Intesa Sanpaolo Seeks to Put Funds in Reserve Rather than Pay Italian Banking Tax

26 Outubro 2023 - 4:25AM

Dow Jones News

By Pierre Bertrand

Intesa Sanpaolo said late Wednesday that it will propose to

shareholders that it exercise the option given to it by the Italian

government to put funds aside rather than pay the government's

banking windfall tax.

Intesa said that it will instruct its subsidiary banks,

Fideuram, Intesa Sanpaolo Private Banking and Isybank, to follow

its lead in setting aside two-and-a-half times the amount they

would have paid as tax.

Across the whole group, 2.07 billion euros ($2.19 billion) will

be put in a non-distributable reserve-- a fund that can't be

distributed to shareholders--based on a tax amount of around EUR828

million, Instesa said.

Intesa, the parent company, intends to put around EUR1.99

billion aside, based on a calculated tax amount of around EUR797

million, the bank said.

Shareholders will consider the proposal when approving the

bank's 2023 financial statements, Intesa said.

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

October 26, 2023 03:10 ET (07:10 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

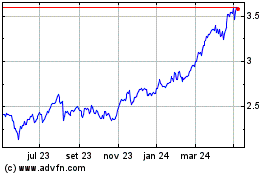

Intesa Sanpaolo (BIT:ISP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

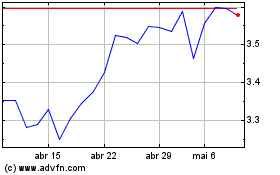

Intesa Sanpaolo (BIT:ISP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024