|

PRELIMINARY PROSPECTUS SUPPLEMENT

(TO PROSPECTUS DATED JANUARY 18, 2022)

(DATED JANUARY 18, 2022 SUBJECT TO COMPLETION)

|

Filed pursuant to Rule 424(b)(2)

Registration Statement File No. 333-262202

|

BRF S.A.

Up to 324,000,000 Common Shares of BRF S.A., including

Common Shares represented by American Depositary Shares

We are offering up to 324,000,000 of our common

shares, which may be represented by American depositary shares, or the ADSs, in a global offering that consists of (i) an international

offering of common shares, including common shares represented by ADSs, outside Brazil and (ii) a concurrent restricted public offering

of common shares in Brazil. The international offering includes a registered offering in the United States. The closings of the international

and Brazilian offerings are conditioned upon each other. In the international offering, we are offering our common shares, including common

shares represented by ADSs, each of which represents one common share. ADSs sold in the international offering will be paid for in U.S.

dollars. Common shares sold in the international offering will be delivered in Brazil and paid for in reais.

The international underwriters named in this

prospectus supplement are underwriting the sale of ADSs, which represent common shares. The Brazilian underwriters are placing common

shares, including common shares sold in the international offering, to investors outside Brazil The international underwriters, together with Safra Securities LLC, will

collectively act as placement agents on behalf of the Brazilian underwriters with respect to the offering of common shares (not including

common shares represented by ADSs) sold outside Brazil.

In accordance with Article 9-A of CVM

Instruction No. 476/2009, as amended, or CVM Instruction No. 476, the Brazilian offering includes and is subject to a priority

offering in Brazil pursuant to which our existing shareholders have the right to reserve for purchase an aggregate of up to 100% of

our common shares offered hereby limited to each shareholder’s proportional interest in our common share capital, excluding

treasury shares, as of January 20, 2022 and as of January 27, 2022, in each case after closing of the market. The price per common

share under the priority offering will be the same as the price per common share under this offering, as indicated below. As a

result of this priority offering, the quantity of common shares offered may be materially reduced regardless of the effective

participation of new investors in this offering. The priority offering is not available to existing holders of our ADSs. See

“The Offering—Priority offering.”

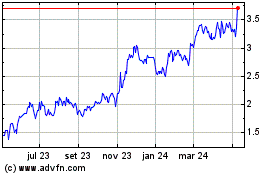

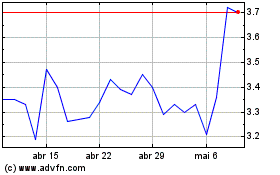

Our common shares are listed on the Novo Mercado

segment of the B3 S.A. – Brasil, Bolsa, Balcão, or the B3, under the ticker symbol “BRFS3.” On January

17, 2022, the last reported sale price of our common shares on the B3 was R$24.75 per common share. ADSs representing our common shares

are listed on the New York Stock Exchange, or the NYSE, under the ticker symbol “BRFS.” On January 14, 2022, the last reported

sale price of our ADSs on the NYSE was US$4.38 per ADS.

You should carefully read this prospectus supplement

and the accompanying prospectus, together with any documents we incorporate by reference, before you invest in our common shares or the

ADSs.

Investing in our securities involves risks.

See “Risk Factors” beginning on page S-25 and under our Third Quarter MD&A Report (as defined below) to read about factors

you should consider before investing in the securities offered by this prospectus supplement and the accompanying prospectus.

Neither the U.S. Securities and Exchange Commission,

or the SEC, the Brazilian Securities Commission (Comissão de Valores Mobiliários), or the CVM, nor any state securities

commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the

accompanying prospectus. Any representation to the contrary is a criminal offense.

|

|

Per ADS

|

Per Common Share

|

Total(1)

|

|

Public offering price ….

|

U.S.$

|

R$

|

U.S.$

|

|

Underwriting discounts, fees and commissions(2)(3)

|

U.S.$

|

R$

|

U.S.$

|

|

Proceeds, before expenses (2)(3)...

|

U.S.$

|

R$

|

U.S.$

|

|

|

(1)

|

Amounts in reais have been translated into U.S.

dollars at the selling rate reported by the Brazilian Central Bank (Banco Central do Brasil) as of , 2022, which was R$ to U.S.$1.00.

|

|

|

(2)

|

Underwriting discounts, fees and commissions will be

payable only on the portion of the common shares, including common shares represented by ADSs, being sold and placed by the international

underwriters, the placement agents and their respective affiliates, and the Brazilian underwriters, respectively.

|

|

|

(3)

|

See “Underwriting” beginning on page S-39

of this prospectus supplement for additional information regarding underwriting compensation.

|

————————————

The international underwriters expect to deliver

the ADSs through the facilities of The Depository Trust Company against payment in New York, New York on or about , 2022. Delivery of

our common shares, including common shares offered in the international offering, will be made in Brazil through the book-entry facilities

of the B3 Central Depository (Central Depositária da B3) on or about , 2022.

Global Coordinator

Citigroup

Joint Bookrunners

|

Bradesco BBI

|

BTG Pactual

|

Itaú BBA

|

J.P. Morgan

|

Morgan Stanley

|

Safra

|

Santander

|

BofA Securities

|

Credit Suisse

|

UBS Investment Bank

|

————————————

The date of this prospectus supplement is , 2022.

Table of Contents

Prospectus Supplement

Prospectus

|

About This Prospectus

|

1

|

|

Forward-Looking Statements

|

2

|

|

BRF

|

4

|

|

Risk Factors

|

5

|

|

Use of Proceeds

|

6

|

|

The Securities

|

7

|

|

Description of Common Shares

|

8

|

|

Description of American Depositary Shares

|

26

|

|

Taxation

|

31

|

|

Plan of Distribution

|

32

|

|

Legal Matters

|

33

|

|

Experts

|

34

|

|

Service of Process and Enforcement of Judgments

|

35

|

|

Where You Can Find More Information

|

37

|

|

Incorporation of Certain Documents By Reference

|

38

|

S-i

About This Prospectus Supplement

This document consists of two parts. The first

part is this prospectus supplement, which describes the offering by us and certain other matters relating to us and our business, financial

condition and results of operations. The second part, the accompanying prospectus, gives more general information about the common shares

and common shares represented by ADSs offered by us. If the information in this prospectus supplement differs from the information in

the accompanying prospectus, the information in this prospectus supplement supersedes the information in the accompanying prospectus.

We are responsible for the information

contained and incorporated by reference in this prospectus supplement and in any related free-writing prospectus prepared or

authorized by us. We have not authorized anyone to give you any other information, and we take no responsibility for any other

information that others may give you. Neither we nor the international underwriters or the placements agents are making an offer to

sell our common shares or the ADSs representing our common shares in any jurisdiction where the offer is not permitted.

You should not assume that the information in

this prospectus supplement, the accompanying prospectus or any document incorporated by reference is accurate as of any date other than

the date of the relevant document.

We are using this prospectus to offer our common

shares and the ADSs representing our common shares outside Brazil. We are also offering our common shares in Brazil by means of a Brazilian

offering memorandum (Memorando de Oferta) and accompanying reference form (Formulário de Referência) in Portuguese,

or together, the Brazilian offering documents. The Portuguese language offering memorandum, which has not been and will not be filed with

the CVM, is in a format different from that of this prospectus supplement, and contains information not generally included in documents

such as this prospectus supplement and in the accompanying prospectus. This offering of common shares, including common shares represented

by ADSs, is made in the United States and elsewhere outside Brazil solely on the basis of the information contained in this prospectus

supplement and in the accompanying prospectus.

