|

|

CALCULATION

OF REGISTRATION FEE

|

Title

Of Each

Class Of Securities To Be Registered

|

Amount To Be Registered

|

Proposed Maximum Offering

Price Per Unit

|

Proposed Maximum Aggregate

Offering Price

|

Amount

of Registration Fee

(1)

|

|

Units (including units represented by American

Depositary Shares)

(2)

|

92,000,000

(3)

|

$8.085

|

$743,820,000.00

|

$86,208.74

|

|

|

(1)

|

Calculated in accordance with Rule 457(r) of the Securities

Act of 1933.

|

|

|

(2)

|

American Depositary Shares, each representing one unit, are

traded on the New York Stock Exchange. Each unit represents one common share, without

par value, and one preferred share, without par value of Banco Santander (Brasil) S.A.

A separate Registration Statement on Form F-6 (File No. 333-207353) was filed on October

9, 2015. The Registration Statement on Form F-6 relates to the registration of American

Depositary Shares, or “ADSs,” issuable upon deposit of the units registered

hereby.

|

|

|

(3)

|

Includes additional ADSs that may be purchased by the international

underwriters.

|

|

|

Filed Pursuant to Rule 424(b)(7)

Registration No. 333-216976

|

PROSPECTUS SUPPLEMENT

(To Prospectus dated March 28,

2017)

80,000,000 Units

Banco Santander (Brasil) S.A.

(incorporated in the Federative Republic

of Brazil)

Including units in the form of American

depositary shares

The selling shareholder named in this

prospectus supplement, Qatar Holding LLC (“Qatar Holding”, or the “Selling Shareholder”), is offering

a total of 80,000,000 units (each, a “unit”), which is composed of one common share, no par value, and one preferred

share, no par value, of Banco Santander (Brasil) S.A. This offering is being conducted by the international underwriters named

in this prospectus supplement in the United States and elsewhere outside Brazil (the “international offering”). In

the international offering, 58,000,000 units are being offered in the form of American depositary shares (the “ADSs”),

each of which represents one unit. The offering of the ADSs is being underwritten by the international underwriters named in this

prospectus. The Brazilian underwriters named in this prospectus supplement are offering 22,000,000 units in a separate

offering in Brazil (the “Brazilian offering” and, together with the international offering, the “global offering”).

Any units not in the form of ADSs purchased by investors outside Brazil will be settled in Brazil and paid for in reais. Each

of the international offering and the Brazilian offering is conditioned on the closing of the other. We will not receive any proceeds

from the sale of ADSs or units by the Selling Shareholder.

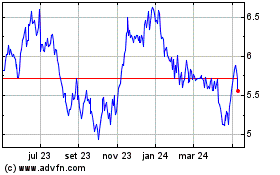

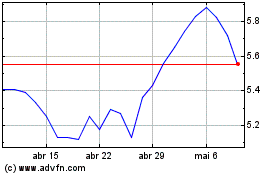

Our units, common shares and preferred

shares are listed on the São Paulo Stock Exchange (

BM&FBOVESPA S.A. - Bolsa de Valores, Mercadorias e Futuros

)

(the “BM&FBOVESPA”), under the symbol “SANB11”, “SANB3” and “SANB4” respectively.

The ADSs are listed on the New York Stock Exchange under the symbol “BSBR.” On April 4, 2017, the last reported

sale price of the ADSs on the New York Stock Exchange was U.S.$8.81 per ADS.

This offering has not been and will not

be registered with the Brazilian Securities Commission (

Comissão de Valores Mobiliários

) (the “CVM”).

In Brazil, the Brazilian underwriters will offer units pursuant to a confidential Portuguese language memorandum (the “Brazilian

memorandum”), which includes our

formulário de referência

incorporated by reference therein, as an offering

with restricted placement efforts to no more than 75 professional investors in Brazil (excluding non-Brazilian investors), and

our units offered may be acquired by no more than 50 professional investors in Brazil (excluding non-Brazilian investors), in compliance

with CVM Instruction No. 476, dated January 16, 2009, as amended (“CVM Instruction No. 476”). The abovementioned restrictions

are not applicable to placement efforts or acquisitions concerning non-Brazilian investors. Investment funds and securities portfolios

in which the investment decisions are made by the same manager shall be regarded as one sole professional investor, pursuant to

the terms of article 3 of CVM Instruction No. 476. This prospectus supplement is not addressed to Brazilian residents and it should

not be forwarded or distributed to, nor read or consulted by, acted on or relied upon by Brazilian residents. Any investment to

which this prospectus relates is available only to non-Brazilian residents and will only be made by non-Brazilian residents. If

you are a Brazilian resident and received this prospectus supplement, please destroy it along with any copies.

The Selling Shareholder has granted the

international underwriters the option to purchase up to 12,000,000 additional ADSs (the “Additional ADSs”)

within 30 days from, but not including, the date of this prospectus supplement, solely to cover over-allotments of ADSs, if any.

The Additional ADSs, if any, will be purchased by the international underwriters in connection with the international offering,

and this option to purchase the Additional ADSs, if exercised, will not result in any offering of units in Brazil or placement

of units outside Brazil under the terms of the Brazilian Offering.

Investing in our units, common shares,

preferred shares and the ADSs involves risks. You should carefully review the “Risk Factors” section beginning on

page S-18 of this prospectus supplement, as well as in the documents incorporated by reference into the accompanying prospectus.

|

|

|

|

Per

ADS

|

|

|

|

Total

|

|

|

Public offering price

|

|

U.S.$8.085

|

|

|

|

U.S.$468,930,000

|

|

|

|

Underwriting discounts and commissions

|

|

U.S.$0.1455

|

|

|

|

U.S.$8,439,000

|

|

|

|

Proceeds, before expenses, to the Selling Shareholder

|

|

U.S.$7.9395

|

|

|

|

U.S.$460,491,000

|

|

|

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the ADSs or passed upon the accuracy or adequacy of this prospectus

supplement. Any representation to the contrary is a criminal offense.

