ConocoPhillips to Further Diversify Global LNG Portfolio with Additional Long-Term Agreement for European Regas Capacity

14 Setembro 2023 - 5:15PM

Business Wire

ConocoPhillips (NYSE: COP) announced today further progress on

its global liquefied natural gas (LNG) strategy, signing a

commercial agreement to secure additional regasification capacity

in Europe at the Gate LNG terminal in the Netherlands. This

agreement further complements the company’s foundational LNG

resource positions in Qatar and Australia, offtake and equity in

Sempra’s recently sanctioned Port Arthur LNG Phase 1 project on the

U.S. Gulf Coast, regasification agreement at the German LNG

Terminal announced last year, and the offtake agreements at Mexico

Pacific’s Saguaro LNG export facility on the west coast of Mexico

announced last month.

“Adding capacity at the Gate LNG terminal fits well with our

efforts to deliver reliable, lower-carbon energy into Europe from

highly competitive LNG supply,” said Bill Bullock, executive vice

president and chief financial officer of ConocoPhillips. “Expanding

our LNG footprint with agreements like this further enhances a

balanced, diversified, and attractive portfolio as we progress our

global LNG strategy.”

Gate Terminal B.V., a joint venture of Vopak and Gasunie, is an

LNG hub at the Port of Rotterdam that contributes to the natural

gas supply in the Netherlands and northwest Europe. The terminal

began operations in 2011. ConocoPhillips’ 15-year throughput

agreement for approximately 1.5 million tonnes per annum (MTPA), or

2 BCM equivalent, begins in September 2031 and secures access to

this important market for the company’s growing global LNG

portfolio.

--- # # # ---

About ConocoPhillips

ConocoPhillips is one of the world’s leading exploration and

production companies based on both production and reserves, with a

globally diversified asset portfolio. Headquartered in Houston,

Texas, ConocoPhillips had operations and activities in 13

countries, $90 billion of total assets, and approximately 9,700

employees at June 30, 2023. Production averaged 1,798 MBOED for the

six months ended June 30, 2023, and proved reserves were 6.6 BBOE

as of December 31, 2022. For more information, go to

www.conocophillips.com.

CAUTIONARY STATEMENT FOR THE PURPOSES

OF THE "SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements as defined

under the federal securities laws. Forward-looking statements

relate to future events, plans and anticipated results of

operations, business strategies, and other aspects of our

operations or operating results. Words and phrases such as

“anticipate," “estimate,” “believe,” “budget,” “continue,” “could,”

“intend,” “may,” “plan,” “potential,” “predict," “seek,” “should,”

“will,” “would,” “expect,” “objective,” “projection,” “forecast,”

“goal,” “guidance,” “outlook,” “effort,” “target” and other similar

words can be used to identify forward-looking statements. However,

the absence of these words does not mean that the statements are

not forward-looking. Where, in any forward-looking statement, the

company expresses an expectation or belief as to future results,

such expectation or belief is expressed in good faith and believed

to be reasonable at the time such forward-looking statement is

made. However, these statements are not guarantees of future

performance and involve certain risks, uncertainties and other

factors beyond our control. Therefore, actual outcomes and results

may differ materially from what is expressed or forecast in the

forward-looking statements. Factors that could cause actual results

or events to differ materially from what is presented include

changes in commodity prices, including a prolonged decline in these

prices relative to historical or future expected levels; global and

regional changes in the demand, supply, prices, differentials or

other market conditions affecting oil and gas, including changes

resulting from any ongoing military conflict, including the

conflict between Russia and Ukraine and the global response to such

conflict, security threats on facilities and infrastructure, or

from a public health crisis or from the imposition or lifting of

crude oil production quotas or other actions that might be imposed

by OPEC and other producing countries and the resulting company or

third-party actions in response to such changes; insufficient

liquidity or other factors, such as those listed herein, that could

impact our ability to repurchase shares and declare and pay

dividends such that we suspend our share repurchase program and

reduce, suspend, or totally eliminate dividend payments in the

future, whether variable or fixed; changes in expected levels of

oil and gas reserves or production; potential failures or delays in

achieving expected reserve or production levels from existing and

future oil and gas developments, including due to operating

hazards, drilling risks or unsuccessful exploratory activities;

unexpected cost increases, inflationary pressures or technical

difficulties in constructing, maintaining or modifying company

facilities; legislative and regulatory initiatives addressing

global climate change or other environmental concerns; public

health crises, including pandemics (such as COVID-19) and epidemics

and any impacts or related company or government policies or

actions; investment in and development of competing or alternative

energy sources; potential failures or delays in delivering on our

current or future low-carbon strategy, including our inability to

develop new technologies; disruptions or interruptions impacting

the transportation for our oil and gas production; international

monetary conditions and exchange rate fluctuations; changes in

international trade relationships or governmental policies,

including the imposition of price caps or the imposition of trade

restrictions or tariffs on any materials or products (such as

aluminum and steel) used in the operation of our business,

including any sanctions imposed as a result of any ongoing military

conflict, including the conflict between Russia and Ukraine; our

ability to collect payments when due, including our ability to

collect payments from the government of Venezuela or PDVSA; our

ability to complete any announced or any future dispositions or

acquisitions on time, if at all; the possibility that regulatory

approvals for any announced or any future dispositions or

acquisitions will not be received on a timely basis, if at all, or

that such approvals may require modification to the terms of the

transactions or our remaining business; business disruptions

following any announced or future dispositions or acquisitions,

including the diversion of management time and attention; the

ability to deploy net proceeds from our announced or any future

dispositions in the manner and timeframe we anticipate, if at all;

potential liability for remedial actions under existing or future

environmental regulations; potential liability resulting from

pending or future litigation, including litigation related directly

or indirectly to our transaction with Concho Resources Inc.; the

impact of competition and consolidation in the oil and gas

industry; limited access to capital or insurance or significantly

higher cost of capital or insurance related to illiquidity or

uncertainty in the domestic or international financial markets or

investor sentiment; general domestic and international economic and

political conditions or developments, including as a result of any

ongoing military conflict, including the conflict between Russia

and Ukraine; changes in fiscal regime or tax, environmental and

other laws applicable to our business; and disruptions resulting

from accidents, extraordinary weather events, civil unrest,

political events, war, terrorism, cybersecurity threats or

information technology failures, constraints or disruptions; and

other economic, business, competitive and/or regulatory factors

affecting our business generally as set forth in our filings with

the Securities and Exchange Commission. Unless legally required,

ConocoPhillips expressly disclaims any obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230914320053/en/

Dennis Nuss (media) 281-293-1149

dennis.nuss@conocophillips.com

Investor Relations 281-293-5000

investor.relations@conocophillips.com

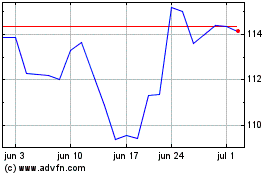

ConocoPhillips (NYSE:COP)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

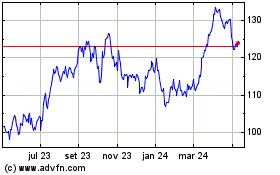

ConocoPhillips (NYSE:COP)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024