Any investors outside Brazil purchasing common

shares directly (not represented by ADSs) must be authorized to invest in Brazilian securities under the requirements established by

Brazilian law, especially by the Brazilian National Monetary Council (Conselho Monetário Nacional), or the CMN, the CVM

and the Central Bank, complying with the requirements set forth in Resolution No. 13, dated November 18, 2020, of the CVM, as amended,

and Resolution No. 4,373, dated September 29, 2014, as amended, of the Central Bank and Law No. 4,131 of September 3, 1962, as amended.

No offer or sale of ADSs may be made to the public in Brazil except in circumstances that do not constitute a public offer or distribution

under Brazilian laws and regulations. Any offer or sale of ADSs in Brazil to non-Brazilian residents may be made only under circumstances

that do not constitute a public offer or distribution under Brazilian laws and regulations.

For

investors outside the United States: Neither we nor the international underwriters, the placement agents, or the Brazilian underwriters

have done anything that would permit this offering or possession or distribution of this prospectus supplement in any jurisdiction, other

than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this

prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of the common shares including

the common shares represented by ADSs and the distribution of this prospectus supplement outside the United States and in their jurisdiction.

In this prospectus supplement, unless the context

requires otherwise, references to “BRF, ” the “Company,” “we,” “us” or “our”

mean BRF S.A. and its consolidated subsidiaries.

The term “international underwriters”

refers to Citigroup Global Markets Inc., Banco Bradesco BBI S.A., Banco BTG Pactual S.A. – Cayman Branch, Itau BBA USA Securities,

Inc., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, Santander Investment Securities Inc., BofA Securities Inc., Credit Suisse

Securities (USA) LLC and UBS Securities LLC, who will collectively act as underwriters with respect to the offering of the ADSs. Please

see “Underwriting” for more information.

The term “Brazilian underwriters”

refers to Citigroup Global Markets Brasil, Corretora de Câmbio, Títulos e Valores Mobiliários S.A., Banco Bradesco

BBI S.A., Banco BTG Pactual S.A., Banco Itaú BBA S.A., Banco J.P. Morgan S,A., Banco Morgan Stanley S.A., Banco Safra S.A., Banco

Santander (Brasil) S.A., Bank of America Merrill Lynch Banco Múltiplo S.A., Banco de Investimentos Credit Suisse (Brasil) S.A.

and UBS Brasil Corretora de Câmbio, Títulos e Valores Mobiliários S.A., who will act collectively as Brazilian underwriters

with respect to the sale of shares in the public offering in Brazil.

The term “placement agents” refers,

collectively, to the international underwriters and Safra Securities LLC. Safra Securities LLC’s participation in the offering will

be strictly limited to its role as a placement agent outside of Brazil, on behalf of Banco Safra S.A., of common shares not including

the common shares represented by ADSs, and it

will not underwrite, offer or sell any ADSs.

References herein to “reais” or

“R$” are to the lawful currency of Brazil. References herein to “U.S. dollars” or “U.S.$” are to the

lawful currency of the United States.

Incorporation of Certain Documents by Reference

The SEC allows us to “incorporate by reference”

information filed with and/or furnished to the SEC, which means that we can disclose important information to you by referring you to

those documents. The information incorporated by reference is considered to be part of this prospectus supplement, and certain later information

that we file with and/or furnish to the SEC will automatically update and supersede earlier information filed with the SEC or included

in this prospectus supplement.

We are incorporating by reference into this prospectus

supplement the following documents that it has filed with or furnished to the SEC:

|

|

(1)

|

Our annual report on Form 20-F for the year ended December 31, 2020, as filed with the SEC on March

26, 2021 (Acc-No: 0001292814-21-001201 (34 Act));

|

|

|

(2)

|

Our report on Form 6-K furnished to the SEC on January 18, 2022, containing our unaudited condensed

consolidated interim financial information as of September 30, 2021 and for the nine month period ended September 30, 2021 and 2020, or

our Third Quarter Financial Statement Report;

|

|

|

(3)

|

Our report on Form 6-K furnished to the SEC on January 18, 2022, containing (i) a discussion of our

financial condition as of September 30, 2021 and for the nine months ended September 30, 2021 and (ii) a summary of certain other recent

developments, or our Third Quarter MD&A Report; and

|

|

|

(4)

|

Any of our future annual reports on Form 20-F filed with, and all reports on Form 6-K that are designated

in such reports as being incorporated by reference into this prospectus supplement furnished to, the SEC after the date of this prospectus

supplement and prior to the termination of the offering.

|

All of the documents that are incorporated by reference

herein are available on the website maintained by the SEC at http://www.sec.gov. Other than documents incorporated by reference herein,

the information contained on, or accessible through, such website is not incorporated by reference into this prospectus supplement and

should not be considered a part of this prospectus supplement.

We will provide without charge to any person to whom

a copy of this prospectus supplement is delivered, upon the written or oral request of any such person, a copy of any or all of the documents

referred to above which have been or may be incorporated herein by reference, other than exhibits to such documents (unless such exhibits

are specifically incorporated by reference in such documents). Requests should be directed to our investor relations department located

at Av. das Nações Unidas, 8501 – 1st Floor, São Paulo, São Paulo 05425-070, Brazil; telephone: +55 (11)

2322-5377; e-mail: acoes@brf-br.com.

Forward-Looking Statements

Some of the information contained or incorporated

by reference in this prospectus supplement are forward-looking statements within the meaning of Section 27A of the U.S. Securities Act

of 1933, as amended, or the Securities Act, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act,

that are not based on historical facts and are not assurances of future results.

Statements that are predictive in nature, that

depend upon or refer to future events or conditions or that include words such as “anticipates,” “believes,” “estimates,”

“expects,” “foresees,” “intends,” “plans,” “potential,” “should,”

“will,” “would,” “continues,” “aims,” may” and similar expressions are forward-looking

statements. Although we believe that these forward-looking statements are based upon reasonable assumptions, these statements are subject

to several risks and uncertainties and are made in light of information currently available to us.