The ADSs will be ready for delivery on

or about April 11, 2017.

|

|

Bookrunners

|

|

|

BofA Merrill Lynch

|

Credit Suisse

|

Santander

|

The date of this prospectus supplement

is April 5, 2017.

We and the Selling Shareholder have not

authorized any other person to provide you with information different from or in addition to that included in this prospectus supplement

or in the accompanying prospectus. The Selling Shareholder is not making an offer to sell the units, common shares, preferred shares

and ADSs in any jurisdiction where the offer or sale is not permitted. You should not assume that the information in this prospectus

supplement or in the accompanying prospectus is accurate as of any date other than the date on the front of those documents.

About This

Prospectus Supplement

This document is in two parts. The first

part is this prospectus supplement, which describes the specific terms of this offering and adds to and updates information contained

in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying

prospectus. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering.

To the extent there is a conflict between

the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus

or in any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, on the

other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent

with a statement in another document having a later date (for example, a document incorporated by reference in this prospectus

supplement) the statement in the document having the later date modifies or supersedes the earlier statement.

Where You

Can Find More Information

We have filed with the SEC a registration

statement (including any amendments and exhibits to the registration statement) on Form F-3 under the Securities Act. This prospectus

supplement, which is part of the registration statement, does not contain all of the information set forth in the registration

statement and the exhibits and schedules to the registration statement. For further information, we refer you to the registration

statement and the exhibits and schedules filed as part of the registration statement. If a document has been filed as an exhibit

to the registration statement, we refer you to the copy of the document that has been filed. Each statement in this prospectus

supplement relating to a document filed as an exhibit is qualified in all respects by the filed exhibit.

We are subject to the informational requirements

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, we are required to file reports

and other information with the SEC, including annual reports on Form 20-F and reports on Form 6-K referred to, and incorporated,

herein. You may inspect and copy reports and other information filed with the SEC at the Public Reference Room at 100 F Street,

N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

In addition, the SEC maintains an Internet website that contains reports and other information about issuers, like us, that file

electronically with the SEC. The address of that website is www.sec.gov.

As a foreign private issuer, we are exempt

under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and our

executive officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions

contained in Section 16 of the Exchange Act. In addition, we will not be required under the Exchange Act to file periodic reports

and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the

Exchange Act.

Incorporation

of Certain Documents by Reference

The SEC allows us to “incorporate

by reference” information into this prospectus supplement. This means that we can disclose important information to you by

referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be

a part of this prospectus supplement, except for any information superseded by information that is included directly in this document

or incorporated by reference subsequent to the date of this document.

We incorporate by reference into this

prospectus supplement our Annual Report on Form 20-F for the year ended December 31, 2016, filed with the SEC on March 28,

2017 (File No. 001-34476), which we refer to as our “2016 Annual Report”.

All annual reports we file with the SEC

pursuant to the Exchange Act on Form 20-F after the date of this prospectus supplement and prior to the termination of the offering

shall be deemed to be incorporated by reference into this prospectus supplement and to be part hereof from the date of filing of

such documents. We may incorporate by reference any Form 6-K submitted to the SEC after the date of this prospectus supplement

by identifying in such Form that it is being incorporated by reference into this prospectus supplement.

Any statement contained in this prospectus

supplement, the accompanying prospectus or in a document incorporated or deemed incorporated by reference into this prospectus

supplement or the accompanying prospectus will be deemed to be modified or superseded for purposes of this prospectus supplement

and the accompanying prospectus to the extent that a statement contained in any such subsequent document modifies or supersedes

that statement. Any statement that is modified or superseded in this manner will no longer be a part of this prospectus supplement

or the accompanying prospectus, except as modified or superseded.

We will provide without charge to each

person to whom this prospectus supplement has been delivered, upon the written or oral request of any such person to us, a copy

of any or all of the documents referred to above that have been or may be incorporated into this prospectus supplement by reference,

including exhibits to such documents. Requests for such copies should be directed to:

Avenida Presidente Juscelino Kubitschek,

2,041 and 2,235- Bloco A

Vila Olímpia

São Paulo, SP 04543-011

Federative Republic of Brazil

Phone: (55 11) 3553-3300

Forward-Looking

Statements

This prospectus supplement, the accompanying

prospectus and the documents incorporated herein or therein by reference contain estimates and forward-looking statements subject

to risks and uncertainties. Some of the matters discussed concerning our business operations and financial performance include

estimates and forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995.

Our estimates and forward-looking statements

are based mainly on our current expectations and estimates or projections of future events and trends, which affect or may affect

our businesses and results of operations. Although we believe that these estimates and forward-looking statements are based upon

reasonable assumptions, they are subject to certain risks and uncertainties and are made in light of information currently available

to us. Our estimates and forward-looking statements may be influenced by the following factors, among others:

|

|

·

|

general economic, political, social and business conditions in Brazil, including the impact of the current international economic

environment and the macroeconomic conditions in Brazil;

|

|

|

·

|

exposure to various types of inflation and interest rate risks, and Brazilian government efforts to control inflation and interest

rates;

|

|

|

·

|

exposure to the sovereign debt of Brazil;

|

|

|

·

|

the effect of interest rate fluctuations on our obligations under employee pension funds;

|

|

|

·

|

exchange rate volatility;

|

|

|

·

|

infrastructure and labor force deficiencies in Brazil;

|

|

|

·

|

economic developments and perception of risk in other countries;

|

|

|

·

|

increasing competition and consolidation in the Brazilian financial services industry;

|

|

|

·

|

extensive regulation by the Brazilian government and the Brazilian Central Bank, among others;

|

|

|

·

|

changes in reserve requirements;

|

|

|

·

|

changes in taxes or other fiscal assessments;

|

|

|

·

|

potential losses associated with non-performing loans or non-performance by counterparties to other types of financial instruments;

|

|

|

·

|

a decrease in the rate of growth of our loan portfolio;

|

|

|

·

|

potential prepayment of our loan and investment portfolio;

