KKR and PSP Investments Acquire Minority Stake in Two American Electric Power Transmission Companies

09 Janeiro 2025 - 5:00PM

Business Wire

Investment to support modernization of

infrastructure and increased reliability

Strategic partnership comes as need for

reliable power soars in the U.S.

Today, investment funds managed by KKR, a leading global

investment firm, and the Public Sector Pension Investment Board

(“PSP Investments”), one of Canada’s largest pension investors,

announced an agreement to acquire a 19.9% interest in American

Electric Power’s (“AEP”) Ohio and Indiana & Michigan

transmission companies for $2.82 billion. Founded in 1906 and one

of the largest electric utilities in the U.S., AEP has pioneered

the country’s energy system through the delivery of safe, reliable

and affordable energy for millions of homes. The investment will

support AEP’s ability to meet increasing customer demand and

enhance grid reliability. KKR and PSP Investments have formed a

50/50 strategic partnership to pursue the acquisition.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250109303908/en/

AEP is a fully regulated electric utility that serves 5.6

million retail and wholesale customers across 11 states. Ohio,

Indiana and Michigan are among AEP’s fastest-growing service

territories driven primarily by the strong American manufacturing

industry and newer sources of load growth. The investment by KKR

and PSP Investments in these two transmission companies will

support AEP’s previously announced five-year capital plan to

benefit customers.

“We are thrilled to strategically partner with the best-in-class

leader in transmission in the U.S., and are impressed with AEP’s

deep operational capabilities, highly experienced leadership team,

and its history of innovation,” said Kathleen Lawler, Managing

Director, KKR. “KKR’s infrastructure business has a long track

record of investing behind the energy transition and

electrification opportunities, and this investment in AEP sits

squarely at the intersection of these two trends. The simplicity

and stability of the assets, coupled with the robust demand for

electricity, make AEP’s transmission assets an ideal investment for

KKR.”

“We are delighted to form this partnership with AEP to support

its ambitious growth plan to build much needed transmission

infrastructure in a region that is undergoing significant tailwinds

from digitalization and reshoring of critical manufacturing,” said

Michael Rosenfeld, Managing Director, Infrastructure

Investments, PSP Investments. “This investment marks an

important milestone in PSP Infrastructure’s roll out of its High

Inflation Correlated Infrastructure (“HICI”) strategy, which is

predicated on investing in North American core infrastructure

assets that exhibit a defensive and predictable inflation-linked

cashflow profile.”

“We are pleased to launch this strategic partnership with two of

the world’s premier global infrastructure investors. KKR and PSP

are experienced investors in the utilities and energy space with a

proven track record of successful infrastructure investments,” said

Bill Fehrman, AEP president and chief executive officer.

“This transaction allows AEP to efficiently finance a growing

segment of our business and enhances our ability to serve growing

customer demand and provide reliable service to our customers.”

Upon the closing of the transaction, AEP will remain the

majority owner and operator of the transmission assets. KKR is

funding this investment from its core infrastructure strategy.

Moelis and Morgan Stanley served as financial advisors and

Simpson Thacher served as legal advisor to KKR and PSP

Investments.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

About PSP Investments

The Public Sector Pension Investment Board (PSP Investments) is

one of Canada's largest pension investors with $264.9 billion of

net assets under management as of March 31, 2024. It manages a

diversified global portfolio composed of investments in capital

markets, private equity, real estate, infrastructure, natural

resources, and credit investments. Established in 1999, PSP

Investments manages and invests amounts transferred to it by the

Government of Canada for the pension plans of the federal public

service, the Canadian Forces, the Royal Canadian Mounted Police and

the Reserve Force. Headquartered in Ottawa, PSP Investments has its

principal business office in Montréal and offices in New York,

London and Hong Kong. For more information, visit investpsp.com or

follow us on LinkedIn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250109303908/en/

Media:

KKR Liidia Liuksila or Emily Cummings (212) 750-8300

media@kkr.com

PSP Investments Charles Bonhomme +1 438 465-1260

media@investpsp.ca

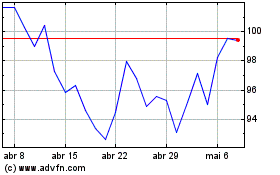

KKR (NYSE:KKR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

KKR (NYSE:KKR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025