Our forward-looking statements may be influenced

by numerous factors, including the following:

|

|

·

|

the economic, financial, political and social effects of the coronavirus, or COVID-19, pandemic (or

other pandemics, epidemics and similar crises) particularly in Brazil and to the extent that they continue to cause serious negative macroeconomic

effects, thus enhancing the risks described under the “Risk Factors” under our Third Quarter MD&A Report and in the reports

filed with or furnished to the SEC that are incorporated by reference herein;

|

|

|

·

|

general economic, political and business conditions both in Brazil and abroad, including, in Brazil,

developments and the perception of risks in connection with ongoing corruption and other investigations and increasing fractious relations

and infighting within the administration of President Bolsonaro, as well as policies and potential changes to address these matters or

otherwise, including economic and fiscal reforms and in response to the ongoing effects of the COVID-19 pandemic, any of which may negatively

affect growth prospects in the Brazilian economy as a whole;

|

|

|

·

|

our ability to timely and efficiently implement any necessary measures in response to, or to mitigate

the impacts of, the COVID-19 pandemic on our business, operations, cash flows, prospects, liquidity and financial condition;

|

|

|

·

|

our ability to predict and efficiently react to the temporary or long-term term changes in our customers’

behavior as a result of the COVID-19 pandemic, even when the outbreak is sufficiently controlled;

|

|

|

·

|

health and food safety risks related to the food industry, including in connection with ongoing investigations

and legal proceedings;

|

|

|

·

|

more stringent trade barriers in key export markets and increased regulation of food safety and security;

|

|

|

·

|

the risk of outbreak of animal diseases;

|

|

|

·

|

risks related to climate change;

|

|

|

·

|

the risk of any shortage or lack of water or other raw materials necessary for our business;

|

|

|

·

|

compliance with various laws and regulations;

|

|

|

·

|

risks related to new product innovation;

|

|

|

·

|

the implementation of our principal operating strategies, including through divestitures, acquisitions

or joint ventures;

|

|

|

·

|

the cyclicality and volatility of raw materials and selling prices, including as a result of ongoing

global trade disputes;

|

|

|

·

|

strong international and domestic competition;

|

|

|

·

|

risks related to labor relations;

|

|

|

·

|

the protection of our intellectual property;

|

|

|

·

|

the potential unavailability of transportation and logistics services;

|

|

|

·

|

the risk that our insurance policies may not cover certain of our costs;

|

|

|

·

|

our ability to recruit and retain qualified professionals;

|

|

|

·

|

the risk of cybersecurity breaches;

|

|

|

·

|

risks related to our indebtedness;

|

|

|

·

|

risks related to the Brazilian economy and to Brazilian politics;

|

|

|

·

|

interest rate fluctuations, inflation and exchange rate movements of the real in relation to the U.S.

dollar and other currencies;

|

|

|

·

|

the direction of our future operations;

|

|

|

·

|

our financial condition or results of operations; and

|

|

|

·

|

other factors identified under the “Risk Factors” under our Third Quarter MD&A Report

and in the reports filed with or furnished to the SEC that are incorporated by reference herein.

|

Our forward-looking statements are not a guarantee

of future performance, and our actual results of operations or other developments may differ materially from the expectations expressed

in our forward-looking statements. As for forward-looking statements that relate to future financial results and other projections, actual

results will be different due to the inherent uncertainty of estimates, forecasts and projections. Because of these uncertainties, readers

should not rely on these forward-looking statements.

For additional information on factors that could

cause our actual results of operations to differ from expectations reflected in forward-looking statements, please see the “Risk

Factors” section set forth under our Third Quarter MD&A Report, which is incorporated by reference herein.

All forward-looking statements attributed

to us or a person acting on our behalf are qualified in their entirety by this cautionary statement, and you should not place undue reliance

on any forward-looking statement included in this prospectus supplement, which speak only as of the date on which they are made. There

is no assurance that the expected events, trends or results will actually occur and we undertake no obligation to publicly update or revise

any forward-looking statements, whether as a result of new information or future events or for any other reason.

Summary

This summary highlights key information described

in greater detail elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying prospectus. You should read

carefully the entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein

before making an investment decision.

BRF S.A. is one of the largest producers of

fresh and frozen protein foods in the world in terms of production capacity, according to WattAgNet, with a portfolio of approximately

7,500 stock keeping units (“SKUs”) as of December 31, 2021. We are committed to operating our business and delivering products

to our global customer base in line with our core values: quality, safety and integrity. Our processed products include marinated and

frozen chicken, Chester® rooster and turkey meats, specialty meats, frozen processed meats, frozen prepared entrees, portioned

products and sliced products. We also sell margarine, butter, cream cheese, sweet specialties, sandwiches, plant-based products, animal

feed and pet food. We are the holder of brands such as Sadia, Perdigão, Qualy, Perdix, Confidence and Hilal.

For the nine months ended September 30, 2021, we were responsible for 11.5% of the world’s poultry trade, according to USDA.

Our portfolio strategy is focused on creating

new, convenient, practical and healthy products for our consumers based on their preferences. We seek to achieve that goal through strong

innovation to provide us with increasing value-added items that will differentiate us from our competitors and strengthen our brands.

With 38 industrial facilities in Brazil, as

of December 31, 2021, we have among our main assets a distribution network that enables our products to reach Brazilian consumers through

more than 524,500 average monthly deliveries and 27 distribution centers in the domestic market.

We have been a public company since 1980. Our

shares have been listed on the Novo Mercado of the B3 as BRFS3 since 2006, and ADRs representing our

common shares are traded on the New York Stock Exchange, or “NYSE” (ADR level III).

A breakdown of our products is as follows, which

are sold both in Brazil and to our international customers:

|

|

·

|

Meat Products, consisting of in natura meat, which we define as frozen whole chicken

and cut chicken, as well as frozen pork;

|

|

|

·

|

Processed Food Products, including the following:

|

marinated, frozen, whole chicken and cut

chicken, roosters (sold under the Chester® brand) and turkey;

specialty meats, such as sausages, ham

products, bologna, frankfurters, salami, bacon and other smoked products; and

frozen processed meats, such as hamburgers,

steaks, breaded meat products, kibbeh and meatballs;

|

|

·

|

Other Processed Products including the following:

|

Halal products for Islamic markets in

accordance with the Halal method of animal slaughtering;

margarine, butter and cream cheese and

cheese bread;

frozen prepared entrees, such as lasagna,

macaroni and cheese, pies, ready-to-eat meals, and pizzas, as well as other frozen foods;

plant-based products, such as nuggets,

pies, vegetables and burgers; and

snacks (salamitos);

frozen desserts;

|

|

·

|

Other, consisting of soy meal, refined soy flour, animal feed and pet food.

|

In Brazil, as of December 31, 2021, we operated

35 meat processing plants, three margarine processing plants, three pasta processing plants, three feed meal plants, one dessert processing

plant and three soybean crushing plants. All of these industrial facilities are located near our raw material suppliers or main consumer

centers. We have an advanced logistics system in our domestic market, with 27 distribution centers, five of which are owned by us and

22 of which are leased from third parties, all of which serve supermarkets, retail stores, wholesale stores, restaurants and other clients.

In our international market, as of December

31, 2021, we operated six industrial facilities for meat processing. Additionally, after giving effect to the divestitures made in connection

with our financial and operational restructuring plan, we operate 18 distribution centers and 11 warehouses located in Asia, the Southern

Cone and the Middle East, as well as commercial offices on four continents.

We are also focused

on addressing the impact of climate change on the environment and our business. Among the initiatives that we have taken to reduce our

exposure to climate change and to maintain our competitiveness in terms of costs is the monitoring of grain stocks and purchases and the

constant monitoring of the weather in agricultural regions to guide our purchasing decisions, as well as anticipating price movements

in the commodity markets. Other initiatives include technological innovations in our animal-raising facilities to improve efficiency and

safeguard animal welfare. In addition, we recognize that consumers, investors and other stakeholders are more conscious of social and

environmental aspects of the production chain. The commitment assumed by us to achieve Net Zero by 2040, established in 2021, was an important

step in the climate agenda. We have taken initiatives to address this aspect, such as the Sustainable Grain Purchase Policy, which establishes

guidelines with regard to commitments and principles to be applied in the business, with a focus on incorporating environmental, social

and sustainable practices to manage BRF's production chain and investments in clean energy, in partnership with AES Brasil Energia and

Ïntrepid Participações S.A., with which

it will be possible to reach almost 90% of electricity from clean sources in BRF's operations in Brazil. From 2014 until 2021, we allocated

R$1,258.2 million (€360.1 million) to projects with environmental benefits, and we planted a renewable forest covering 30 thousand

hectares (the amount referring to the investments made in 2021 is still subject to a second opinion from an external certifier, which

may result in an adjustment of this amount).

