FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated February

29, 2024

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: February 29, 2024 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

Incentive Compensation

Clawback Policy

(As Adopted on November 13th,

2023 Pursuant to NYSE Rule 303A.14)

1.

Overview. The Board of Directors (conselho de administração or the “Board”)

of BRF S.A. (the “Company”) has adopted this Incentive Compensation Clawback Policy (the “Policy”)

which requires the recoupment of certain incentive-based compensation in accordance with the terms herein and is intended to comply with

Section 303A.14 of The New York Stock Exchange Listed Company Manual, as such section may be amended from time to time (the “Listing

Rules”). Capitalized terms not otherwise defined herein shall have the meanings assigned to such terms under Section 12

of this Policy.

2.

Interpretation and Administration. The Board shall have full authority to interpret and enforce the Policy; provided,

however, that the Policy shall be interpreted in a manner consistent with its intent to meet the requirements of the Listing Rules.

As further set forth in Section 10 below, this Policy is intended to supplement any other clawback policies and procedures that the Company

may have in place from time to time pursuant to other applicable law, plans, policies or agreements.

3.

Covered Executives. The Policy applies to each current and former Executive Officer of the Company who serves

or served as an Executive Officer at any time during a performance period in respect of which Incentive Compensation is Received,

to the extent that any portion of such Incentive Compensation is (a) Received by the Executive Officer during (i) the last three completed

Fiscal Years or (ii) any applicable Transition Period preceding the date that the Company is required to prepare a Restatement (regardless

of whether any such Restatement is actually filed) and (b) determined to have included Erroneously Awarded Compensation. For purposes

of determining the relevant recovery period referenced in the preceding clause (a), the date that the Company is required to prepare a

Restatement under the Policy is the earlier to occur of (i) the date that the Board, a committee of the Board, or the officer or officers

of the Company authorized to take such action if Board action is not required, concludes, or reasonably should have concluded, that the

Company is required to prepare a Restatement or (ii) the date a court, regulator, or other legally authorized body directs the Company

to prepare a Restatement. Executive Officers subject to this Policy pursuant to this Section 3 are referred to herein as “Covered

Executives.”

4.

Recovery of Erroneously Awarded Compensation. If any Erroneously Awarded Compensation is Received by a Covered

Executive, the Company shall reasonably promptly take steps to recover such Erroneously Awarded Compensation in a manner described under

Section 5 of this Policy. If the general counsel of the Company becomes aware of any fact that makes him/her suspect of the need of any

Restatement, he/she shall promptly report any such underlying facts to the Board and its People, Governance, Organization and Culture

Committee.

5.

Forms of Recovery. The Board shall determine, in its sole discretion and in a manner that effectuates the purpose

of the Listing Rules, one or more methods for recovering any Erroneously Awarded Compensation hereunder in accordance with Section 4

above, which may include, without limitation: (a) requiring cash reimbursement; (b) seeking recovery or forfeiture of any gain realized

on the vesting, exercise, settlement, sale, transfer or other disposition of any equity-based awards; (c) offsetting the amount to be

recouped from any compensation otherwise owed by the Company to the Covered Executive; (d) cancelling outstanding vested or unvested

equity awards; or (e) taking any other remedial and recovery action permitted by law, as determined by the Board. To the extent the Covered

Executive refuses to pay to the Company an amount equal to the Erroneously Awarded Compensation, the Company shall have the right to

sue for repayment and/or enforce the Covered Executive’s obligation to make payment through the reduction or cancellation of outstanding

and future compensation. Any reduction, cancellation or forfeiture of compensation shall be done in compliance with applicable laws,

including without limitation, applicable provisions of Section 409A of the Internal Revenue Code of 1986, as amended, and the regulations

promulgated thereunder.

6.

No Indemnification or Insurance. The Company shall not indemnify any Covered Executive against the loss of any

Erroneously Awarded Compensation for which the Board has determined to seek recoupment pursuant to this Policy. For the purposes of the

Policy, the payment or reimbursement by the Company of the insurance premiums to cover losses incurred as a result of Erroneously Awarded

Compensation are considered an indemnification pursuant to this section 6.

7.

Exceptions to the Recovery Requirement. Notwithstanding anything in this Policy to the contrary, Erroneously

Awarded Compensation need not be recovered pursuant to this Policy if a majority of the Independent Directors serving on the Board) determines

that recovery would be impracticable as a result of any of the following:

(a)

the direct expense paid to a third party to assist in enforcing the Policy would exceed the amount to be recovered; provided

that, before concluding that it would be impracticable to recover any amount of Erroneously Awarded Compensation based on expense of enforcement,

the Company must make a reasonable attempt to recover such Erroneously Awarded Compensation, document such reasonable attempt(s) to recover,

and provide that documentation to the Exchange;

(b)

recovery would violate home country law where that law was adopted prior to November 28, 2022; provided that, before concluding

that it would be impracticable to recover any amount of Erroneously Awarded Compensation based on violation of home country law, the Company

must obtain an opinion of home country counsel, acceptable to the Exchange, that recovery would result in such a violation, and must provide

such opinion to the Exchange; or

(c)

recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees

of the Company, to fail to meet the requirements of applicable laws, including without limitation any applicable provisions of 26 U.S.C.

401(a)(13) or 26 U.S.C. 411(a) and the regulations thereunder.

8.

Board Determination Final. Any determination by the Board with respect to the Policy shall be final, conclusive

and binding on all interested parties.

9.

Amendment. The Policy may be amended by the Board from time to time, to the extent permitted under the Listing

Rules.

10.

