U.S. Dollar Extends Rise As Fed Rate Cut Worries Fade

02 Abril 2024 - 12:45AM

RTTF2

The U.S. dollar strengthened against other major currencies in

the Asian session on Tuesday, as trader's speculation on the

Federal Reserve interest rate cut faded.

Data on Monday showed that the U.S. manufacturing sector

expanded in March for the first time since September 2022.

Data from the Institute for Supply Management showed that the

manufacturing PMI jumped to 50.3 in March from 47.8 in February,

with a reading above 50 indicating growth in the sector. Economists

had expected the index to inch up to 48.4.

The robust manufacturing PMI data led to the rise of Treasury

yields, with the yield on the benchmark ten-year note touching 4.31

percent, boosted the U.S. dollar.

The data is "along the lines of what we would like to see," Fed

Chair Jerome Powell said on Friday at a conference and repeated the

central bank is no hurry to cut interest rates. He also

acknowledged the risks of leaving interest rates where they are

now.

The U.S. dollar started trading higher against its major rivals

from March 29th, 2024.

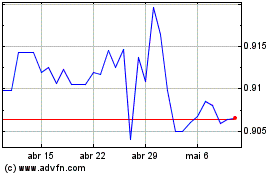

In the Asian trading now, the U.S. dollar rose to a 1-1/2-month

high of 1.0729 against the euro, a 6-day high of 151.80 against the

yen and a 5-day high of 0.9065 against the Swiss franc, from

yesterday's closing quotes of 1.0743, 151.63 and 0.9041,

respectively. If the greenback extends its uptrend, it is likely to

find resistance around 1.06 against the euro, 153.00 against the

yen and 0.91 against the franc.

Against the pound and the Canadian dollar, the greenback edged

up to 1.2541 and 1.3584 from yesterday's closing quotes of 1.2550

and 1.3569, respectively. On the upside, 1.24 against the pound and

1.37 against the loonie is seen as the next resistance level for

the greenback.

Looking ahead, Manufacturing PMI reports for March from U.K. and

various European economies, U.K. mortgage approvals data for

February, are due to be released in the European session.

At 8:00 am ET, Destatis is set to release Germany's flash

inflation figures for March. Economists forecast consumer price

inflation to ease to 2.2 percent from 2.5 percent in February.

In the New York session, U.S. factory orders for February is

slated for release.

At 10:10 am ET, Federal Reserve Board Governor Michelle Bowman

will speak virtually on "Bank Mergers and Acquisitions, and De Novo

Bank Formation: Implications for the Future of the Banking System"

before the Workshop on the Future of Banking hosted by the Federal

Reserve Bank of Kansas City, in Washington D.C., U.S.

At 12:00 pm ET, Federal Reserve Bank of New York President John

Williams will moderate a discussion with Jeremy Siegel, professor

of finance at the Wharton School of the University of Pennsylvania,

before the Economic Club of New York, in New York, U.S.

Five minutes later, Federal Reserve Bank of Cleveland President

Loretta Mester speaks on the economic outlook before the Cleveland

Association for Business Economics and Team NEO Luncheon, in

Cleveland, U.S.

At 1:30 pm ET, Federal Reserve Bank of San Francisco President

Mary Daly will participate in hybrid fireside chat in partnership

with the Henderson Chamber of Commerce, Latin Chamber of Commerce

Nevada, and Vegas Chamber of Commerce, in Las Vegas, in U.S.

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024