|

|

|

·

|

potential increase in our cost of funding, in particular with relation to short-term deposits;

|

|

|

·

|

a default on, or a ratings downgrade of, the sovereign debt of Brazil or of our controlling shareholder;

|

|

|

·

|

the effectiveness of our credit risk management policies;

|

|

|

·

|

our ability to adequately manage market and operational risks;

|

|

|

·

|

potential deterioration in the value of the collateral securing our loan portfolio;

|

|

|

·

|

our dependence on proper functioning of information technology systems;

|

|

|

·

|

our ability to protect personal data;

|

|

|

·

|

our ability to protect our reputation;

|

|

|

·

|

our ability to detect and prevent money laundering and other illegal activity;

|

|

|

·

|

our ability to manage the growth of our operations;

|

|

|

·

|

our ability to successfully and effectively integrate acquisitions or to evaluate risks arising from asset acquisitions; and

|

|

|

·

|

other risk factors as set forth under “Item 3. Key Information—D. Risk Factors” in our most recent annual

report on Form 20-F and in “Risk Factors” in this prospectus supplement.

|

The words “believe,” “may,”

“will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “forecast” and similar words are intended to identify estimates and forward-looking statements.

Estimates and forward-looking statements are intended to be accurate only as of the date they were made, and we undertake no obligation

to update or to review any estimate and/or forward-looking statement because of new information, future events or other factors.

Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Our future

results may differ materially from those expressed in these estimates and forward-looking statements. You should therefore not

make any investment decision based on these estimates and forward-looking statements.

The forward-looking statements contained

in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein or therein, speak

only as of the date they were made. We do not undertake to update any forward-looking statement to reflect events or circumstances

after that date or to reflect the occurrence of unanticipated events.

Certain

Terms and Conventions

In this prospectus, the terms “Santander

Brasil,” the “Bank,” “we,” “us,” “our,” “our company” and “our

organization” mean Banco Santander (Brasil) S.A. and its consolidated subsidiaries, unless otherwise indicated. References

to “Banco Real” mean Banco ABN AMRO Real S.A. and ABN AMRO Brasil Dois Participações S.A. and their respective

consolidated subsidiaries, unless otherwise indicated. The term “Santander Spain” means Banco Santander, S.A. References

to “Santander Group” mean the worldwide operations of the Santander Spain conglomerate, as directly or indirectly controlled

by Santander Spain and its consolidated subsidiaries, including Santander Brasil.

All references herein to the “

real

,”

“

reais

” or “R$” are to the Brazilian

real

, the official currency of Brazil. All references

to “U.S. dollars,” “dollars” or “U.S.$” are to United States (or “U.S.”) dollars.

All references to “

euro

,” “

euros

” or “€”are to the common legal currency

of the member states participating in the European Economic and Monetary Union. We have made rounding adjustments to reach some

of the figures included in this prospectus. As a result, numerical figures shown as totals in some tables may not be an arithmetic

aggregation of the figures that preceded them.

Prospectus

Supplement Summary

This summary highlights selected information

from this prospectus supplement and may not contain all the information that may be important to you. To understand the terms of

the securities being offered by this prospectus supplement, you should read the entire prospectus supplement, the accompanying

prospectus and the documents identified in the prospectus under the caption “Where You Can Find More Information.”

The Company

We are a leading full-service bank in Brazil,

with a strong presence in attractive demographic and geographic areas and we have strengthened our competitive position in all

Brazilian regions. We believe that we are well positioned to benefit from the growth of our customer base and the relatively low

penetration of financial products and services in Brazil. We are ranked third among the privately-owned banks in Brazil in terms

of assets, with a market share of 8.1% as of September 2016, according to information provided by the Brazilian Central Bank. Our

operations are present in all Brazilian regions, including a strategic position in the South and Southeast regions, an area that

accounted for approximately 71.3% of Brazil’s GDP.

As of and for the year ended December 31,

2016, we generated consolidated profit of R$7.465 billion and had total assets of R$634.393 billion and total stockholders’

equity of R$84.812 billion. Our Basel capital adequacy ratio at December 31, 2016 was 16.3%.

We operate along two segments: Commercial

Banking and Global Wholesale Banking. In our Commercial Banking business segment, we focus on long-term relationships with our

individual and corporate customers (other than global enterprise customers that are serviced by our Global Wholesale Banking segment),

seeking to support all of their financial needs through our credit, banking services, financial products, acquiring services, asset

management and insurance products. We also offer special financing and credit opportunities for corporate customers pursuing social

and environmental improvement programs. Our business model and segmentation allow us to provide a tailored approach to each client

in order to address their specific needs. Through our Global Wholesale Banking segment we offer financial services and sophisticated

and structured solutions to our customers, in parallel with our proprietary trading activities. Our wholesale banking business

focuses on servicing local and multinational conglomerates, which we refer to as GCB customers. Our wholesale business provides

our customers with a wide range of domestic and international services that are specifically tailored to the needs of each client.

Our customers benefit from the global services provided by the Santander Group’s integrated wholesale banking network and

local market expertise. Our proprietary trading desk is under strict risk control oversight and has consistently shown positive

results, even under volatile scenarios.

Santander Group controls us directly and

indirectly through Santander Spain, Sterrebeeck B.V. and Grupo Empresarial Santander, S.L. which are controlled subsidiaries of

the Santander Group. As of December 31, 2016, Santander Spain held, directly and indirectly, 88.8% of our voting stock (not including

the shares held by Banco Madesant - Sociedade Unipessoal).

Santander Spain ended December 2016 as

the largest bank in the euro zone, with a market capitalization of approximately €72,314 million. As of December 31, 2016,

Santander Spain’s attributable profit totaled €6,621 million, 0.8% higher than the previous year, and the total shareholder

remuneration on account of the earnings for the 2016 financial year is €0.41 per share. The Santander Group operates principally

in Spain, the United Kingdom, other European countries, Brazil and other Latin American countries and the United States, offering

a wide range of financial products. In Latin America, the Santander Group has majority shareholdings in financial institutions

in Argentina, Brazil, Chile, Mexico, Peru, Puerto Rico and Uruguay. As of December 31, 2016, Santander Brasil contributed 21% of

the profit attributable to the Santander Group.

