U.S. Bancorp Releases Dodd-Frank Act Stress Test Results

28 Junho 2024 - 7:06PM

Business Wire

U.S. Bancorp (NYSE: USB) commented on the results of the Federal

Reserve’s Dodd-Frank Act Stress Test (DFAST) conducted in

accordance with the Dodd-Frank Wall Street Reform and Consumer

Protection Act.

Based on its 2024 stress test results, the company expects to be

subject to a preliminary stress capital buffer (SCB) of 3.1

percent, for the period beginning October 1, 2024, and ending on

September 30, 2025. The Federal Reserve has stated that it expects

to finalize the SCB for all firms by August 31, 2024. The SCB, when

added to the Basel III Common Equity Tier 1 (CET1) capital to

risk-weighted assets ratio minimum of 4.5 percent, requires the

company to maintain a CET1 ratio at or above 7.6 percent through

this period.

All U.S. Bancorp regulatory ratios continue to reflect strong

capital levels and are in excess of “well-capitalized”

requirements. The company’s CET1 capital to risk-weighted assets

ratio using the Basel III standardized approach was 10.0 percent as

of March 31, 2024.

U.S. Bancorp’s planned capital actions include a 2 percent

increase of a quarterly common stock dividend from $0.49 to $0.50

per share, subject to approval by U.S. Bancorp's Board of

Directors, effective in the fourth quarter of 2024.

The company’s common stock repurchases, except for those done

exclusively in connection with its stock-based compensation

programs, currently remain suspended. The company will evaluate its

share repurchases in connection with the potential capital

requirements given proposed regulatory capital rules and related

landscape. Any additional capital distributions remain subject to

the approval of U.S. Bancorp’s Board of Directors and compliance

with regulatory requirements.

“The results of this year’s stress test demonstrate that we are

well-capitalized, have a healthy balance sheet and remain prepared

to manage potential industry stress and withstand a severe economic

downturn,” said Andy Cecere, Chairman and CEO of U.S. Bancorp.

In addition, the company has published its company-run DFAST

results, which are available on the company’s website at

www.usbank.com under “About Us,” “Investor Relations,”

“Financials,” “Supporting documents” and “Dodd-Frank Act Stress

test results.”

The company’s DFAST results may differ from those calculated and

published by the Federal Reserve Board largely due to, but not

limited to, differences in models, methodologies, assumptions and

applicable capital and accounting rules.

About U.S. Bancorp

U.S. Bancorp, with more than 70,000 employees and $684 billion

in assets as of March 31, 2024, is the parent company of U.S. Bank

National Association. Headquartered in Minneapolis, the company

serves millions of customers locally, nationally and globally

through a diversified mix of businesses including consumer banking,

business banking, commercial banking, institutional banking,

payments and wealth management. U.S. Bancorp has been recognized

for its approach to digital innovation, community partnerships and

customer service, including being named one of the 2024 World’s

Most Ethical Companies and Fortune’s most admired superregional

bank. To learn more, please visit the U.S. Bancorp website at

usbank.com and click on “About Us.”

Forward-Looking Statements

This press release contains forward-looking statements about

U.S. Bancorp. Statements that are not historical or current facts,

including statements about beliefs and expectations, are

forward-looking statements and are based on the information

available to, and assumptions and estimates made by, management as

of the date hereof. These forward-looking statements cover, among

other things, U.S. Bancorp’s SCB requirement and capital action

plans. Forward-looking statements involve inherent risks and

uncertainties that could cause actual results to differ materially

from those set forth in forward-looking statements. Readers are

cautioned not to place undue reliance on any forward-looking

statements. Forward-looking statements speak only as of the date

hereof, and the Company undertakes no obligation to update them in

light of new information or future events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240628787404/en/

Investor contact: George Andersen, U.S. Bancorp Investor

Relations george.andersen@usbank.com 612.303.3620 Media contact:

Jeff Shelman, U.S. Bancorp Public Affairs and Communications

jeffrey.shelman@usbank.com 612.303.9933

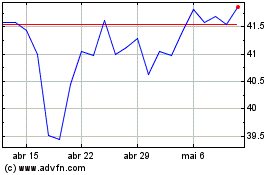

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025