Yen Slides Amid Expectations Of Monetary Policy Divergence

28 Maio 2015 - 2:37AM

RTTF2

The Japanese yen continued to be weaker against the other major

currencies in the Asian session on Thursday, as comments by Bank of

Japan officials supported expectations that the extremely

accommodative policy of the central bank is here to say even as

fears that its U.S. peer will begin to hike rates as early as this

year are abounding.

Speaking to business leaders in Sapporo on Wednesday, Bank of

Japan Deputy Governor Kikuo Iwata said that the inflation target of

2 percent is expected to be achieved around the first half of

fiscal 2016.

"This timing is somewhat delayed from the previous projection,"

he told. He also noted that the underlying trend in inflation

itself has been rising steadily with the mechanism of quantitative

and qualitative easing as envisaged.

BoJ Governor Haruhiko Kuroda reiterated this week that the

monetary policy will be adjusted to meet the inflation target of 2

percent, if needed.

At a press conference last Friday, Kuroda said, "it is too early

to discuss when the monetary easing should end,".

Meanwhile, Asian stock markets are mostly higher, tracking the

positive lead from Wall Street overnight and on optimism that

Greece may be on the verge of a rescue deal with its international

creditors.

Greek Prime Minister Alexis Tspiras said in a statement his

country was close to an agreement with its international creditors.

He also added that the agreement would be beneficial to Greece with

no impingement on pensions, salaries, banks or deposits in the

proposed deal.

The weaker yen is propping up export-related stocks. The

benchmark Nikkei 225 index is currently up 0.64 percent or 130.94

points at 20,603.

The growing speculation that Federal Reserve would raise U.S.

interest rates this year also weighed on the currency. The

speculation gained ground on comments made by Fed Chair Janet

Yellen about the possibility of an interest rate hike, if the

economy meets her forecasts.

In other economic news, data from the Ministry of Economy, Trade

and Industry showed that retail sales in Japan advanced 5.0 percent

on year in April, coming in at 11.562 trillion yen. That was shy of

forecasts for an increase of 5.5 percent following a 9.7 percent

contraction in March.

On a seasonally adjusted monthly basis, retail sales added 0.4

percent - well shy of forecasts for 1.1 percent after shedding 1.8

percent a month earlier.

Wednesday, the yen fell 0.37 percent against the euro, 0.35

percent against the pound, 0.60 percent against the U.S. dollar and

0.41 percent against the Swiss franc.

In the Asian trading today, the yen fell to 124.24 against the

U.S. dollar for the first time since December 2002, from

yesterday's closing value of 123.60. On the downside, 126.00 is

seen as the next support level for the yen.

Against the pound, the yen dropped to 190.69 for the first time

since September 2008 from yesterday's closing value of 189.76. The

yen may now seek support near the 192.50 region.

The yen slipped to near 2-week lows of 130.90 against the Swiss

franc and 99.65 against the Canadian dollar, from yesterday's

closing quotes of 130.17 and 99.26, respectively. If the yen

extends its downtrend, it is likely to find support around 135.00

against the franc and 100.50 against the loonie.

Against the euro, the yen declined to a 9-day low of 135.39 from

yesterday's closing value of 134.77. The yen is likely to find

support around the 138.00 area.

Looking ahead, Swiss trade balance and German import price index

- both for April, are due to be released at 2:00 am ET.

At 2:20 am ET, Federal Reserve Bank of San Francisco President

John Williams is expected to speak about banking supervision at the

Monetary Authority of Singapore Banking Supervision and Regulation

Joint Conference in Singapore.

Swiss industrial production for the first quarter, the second

estimate of first quarter U.K. GDP, U.K. index of services for

March and Eurozone business climate index for May are also set to

be published in the European session.

In the New York session, Canada industrial product and raw

material price indices for April, U.S. weekly jobless claims for

the week ended Mar 23 and U.S. pending home sales data for April

are slated for release.

At 7:00 am ET, ECB board member Yves Mersch is expected to speak

at the Bulgarian Authorities 2015 IMF/World Bank Constituency

Meetings in Sofia, Bulgaria.

At 2:45 pm ET, Federal Reserve Bank of Minneapolis President

Narayana Kocherlakota will deliver a speech on monetary policy

before a Community Leader Lunch hosted by the Helena Branch of the

Federal Reserve Bank of Minneapolis in Helena, Montana.

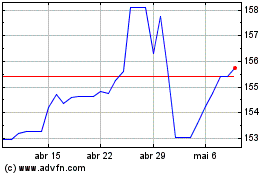

US Dollar vs Yen (FX:USDJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

US Dollar vs Yen (FX:USDJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024