UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

BRF

S.A.

(Name of Issuer)

Common Shares

(“Shares”) and American Depositary Shares (“ADSs”) evidenced by American Depositary Receipts (“ADRs”),

representing common shares of BRF S.A.

(Title of Class of Securities)

56656T105

(CUSIP Number)

Heraldo Geres

Marfrig Global Foods S.A.

Avenida Queiroz Filho, n. 1.560, Bloco 5 (Torre

Sabiá), 3º andar, sala 301

Vila Hamburguesa, São Paulo, SP, 05319-000

Brazil

Telephone: 55

11 3792-8600

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

Copy to:

Matthew S. Poulter

Linklaters LLP

1290 Avenue of the Americas

New York, New York 10104

Telephone: (212) 903-9000

May 20, 2021

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for

a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 56656T105 |

|

13D |

|

Page 2 of 4 Pages |

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Marfrig Global Foods S.A. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) ¨ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

BK, WC |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨

|

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Federative Republic of Brazil |

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

359,933,582 |

| |

8. |

|

SHARED VOTING POWER

— |

| |

9. |

|

SOLE DISPOSITIVE POWER

359,933,582 |

| |

10. |

|

SHARED DISPOSITIVE POWER

— |

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

359,933,582 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ¨ |

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.2% |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

OO |

|

|

| CUSIP No. 56656T105 |

|

13D |

|

Page 3 of 4 Pages |

EXPLANATORY NOTE

This Amendment No. 3 (the “Amendment”)

amends and supplements the statement on Schedule 13D filed by Marfrig Global Foods S.A. and Marfrig Overseas Ltd. on June 4, 2020, as

amended by Amendment No. 1 filed on June 10, 2021 and Amendment No. 2 filed on October 25, 2021 (the “Schedule 13D”)

relating to the beneficial ownership of common stock of BRF S.A. (the “Shares”).

This Amendment is being filed to report the following

events in connection with the matters disclosed herein:

| i. | the acquisition of beneficial ownership of an additional 90,198,779 Shares, representing 8.3% of the outstanding Shares pursuant to

the BRF Capital Increase (as defined below); and |

| ii. | the entry by Marfrig, the Lender and the Collateral Agent into an amendment agreement dated as of February 25, 2022 in respect of

the First Collar Transaction Loan Agreement dated as of October 23, 2021. |

The Items below amend the information disclosed

under the corresponding Items of the Schedule 13D as described below. Except as specifically provided herein, this Amendment does not

modify any of the information previously reported in the Schedule 13D. Capitalized terms used herein and not otherwise defined shall have

the respective meanings ascribed to them in the Schedule 13D.

Item 1. Security and Issuer.

Item 2. Identity and Background.

Item 3. Source or Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is hereby further amended

by adding the following:

The BRF Capital Increase

On February 1, 2022, BRF announced the pricing

of a capital increase, pursuant to which it issued 270,000,000 common shares, including 11,250,000 common shares in the form of ADSs,

for a price of R$20.00 per common share and US$3.79 per ADS (the “BRF Capital Increase”).

The offering of ADSs was made in the United States

by means of a prospectus included in an effective automatic-shelf registration statement on Form F-3, and an accompanying preliminary

prospectus supplement filed with the Securities and Exchange Commission on January 18, 2022. The common shares were offered in Brazil

in a public offering with restricted selling efforts by means of a Brazilian offering memorandum pursuant to CVM Instruction No. 476.

Marfrig subscribed for 90,198,779 Shares in the

BRF Capital Increase and paid for such Shares with cash available on-hand.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended and

replaced as follows:

Marfrig intends to present a slate of candidates

for the Board of Directors of BRF. The proposed slate of candidates consists of: (i) Marcos Antonio Molina dos Santos (Chairman of the

Board of Directors); (ii) Sergio Agapito Rial (Vice-Chairman of the Board of Directors); (iii) Márcia Aparecida Pascoal Marçal

dos Santos; (iv) Augusto Marques da Cruz Filho; (v) Deborah Stern Vieitas; (vi) Flávia Maria Bittencourt; (vii) Oscar de Paula

Bernardes Neto; (viii) Pedro de Camargo Neto; (ix) Altamir Batista Mateus da Silva; and (x) Eduardo Augusto Rocha Pocetti. Marfrig expects

its slate of candidates to be presented to the shareholders of BRF at the next ordinary shareholders’ meeting.