Our headquarters are located in Brazil,

in the city of São Paulo, state of São Paulo, at Avenida Presidente Juscelino Kubitschek, 2,041 and 2,235, Bloco

A, Vila Olímpia, 04543-011. Our telephone number is 55-11-3553-3300. Our website is www.santander.com.br. Information contained

on, or accessible through, our website is not incorporated by reference in, and shall not be considered part of, this prospectus

supplement.

The

Offering

|

Issuer

|

|

Banco Santander (Brasil) S.A.

|

|

|

|

|

|

Global Offering

|

|

The global offering of 80,000,000 units consists of the international offering and the concurrent Brazilian offering.

The number of units offered in the international offering and the Brazilian offering is subject to reallocation between the

offerings. The closings of the international offering and the Brazilian offering are conditioned upon each other.

|

|

|

|

|

|

International offering

|

|

The Selling Shareholder is offering 58,000,000 ADSs, through

the international underwriters in the United States and elsewhere outside Brazil.

|

|

|

|

|

|

|

|

The international underwriters will also act as placement agents on behalf of the Brazilian underwriters with respect to the sale of units to investors located outside Brazil who are authorized to invest in Brazilian securities according to the rules of the Brazilian Central Bank (Banco Central do Brasil) (the “BACEN”), the Brazilian National Monetary Council (

Conselho Monetário Nacional

) (the “CMN”), and the CVM. Any units not in the form of ADSs purchased by any investor outside Brazil will be settled in Brazil and paid for in reais.

|

|

|

|

|

|

Brazilian offering

|

|

Concurrently with the international offering, the Selling

Shareholder is offering 22,000,000 units through the

Brazilian underwriters to professional investors in Brazil, in a public offering with restricted placement efforts, pursuant

to CVM Instruction 476.

A portion of these units offered through the Brazilian

offering may be placed by the international underwriters outside of Brazil. We are offering a total of 22,000,000

units when considering the units offered through the Brazilian underwriters to investors in Brazil together with the

units placed by the international underwriters outside of Brazil.

Payment for our units (other than units represented

by ADSs) must be made in

reais

through the facilities of the BM&FBOVESPA Central Depository (

Central Depositária

BM&FBOVESPA

). We expect to deliver our units in the Brazilian offering through the facilities of the BM&FBOVESPA

Central Depository on or about April 11, 2017. Trades in our units on the BM&FBOVESPA will settle through the

facilities of the BM&FBOVESPA Central Depository.

|

|

|

|

|

|

Selling Shareholder

|

|

Qatar Holding LLC. See “Principal and Selling Shareholders—Selling Shareholder.”

|

|

|

|

|

|

International underwriters

|

|

Credit Suisse Securities (USA) LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, and Santander Investment Securities Inc.

|

|

|

|

|

|

Brazilian underwriters

|

|

Banco Santander (Brasil) S.A., Banco de Investimentos Credit Suisse (Brasil) S.A. and Bank of America Merrill Lynch Banco Múltiplo S.A.

|

|

Units

|

|

Each unit represents one common share and one preferred share. A holder of units will be entitled to the same dividend and voting rights as a holder of the underlying shares. For a description of the material terms of the units and of a unit holder’s material rights, see “Description of Capital Stock–Description of Units” in the accompanying prospectus.

|

|

|

|

|

|

ADSs

|

|

Each ADS represents one unit. ADSs are evidenced by American depositary receipts (“ADRs”). The ADSs have been issued under a deposit agreement among us, The Bank of New York Mellon, as depositary, and the registered holders, indirect holders and beneficial owners from time to time of ADSs issued thereunder.

|

|

|

|

|

|

Offering price

|

|

The public offering price for the international offering for the ADSs is set forth on the cover page of this prospectus.

|

|

|

|

|

|

Over-allotment option

|

|

The Selling Shareholder has granted the international underwriters the option to purchase up to 12,000,000 Additional ADSs within 30 days from, but not including, the date of this prospectus supplement, solely to cover over-allotments of ADSs, if any. The Additional ADSs will be purchased by the international underwriters in connection with the international offering, and this option to purchase the Additional ADSs, if exercised, will not result in any offering of units in Brazil or placement of units outside Brazil under the terms of the Brazilian Offering.

|

|

|

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of ADSs by the Selling Shareholder.

|

|

|

|

|

|

Listing

|

|

The ADSs are listed on the New York Stock Exchange, or NYSE, under the symbol “BSBR” and the units are listed on the basic listing segment of BM&FBOVESPA under the symbol “SANB11.”

|

|

|

|

|

|

Voting rights

|

|

A holder of units will be entitled to the same voting rights

as a holder of the underlying common and preferred shares.

Holders of our common shares are entitled to vote in our shareholders’

meetings. Holders of our preferred shares are not entitled to vote in our shareholders’ meetings, with limited exceptions.

See “Description of Capital Stock – Rights of Common Shares and Preferred Shares” in the accompanying prospectus.

|

|

|

|

|

|

Dividends

|

|

We intend to declare and pay dividends and/or interest attributed to shareholders’ equity, as required by Brazilian corporate law and our bylaws. The amount of any distributions will depend on many factors, such as our results of operations, financial condition, cash requirements, prospects and other factors deemed relevant by our board of directors and shareholders.

|

|

|

|

|

|

|

|

Holders of the ADSs will be entitled to receive dividends to the same extent as the owners of our common and preferred

shares, subject to the deduction of the fees of the depositary and the costs of foreign exchange conversion. See

“Item 8. Financial Information—8.A. Consolidated Statements and Other Financial Information—Dividend Policy”

in our 2016 Annual Report and “Description of American Depositary Shares” in the accompanying prospectus.