A Fully Integrated Platform

We are a fully integrated food platform present

in all stages of the complex value chain in which we operate, involving a number of partners selected based on sustainable criteria as

well as our integrated farmers and outgrowers, production facilities, distribution centers, and omnichannel sales. Our robust operations

include approximately 100,000 employees, 9,989 integrated farmers, 55 production facilities across the Americas, Africa, Asia, and the

Middle East, 45 logistics centers, 114 countries, and sales channels that varies between traditional retail and other innovative omnichannel

formats, such as Mercato em Casa, Sadia Market, online marketplaces and store-within-a-store concept.

Efficiency and Cost Control

We believe that we encourage a culture of excellence

and for that reason we seek to constantly challenge ourselves to ensure operational efficiency using our programs and action plans. We

seek to minimize our losses and improve our procurement and industrial process in order to consistently deliver profitability.

Such pursuit for high-precision cost

control culture is increasingly important in order to navigate periods of exacerbated cost pressure and ensure profitability

throughout the cycle. As an example, according to CEPEA/ESALQ, corn and soybean prices, which have a direct impact in our cost of

goods sold, have increased over 100% in the last 2 years in Brazil, on average, an unprecedented variation for the sector, while we

managed in the same period to keep operating at margins considered adequate according to our evaluation.

An important tool to perpetuate our pursuit

for excellence is what we call “SEO” – Sistema de Excelência Operacional (Operational Excellence System).

The SEO intends to improve productivity and reduce costs worldwide as it is replicable in several geographies and ties into our digital

processes by monitoring crops and estimating timing for potential price increases. As of September 2021, with the support of our SEO,

we have been able to reduce our losses in the production process by 73%, idleness in farming and industry by 43%, loading time of finished

products in factories by 49% and accidents by 25%, in relation to the same period in 2018. We believe the information provided by the

SEO combined with our expanding grain storage capacity provide opportunities to have greater inventory during times of higher prices,

which promotes a smaller margin decrease that would be expected from more expensive raw material.

As a result, we have improved our profitability,

which can be measured by: (i) the increase of R$3,105,879 thousand, or 1,505%, in our income (loss) before financial results and income

taxes, comparing the twelve months ended September 30, 2021 to the year ended December 31, 2018, and (ii) the increase of R$2,997,037

thousand, or 122%, in our Adjusted EBITDA for the twelve months ended September 30, 2021 compared to the Adjusted EBITDA for the year

of 2018, a period when the accumulated evolution of the industry’s main cost indexes was 78%1

while ours increased by only 41%. Efficiency is an important part of our business and we intend to continuously put our

efforts in finding new ways to improve our processes across more than 114 countries that are covered by our sales channels.

House of Strong Brands

In 2021, BRF has reached 87 years of operations

in the consumer food industry. We have decades of accumulated experience on consumer trends and behavior, providing us the knowledge to

operate in the global food market. We seek to offer increasingly practical high added-value products within a strong portfolio of brands

aiming to offer quality food in a way that improves people’s life, delivering products from farm to table. We believe that such

expertise has contributed to the development of our brands in the Brazilian and international markets, reaching millions of households

with Sadia, Qualy and Perdigão in Brazil and Sadia Halal and Banvit across the globe.

We believe our brands have contributed to the

improvement of our results in 2021 due to increased awareness, which translated to over 300 thousand active clients purchasing BRF brands

in Brazil over the months of July to September 2021. We calculate active clients as the number of clients who purchased our products (directly

or indirectly, through distributors) at least once during the last three months as of any given reference date. Such awareness contributed

to promoting Sadia as the most valuable food brand in Brazil in 2020, according to Kantar BrandZ, while also increasing net revenue by

23.7% in the nine months ended September 30, 2021, compared to the nine months ended September 30, 2020.

There has also been a strategic improvement

in our portfolio, which now comprises a variety of high added-value products, including new categories, boosted by improved consumer experience,

healthy options and an omnichannel approach. Brazil has played a key role as these new products and categories now represent over 80%

of our revenues in Brazil and 45% of our total revenues, each as of September 2021. As for our international segments, such as Halal,

Asia, and Direct Sales, the high added-value products have still plenty of room for growth with 5% of revenues coming from these products.

Additionally, we believe the improvement in

innovation during 2021 was in part due to our robust and seasoned management team, which sought to create clear guidelines to promote

flexibility in order to allow for quick decision-making throughout our organizational structure.

[1]

Considers the evolution of the price of corn, soybean meal, main plastics for rigid and flexible packaging, variation of inflation indexes,

IPCA, IGP-FGV, diesel (ANEP) and US$.

Omnichannel Strategy

We aim to continuously improve our collaborations

with brick-and-mortar and digital initiatives, while advancing with our marketplace, bringing custom-made solutions to improve our level

of service. By understanding our customers even more and exceeding their expectations, we intend to provide the best experience with our

products, services and brands. As an example of such initiatives for greater proximity with customers, we opened a concept store (the

Sadia Market) with digital solutions and a completely integrated online brand.

Ultimately, we aim for the consumer to be the

central point of our sales strategy not only by being provided with added-value products, but also by having a stronger direct-to-consumer

relationship through our own channels, whether digital or physical. In addition to Sadia Market and Mercato em Casa, we expect our partnerships

with online marketplaces to play a key role in leveraging their current number of customers into having exposure to the BRF brands. Ongoing

partnerships include iFood, Rappi, Magalu, Bees and others.

Additionally, our store-within-a-store concept

holds more than 40 partnering stores in large retail chains in Brazil, which is complementary to our e-commerce that already serves the

majority of the national metropolitan areas.

Environmental, Social and Governance (ESG) – Sustainability

in Everything We Do

Our intention to offer quality food in a way

that improves people’s lives is connected to our commitment to society and the planet. We expect our growth in the coming years

to be aligned with a positive change in sustainability. One of our principles is to ensure the sustainable growth of our chain and we

expect our efforts toward sustainability to be stronger by 2030.

According to an IBM Research involving 19,000

people in 28 countries released in early 2020, 57% of consumers were willing to change their purchasing habits to reduce negative environmental

impact, and 71% were willing to pay an additional premium for companies offering full transparency and traceability. Therefore, adopting

policies and guidelines for sustainable practices can be essential for the growth in the long run.

We expect that by 2024 approximately 90% of

our energy requirement in Brazil will be supplied by clean and renewable sources (wind and solar). Additionally, in partnership with Banco

do Brasil, we have committed to provide solar energy and panels to integrated farmers with whom we trade, representing an expected investment

of more than R$200 million. We are confident that our producers and partners will remain devoted to this project, and together with Banco

do Brasil, we expect to build solar farms to meet our own demand, as well as to ensure that in the long-term we will have 100% of our

energy requirement supplied by renewable sources. For instance, in August and September 2021, we entered into certain agreements for the

implementation of clean energy projects, including a joint venture for the construction of a self-generated wind energy farm complex and

a power purchase agreement with an option to form a joint venture for the construction of a self-generated solar energy plant.