Non-Exclusivity. Nothing in the Policy shall be viewed as limiting the right of the Company or the Board to pursue

additional remedies or recoupment under or as required by any similar policy adopted by the Company or under the Company’s compensation

plans, award agreements, employment agreements or similar agreements or the applicable provisions of any law, rule or regulation which

may require or permit recoupment to a greater degree or with respect to additional compensation as compared to this Policy (but without

duplication as to any recoupment already made with respect to Erroneously Awarded Compensation pursuant to this Policy). This Policy shall

be interpreted in all respects to comply with the Listing Rules.

11.

Successors. The Policy shall be binding and enforceable against all Covered Executives and their beneficiaries,

heirs, executors, administrators or other legal representatives.

12.

Defined Terms.

“Covered Executives”

shall have the meaning set forth in Section 3 of this Policy.

“Erroneously

Awarded Compensation” shall mean the amount of Incentive Compensation actually Received that exceeds the amount of Incentive

Compensation that otherwise would have been Received had it been determined based on the restated amounts, and computed without regard

to any taxes paid. For Incentive Compensation based on stock price or total shareholder return, where the amount of erroneously awarded

Incentive Compensation is not subject to mathematical recalculation directly from the information in a Restatement:

| (A) | The calculation of Erroneously Awarded Compensation shall be based on a reasonable estimate of the effect

of the Restatement on the stock price or total shareholder return upon which the Incentive Compensation was Received; and |

| (B) | The Company shall maintain documentation of the determination of that reasonable estimate and provide

such documentation to the Exchange. |

“Exchange”

shall mean The New York Stock Exchange.

“Executive Officer”

shall mean the Company’s president, principal financial officer, principal accounting officer (or if there is no such accounting

officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales,

administration, or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making

functions for the Company. Executive officers of the Company’s parent(s) or subsidiaries shall be deemed executive officers of the

Company if they perform such policy-making functions for the Company. Policy-making function is not intended to include policymaking functions

that are not significant.

“Financial Reporting

Measures” shall mean measures that are determined and presented in accordance with the accounting principles used in preparing

the Company’s financial statements, and any measures that are derived wholly or in part from such measures, including, without limitation, stock price and total shareholder

return (in each case, regardless of whether such measures are presented within the Company’s financial statements or included in

a filing with the Securities and Exchange Commission).

“Fiscal Year”

shall mean the Company’s fiscal year; provided that a Transition Period between the last day of the Company’s previous fiscal

year end and the first day of its new fiscal year that comprises a period of nine to 12 months will be deemed a completed fiscal year.

“Incentive Compensation”

shall mean any compensation (whether cash or equity-based) that is granted, earned, or vested based wholly or in part upon the attainment

of a Financial Reporting Measure, and may include, but shall not be limited to, performance bonuses and long-term incentive awards such

as stock options, stock appreciation rights, restricted stock, restricted stock units, performance share units or other equity-based awards.

For the avoidance of doubt, Incentive Compensation does not include (i) awards that are granted, earned and vested exclusively upon completion

of a specified employment period, without any performance condition, and (ii) bonus awards that are discretionary or based on subjective

goals or goals unrelated to Financial Reporting Measures. Notwithstanding the foregoing, compensation amounts shall not be considered

“Incentive Compensation” for purposes of the Policy unless such compensation is Received (1) while the Company has a class

of securities listed on a national securities exchange or a national securities association, and (2) on or after October 2, 2023, the

effective date of the Listing Rules.

“Independent

Director” shall mean a director who is determined by the Board to be “independent” for Board membership, as

applicable, under the rules of the Brazilian Securities Exchange Commission (Comissão de Valores Mobiliários), as

of any determination date.

“Listing Rules”

shall have the meaning set forth in Section 1 of this Policy.

Incentive Compensation shall

be deemed “Received” in the Company’s fiscal period during which the Financial Reporting Measure specified

in the Incentive Compensation award is attained, even if the payment or grant of the Incentive Compensation occurs after the end of that

period.

“Restatement”

shall mean an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the

securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material

to the Company’s previously issued financial statements, or that would result in a material misstatement if the error were corrected

in the current period or left uncorrected in the current period.

“Transition Period”

shall mean any transition period that results from a change in the Company’s Fiscal Year within or immediately following the three

completed Fiscal Years immediately preceding the Company’s requirement to prepare a Restatement.

Adopted on: November 13th,

2023

Acknowledgment of Incentive

Compensation Clawback Policy

Reference is made to the BRF S.A.

Incentive Compensation Clawback Policy (as adopted on November 13th, 2023 pursuant to NYSE Rule 303A.14) (the “Policy”).

Capitalized terms used herein without definition have the meanings assigned to such terms under the Policy.

By signing below, the undersigned

acknowledges, confirms and agrees that:

| · | the undersigned has received and reviewed a copy of the Policy; |

| · | the undersigned is, and will continue to be, subject to the Policy to the extent provided therein; |

| · | the Policy may apply both during and after termination of the undersigned’s employment with the

Company and its affiliates; and |

| · | the undersigned agrees to abide by the terms of the Policy, including, without limitation, by returning

any Erroneously Awarded Compensation to the Company pursuant to the Policy. |

________________________________

Signature

________________________________

Print Name

________________________________

Date

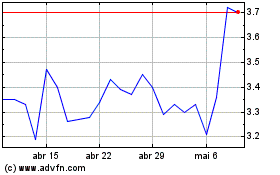

BRF (NYSE:BRFS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

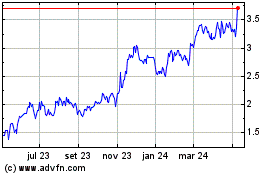

BRF (NYSE:BRFS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024