|

|

|

|

|

|

Lock-up agreement

|

|

The Selling Shareholder has agreed with the international underwriters, subject to certain exceptions, not to offer, sell, or dispose of any shares of our share capital or securities convertible into or exchangeable or exercisable for any shares of our share capital during the 180-day period following the date of this prospectus.

|

|

|

|

|

|

ADR Depositary

|

|

The Bank of New York Mellon

|

|

|

|

|

|

Taxation

|

|

For a discussion of the material U.S. federal income tax consequences relating to an investment in our ADSs or units, see “Taxation—Material U.S. Federal Income Tax Considerations for U.S. Holders.”

|

|

|

|

|

|

|

|

For a discussion of certain Brazilian income tax consequences of the acquisition, ownership and disposition of ADSs or units, see “Taxation—Brazilian Tax Considerations.”

|

|

|

|

|

|

|

|

|

|

Conflicts of interest

|

|

Santander Investment Securities Inc., the Issuer’s affiliate, is participating in this offering of ADSs as an international underwriter. Accordingly, this offering is being made in compliance with the requirements of FINRA Rule 5121. Pursuant to FINRA Rule 5121, Santander Investment Securities Inc. will not sell to an account holder with a discretionary account any security with respect to which the conflict exists, unless Santander Investment Securities Inc. has received specific written approval of the transaction from the account holder and retains documentation of the approval in its records.

|

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” and other information included in this prospectus supplement and the accompanying prospectus for a discussion of factors you should consider before deciding to invest in the units or ADSs.

|

Summary

Financial and Operating Data

The following tables present our selected

consolidated financial data for each of the periods indicated. You should read this information in conjunction with our audited

financial statements and related notes included in the 2016 Annual Report.

We have derived our selected consolidated

income statement data for the years ended December 31, 2012, 2013, 2014, 2015 and 2016 and our selected consolidated balance sheet

data as of December 31, 2012, 2013, 2014, 2015 and 2016 from our audited financial statements, which have been prepared in accordance

with International Financial Reporting Standards (“IFRS”) as issued by International Accounting Standard Board (“IASB”).

INCOME STATEMENT DATA

|

|

|

For the year ended December 31,

|

|

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

|

|

(in millions of

U.S.$)(1)

|

|

|

(in millions of R$)

|

|

|

Interest and similar income

|

|

|

23,671

|

|

|

|

77,146

|

|

|

|

69,870

|

|

|

|

58,924

|

|

|

|

51,217

|

|

|

|

52,644

|

|

|

Interest expense and similar charges

|

|

|

(14,286

|

)

|

|

|

(46,560

|

)

|

|

|

(38,533

|

)

|

|

|

(31,695

|

)

|

|

|

(22,738

|

)

|

|

|

(21,057

|

)

|

|

Net interest income

|

|

|

9,385

|

|

|

|

30,586

|

|

|

|

31,337

|

|

|

|

27,229

|

|

|

|

28,479

|

|

|

|

31,587

|

|

|

Income from equity instruments

|

|

|

79

|

|

|

|

259

|

|

|

|

143

|

|

|

|

222

|

|

|

|

81

|

|

|

|

94

|

|

|

Income from companies accounted for by the equity method

|

|

|

15

|

|

|

|

48

|

|

|

|

116

|

|

|

|

91

|

|

|

|

91

|

|

|

|

73

|

|

|

Fee and commission income

|

|

|

4,157

|

|

|

|

13,548

|

|

|

|

11,797

|

|

|

|

11,368

|

|

|

|

10,742

|

|

|

|

9,611

|

|

|

Fee and commission expense

|

|

|

(789

|

)

|

|

|

(2,571

|

)

|

|

|

(2,314

|

)

|

|

|

(2,602

|

)

|

|

|

(2,641

|

)

|

|

|

(2,001

|

)

|

|

Gains (losses) on financial assets and liabilities (net)

|

|

|

925

|

|

|

|

3,016

|

|

|

|

(20,002

|

)

|

|

|

2,748

|

|

|

|

(1,146

|

)

|

|

|

(548

|

)

|

|

Exchange differences (net)

|

|

|

1,404

|

|

|

|

4,575

|

|

|

|

10,084

|

|

|

|

(3,636

|

)

|

|

|

551

|

|

|

|

378

|

|

|

Other operating income (expenses)

|

|

|

(192

|

)

|

|

|

(625

|

)

|

|

|

(347

|

)

|

|

|

(470

|

)

|

|

|

(445

|

)

|

|

|

(623

|

)

|

|

Total income

|

|

|

14,985

|

|

|

|

48,837

|

|

|

|

30,814

|

|

|

|

34,950

|

|

|

|

35,712

|

|

|

|

38,571

|

|

|

Administrative expenses

|

|

|

(4,578

|

)

|

|

|

(14,920

|

)

|

|

|

(14,515

|

)

|

|

|

(13,942

|

)

|

|

|

(13,850

|

)

|

|

|

(13,773

|

)

|

|

Depreciation and amortization

|

|

|

(455

|

)

|

|

|

(1,483

|

)

|

|

|

(1,490

|

)

|

|

|

(1,362

|

)

|

|

|

(1,252

|

)

|

|

|

(1,201

|

)

|

|

Provisions (net)(2)

|

|

|

(836

|

)

|

|

|

(2,725

|

)

|

|

|

(4,001

|

)

|

|

|

(2,036

|

)

|

|

|

(2,692

|

)

|

|

|

(2,057

|

)

|

|

Impairment losses on financial assets (net)(3)

|

|

|

(4,081

|

)

|

|

|

(13,301

|

)

|

|

|

(13,634

|

)

|

|

|

(11,272

|

)

|

|

|

(14,118

|

)

|

|

|

(16,476

|

)

|

|

Impairment losses on other assets (net)

|

|

|

(35

|

)

|

|

|

(114

|

)

|

|

|

(1,221

|

)

|

|

|

4

|

|

|

|

(345

|

)

|

|

|

(38

|

)

|

|

Gains (losses) on disposal of assets not classified as non-current assets held for sale