As to social aspects, we seek to maintain transparent

dialogs with society, and expect to keep developing the communities where we operate and encouraging innovation and knowledge. We value

education and inclusion, and we expect to invest at least R$400 million in social initiatives by 2030, contributing to the development

of communities where we operate. We have also donated approximately R$100 million to communities where we operate in Brazil and abroad

to combat the COVID-19 pandemic.

With respect to governance practices, we seek

to maintain a clear link between ESG targets and our variable compensation programs, especially for the senior executives that are driving

our long-term strategy. New policies are already in place to ensure that we comply with human rights, sustainability and the sustainable

purchase of grains moving forward. Such is our commitment with governance that we have already been awarded with the Transparency Award

for our Integrated Report, IIA and ISO 37,001 certifications.

From 2019 to 2021, we have invested in actions

that reinforce the respect to the environment in all production chain. We are a signatory of the Global Pact of U.N. and are also listed

in B3 in the corporate sustainability index (ISE), being the only food company in the food sector in Brazil that is included in this index.

Aiming to increase our transparency, we have

established global commitments to ESG aspects, related to BRF's Vision for 2030, in harmony with the world’s largest corporate sustainability

initiative (UN Global Compact), of the size BRF wants to be. Such commitments are highlighted below:

Animal Welfare

|

|

o

|

Certify

by third-party audits 100% of the plants in Animal Welfare by 2025.2

|

|

|

o

|

Only use cage-free chicken eggs in the industrial food process globally by 2025.

|

|

|

o

|

Ensure that no antibiotics growth promoter is used in the livestock chain.

|

|

|

o

|

Ensure that 100% of the poultry in the integration system are cage-free globally by 2023.

|

|

|

o

|

BRF is strictly committed to zero tolerance to animal mistreatment, whether through abuse or neglect.

|

|

|

o

|

Use environmental enrichment in 100% of the integration of poultry by 2025.

|

Science and Innovation

|

|

o

|

100% adherence of new product innovation projects to BRF´s sustainability indicator by 2022.

|

Commodities

|

|

o

|

Ensure 100% traceability of grain acquired from the Brazilian Amazon and the Brazilian

Cerrado by 2025.3

|

Communities

|

|

o

|

Invest

R$ 400 million in communities by 2030.4

|

Food Waste

|

|

o

|

Promote

education to reduce food waste to 1.5 million people globally by 2030.

|

Diversity

|

|

o

|

Achieve 30% of women in top leadership by 2025. We joined the Equity is Priority movement, which is

part of the UN Brazil Global Compact Network that reinforces

this commitment.

|

|

|

o

|

The public sector´s commitment to combat racism.

|

Packaging

|

|

o

|

Have

100% recyclable, reusable or biodegradable packaging by 2025.

|

Greenhouse Gases

|

|

o

|

Implement a carbon neutral product line by 2021.

|

Natural Resources

|

|

o

|

Increase electricity from clean sources by 50% by 2030.

|

|

|

o

|

Reduce

BRF´s water consumption indicator by 13% by 2025.

|

[2]

Respecting the religious and/or cultural requirements demanded by our customers.

[3]

ESG targets linked to our variable compensation system (includes bonus-eligible and executives in accordance with the collective bargaining

agreement in effect on the payment date).

[4]

Increase our shared value generation by investing its own resources in the communities, especially in social development and economic

inclusion agendas.

The Offering

|

Issuer

|

BRF S.A.

|

|

Global offering

|

The

global offering consists of the international offering and the concurrent Brazilian offering of up to 324,000,000 of our common shares

(including common shares represented by ADSs). The number of common shares offered in the international offering and the Brazilian offering

is subject to reallocation between the offerings. The international offering and the Brazilian offering are being conducted concurrently,

and the closing of each is conditioned upon the closing of the other.

Our base offering in the global offering consists of an offering of 270,000,000

common shares (including common shares represented by ADSs). In addition, we have the right to sell, in a joint decision with the international

underwriters, the placement agents and the Brazilian underwriters, up to additional 54,000,000 of our common shares (including common

shares represented by ADSs) in the global offering.

|

|

International offering

|

common shares, including common shares represented

by ADSs, are being offered by us through the international underwriters and their respective affiliates (which, in the case of the common

shares, are acting as placement agents on behalf of the Brazilian underwriters

named elsewhere in this prospectus supplement) in the United States and other countries outside Brazil.

Safra Securities LLC will only be placing common shares, not

including common shares represented by ADSs outside of Brazil.

The common shares purchased by any investor outside Brazil will be settled

in Brazil and paid for in reais, and the offering of these common shares is being made by the Brazilian underwriters.

Any investor outside Brazil purchasing common shares must be authorized to invest in Brazilian securities under the requirements established

by Brazilian law, especially by the CVM and the Central Bank, complying with the requirements set forth in CMN Resolution No. 4,373,

dated as of November 29, 2014, as amended, and CVM Resolution No. 13, dated November 18, 2020, as amended, or CVM Resolution No. 13.

|

|

SEC registered offering

|

The securities sold as part of the international offering to investors outside Brazil are being sold by means of this prospectus supplement in an offering registered with the SEC.

|

|

Brazilian offering

|

Concurrently with the international offering, common

shares are being offered through the Brazilian underwriters in a public offering with restricted

placement efforts:

(i) our existing shareholders who hold our common shares as of January

20, 2022 and as of January 27, 2022 (as verified through the records of the Central Depository B3 and Itaú Corretora de Valores

S.A., the custody agent in Brazil of our common shares, in each case after closing of the market). For information on the priority offering,

see “––Priority Offering” below;

(ii) to no more than 75 professional investors (as defined in CVM

Resolution 30, dated May 11, 2021) to be subscribed or acquired by no more than 50 professional investors headquartered or resident in

Brazil;

(iii) pursuant to an exemption from registration

under CVM Instruction No. 476; and

(iv) to

investors outside of Brazil that comply with the registration requirements of CVM Resolution No. 13 and

CMN Resolution No. 4,373 or Law No. 4,131.

The Brazilian offering will be made by means of a separate Portuguese

language offering memorandum. The Brazilian offering has not been and will not be registered with the CVM and the offering to investors

in Brazil is exempt from registration with the SEC under Regulation S of the U.S. Securities Act of 1933, as amended, or the Securities

Act.