The Group will continue review its investments

in BRF on an ongoing basis. Any actions the Group might undertake, including additional purchases or sales of BRF securities, will be dependent upon the Group’s review of numerous factors,

including, but not limited to: an ongoing evaluation of BRF’s business, financial condition, operations and prospects; price levels

of BRF’s securities; general market, industry and economic conditions; the relative attractiveness of alternative business and investment

opportunities; and other current and future developments.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and replaced

as follows:

In the aggregate, Marfrig beneficially owns 359,933,582 Shares

(representing 33.25% of the outstanding Shares).

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is hereby amended by adding the

following:

Amendment to the First Collar Loan Agreement

Pursuant to the Amendment to the First Collar

Loan Agreement, the First Collar Loan Agreement was amended to, among others: (i) permit that Marfrig pledge Shares to certain Lenders

and (ii) remove restrictive covenants relating to certain Restricted Transactions and Prohibited actions, each as defined in the First

Collar Loan Agreement. In order to enter into the First Collar Loan Agreement, certain amendments were made to the security package initially

granted to the Collateral Agent on October 22, 2021. In addition, prior to the execution of the Amendment to the First Collar Loan Agreement,

the related derivative instruments were unwound on February 18, 2022.

The foregoing description of the Amendment to

the First Collar Loan Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of Amendment

to the First Collar Loan Agreement, which is attached hereto as Exhibit 99.10 and incorporated herein by reference.

Prepayment of the Second Collar Loan Agreement

On February 11, 2022, Marfrig repaid the Second

Collar Loan Agreement in full and unwound the related derivative instruments.

Item 7. Material to Be Filed as Exhibits.

| CUSIP No. 56656T105 |

|

13D |

|

Page 4 of 4 Pages |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: March 1, 2022

| |

MARFRIG GLOBAL FOODS S.A. |

| |

|

| |

By: |

/s/ Tang David |

| |

Name: Tang

David |

| |

Title: Chief

Financial Officer |

| |

|

| |

By: |

/s/ Heraldo

Geres |

| |

Name: Heraldo

Geres |

| |

Title: General

Counsel |

Exhibit 99.10

Execution Version

FIRST AMENDMENT AND WAIVER

TO LOAN AGREEMENT

FIRST AMENDMENT AGREEMENT (this “Amendment”),

dated as of February 25, 2022 by and among MARFRIG GLOBAL FOODS S.A., as Borrower (“Borrower”), JPMORGAN CHASE BANK,

N.A., LONDON BRANCH, as Lender (“Lender”), and BANCO J.P.MORGAN S.A., as Collateral Agent (“Collateral Agent”).

RECITALS:

WHEREAS, reference is made to the Loan Agreement

dated as of October 22, 2021 (the “Loan Agreement”) by and among Borrower, Lender and Collateral Agent;

WHEREAS, Borrower and Lender have mutually agreed

to certain modifications to the Collateral under the Loan Agreement and to certain covenants thereunder on the terms, and subject to the

conditions, set forth herein;

WHEREAS, Borrower has also requested that Lender

permit the Borrower to unwind of the Collar Transaction without prepaying a proportionate amount of the Advance outstanding under the

Loan Agreement at such time, together with accrued and unpaid interest thereon (the “Waiver”) until April 25,

2022 (“Waiver End Date”); and

NOW, THEREFORE, in consideration of the premises

and agreements, provisions and covenants herein contained, the parties hereto agree as follows:

1.

Defined Terms; References. Unless otherwise specifically defined herein, each term used herein that is defined in Annex

A hereto has the meaning assigned to such term in Annex A hereto.

Each reference to “hereof”, “hereunder”,

“herein” and “hereby” and each other similar reference and each reference to “this Agreement” and

each other similar reference contained in the Loan Agreement shall, after this Amendment becomes effective, refer to the Loan Agreement

as amended hereby. For the avoidance of doubt, after the Amendment Effective Date (as defined below), any references to “date hereof,”

or “date of this Agreement,” in the Loan Agreement shall continue to refer to October 22, 2021.

2.

Amendments to Loan Agreement. Effective on and as of the Amendment Effective Date the Loan Agreement is hereby amended by

incorporating the changes shown in the blackline attached as Annex A hereto;

3.

Waiver. Effective on and as of the Amendment Effective Date to but not including the Waiver End Date, notwithstanding Section

2.05(b) of the Loan Agreement, Borrower shall not be required to prepay any portion of the outstanding Advance following the consensual

unwind of the Collar Transaction, if any.

