Visa (NYSE:V) – The US Department of Justice is

suing Visa, accusing the company of illegally monopolizing the

debit card market. The lawsuit, which will take place in federal

court, is based on the company’s anti-competitive behavior. The

investigation began in 2021 to determine whether Visa prevents

competition. Shares fell 1.8% in pre-market trading after closing

up 1.4% on Monday.

Meta Platforms (NASDAQ:META) – Meta plans to

announce deals with celebrities like Judi Dench, Kristen Bell, and

John Cena to voice its Meta AI chatbot. The announcement will be

made during the Connect conference, where the company will also

unveil new augmented reality glasses. Celebrity voices will begin

rolling out this week. Shares rose 0.7% in pre-market trading after

closing up 0.6% on Monday.

Stellantis (NYSE:STLA) – Stellantis has begun

the search for a successor to CEO Carlos Tavares, whose contract

ends in January 2026. Tavares, who has led the company since its

inception, faces pressure to improve operations in North America,

where the automaker is experiencing significant drops in sales and

profits. The company plans to cut vehicle inventories and prices.

Stellantis also denied breaching commitments with the United Auto

Workers (UAW) regarding a 2023 agreement, as the union prepares for

a strike. UAW President Shawn Fain accused the company of delays in

investments, especially in a new battery plant in Illinois and

production of the Dodge Durango SUV. Additionally, Stellantis

partnered with Leapmotor to start taking orders in Europe for an

urban car and SUV, expanding its low-cost electric vehicle lineup.

The T03 model will launch from €18,900, while the C10 SUV will be

available in October at €36,400. Shares rose 1.2% in pre-market

trading after closing up 3.0% on Monday.

Apple (NASDAQ:AAPL) – Last Friday, Apple’s

stock initially looked promising but dropped more than 2% before

the close, surprising the market. A large imbalance of sell orders

indicated the disposal of 30 million shares, possibly due to funds

taking advantage of the quarterly adjustment to sell. Shares rose

0.6% in pre-market trading after closing down -0.8% on Monday.

Constellation Energy (NASDAQ:CEG) – Jefferies

analysts provided estimates on Microsoft’s payment to Constellation

Energy, highlighting the growing demand for clean energy to power

data centers and AI technologies. They estimated that Microsoft

will pay Constellation between $110 and $115 per MWh in a 20-year

PPA related to the Three Mile Island plant. Joe Dominguez, CEO of

Constellation Energy, stated that to meet the growing electricity

demand for AI, the US must adopt a similar approach to China,

building data centers near power plants to avoid long transmission

lines due to infrastructure shortages.

Vistra Corp. (NYSE:VST) – Vistra’s shares have

outperformed Nvidia in the S&P 500, up 180% this year. Interest

focuses on the potential of nuclear energy to meet the growing

demands of data centers, especially after Constellation signed a

20-year deal with Microsoft. Shares rose 3.5% on Monday.

Microsoft (NASDAQ:MSFT) – Microsoft hired new

cybersecurity executives after a series of breaches, including US

government veterans, according to Bloomberg. The company holds

weekly meetings to reinforce its Secure Future Initiative, aiming

to improve software security. CEO Satya Nadella emphasized the

importance of prioritizing security across all products, despite

pressure for rapid innovations. Shares were stable in pre-market

trading after closing down -0.4% on Monday.

Ciena (NYSE:CIEN) – Ciena shares closed up 5.0%

on Monday after Citi upgraded its rating from “Sell” to “Buy,”

forecasting a return to growth. The stock’s price target was raised

from $44 to $68. Analysts expect demand in the telecommunications

sector to improve, benefiting the company. Shares rose 0.2% in

pre-market trading.

OpenAI – OpenAI reported that its X account was

compromised on Monday when a hacker posted fraudulent messages

about a fake cryptocurrency token linked to the company. OpenAI’s

security team had already warned internally about a rise in

employee account breaches.

Cloudflare (NYSE:NET) – Cloudflare CEO Matthew

Prince stated that the company did not help Elon Musk’s X evade a

ban in Brazil nor supported regulators in restoring the block. X

briefly went back online after a technical change, but Prince

denied any collaboration with Brazilian authorities. Shares closed

up 3.8% on Monday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group’s shares fell 10.3% on Monday,

hitting a new low after insider trading restrictions ended. With

six consecutive days of decline, the company’s market

capitalization is $2.38 billion, reflecting significant losses

since its March debut. Shares rose 1.2% in pre-market trading.

Telegram – Telegram CEO Pavel Durov announced

that the platform will begin providing users’ IP addresses and

phone numbers to authorities in response to valid legal requests.

This change, following his arrest in France, represents a new

approach to avoid abuses and improve content moderation.