Payment for our common shares (other than common shares represented

by ADSs) must be made in reais through the facilities of the Central Depositary of the B3. The common shares in the Brazilian offering

are expected to be delivered through the facilities of the Central Depositary of the B3 on or about , 2022. Trades in our common shares

on the B3 will settle through the facilities of the Central Depositary of the B3.

|

|

ADSs

|

Each ADS represents one common share. ADSs may be evidenced by American Depositary Receipts, or ADRs. The ADSs will be issued under that certain Amended and Restated Deposit Agreement, or the deposit agreement, dated as of November 14, 2011, by and among us, The Bank of New York Mellon, as depositary, and the holders and beneficial owners from time to time of ADSs issued thereunder. For more information, see “Description of American Depositary Shares” included in the accompanying prospectus.

|

|

Priority offering

|

In accordance with Article 9-A of CVM Instruction No. 476,

the Brazilian offering includes and is subject to a priority offering in Brazil pursuant to which our existing shareholders who hold our

common shares as of January 20, 2022 and as of January 27, 2022 (as verified through the records of the Central Depository B3 and Itaú

Corretora de Valores S.A., the custody agent of our common shares, in each case after closing of the market) have the right to reserve

for purchase an aggregate of up to 100% of our common shares offered hereby, limited to each shareholder’s proportional interest

in our common share capital (excluding treasury shares) from (and including) January 24, 2022 through (and including) January 28, 2022.

The number of common shares available for sale in the global offering

to investors will be reduced to the extent that existing shareholders of our company subscribe on the priority basis for common shares

in the Brazilian offering.

The price of the common shares subscribed pursuant to the

priority offering will be the public offering price in the Brazilian offering, which will be determined when the marketing of the

global offering has been completed, by agreement between us, the Brazilian underwriters, international

underwriters and the placement agents based on the process for evaluating investor

demand known as bookbuilding. The price will be set forth on the cover page of the final prospectus supplement for the global

offering.

A holder of common shares will not know the price per common share

at the time such holder commits to subscribe common shares in the priority offering. A holder of common shares will consequently be unable

to know the cost of avoiding dilution of its interest in us, and a holder of common shares will also be unable to estimate the book value

dilution that will result from the public offering price.

The priority offering is not available to existing holders of

ADSs. See "Underwriting— Priority Offering in Brazil." In order to participate in the priority offering, non-US

persons who are holders of ADSs may surrender any or all of their ADSs and withdraw the respective underlying common shares so that

such holder is deemed a record holder of our common shares in Brazil for purposes of the priority offering as of the applicable

record dates of January 20, 2022 and as January 27, 2022 (as verified through the records of the Central Depository B3 and

Itaú Corretora de Valores S.A., the custody agent of our common shares, in each case after closing of the market). Holders of

our common shares will only be entitled to participate in our priority offering as long as they hold one (1) common share as of

January 20, 2022 and such participation will only be based on such shareholders proportional interest in our common share capital,

excluding treasury shares, as of January 27, 2022. For further information regarding the procedures to surrender your ADS and

withdraw the common shares they represent, see “Description of American Depositary Shares–– Holders’ Rights

to Receive the Common Shares Represented by their ADSs” included in the accompanying prospectus. For further information with

respect to the procedures for existing shareholders who are non-US persons to participate in the priority offering, such

shareholders are cautioned to review in detail the separate Portuguese language material fact to be made public by us in the context

of the Brazilian offering.

Holders interested in surrendering their ADSs and withdrawing the

common shares they represent should consult and are encouraged to liaise with their respective brokers or financial institutions, including

such holders’ brokers or financial institutions in Brazil, to give effect to any such process.

The priority offering is also not available to an existing shareholder

if the offering would violate local laws of the shareholder's jurisdiction.

|

|

Capital stock before and after the offering

|

As of the date hereof, we have 812,473,246 common shares outstanding, 154,126,518 of which are represented by ADSs. After the global offering, assuming the sale of all 324,000,000 common shares offered hereby, we will have a maximum of 1,136,473,246 common shares outstanding (including common shares represented by ADSs).

|

|

Offering price

|

The public offering prices in the international offering are set

forth on the cover page of this prospectus supplement, in U.S. dollars per ADS and reais per common share.

The public offering prices of our common shares and the ADSs were

approximately equivalent to each other after giving effect to the applicable exchange rates on January 14, 2022.

|

|

Use of proceeds

|

We expect to use the net proceeds from any sale of common shares, including common shares represented by ADSs, to strengthen our capital structure, allowing us to continue expanding our activities and making strategic investments, as well as to reduce our financial expenses with the payment of a portion of our indebtedness. See “Use of Proceeds.”

|

|

Distributions

|

Consistent with Law 6,404/1976, as amended, or the Brazilian Corporate Law, our bylaws provide that an amount equal to 25% of our adjusted net profits (as such term is defined under Brazilian Corporate Law) must be allocated for dividend distributions or payment of interest on shareholders’ equity in a particular year. For more information, see “Description of Common Shares—Allocation of Net Income and Distribution of Dividends in the accompanying prospectus.

|

|

|

The holders of ADSs are entitled to receive dividends to the same extent as the holders of our common shares, converted into U.S. dollars, subject to deduction of any applicable fees and charges. See “Description of American Depositary Shares— Dividends and Other Distributions.”

|

|

Voting rights

|

Holders of our common shares are entitled to one vote per share at meetings of our shareholders.

|

|

|

Holders of the ADSs do not have voting rights, but may instruct the ADS depositary how to vote the common shares underlying their ADSs under the circumstances described in the deposit agreement pursuant to which the ADSs were issued. For more information, see "Risk Factors—Risks Relating to the ADSs and Our Common Shares—Holders of our ADSs do not have the same voting rights as our shareholders” under our Third Quarter MD&A Report and “Description of American Depositary Shares—Voting Rights” included in the accompanying prospectus.

|

|

Listings

|

Our common shares are publicly traded in Brazil on the Novo Mercado segment of the B3 under the symbol “BRFS3.”

|

|

|

The ADSs representing our common shares trade on the NYSE under the symbol “BRFS.”

|

|

Lock-up agreements

|

We have agreed with the international underwriters, subject to certain exceptions, not to offer, sell or dispose of any of our common shares and ADSs or any such securities convertible into or exchangeable or exercisable for any common shares and ADSs during the 90-day period following the date of this prospectus supplement. Members of our board of directors and our executive officers have agreed to substantially similar lock-up provisions, subject to certain exceptions. See “Underwriting—No Sale of Similar Securities.”

|

|

ADS depositary

|

The Bank of New York Mellon.

|

|

Expected timetable for the global offering (subject to change)

|

Commencement of marketing of the global offering: January 18, 2022

Announcement of offer price: February 1, 2022

Allocation of common shares and common shares represented by ADSs: February 1, 2022

Settlement and delivery of common shares and common shares represented by ADSs: February 4, 2022

|

|

Risk factors

|

You should carefully consider the risk factors discussed beginning on page S-27, those set forth under our Third Quarter MD&A Report, which is incorporated by reference in this prospectus supplement, and the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, before purchasing any common shares or common shares represented by ADSs.

|

Summary Financial and Other Information

The following summary financial information

as of December 31, 2020 and 2019 and for the years ended December 31, 2020, 2019 and 2018 is derived from our audited consolidated financial

statements, which were prepared for purposes of inclusion in our 2020 Form 20-F, and should be read in conjunction with our audited consolidated

financial statements included in our 2020 Form 20-F, incorporated by reference in this prospectus supplement. The summary financial information

as of September 30, 2021 and for the nine months ended September 30, 2021 and 2020 is derived from our unaudited condensed consolidated

interim financial information, and should be read in conjunction with our unaudited condensed consolidated interim financial information

included in our Third Quarter Financial Statement Report, incorporated by reference in this prospectus supplement. Our audited consolidated

financial statements incorporated by reference in this prospectus supplement have been prepared in accordance with IFRS, as issued by

IASB. Our unaudited condensed consolidated interim financial information, incorporated by reference in this prospectus supplement, has

been prepared in accordance with IAS 34—Interim Financial Reporting. The results for the nine months ended September 30, 2021

are not necessarily indicative of the results to be expected for the entire year ending December 31, 2021 or any other period.

