tool that quickly analyzes data from 300,000 companies to

support mergers and acquisitions. The tool helps generate ideas,

identify buyers, and assess activist campaigns. While promising,

the implementation faces compliance and liability challenges. UBS

has been using the tool for a year. Shares rose 0.7% in pre-market

trading after closing down 1.3% on Tuesday.

Santander (NYSE:SAN) – Banco Santander

announced the sale of a 5.2% stake in its Polish subsidiary,

Santander Bank Polska, for $633.6 million. After the sale,

Santander will retain a 62.2% stake. The funds will be used for

growth and share buybacks. The transaction, at a 7.9% discount, is

expected to close by Friday. Shares rose 0.4% in pre-market trading

after closing down 2.1% on Tuesday.

HSBC Holdings (NYSE:HSBC) – HSBC has initiated

a strategic review of its Malta unit following the appointment of

Georges Elhedery as CEO. The bank is evaluating options for its 70%

stake in the operation and promised to provide more information in

the future. This sale would be the first major transaction under

Elhedery’s new leadership.

Charles Schwab (NYSE:SCHW) – Charles Schwab is

being sued by Ruth Rootenberg, 92, who lost $278,000 in a scam. The

elderly woman claims the brokerage ignored warning signs and failed

to prevent fraud. Schwab asserts that it followed its policies and

defends its actions. Shares fell 0.3% in pre-market trading after

closing up 0.1% on Tuesday.

Corebridge Financial (NYSE:CRBG) – Corebridge

Financial CEO Kevin Hogan expects the company’s $5.5 billion

alternative portfolio to generate 8% to 9% returns annually over

the long term, though it returned about 4% last quarter. He expects

similar performance this quarter, with losses in hedge funds offset

by gains in real estate.

US Steel (NYSE:X) – Nippon Steel’s vice

president, Takahiro Mori, will meet with U.S. officials in

Washington to advocate for its $14.9 billion acquisition proposal

for US Steel. The deal faces opposition from the Committee on

Foreign Investment in the U.S. (CFIUS) and politicians concerned

about national security issues.

Anglo American Plc (LSE:AAL) – Anglo American

sold 13.94 million shares of Anglo American Platinum at 515 rand

each, raising about $402 million. The sale, representing about 5.3%

of Amplats shares, aims to increase liquidity before a complete

exit from the South African company as part of a restructuring

plan.

Exxon Mobil (NYSE:XOM) – Exxon CEO Darren Woods

warned that the company may sue activist shareholders who abuse the

proxy proposal process, as occurred with climate resolutions in

January. Woods said that while Exxon doesn’t oppose shareholder

proposals, it will demand proper use of the process. Shares rose

0.5% in pre-market trading after closing down 3.6% on Tuesday.

SLB (NYSE:SLB) – SLB announced breakthroughs in

its lithium extraction technology, recovering 96% of the metal at a

test plant in Nevada. Using a faster and more environmentally

friendly approach than traditional evaporation, the company aims to

produce commercial lithium in a smaller footprint. The DLE

technology promises greater efficiency and sustainability and could

transform lithium supply. Shares rose 0.4% in pre-market trading

after closing down 2.0% on Tuesday.

Deere (NYSE:DE) – Deere agreed to pay $9.93

million to settle SEC charges of bribery involving its subsidiary

in Thailand. The company was accused of offering improper gifts and

services to win contracts, violating integrity standards. The

settlement includes a fine, disgorgement, and interest.

Walgreens (NASDAQ:WBA), Teva

Pharmaceutical (NYSE:TEVA) – Baltimore announced a

settlement with Walgreens over allegations that the pharmacy

contributed to the city’s opioid crisis. According to Reuters, the

settlement amount, undisclosed, could be around $80 million,

similar to the agreement with Teva. The city seeks larger

recoveries outside national settlements to recover more funds.

Novo Nordisk (NYSE:NVO) – Researchers found

that Novo Nordisk’s obesity drug Liraglutide may be safe and

effective for overweight children as young as six years old. In a

study, children taking the drug had an average 5.8% reduction in

BMI compared to a 1.6% increase in the placebo group. Shares rose

1.0% in pre-market trading after closing down 1.6% on Tuesday.

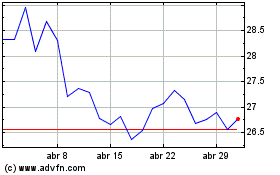

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024