BlackRock Warns Markets Not Appreciating Worsening Geopolitical Backdrop

22 Janeiro 2024 - 9:20PM

Dow Jones News

By James Glynn

SYDNEY--The world's largest investment manager BlackRock has

warned of further deterioration in the geopolitical backdrop for

financial markets in 2024, adding that asset markets aren't fully

appreciating the risks.

"We expect deeper fragmentation, heightened competition and less

cooperation between major nations in 2024," BlackRock said in a

note to clients.

"Yet as broad stocks and other assets move on quickly from

geopolitical events, we worry they may not be appreciating that we

have entered a new geopolitical regime. The old playbook no longer

applies, in our view," it added.

The warning comes as the Dow industrials finished Monday above

38000 for the first time, while the S&P 500 also clinched

another record close.

"Geopolitical fragmentation's economic and market impact will

depend, in part, on if changes to the global order are managed or

disorderly," BlackRock said.

BlackRock's assets under management climbed to $10 trillion in

the fourth quarter, beating analyst expectations.

The investment group reaffirmed its highest-level Gulf tensions

rating saying the risk of escalation is high.

"The disruption of Red Sea shipping aiming to pass through the

Suez Canal shows how the conflict can expand to hamper supply

chains and drive up production costs, in this case via rising

shipping costs," it added.

BlackRock is also keeping its U.S.-China strategic competition

risk rating at a high level.

"Taiwan remains a significant flashpoint, as the recent election

shows. We think intense, structural competition between the U.S.

and China is the new normal, especially in defense and technology,"

the investment firm added.

Write to James Glynn at James.Glynn@wsj.com

(END) Dow Jones Newswires

January 22, 2024 19:05 ET (00:05 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

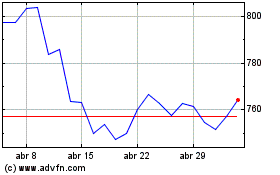

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024