The summary financial information should be

read in conjunction our Third Quarter MD&A Report.

Summary Statement of Income (Loss)

|

|

Year Ended December 31,

|

|

|

2020(1)

|

2020

|

2019

|

2018

|

|

|

(in thousands

of U.S.$)

|

(in thousands of R$)

|

|

|

|

|

|

Net sales

|

7,256,260

|

39,469,700

|

33,446,980

|

30,188,421

|

|

Cost of sales

|

(5,515,098)

|

(29,998,822)

|

(25,370,042)

|

(25,320,753)

|

|

Gross profit

|

1,741,162

|

9,470,878

|

8,076,938

|

4,867,668

|

|

Operating income (expenses):

|

|

|

|

|

|

Selling expenses

|

(1,027,225)

|

(5,587,488)

|

(4,911,666)

|

(4,513,594)

|

|

General and administrative expenses

|

(141,612)

|

(770,282)

|

(615,683)

|

(551,165)

|

|

Impairment loss on trade receivables

|

(2,231)

|

(12,137)

|

(23,899)

|

(46,269)

|

|

Other operating income (expenses), net

|

(9,145)

|

(49,742)

|

224,384

|

19,311

|

|

Income (loss) from associates and joint ventures

|

—

|

—

|

(1,737)

|

17,715

|

|

Income (loss) before financial results and income taxes

|

560,950

|

3,051,229

|

2,748,337

|

(206,334)

|

|

Financial expenses

|

(347,364)

|

(1,889,454)

|

(3,096,716)

|

(2,130,194)

|

|

Financial income

|

77,354

|

420,757

|

1,304,187

|

869,534

|

|

Foreign exchange and monetary variations

|

(42,339)

|

(230,298)

|

(72,870)

|

(980,814)

|

|

Income (loss) before taxes

|

248,600

|

1,352,234

|

882,938

|

(2,447,808)

|

|

Income taxes

|

31,761

|

172,763

|

195,395

|

333,302

|

|

Income (loss) from continuing operations

|

280,361

|

1,524,997

|

1,078,333

|

(2,114,506)

|

|

Loss from discontinued operations

|

—

|

—

|

(915,809)

|

(2,351,740)

|

|

Net income (loss)

|

280,361

|

1,524,997

|

162,524

|

(4,466,246)

|

|

Net income (loss) from continuing operations

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

Controlling shareholders

|

279,165

|

1,518,492

|

1,067,312

|

(2,114,968)

|

|

Non-controlling interest

|

1,196

|

6,505

|

11,021

|

462

|

|

|

280,361

|

1,524,997

|

1,078,333

|

(2,114,506)

|

|

Net loss from discontinued operations

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

Controlling shareholders

|

—

|

—

|

(904,628)

|

(2,333,093)

|

|

Non-controlling interest

|

—

|

—

|

(11,181)

|

(18,647)

|

|

Total

|

—

|

—

|

(915,809)

|

(2,351,740)

|

|

|

(1)

|

Translated for convenience only using the selling rate as reported by the Central Bank for reais into U.S. dollars at September

30, 2021 of R$5.4394 to U.S.$1.00.

|

|

|

Nine Months Ended

September 30,

|

|

|

2021(1)

|

2021

|

2020

|

|

|

(in thousands

of U.S.$)

|

(in thousands of R$)

|

|

|

|

|

|

|

Continuing Operations

|

|

|

|

|

Net sales

|

6,364,464

|

34,618,863

|

27,995,582

|

|

Cost of sales

|

(5,069,169)

|

(27,573,239)

|

(21,419,255)

|

|

Gross profit

|

1,295,294

|

7,045,624

|

6,576,327

|

|

Operating income (expenses)

|

|

|

|

|

Selling expenses

|

(850,259)

|

(4,624,899)

|

(4,011,692)

|

|

General and administrative expenses

|

(105,520)

|

(573,966)

|

(550,373)

|

|

Impairment loss on trade receivables

|

(2,138)

|

(11,627)

|

(15,126)

|

|

Other operating income (expenses), net

|

19,043

|

103,581

|

91,243

|

|

Income before financial results and income taxes

|

356,420

|

1,938,713

|

2,090,379

|

|

Financial income

|

62,559

|

340,283

|

267,413

|

|

Financial expenses

|

(454,256)

|

(2,470,878)

|

(1,327,579)

|

|

Foreign exchange and monetary variations

|

(39,780)

|

(216,381)

|

(173,025)

|

|

Financial income (expenses), net

|

(431,477)

|

(2,346,976)

|

(1,233,191)

|

|

Income (loss) before taxes

|

(75,057)

|

(408,263)

|

857,188

|

|

Income taxes

|

(7,136)

|

(38,818)

|

(234,654)

|

|

Income (loss) from continuing operations

|

(82,193)

|

(447,081)

|

622,534

|

|

Loss from discontinued operations

|

(8,788)

|

(47,802)

|

—

|

|

Net Income (loss)

|

(90,981)

|

(494,883)

|

622,534

|

|

Net income (loss) from continuing operations

Attributable to:

|

|

|

|

|

Controlling shareholders

|

(83,468)

|

(454,014)

|

609,668

|

|

Non-controlling interest

|

1,275

|

6,933

|

12,866

|

|

|

(82,184)

|

(447,081)

|

622,534

|

|

Net loss from discontinued operations

|

|

|

|

|

Attributable to:

|

|

|

|

|

Controlling shareholders

|

(8,788)

|

(47,802)

|

—

|

|

Non-controlling interest

|

—

|

—

|

—

|

|

Total

|

(8,788)

|

(47,802)

|

—

|

|

|

(1)

|

Translated for convenience only using the selling rate as reported by the Central Bank for reais into U.S. dollars at September

30, 2021 of R$5.4394 to U.S.$1.00.

|

Summary Statement of Financial Position

|

|

As

of December 31,

|

|

|

2020(1)

|

2020

|

2019

|

2018

|

|

|

(in thousands

of U.S.$)

|

(in thousands of R$)

