Report of Foreign Issuer (6-k)

15 Maio 2017 - 6:39PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2017

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A

BANCO SANTANDER (BRASIL) S.A.

Publicly-Held Company with Authorized Capital

CNPJ/MF: 90.400.888/0001-42

NIRE: 35.300.332.067

NOTICE TO THE MARKET

On May 12, 2017,

Banco Santander (Brasil) S.A.

(“Santander Brasil”) received the Official Letter 958/2017-SAE, pursuant to which BM&FBOVESPA S.A. Bolsa de Valores, Mercadorias e Futuros (“BOVESPA”) inquired the Company about the content of the news published on the Newspaper named “O Estado de São Paulo” (local paper) on May 11, 2017, under the title “Carf maintains a fine of R$ 2 billion to Santander for the purchase of Banespa

”

as well as other information deemed relevant.

I. OFFICIAL LETTER BOVESPA 958/2017-SAE:

“May 12, 2017

958/2017-SAE

Banco Santander (Brasil) S.A.

At. Mr. Angel Santodomingo Martell

Investor Relations Officer

Ref.:

Request for clarification on news in the press

Dear Sirs,

In news published by the newspaper O Estado de São Paulo, on 05/12/2017, it is stated, among other information, that:

-

Santander will have to pay about R$ 2 billion in taxes from the purchase of Banespa in 2000;

-

The bank informed that it will appeal to the court of the decision;

-

The amount of the assessment fell from R$ 4 billion to approximately R$ 1.2 billion, which would reach approximately R$ 2 billion in updated amounts.

We did not identify this information in the documents sent by this company through the Empresas.NET System.

In case of contradictory, please inform the document and the pages that contain the information and the date and time in which they were sent.

It should be noted that the company must disclose periodic information, contingencies and other information of interest to the market, through the Empresas.NET System, guaranteeing its wide and immediate dissemination and fair treatment of its investors and other market participants.

That said, we request clarification on the items indicated, until 05/15/2017, without prejudice to the provisions of the sole paragraph of art. 6 of CVM Instruction 358/02, with its confirmation or otherwise, as well as other information considered important.

The response of this company should be sent through the IPE module, selecting the Category: Relevant Fact or Category: Notice to the Market, Type: Clarification on CVM / Bovespa queries and then the Subject: News published in the media, which will result in the simultaneous transmission of the file to BM&FBOVESPA and CVM.

The option to respond through Relevant Fact does not prevent the CVM from determining its responsibility for its untimely disclosure, pursuant to CVM Instruction 358/02.

We emphasize the obligation, set forth in the sole paragraph of art. 4 of CVM Instruction 358/02, to inquire the company's management and controlling shareholders, as well as all other persons with access to relevant acts or facts, with the purpose of ascertaining whether they would have knowledge of information that should be disclosed to the market .

The content of the query formulated above must be transcribed in the file to be sent by the company before its response.

This request is based on the Cooperation Agreement entered into between CVM and BM&FBOVESPA on December 13, 2011, and failure to comply with this request may subject the company to a fine imposed by the Company Relations Authority – SEP of the CVM, pursuant to CVM Ruling 452/07.

Regards,

Nelson Barroso Ortega

Superintendence of Companies Monitoring

BM&FBOVESPA S.A. Stock Exchange, Commodities and Futures Exchange

C.c .: CVM - Brazilian Securities and Exchange Commission

Mr. Fernando Soares Vieira - Superintendent of Companies Relations

Mr. Francisco José Bastos Santos - Superintendent of Market Relations and Intermediaries"

II. CLARIFICATIONS MADE BY SANTANDER BRASIL:

The news is related to the judgment of May 11, 2017 by the Superior Chamber of Tax Appeals of the Administrative Council of Tax Appeals ("CSRF"). The content and amounts involved in the administrative proceeding object of the news have been

reported by the Company in the Reference Form and Form 20-F since 2012, and the previous decision of first instance was disclosed to the Market on April 17, 2014.

Santander Brasil is convinced that the operations related to the acquisition of Banespa have met all the requirements of the legislation in force at the time, and therefore will appeal the decision of the CSRF in the appropriate instances.

Santander Brasil will keep its shareholders and the market informed about the completion of these tax procedures.

São Paulo, May 15, 2017.

Angel Santodomingo

Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: May 15, 2017

|

Banco Santander (Brasil) S.A.

|

|

|

|

|

|

By:

|

/

S

/

Amancio Acurcio Gouveia

|

|

|

|

Amancio Acurcio Gouveia

Officer Without Specific Designation

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/

S

/

Angel Santodomingo Martell

|

|

|

|

Angel Santodomingo Martell

Vice - President Executive Officer

|

|

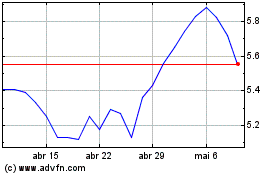

Banco Santander Brasil (NYSE:BSBR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

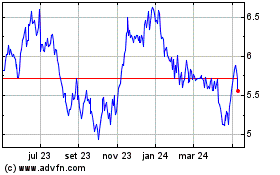

Banco Santander Brasil (NYSE:BSBR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024