U.S. Bank Freight Payment Index: Less Contraction, Regional Bright Spots in Second Quarter

01 Agosto 2024 - 9:00AM

Business Wire

Truck freight shipments increase in West,

Northeast and Southeast regions compared to first quarter

Truck freight volumes and spending continued to drop in the

second quarter, but at a slower pace than recent quarters,

according to the latest U.S. Bank Freight Payment Index. Shipments

increased in three regions – the West, Northeast and Southeast – on

a quarterly basis, the first time multiple regions have experienced

increased volume in more than a year.

“Our data is showing some signs that the very challenging

freight market could be nearing a bottom,” said Bobby Holland,

director of freight business analytics, U.S. Bank. “There are still

headwinds for carriers, but at least in terms of volume, there are

some bright spots across the country.”

In the second quarter, shipments nationally dropped 2.2% while

spending contracted 2.8% on a quarterly basis. The declines were

less severe than the first quarter, when spending fell 16.8% and

shipping volume dropped 7.8%. Still, second quarter shipments were

down 22.4% compared to a year earlier and spend was off 23.5%.

“Trucking companies are facing a triple challenge of lower

volumes due to consumer preference to spend on experiences versus

goods, suppressed rates and higher costs,” said Bob Costello,

senior vice president and chief economist at the American Trucking

Associations. “This situation is likely to cause further capacity

reductions in the industry.”

The U.S. Bank Freight Payment Index measures quantitative

changes in freight shipments and spend activity based on data from

transactions processed through U.S. Bank Freight Payment, which

processes more than $42 billion in freight payments annually for

shippers and carriers across the U.S. The Index insights are

provided to U.S. Bank customers to help them make business

decisions and discover new opportunities.

Data

National Data Shipments Linked quarter: -2.2% Year over

year: -22.4%

Spending Linked quarter: -2.8% Year over year: -23.5%

Regional Data West Shipments Linked quarter: 1.5%

Year over year: -19.8%

Spending Linked quarter: -2.3% Year over year: -25.5%

This marked the first sequential volume gain for the West since

the first quarter of 2022. Seaport volume as well as

truck-transported exports and imports in the region have increased,

which boosts truck freight.

Southwest Shipments Linked quarter: -13.6% Year over

year: -26.8%

Spending Linked quarter: -1.4% Year over year: -25.5%

The Southwest truck freight market has struggled the last

several quarters after outperforming other regions in parts of 2022

and 2023. The 1.4% quarterly spending drop was much better than the

first quarter, when spending was down -16.5%. Cross border trucking

in the region has been one of the few bright spots for the

market.

Midwest Shipments Linked quarter: -2.7% Year over year:

-20.3%

Spending Linked quarter: -6.0% Year over year: -23.1%

One of only two regions to post a quarterly decline in volumes,

the Midwest experienced sequential declines in five consecutive

quarters. The findings align with flat or slightly declining

economic indicators in the region.

Northeast Shipments Linked quarter: 2.7% Year over year:

-25.2%

Spending Linked quarter: -0.1% Year over year: -26.9%

This was the first time in two years the Northeast experienced a

quarterly increase in shipments. According to the Federal Reserve’s

Beige Book, spending on goods have held steady in the region, which

supports truck freight.

Southeast Shipments Linked quarter: 1.8% Year over year:

-22.9%

Spending Linked quarter: -0.9% Year over year: -20.3%

Southeast shipments increased for the first time in three years.

The region is experiencing improved home construction, retail

demand and seaport volume.

To see the full report including in-depth regional data, visit

the U.S. Bank Freight Payment Index website. For more than 25

years, organizations have turned to U.S. Bank Freight Payment for

the service, reliability, and security of a full-service, federally

regulated financial institution. The U.S. Bank Freight Payment

Index measures quantitative changes in freight shipments and spend

activity based on data from transactions processed through U.S.

Bank Freight Payment.

About U.S. Bank

U.S. Bancorp, with more than 70,000 employees and $680 billion

in assets as of June 30, 2024, is the parent company of U.S. Bank

National Association. Headquartered in Minneapolis, the company

serves millions of customers locally, nationally and globally

through a diversified mix of businesses including consumer banking,

business banking, commercial banking, institutional banking,

payments and wealth management. U.S. Bancorp has been recognized

for its approach to digital innovation, community partnerships and

customer service, including being named one of the 2024 World’s

Most Ethical Companies and Fortune’s most admired superregional

bank. Learn more at usbank.com/about.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801975263/en/

Todd Deutsch, U.S. Bank Public Affairs & Communications

todd.deutsch@usbank.com

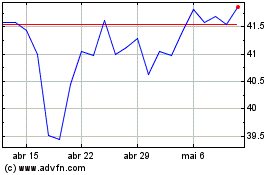

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

US Bancorp (NYSE:USB)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025