|

|

|

|

|

|

|

|

Cash and cash equivalent

|

1,392,916

|

7,576,625

|

4,237,785

|

4,869,562

|

|

Marketable securities

|

57,756

|

314,158

|

418,182

|

507,035

|

|

Trade and other receivables

|

760,455

|

4,136,421

|

3,090,691

|

2,720,041

|

|

Inventories

|

1,250,645

|

6,802,759

|

3,887,916

|

3,877,294

|

|

Biological assets

|

391,405

|

2,129,010

|

1,603,039

|

1,513,133

|

|

Recoverable taxes

|

165,298

|

899,120

|

473,732

|

560,389

|

|

Recoverable income taxes

|

8,060

|

43,840

|

152,486

|

506,483

|

|

Derivative financial instruments

|

69,448

|

377,756

|

195,324

|

182,339

|

|

Restricted cash

|

—

|

1

|

296,294

|

277,321

|

|

Assets held for sale

|

34,200

|

186,025

|

99,245

|

3,326,305

|

|

Other current assets

|

82,044

|

446,269

|

590,733

|

690,998

|

|

Total current assets

|

4,212,266

|

22,911,984

|

15,045,427

|

19,030,900

|

|

Marketable securities

|

63,348

|

344,577

|

307,352

|

290,625

|

|

Trade and other receivables

|

9,167

|

49,864

|

71,029

|

96,922

|

|

Recoverable taxes

|

894,988

|

4,868,198

|

5,169,547

|

3,142,547

|

|

Recoverable income taxes

|

10,085

|

54,859

|

269,263

|

7,246

|

|

Deferred income taxes

|

387,738

|

2,109,064

|

1,915,370

|

1,519,652

|

|

Judicial deposits

|

101,728

|

553,341

|

575,750

|

669,098

|

|

Biological assets

|

224,611

|

1,221,749

|

1,081,025

|

1,061,314

|

|

Derivative financial instruments

|

43

|

234

|

49,991

|

—

|

|

Restricted cash

|

4,478

|

24,357

|

—

|

584,300

|

|

Other non-current assets

|

15,098

|

82,123

|

85,537

|

177,372

|

|

Total long-term receivables

|

1,711,285

|

9,308,366

|

9,524,864

|

7,549,076

|

|

Investments

|

1,631

|

8,874

|

14,880

|

86,005

|

|

Property, plant and equipment, net

|

2,245,759

|

12,215,580

|

12,276,889

|

10,696,998

|

|

Intangible assets

|

959,683

|

5,220,102

|

4,908,079

|

5,019,398

|

|

Total non-current assets

|

4,918,359

|

26,752,922

|

26,724,712

|

23,351,477

|

|

Total assets

|

9,130,585

|

49,664,906

|

41,770,139

|

42,382,377

|

|

Loans and borrowings

|

194,871

|

1,059,984

|

3,132,029

|

4,547,389

|

|

Trade accounts payable

|

1,653,897

|

8,996,206

|

5,784,419

|

5,487,205

|

|

Supply chain finance

|

267,058

|

1,452,637

|

842,037

|

875,300

|

|

Lease liability

|

70,442

|

383,162

|

376,628

|

75,712

|

|

Payroll, related charges and employee profit sharing

|

172,963

|

940,816

|

825,254

|

618,669

|

|

Taxes payable

|

72,734

|

395,630

|

517,208

|

402,971

|

|

Derivative financial instruments

|

70,774

|

384,969

|

153,612

|

235,035

|

|

Provision for tax, civil and labor risks

|

159,087

|

865,338

|

1,084,308

|

495,584

|

|

Employee benefits

|

23,023

|

125,230

|

95,919

|

94,728

|

|

Liabilities directly associated with assets held for sale

|

3,993

|

21,718

|

—

|

1,131,529

|

|

Other current liabilities

|

149,766

|

814,638

|

717,027

|

524,518

|

|

Total current liabilities

|

2,838,609

|

15,440,328

|

13,528,441

|

14,488,640

|

|

Loans and borrowings

|

3,924,043

|

21,344,442

|

15,488,250

|

17,618,055

|

|

Trade accounts payable

|

2,534

|

13,781

|

12,347

|

12,803

|

|

Lease liability

|

395,911

|

2,153,519

|

2,054,552

|

167,041

|

|

Taxes payable

|

25,968

|

141,252

|

190,257

|

162,239

|

|

Provision for tax, civil and labor risks

|

153,947

|

837,382

|

710,061

|

854,667

|

|

Deferred income taxes

|

4,877

|

26,527

|

85,310

|

65,774

|

|

Employee benefits

|

119,742

|

651,325

|

593,555

|

373,423

|

|

Derivative financial instruments

|

134

|

727

|

3

|

—

|

|

Other non-current liabilities

|

44,507

|

242,089

|

1,093,942

|

1,107,958

|

|

Total non-current liabilities

|

4,671,663

|

25,411,044

|

20,228,277

|

20,361,960

|

|

Capital

|

2,290,780

|

12,460,471

|

12,460,471

|

12,460,471

|

|

Capital reserves

|

26,121

|

142,080

|

192,845

|

115,354

|

|

Accumulated losses

|

(476,896)

|

(2,594,028)

|

(4,131,913)

|

(4,279,003)

|

|

Treasury shares

|

(22,785)

|

(123,938)

|

(38,239)

|

(56,676)

|

|

Other comprehensive loss

|

(238,777)

|

(1,298,801)

|

(722,469)

|

(1,275,519)

|

|

Equity attributable to controlling shareholders

|

1,578,443

|

8,585,784

|

7,760,695

|

6,964,627

|

|

Equity attributable to non-controlling interest

|

41,870

|

227,750

|

252,726

|

567,150

|

|

Total equity

|

1,620,314

|

8,813,534

|

8,013,421

|

7,531,777

|

|

Total liabilities and equity

|

9,130,585

|

49,664,906

|

41,770,139

|

42,382,377

|

|

|

(1)

|

Translated for convenience only using the selling rate as reported by the Central Bank for reais into U.S. dollars at September

30, 2021 of R$5.4394 to U.S.$1.00.

|

|

|

As of September 30,

|

|

|

2021(1)

|

2021

|

|

|

(in thousands

of U.S.$)

|

(in thousands

of reais)

|

|

|

|

|

|

Cash and cash equivalents

|

1,266,655

|

6,889,844

|

|

Marketable securities

|

63,092

|

343,182

|

|

Trade and other receivables

|

659,402

|

3,586,751

|

|

Inventories

|

1,702,195

|

9,258,921

|

|

Biological assets

|

490,507

|

2,668,065

|

|

Recoverable taxes

|

162,470

|

883,740

|

|

Recoverable income taxes

|

17,453

|

94,936

|

|

Derivative financial instruments

|

15,286

|

83,144

|

|

Restricted cash

|

4,510

|

24,529

|

|

Assets held for sale

|

4,003

|

21,773

|

|

Other current assets

|

71,210

|

387,341

|

|

Total current assets

|

4,456,783

|

24,242,226

|

|

Marketable securities

|

69,108

|

375,906

|

|

Trade and other receivables

|

7,700

|

41,886

|

|

Recoverable taxes

|

872,092

|

4,743,657

|

|

Recoverable income taxes

|

11,006

|

59,864

|

|

Deferred income taxes

|

460,530

|

2,505,005

|

|

Judicial deposits

|

99,847

|

543,106

|

|

Biological assets

|

254,225

|

1,382,832

|

|

Derivative financial instruments

|

393

|

2,139

|

|

Restricted cash

|

0

|

1

|

|

Other non-current assets

|

14,253

|

77,528

|

|

Total long-term receivables

|

1,789,154

|

9,731,924

|

|

Investments

|

1,271

|

6,911

|

|

Property, plant and equipment, net

|

2,357,382

|

12,822,742

|

|

Intangible assets

|

1,148,113

|

6,245,045

|

|

Total non-current assets

|

5,295,919

|

28,806,622

|

|

Total assets

|

9,752,702

|

53,048,848

|

|

Loans and borrowings

|

526,023

|

2,861,250

|

|

Trade accounts payable

|

2,036,474

|

11,077,197

|

|

Supply chain finance