Qualcomm (NASDAQ:QCOM) – Analysts from

TECHnalysis Research and Bernstein expressed skepticism about

Qualcomm’s acquisition of Intel, suggesting the acquisition could

accelerate its diversification but also burden the company with an

underperforming manufacturing unit. Furthermore, the merger would

face stringent global antitrust scrutiny as it would combine two

large chipmakers, complicating the sector’s current crisis. Shares

rose 0.9% in pre-market trading after closing down -1.75% on

Monday.

Boeing (NYSE:BA) – Boeing made a final wage

offer to striking workers, offering to reinstate a performance

bonus, improve retirement benefits, and double the ratification

bonus to $6,000. The union refused to put it to a vote, stating the

proposal was not negotiated and did not meet members’ demands for a

40% wage increase. Shares fell 0.2% in pre-market trading after

closing up 2.0% on Monday.

Spirit AeroSystems (NYSE:SPR) – Spirit

AeroSystems is investigating its parts record-keeping after

discovering missing and duplicate documents, representing 4% of all

records since 2010, measured by coordinate measuring machines

(CMM). So far, no safety issues have been identified. The company

notified affected customers and plans to automate production and

report storage to avoid human error.

StandardAero – StandardAero, backed by the

Carlyle Group and Singapore’s sovereign wealth fund GIC, seeks a

valuation of up to $7.54 billion in its US initial public offering

(IPO). The company, which provides maintenance services for

aerospace engines, plans to sell 46.5 million shares between $20

and $23.

Toyota Motor (NYSE:TM) – Toyota faces a

proposed class-action lawsuit in the US, accused of emissions fraud

in nine forklift engines. Buyers claim the automaker altered

software and swapped engines during emissions testing, resulting in

misleading performance. Additionally, Toyota increased its share

buyback to ¥1.2 trillion ($8.3 billion), driven by strong demand in

its core markets. The automaker added ¥200 billion to the original

plan, anticipating repurchasing up to 3.93% of its shares. Shares

fell 0.9% in pre-market trading after closing up 0.7% on

Monday.

Tesla (NASDAQ:TSLA) – Next week, Tesla’s

delivery numbers could bring an optimistic dynamic to Wall Street,

with bullish investors more positive. Outperforming deliveries

could boost the stock, which has risen 36% in the last three

months. Despite challenges in Europe, performance in China and the

introduction of the Cybertruck are promising. Investors are also

eyeing Robotaxi Day in October. Shares rose 1.8% in pre-market

trading after closing up 4.9% on Monday.

Chevron (NYSE:CVX), Exxon

Mobil (NYSE:XOM), Hess (NYSE:HES),

BP plc (NYSE:BP), Shell

(NYSE:SHEL) – US oil producers began evacuating employees from

platforms in the Gulf of Mexico due to the forecast of a second

major hurricane in two weeks. The National Hurricane Center warned

that a tropical cyclone in the Caribbean could intensify, bringing

winds up to 185 km/h. Companies like BP, Chevron, and Shell have

already halted some production and evacuated personnel. Meanwhile,

the US Federal Trade Commission is expected to approve Chevron’s

$53 billion acquisition of Hess this week, a deal facing resistance

from Exxon Mobil. Exxon is contesting the deal, claiming preference

rights over assets in Guyana, with a decision expected in August

2025. Additionally, California and environmental groups sued Exxon

Mobil, accusing the company of contributing to global plastic

pollution and misleading the public about recycling efficacy. Hess

shares rose 3.2% in pre-market trading, while Exxon shares rose

0.6%.

Petrobras (NYSE:PBR) – Petrobras plans to

invest in converting corn or sugarcane ethanol into sustainable

aviation fuel. The company is seeking a location for a new plant

that will serve both domestic and international markets.

Additionally, Petrobras is retrofitting its refineries to produce

biofuels as part of a $16.7 billion investment through 2028. Shares

rose 0.8% in pre-market trading after closing up 1.2% on

Monday.

Equinor ASA (NYSE:EQNR) – Equinor ASA secured

all major contracts for a large natural gas project off Brazil’s

coast, with production expected by 2028. CEO Anders Opedal said

suppliers have been secured to build a floating production vessel

and install subsea infrastructure. The project, named Raia, will

cost around $9 billion and could meet 15% of Brazil’s demand.

Shares rose 1.7% in pre-market trading after closing up 1.6% on

Monday.

JPMorgan Chase (NYSE:JPM) – JPMorgan is

optimistic about India, highlighting its broad growth and business

opportunities, especially in the commercial banking sector, with

expectations of up to a 30% increase. The bank also sees potential

in Japan, due to positive interest rates, and in Southeast Asia,

benefiting from the “China Plus One” strategy, diversifying

investments and supply chains.

HSBC Holdings Plc (NYSE:HSBC) – HSBC aims to

increase its participation in infrastructure financing to support

AI implementation, according to Gerry Keefe, co-head of global

banking coverage. The bank will focus on this area over the next

two years, aligning with initiatives from major companies like

BlackRock and Microsoft. Shares rose 1.1% in pre-market trading

after closing up 2.0% on Monday.