|

|

|

1

|

|

|

|

4

|

|

|

|

781

|

|

|

|

87

|

|

|

|

460

|

|

|

|

501

|

|

|

Gains (losses) on non-current assets held for sale not classified as discontinued operations

|

|

|

27

|

|

|

|

87

|

|

|

|

50

|

|

|

|

15

|

|

|

|

103

|

|

|

|

(52

|

)

|

|

Operating profit before tax

|

|

|

5,027

|

|

|

|

16,384

|

|

|

|

(3,216

|

)

|

|

|

6,443

|

|

|

|

4,018

|

|

|

|

5,475

|

|

|

Income taxes

|

|

|

(2,737

|

)

|

|

|

(8,919

|

)

|

|

|

13,050

|

|

|

|

(736

|

)

|

|

|

(233

|

)

|

|

|

(37

|

)

|

|

Net Profit from Continuing Operations

|

|

|

2,290

|

|

|

|

7,465

|

|

|

|

9,834

|

|

|

|

5,708

|

|

|

|

3,785

|

|

|

|

5,438

|

|

|

Discontinued Operations(4)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,063

|

|

|

|

55

|

|

|

Consolidated Profit for the Year

|

|

|

2,290

|

|

|

|

7,465

|

|

|

|

9,834

|

|

|

|

5,708

|

|

|

|

5,848

|

|

|

|

5,493

|

|

|

|

(1)

|

Translated for convenience only using the selling rate as reported by the Brazilian Central Bank as of December 31, 2016, for

reais

into U.S. dollars of R$3.2591 to U.S.$1.00.

|

|

|

(2)

|

Mainly provisions for tax risks and legal obligations, and judicial and administrative proceedings of labor and civil lawsuits.

For further discussion, see notes 23 and 24 to our consolidated financial statements included in our 2016 Annual Report.

|

|

|

(3)

|

Net provisions to the credit loss allowance less recovery of loans previously written off.

|

|

|

(4)

|

On December 17, 2013, we concluded the sale of our asset management business, by way of disposal of all of the shares of Santander

Brasil Asset Management Distribuidora de Títulos e Valores Mobiliários S.A. The gains/losses from our disposal of

Santander Brasil Asset Management Distribuidora de Títulos e Valores Mobiliários S.A. are recorded in “Discontinued

Operations” pursuant to IFRS 5 – Discontinued Operations.

|

Earnings and Dividend per Share Information

|

|

|

For

the year ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

Basic and Diluted Earnings per 1,000 shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From continuing and discontinued operations(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per shares (

reais

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

929.93

|

|

|

|

1,236.96

|

|

|

|

709.69

|

|

|

|

719.89

|

|

|

|

689.29

|

|

|

Preferred Shares

|

|

|

1,022.92

|

|

|

|

1,360.66

|

|

|

|

780.66

|

|

|

|

791.87

|

|

|

|

758.22

|

|

|

Diluted Earnings per shares (

reais

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

929.03

|

|

|

|

1,235.79

|

|

|

|

709.40

|

|

|

|

719.60

|

|

|

|

688.87

|

|

|

Preferred Shares

|

|

|

1,021.93

|

|

|

|

1,359.36

|

|

|

|

780.34

|

|

|

|

791.56

|

|

|

|

757.75

|

|

|

Basic Earnings per shares (U.S. dollars) (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

285.34

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Shares

|

|

|

313.87

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per shares (U.S. dollars) (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

285.06

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Shares

|

|

|

313.57

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per shares (

reais

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

929.93

|

|

|

|

1,236.96

|

|

|

|

709.69

|

|

|

|

460.35

|

|

|

|

628.34

|

|

|

Preferred Shares

|

|

|

1,022.92

|

|

|

|

1,360.66

|

|

|

|

780.66

|

|

|

|

506.38

|

|

|

|

750.57

|

|

|

Diluted Earnings per shares (

reais

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

929.03

|

|

|

|

1,235.79

|

|

|

|

709.40

|

|

|

|

460.16

|

|

|

|

681.92

|

|

|

Preferred Shares

|

|

|

1,021.93

|

|

|

|

1,359.36

|

|

|

|

780.34

|

|

|

|

506.18

|

|

|

|

750.11

|

|

|

Basic Earnings per shares (U.S. dollars) (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

285.34

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Shares

|

|

|

313.87

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per shares (U.S. dollars) (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

285.06

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Shares

|

|

|

313.57

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From discontinued operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per shares (

reais

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

259.54

|

|

|

|

6.95

|

|

|

Preferred Shares

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

285.49

|

|

|

|

7.65

|

|

|

Diluted Earnings per shares (

reais

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

259.43

|

|

|

|

6.95

|

|

|

Preferred Shares

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

285.38

|

|

|

|

7.64

|

|

|

Basic Earnings per shares (U.S. dollars) (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

Preferred Shares

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings per shares (U.S. dollars) (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

Preferred Shares

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

Dividends and interest on capital per 1,000 shares (undiluted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares (

reais

)

|

|

|

666.21

|

|

|

|

784.90

|

|

|

|

193.26

|

|

|

|

305.15

|

|

|

|

335.73

|

|

|

Preferred Shares (

reais

)

|

|

|

732.83

|

|

|

|

863.39

|

|

|

|

212.59

|

|

|

|

332.36

|

|

|

|

369.30

|

|

|

Common Shares (U.S. dollars)(2)

|

|

|

204.42

|

|

|

|

201.01

|

|

|

|

72.76

|

|

|

|

128.98

|

|

|

|

164.29

|

|

|

Preferred Shares (U.S. dollars)(2)

|

|

|

224.86

|

|

|

|

221.11

|

|

|

|

80.03

|

|

|

|

141.88

|

|

|

|

180.72

|

|

|

Weighted average share outstanding (in thousands) – basic

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

3,828,555

|

|

|

|

3,839,159

|

|

|

|

3,851,278

|

|

|

|

3,858,717

|

|

|

|

3,860,354

|

|

|

Preferred Shares

|

|

|

3,689,696

|

|

|

|

3,700,299

|

|

|

|

3,710,746

|

|

|

|

3,719,858

|

|

|

|

3,721,493

|

|

|

|

|

For

the year ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

Weighted average shares outstanding (in

thousands) – diluted(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares

|

|

|

3,832,211

|

|

|

|

3,842,744

|

|

|

|

3,852,823

|

|

|

|

3,860,239

|

|

|

|

3,862,679

|

|

|

Preferred Shares

|

|

|

3,693,352

|

|

|

|

3,703,884

|

|

|

|

3,712,291

|

|

|

|

3,721,380

|

|

|

|

3,723,817

|

|

|

|

(1)

|

Per share amounts reflect the effects of the bonus share issue and reverse share split described under “Item 5. Operating

and Financial Review and Prospects—A. Operating Results—Factors Affecting the Comparability of our Results of Operations—Bonus

