Oak Hill and Cinelli Family to Sell Metronet to KKR and T-Mobile Joint Venture

24 Julho 2024 - 10:11AM

Business Wire

Joint Venture Will Offer Leading Fiber Solution

to More U.S. Consumers

Metronet (the “Company”) today announced that, together with its

majority shareholders, Oak Hill Capital (together with its

affiliates, “Oak Hill”) and the Cinelli family, it has entered into

definitive agreements to sell the Company to a Joint Venture (“JV”)

between KKR and T-Mobile. Following the transaction’s close,

Metronet will become a wholesale services provider for its retail

customers and 100% of its residential fiber retail operations and

customers will transition to T-Mobile. T-Mobile will have full

responsibility for residential customer acquisition and support,

leveraging its differentiated retail, marketing, brand and service

model, and will utilize Metronet’s deep digital and fiber

infrastructure expertise to expand to more households with fiber

broadband services. Metronet will focus on build plans, network

engineering and design, network deployment, and customer

installation. An affiliate of Oak Hill will make a minority

investment in the JV, and the Cinelli family will also remain

minority investors in the JV alongside KKR and T-Mobile.

Metronet’s management team and Oak Hill have worked together for

more than 10 years to build Metronet into the leading independent

fiber-to-the-home (FTTH) operator in the U.S., and KKR has been a

minority investor in the Company since 2021. Today, Metronet’s

fiber network reaches more than 2 million households across 17

states, with pure play fiber solutions that are built on a

state-of-the art broadband platform. Metronet has the highest build

pace of any private fiber company in the U.S., the third fastest

build pace nationally overall and has Net Promoter Scores well in

excess of industry averages.

“We started Metronet to bring Main Street USA two things their

internet providers weren’t delivering—hyper fast speeds and warm

customer service,” said John Cinelli, co-founder and current

chairman of Metronet. “Today we have found a strong partner in

T-Mobile, a digital infrastructure leader equally focused on

cutting-edge technology and the customer experience. We could not

have grown so far, so quickly, to reach this moment without the

decade-long support of Oak Hill Capital and, for the last three

years, KKR. Their visionary support, together with our hardworking

associates, have provided the capital and energy to build the best

fiber-to-the-home company in the U.S.”

“Our involvement in the Metronet expansion story has been a

joyful experience for all of us at Oak Hill—from our first meetings

with John Cinelli, Al Cinelli and Lohn Weber in 2010, to our

initial investment in the company in 2014, to the decade of

remarkable growth we have achieved together since that time. Over

the past 10 years, Metronet has expanded its network from 10 small

towns in Indiana to over 300 communities across a 17-state

footprint, and from 80,000 locations passed to more than 2 million,

all while maintaining an unwavering commitment to providing an

outstanding experience for its loyal customers and dedicated

associates,” said Benjy Diesbach, Senior Operating Advisor, and

Scott Baker, Managing Partner of Oak Hill. “We are extremely

grateful for the contributions of each of the talented executives

with whom we have worked so closely over the years, and we remain

excited about Metronet's future potential with T-Mobile and

KKR.”

“Metronet is an amazing American business success story, thanks

in large part to Al and John’s entrepreneurial spirit and

leadership, and Oak Hill’s support. We are proud of all that

Metronet has achieved since we first invested in the Company in

2021, and are thrilled to continue to work with the management team

and their associates to build upon the Company’s 20-year legacy. We

look forward to embarking on this new chapter with T-Mobile and

supporting the Company in its future growth,” said Waldemar

Szlezak, Partner and Global Head of Digital Infrastructure at

KKR.

The transaction is expected to close in 2025, subject to

customary closing conditions and regulatory approvals.

Bank Street Group LLC and TD Securities served as financial

advisors to Metronet. Paul, Weiss, Rifkind, Wharton & Garrison

LLP and Polsinelli served as legal counsel to Metronet. Lazard

served as financial advisor to Oak Hill.

Barclays and Morgan Stanley & Co. LLC are serving as lead

financial advisors to KKR, with Goldman Sachs, Mizuho and MUFG also

serving as financial advisors. Simpson Thacher is serving as KKR’s

legal advisor.

About Metronet

Metronet is PCMag's “Fastest Major ISP” for 2023 and 2024,

providing multi-gigabit internet service to homes and businesses in

cities like Colorado Springs, Des Moines, Indianapolis, Lexington,

Norfolk, Tallahassee and more than 300 other communities across 17

states. Expanding its fiber-optic network in more than 90

communities at any one time, Metronet has become the country's

largest and fastest-growing privately owned fiber-to-the-home

company. More information on the Evansville, Ind.-based company can

be found at metronet.com.

About Oak Hill Capital

Oak Hill is a longstanding private equity firm focused on the

North America middle-market. Oak Hill applies a specialized,

theme-based approach to investing in Media & Communications,

Industrials, Services, and Consumer. The Firm implements a highly

systematic approach to theme development, proactive origination,

and value creation in partnership with management to build

franchises of lasting value. Over the past 35+ years, Oak Hill and

its predecessors have raised over $23 billion of initial capital

commitments and co-investments and invested in over 110 companies.

For more information, please visit www.oakhill.com.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR) please visit KKR’s website at www.kkr.com. For

additional information about Global Atlantic Financial Group,

please visit Global Atlantic Group’s website at

www.globalatlantic.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724285262/en/

Media Contacts

Metronet Scott Shapiro media@metronet.com

Oak Hill Nadia Damouni / Kiki O’Keeffe

pro-OakHillCapital@prosek.com

KKR KKR Media Relations Media@KKR.com

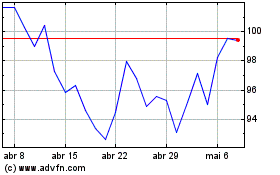

KKR (NYSE:KKR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

KKR (NYSE:KKR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024