U.S. Dollar Rises Ahead Of U.S. Jobs Data

05 Maio 2015 - 7:14AM

RTTF2

The U.S. dollar strengthened against the other major currencies

in the early European session on Tuesday, as traders await the U.S.

jobs data due at the end of the week for fresh clues about the

timing of Fed rate hike.

A report from the Commerce Department on Monday showing a

notable increase in factory orders in the month of March, also

supported the currency.

The Commerce Department said factory orders surged up by 2.1

percent in March following a revised 0.1 percent decrease in

February. Economists had expected orders to increase by about 2.0

percent.

Some economists indicate that Federal Reserve may raise interest

rates in the second half of the year. A June rate hike is

apparently on the table despite first quarter economic weakness, as

recent data has hinted that the U.S. job market is heating up in

time for summer.

The monthly jobs report due on Friday is likely to be in the

spotlight, although reports on service sector activity,

international trade, and labor productivity may also attract

attention along with a speech by Federal Reserve Chair Janet

Yellen.

Meanwhile, traders remain cautious on the whether Greek

negotiations would reach into a deal on May 11 eurogroup meeting.

Uncertainty over Greece still remains on whether it could make

payment.

Greece Labor Minister Panos Skourletis on Monday said in a

television interview that the International Monetary Fund, Greece's

second biggest creditor after euro zone governments, was pushing

the cash-strapped country too hard over labor reforms for an

interim deal to unlock frozen bailout aid.

In the Asian trading, the U.S. dollar held steady against its

major rivals.

In the European trading today, the U.S. dollar rose to 120.30

against the yen for the first time since April 13, from an early

low of 120.02. The greenback may test resistance near the 121.00

region.

Moving away from an early low of 1.5151 against the pound, the

greenback advanced to nearly a 2-week high of 1.5088. On the

upside, 1.45 is seen as the next resistance level for the

greenback.

Against the euro and the Swiss franc, the greenback climbed to a

6-day high of 1.1065 and a 5-day high of 0.9412 from early lows of

1.1150 and 0.9331, respectively. If the greenback extends its

uptrend, it is likely to find resistance around 1.07 against the

euro and 0.97 against the franc.

Looking ahead, U.S. and Canadian trade data for March and U.S.

PMI for April are slated for release in the New York session.

At 12:30 pm ET, Bank of Canada Senior Deputy Governor Carolyn

Wilkins will address Board of Trade of Metropolitan Montreal.

The Japanese banks will be closed in observance of Children's

Day holiday.

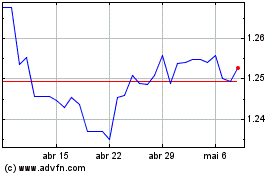

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Abr 2024 até Mai 2024

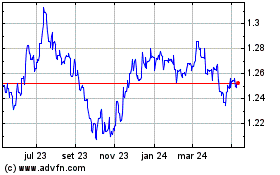

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Mai 2023 até Mai 2024