For the avoidance of doubt, on the Waiver End

Date, the Waiver shall no longer apply and Lender may, in its sole discretion, require the prepayment of any portion of the Advance

outstanding under the Loan Agreement, together with accrued and unpaid interest thereon, before or after a partial termination or

consensual unwind of the Collar Transaction pursuant Section 2.05(b) of the Loan Agreement. In the event Lender decides to require

such prepayment, Lender will notify Borrower in writing and any such amounts shall be payable by Borrower to Lender one (1) Business

Day after receipt of such notice by Borrower. Failure of the Borrower to make any such payments shall constitute an immediate Event

of Default pursuant to Section 7.01(a) of the Loan Agreement.

4.

Effectiveness. This Amendment shall become effective upon satisfaction of each of the following conditions precedent (the

date of such effectiveness, the “Amendment Effective Date”):

| a. | Lender shall have received each of the following documents, duly executed, each dated as of the Amendment Effective Date (except in

the case of lien searches, which shall be dated on or prior to the Amendment Effective Date), in each case, in form and substance reasonably

satisfactory to Lender: |

i.

duly executed counterparts of this Amendment and an amendment to the Shares Security Agreement;

ii.

a certificate of a Responsible Officer of Borrower, dated the Amendment Effective Date, which shall (A) certify the resolutions

of its general partner, board of directors, board of managers, equivalent governing body, or shareholders, as applicable, authorizing

the execution, delivery and performance of this Amendment, (B) identify by name and title and bear the signatures of the Responsible

Officers and any other officers of Borrower authorized to sign this Amendment (including pursuant to any powers of attorney), and (C) certify

certain appropriate attachments, including (x) the Organization Documents of Borrower certified by the relevant authority of the

jurisdiction of organization of Borrower and copies of all shareholders or board of directors resolutions required for the execution,

delivery and performance of this Amendment, as requested by Lender and its counsel and (y) if applicable, a good standing certificate

for Borrower from its jurisdiction of organization;

iii.

a solvency certificate from a Responsible Officer of Borrower;

iv.

other appropriate evidence from filing offices or central securities depository of each jurisdiction as may be necessary to perfect

the security interests created by each Security Agreement (including filing of the amendment to the Credit Rights Security Agreement with

the Brazilian Registry of Deeds and Documents); and

v.

such other certificates or documents as Lender reasonably may require.

| b. | All documented fees and expenses required to be paid under the Collar Loan Documentation on or before the Amendment Effective Date,

including counsel fees invoiced prior to the Amendment Effective Date and UCC financing statement search and filing fees, shall have been

paid. |

| c. | Each of the representations and warranties contained in Section 5 hereof shall be true and correct on and as of the Amendment Effective

Date. |

| d. | Since the date of the Loan Agreement, no event or condition shall have resulted in, or could be reasonably expected to cause, either

individually or in the aggregate, a Material Adverse Effect. |

| e. | No Default, Event of Default, Collateral Event of Default, Early Collar Termination Event, Market Disruption Event or Potential Adjustment

Event shall have occurred and be continuing or would result from the effectiveness of this Amendment. |

| f. | An amount of Collateral Shares no less than the Number of Transaction Shares shall constitute Acceptable Collateral. |

| g. | The Collateral Requirement shall have been satisfied in all respects. |

5.

Representations and Acknowledgements.

| a. | Borrower represents and warrants that (i) the representations and warranties made by it in the Loan Agreement (as amended hereby)

and the other Collar Loan Documentation are true and correct in all material respects, except for any representation and warranty that

is qualified by materiality or reference to Material Adverse Effect, which representation and warranty shall be true and correct in all

respects, on and as of the date of this Amendment with the same effect as if made on and as of such date (except for any such representation

and warranty that by its terms is made only as of an earlier date, which representation and warranty shall remain true and correct in

all material respects as of such earlier date, except for any representation and warranty that is qualified by materiality or reference

to Material Adverse Effect, which representation and warranty shall be true and correct in all respects as of such earlier date), (ii)

no Default, Event of Default, Collateral Event of Default, Early Collar Termination Event, Market Disruption Event or Potential Adjustment

Event has occurred and is continuing on the date hereof and (iii) since the date of the Loan Agreement, no event or condition has

resulted in, or could be reasonably expected to cause, either individually or in the aggregate, a Material Adverse Effect. |

| b. | On the date of the Loan Agreement and the Amendment Effective Date, Borrower made the representations and warranties set forth in

Article 3 thereof as in effect at such time. Nothing in this Amendment shall be deemed to constitute an amendment or modification

of, or a waiver with respect to, any of such representations and warranties made at such time. |

6.