Bank of America (NYSE:BAC) – Bank of America

plans to open more than 165 branches in the US by 2026, focusing on

in-person sales of products like mortgages and investments.

Although the bank has reduced its total number of branches, it

invested $5 billion in renovations, with 40 new branches planned

for this year. Shares rose 0.1% in pre-market trading after closing

down 1.0% on Monday.

Morgan Stanley (NYSE:MS) – Morgan Stanley

advised investors to shift from a defensive stance to focus on

large-cap companies with solid fundamentals. Although defensive

stocks have appreciated, they are expensive compared to earnings.

The bank recommends quality stocks, including members of the

Magnificent Seven.

BlackRock (NYSE:BLK) – Italy approved BlackRock

as a shareholder with over 3% in defense group Leonardo, according

to a document submitted by Prime Minister Giorgia Meloni’s office

to parliament. The government imposed unspecified conditions, but

BlackRock may need to reduce its stake due to the company’s

internal rules limiting external investors, according to

Reuters.

Blackstone (NYSE:BX),

Smartsheet (NYSE:SMAR) – Vista Equity Partners and

Blackstone are nearing a deal to acquire Smartsheet, making

concessions to private creditors. They will include safeguards in a

$3.2 billion debt package to address concerns over controversial

asset transfers. The transaction could value Smartsheet at around

$8 billion.

Brookfield Asset Management (NYSE:BAM) – The

UAE’s Masdar announced its acquisition of Spain’s Saeta Yield SA

from Brookfield Asset Management for around $1.3 billion. This is

Masdar’s second clean energy deal in Spain in months, aiming to

expand its investments in renewable projects. Saeta has 745

megawatts of assets and projects under development in Spain and

Portugal.

Coinbase Global (NASDAQ:COIN) – Coinbase and

the SEC clashed in a federal appeals court in Philadelphia, with

Coinbase pushing for new digital asset rules. The exchange sued the

SEC after its regulatory petition was denied, arguing that the

agency doesn’t provide clarity on how to operate legally. The SEC

defends that current regulations are adequate. Shares rose 1.1% in

pre-market trading after closing up 0.1% on Monday.

Nike (NYSE:NKE) – Nike shares fell 0.4% on

Monday after JPMorgan warned of potentially weak quarterly results.

Analyst Matthew Boss placed the stock under “negative catalyst

watch” and cut the earnings estimate to 48 cents, below consensus,

while the revenue forecast was also reduced. Shares, down 21% this

year, rose 0.8% in pre-market trading.

PVH Corp (NYSE:PVH) – China will open an

investigation into PVH, the parent company of Calvin Klein and

Tommy Hilfiger, over potential market-related violations concerning

Xinjiang products. The company has 30 days to submit documents on

any “discriminatory measures” taken over the past three years. The

ministry also accuses PVH of “unjustly boycotting” cotton from the

region.

Levi Strauss (NYSE:LEVI) – According to the

Financial Times, Levi Strauss’s current target of reaching $9

billion to $10 billion in revenue by 2027 is likely to be

delayed.

Ulta Beauty (NASDAQ:ULTA) – Ulta Beauty was

downgraded by TD Cowen due to increasing competition and lack of

execution. While the company continues to lead the sector,

investments in exclusives and in-store experiences are necessary,

which could pressure its margins in the short term. Shares closed

down 2.0% on Monday.

Tempur Sealy International (NYSE:TPX) – Tempur

Sealy announced plans to sell stores to gain regulatory approval

for its $4 billion merger with Mattress Firm. The company plans to

sell 73 Mattress Firm stores and 103 Sleep Outfitters locations,

along with seven distribution centers, in response to concerns over

prices and jobs.

Novo Nordisk (NYSE:NVO) – Novo Nordisk CEO Lars

Fruergaard Jorgensen said that the diabetes drug Ozempic will be

available for price negotiations with the US government in less

than a year. During a Senate hearing, he noted that net prices of

Ozempic and Wegovy have fallen by about 40% since their launches,

with further reductions expected. Shares rose 0.8% in pre-market

trading after closing down -3.0% on Monday.

Biohaven (NYSE:BHVN) – Biohaven shares closed

up 13.7% on Monday after the company reported that its treatment,

troriluzole, slowed the progression of spinocerebellar ataxia by

50% to 70% during a clinical trial. Biohaven plans to file for US

regulatory approval in Q4, aiming to treat a condition currently

without approved options.

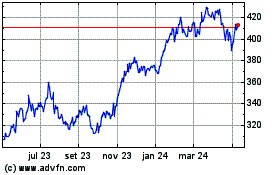

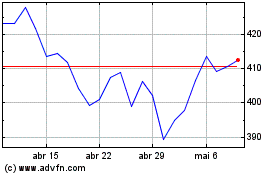

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024