Shares and Reverse Share Split (Inplit)” in our 2016 Annual Report, for each period presented.

|

|

|

(2)

|

Translated for convenience only using the selling rate as reported by the Brazilian Central Bank as of December 31, 2016, for

reais

into U.S. dollars of R$3.2591 to U.S.$1.00.

|

|

|

(3)

|

Average annual balance sheet data has been calculated based upon the average of the monthly balances at 13 dates: as of December

31 of the prior year and each of the month-end balances of the 12 subsequent months.

|

BALANCE SHEET DATA

|

|

|

As

of December 31,

|

|

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

|

|

(in millions

of

U.S.$)(1)

|

|

|

(in

millions of R$)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and balances with the Brazilian Central Bank

|

|

|

33,937

|

|

|

|

110,605

|

|

|

|

89,143

|

|

|

|

55,904

|

|

|

|

51,714

|

|

|

|

55,535

|

|

|

Financial assets held for trading

|

|

|

26,042

|

|

|

|

84,874

|

|

|

|

50,537

|

|

|

|

56,014

|

|

|

|

30,219

|

|

|

|

31,638

|

|

|

Other financial assets at fair value through profit or loss

|

|

|

525

|

|

|

|

1,711

|

|

|

|

2,080

|

|

|

|

997

|

|

|

|

1,298

|

|

|

|

1,228

|

|

|

Available-for-sale financial assets

|

|

|

17,740

|

|

|

|

57,815

|

|

|

|

68,265

|

|

|

|

75,164

|

|

|

|

46,287

|

|

|

|

44,149

|

|

|

Held to maturity investments

|

|

|

3,083

|

|

|

|

10,048

|

|

|

|

10,098

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Loans and receivables

|

|

|

90,838

|

|

|

|

296,049

|

|

|

|

306,269

|

|

|

|

264,608

|

|

|

|

258,778

|

|

|

|

226,957

|

|

|

Hedging derivatives

|

|

|

68

|

|

|

|

223

|

|

|

|

1,312

|

|

|

|

213

|

|

|

|

323

|

|

|

|

156

|

|

|

Non-current assets held for sale

|

|

|

411

|

|

|

|

1,338

|

|

|

|

1,237

|

|

|

|

930

|

|

|

|

275

|

|

|

|

166

|

|

|

Investments in associates and joint ventures

|

|

|

304

|

|

|

|

990

|

|

|

|

1,061

|

|

|

|

1,023

|

|

|

|

1,064

|

|

|

|

472

|

|

|

Tax assets

|

|

|

8,822

|

|

|

|

28,753

|

|

|

|

34,770

|

|

|

|

23,020

|

|

|

|

22,060

|

|

|

|

21,497

|

|

|

Other assets

|

|

|

1,566

|

|

|

|

5,104

|

|

|

|

3,802

|

|

|

|

5,067

|

|

|

|

5,085

|

|

|

|

5,601

|

|

|

Tangible assets

|

|

|

2,039

|

|

|

|

6,646

|

|

|

|

7,006

|

|

|

|

7,071

|

|

|

|

6,886

|

|

|

|

5,938

|

|

|

Intangible assets

|

|

|

9,278

|

|

|

|

30,237

|

|

|

|

29,814

|

|

|

|

30,221

|

|

|

|

29,064

|

|

|

|

29,271

|

|

|

Total assets

|

|

|

194,653

|

|

|

|

634,393

|

|

|

|

605,395

|

|

|

|

520,231

|

|

|

|

453,053

|

|

|

|

422,608

|

|

|

Average total assets*

|

|

|

185,832

|

|

|

|

605,646

|

|

|

|

571,918

|

|

|

|

478,560

|

|

|

|

435,286

|

|

|

|

408,143

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial liabilities held for trading

|

|

|

15,839

|

|

|

|

51,620

|

|

|

|

42,388

|

|

|

|

19,570

|

|

|

|

13,554

|

|

|

|

5,352

|

|

|

Financial liabilities at amortized cost

|

|

|

144,696

|

|

|

|

471,579

|

|

|

|

457,282

|

|

|

|

392,186

|

|

|

|

329,701

|

|

|

|

306,976

|

|

|

Deposits from the Brazilian Central Bank and deposits from credit institutions

|

|

|

24,128

|

|

|

|

78,634

|

|

|

|

69,451

|

|

|

|

63,674

|

|

|

|

34,032

|

|

|

|

35,074

|

|

|

Customer deposits

|

|

|

75,924

|

|

|

|

247,445

|

|

|

|

243,043

|

|

|

|

220,644

|

|

|

|

200,156

|

|

|

|

188,595

|

|

|

Marketable debt securities

|

|

|

30,635

|

|

|

|

99,843

|

|

|

|

94,658

|

|

|

|

70,355

|

|

|

|

65,301

|

|

|

|

54,012

|

|

|

Subordinated debts

|

|

|

143

|

|

|

|

466

|

|

|

|

8,097

|

|

|

|

7,294

|

|

|

|

8,906

|

|

|

|

11,919

|

|

|

Debt Instruments Eligible to Compose Capital

|

|

|

2,550

|

|

|

|

8,312

|

|

|

|

9,959

|

|

|

|

6,773

|

|

|

|

—

|

|

|

|

—

|

|

|

Other financial liabilities

|

|

|

11,316

|

|

|

|

36,879

|

|

|

|

32,073

|

|

|

|

23,446

|

|

|

|

21,306

|

|

|

|

17,376

|

|

|

Hedging derivatives

|

|

|

95

|

|

|

|

311

|

|

|

|

2,377

|

|

|

|

894

|

|

|

|

629

|

|

|

|

282

|

|

|

Provisions(2)