Evidence of Consent. By executing a signature page hereto, each party to this Amendment hereby evidences its agreement to

the amendments and modifications set forth herein.

7.

Confirmation of Security Interests. By signing this Amendment, Borrower hereby confirms that (a) its obligations under

the Loan Agreement, as modified or supplemented hereby, (i) are entitled to the benefits of the security interests set forth or

created in the Security Agreement(s) and (ii) constitute “Obligations” and “Secured Obligations” or any other

similar terms for purposes of such Security Agreement(s) and (b) notwithstanding the effectiveness of the terms hereof, the security

interests granted by it pursuant to the Security Agreement(s) are, and shall continue to be, in full force and effect and are hereby

ratified and confirmed in all respects (after giving effect to the amendments set forth herein). Borrower ratifies and confirms that

all Liens granted, conveyed, or assigned to the secured party or fiduciary assignee, as the case may be, by it pursuant to the Security

Agreement(s) remain in full force and effect, are not released or reduced, and continue to secure full payment and performance of the

Secured Obligations, as modified hereby. All rights and remedies that each of Lender and the Collateral Agent may have now or in the

future under the Collar Loan Documentation and applicable law are expressly reserved.

8.

Collar Loan Documentation. This Amendment constitutes “Collar Loan Documentation” entered into in connection

with the Loan Agreement. The terms of Sections 8.01, 8.06 (b) - (e), 8.08, 8.09 and 8.14 of the Loan Agreement shall apply mutatis

mutandis to this Amendment as if such provisions were fully set forth herein.

9.

Amendment, Modification and Waiver. This Amendment may not be amended, modified or waived except by an instrument or instruments

in writing signed and delivered on behalf of each of the parties hereto.

10.

Governing Law. This Amendment shall be governed by, and construed in accordance with, laws of the State of New York.

11.

Counterparts. This Amendment may be executed in counterparts (and by different parties hereto on different counterparts),

each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed

counterpart of a signature page of this Amendment by telecopy or other electronic imaging means (e.g., “pdf” or “tif”)

shall be effective as delivery of a manually executed counterpart of this Amendment.

IN WITNESS WHEREOF, each party hereto has

caused this Amendment to be duly executed and delivered by its duly authorized representative as of the date first above written.

| |

BORROWER: |

| |

|

| |

MARFRIG GLOBAL FOODS S.A. |

| |

as Borrower |

| |

|

| |

By: |

/s/ Tang David |

| |

Name: Tang David |

| |

Title: Chief Financial Officer |

| |

|

| |

By: |

/s/ Heraldo Geres |

| |

Name: Heraldo Geres |

| |

Title: Chief Legal Officer |

[Signature Page to First Amendment Agreement]

| |

JPMORGAN CHASE BANK, N.A., LONDON BRANCH |

| |

as Lender |

| |

|

| |

By: |

/s/ Andrés Cassinello Herrera |

| |

Name: Andrés Cassinello Herrera |

| |

Title: Executive Director |

[Signature Page to First Amendment Agreement]

| |

BANCO J.P.MORGAN S.A. |

| |

as Collateral Agent |

| |

|

| |

By: |

/s/ Fabio Jorge Resegue |

| |

Name: Fabio Jorge Resegue |

| |

Title: Director |

| |

|

| |

By: |

/s/ Mauricio Vernacci |

| |

Name: Mauricio Vernacci |

| |

Title: Director |

[Signature Page to First Amendment Agreement]

ANNEX A

Amended Loan Agreement

[Attached]

This regulatory filing also includes additional resources:

tm227947d1_ex99-10.pdf

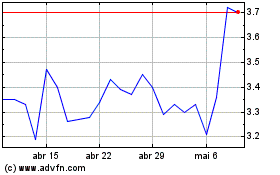

BRF (NYSE:BRFS)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

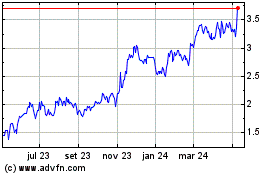

BRF (NYSE:BRFS)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024