|

|

|

3,613

|

|

|

|

11,776

|

|

|

|

11,410

|

|

|

|

11,127

|

|

|

|

10,892

|

|

|

|

12,775

|

|

|

Tax liabilities

|

|

|

1,870

|

|

|

|

6,095

|

|

|

|

5,253

|

|

|

|

12,423

|

|

|

|

11,693

|

|

|

|

13,784

|

|

|

Other liabilities

|

|

|

2,516

|

|

|

|

8,199

|

|

|

|

6,850

|

|

|

|

5,346

|

|

|

|

4,928

|

|

|

|

4,303

|

|

|

Total liabilities

|

|

|

168,630

|

|

|

|

549,581

|

|

|

|

525,559

|

|

|

|

441,548

|

|

|

|

371,397

|

|

|

|

343,472

|

|

|

Stockholders’ equity

|

|

|

26,214

|

|

|

|

85,435

|

|

|

|

83,532

|

|

|

|

80,105

|

|

|

|

83,340

|

|

|

|

79,921

|

|

|

Other Comprehensive Income

|

|

|

(414

|

)

|

|

|

(1,348

|

)

|

|

|

(4,132

|

)

|

|

|

(1,802

|

)

|

|

|

(1,973

|

)

|

|

|

(1,022

|

)

|

|

Non-controlling interests

|

|

|

223

|

|

|

|

726

|

|

|

|

435

|

|

|

|

380

|

|

|

|

289

|

|

|

|

237

|

|

|

Total Stockholders’ Equity

|

|

|

26,023

|

|

|

|

84,812

|

|

|

|

79,835

|

|

|

|

78,683

|

|

|

|

81,655

|

|

|

|

79,136

|

|

|

Total liabilities and stockholders’ equity

|

|

|

194,653

|

|

|

|

634,393

|

|

|

|

605,395

|

|

|

|

520,231

|

|

|

|

453,053

|

|

|

|

422,608

|

|

|

Average interest-bearing liabilities*

|

|

|

125,209

|

|

|

|

408,067

|

|

|

|

400,008

|

|

|

|

318,639

|

|

|

|

287,382

|

|

|

|

265,328

|

|

|

Average total stockholders’ equity*

|

|

|

25,860

|

|

|

|

84,283

|

|

|

|

81,475

|

|

|

|

78,818

|

|

|

|

80,916

|

|

|

|

77,886

|

|

|

*

|

|

The average annual balance sheet data has been calculated based upon the average of

the monthly balances at 13 dates: at December 31 of the prior year and for each of the month-end balances of the 12 subsequent

months.

|

|

|

(1)

|

Translated for convenience only using the selling rate as reported by the Brazilian Central Bank as of December 31, 2016, for

reais

into U.S. dollars of R$3.2591 to U.S.$1.00.

|

|

|

(2)

|

Mainly provisions for tax risks and legal obligations, and judicial and administrative proceedings of labor and civil lawsuits.

|

SELECTED CONSOLIDATED RATIOS(*)

|

|

|

At

and for the Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

|

|

in (%)

|

|

|

Profitability and performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average total assets

|

|

|

1.2

|

|

|

|

1.7

|

|

|

|

1.2

|

|

|

|

1.3

|

|

|

|

1.3

|

|

|

Asset quality

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impaired assets as a percentage of loans and advances to customers (gross)(1)

|

|

|

7.0

|

|

|

|

7.0

|

|

|

|

5.6

|

|

|

|

6.2

|

|

|

|

7.6

|

|

|

Impaired assets as a percentage of total assets(1)

|

|

|

3.0

|

|

|

|

3.1

|

|

|

|

2.7

|

|

|

|

3.1

|

|

|

|

3.8

|

|

|

Impairment losses to customer as a percentage of impaired assets(1) (4)

|

|

|

87.0

|

|

|

|

81.9

|

|

|

|

95.8

|

|

|

|

96.1

|

|

|

|

87.0

|

|

|

Impairment losses to customers as a percentage of loans and advances to customers (gross) (5)

|

|

|

6.1

|

|

|

|

5.7

|

|

|

|

5.4

|

|

|

|

6.0

|

|

|

|

6.6

|

|

|

Derecognized assets as a percentage of loans and advances to customers (gross)

|

|

|

4.3

|

|

|

|

4.4

|

|

|

|

4.9

|

|

|

|

6.5

|

|

|

|

7.2

|

|

|

Impaired assets as a percentage of stockholders’ equity(1)

|

|

|

22.3

|

|

|

|

23.3

|

|

|

|

17.8

|

|

|

|

17.2

|

|

|

|

20.3

|

|

|

Capital adequacy

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basel capital adequacy ratio(2)

|

|

|

16.3

|

|

|

|

15.7

|

|

|

|

17.5

|

|

|

|

19.2

|

|

|

|

20.8

|

|

|

Efficiency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio(3)

|

|

|

30.6

|

|

|

|

47.1

|

|

|

|

39.9

|

|

|

|

38.8

|

|

|

|

35.7

|

|

|

|

*

|

The average annual balance sheet data has been calculated

based upon the average of the monthly balances at 13 dates: at December 31 of the prior year and for each of the month-end balances

of the 12 subsequent months.

|

|

|

(1)

|

Impaired assets include all loans and advances past due by more than 90 days and other doubtful credits. For further information

see “Item 4. Information on the Company—B. Business Overview—Selected Statistical Information—Assets—Impaired

Assets” in our 2016 Annual Report.

|