Report of Foreign Issuer (6-k)

14 Agosto 2017 - 7:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2017

Commission File Number

Novogen

Limited

(Translation of registrant’s name into English)

Level 5, 20 George Street, Hornsby, NSW 2077, Australia

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☑ Form 40-F ☐

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note

: Regulation S-T Rule

101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note

:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which

the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other

document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on

EDGAR.

Indicate by check mark if the registrant by furnishing the information contained in this form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☑

If

“yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Novogen Limited

(Registrant)

Kate Hill

Kate Hill

Company Secretary

Date 14 August 2017

|

|

|

|

|

ASX:NRT

NASDAQ:NVGN

Novogen Ltd

(Company)

ABN 37 063 259 754

Capital Structure

Ordinary Shares on issue:

483 M

Board of Directors

Mr Iain Ross

Chairman

Non-Executive Director

Mr Bryce

Carmine

Non-Executive Director

Mr Steven Coffey

Non-Executive Director

Dr James Garner

Chief Executive Officer

Managing Director

|

|

ASX RELEASE

14 AUGUST 2017

BOARD REVIEW OF BUSINESS OPERATIONS AND GOVERNANCE

• Board

and management have reviewed business operations following appointment of new Chairman in June 2017 and broad-ranging consultation with shareholders

• Approximately $1.8 million of annual cost savings identified, allowing greater

focus on R&D investment; cost of Board reduced by approximately 50%

• In response to shareholder feedback, depository holder instructed not to exercise

unvoted ADR proxies at future general meetings

• Novogen confirms compliance with NASDAQ listing rules following revision of ADR

consolidation ratio

Sydney, 14 August 2017 – Novogen Ltd (ASX: NRT; NASDAQ:

NVGN), an Australian oncology drug development company, is pleased to provide an update to investors on a review of business operations recently completed by the Board and management team. The review was initiated following appointment of Iain Ross

as Chairman on 8 June 2017, and has involved an extensive process of consultation with shareholders and investors.

Streamlined Board Reduces Costs

Novogen previously announced on 8 June 2017 that the Board of Directors had been reduced in size, with two

non-executive

Directors stepping down from the Board. The changes leave Novogen with a Board comprising three

non-executive

Directors (Iain Ross, Bryce Carmine, and

Steven Coffey), and one executive Director (James Garner, Chief Executive Officer), which is considered optimal to satisfy ASX, NASDAQ, and SEC regulatory obligations.

In addition to the streamlined membership of the Board, Directors have offered to reduce their fees, providing additional savings to the Company. As a result

of these changes, the annual cost of the Board has been reduced by approximately 50%.

In order to enhance the operational efficiency of the Board, the number of Board

Sub-Committees

is being streamlined,

and the Charters governing operation of these

Sub-Committees

are being updated to reflect contemporary best practice. The updated Charters will be made available via Novogen’s website as they are

reviewed.

|

AU$ 1.8 Million Annualised Reduction in Operating Expenses

Novogen also indicated in June that it expected to realize additional cost savings through a review of business operations. Approximately $1.8 million of

annualized savings have been identified in operating expenses, principally comprising reduction in consultant expenditure, optimization of the intellectual property portfolio, management of occupancy expenses, and a modest reduction in headcount.

These measures have already been substantially implemented, and will allow a greater allocation of the Company’s resources to progressing the

clinical trials of

GDC-0084

and Cantrixil.

In Response to Shareholder Feedback, ADR Proxies to Remain Unvoted

As announced on 11 August, Novogen has instructed its Depository Holder, BNY Mellon, not to direct unvoted proxies from American Depository

Receipts (ADRs) in future general meetings of shareholders.

During its consultation with shareholders, the Company has become aware that this practice

has become a cause for concern among some shareholders. While the Company has at all times acted in good faith and under independent legal advice on these matters, it recognizes the concerns of shareholders and has accordingly instructed BNY Mellon

not to so direct unvoted proxies in future meetings.

Compliance with NASDAQ Listing Rules Confirmed

On 31 May 2017, Novogen received notification from NASDAQ requiring the Company to ensure that the share price of its NASDAQ-listed securities remained

above US$ 1 per share, in accordance with NASDAQ Listing Rules. In response to this, Novogen announced on 4 July 2017 that it had changed the ratio at which ADRs consolidate underlying Australian shares from 25:1 to 100:1.

The change did not affect the total number of shares on issue, but served to increase the number of ASX shares that were consolidated into each ADR fourfold,

with a commensurate increase in the price of the ADRs on NASDAQ.

In a letter dated 28 July 2017 and received on 29 July, NASDAQ confirmed that,

as a result of these measures, Novogen was compliant with NASDAQ Listing Rule 5550(a)(2) and that the matter was now closed.

Novogen Chairman, Iain Ross, commented “recent efforts have significantly improved the efficiency of

Novogen as a business, and will allow us to better devote our resources to delivering on the substantial value that resides in our pipeline.

The company

has listened carefully to the feedback of shareholders, and has shown its commitment to delivering shareholder value in accordance with the best principles of corporate governance.”

[ENDS]

About Novogen Limited

Novogen Limited (ASX: NRT; NASDAQ: NVGN) is an emerging oncology-focused biotechnology company, based in Sydney, Australia. Novogen has a portfolio of

development candidates, diversified across several distinct technologies, with the potential to yield

first-in-class

and best-

in-class

agents in a range of oncology indications.

The lead program is

GDC-0084,

a small molecule inhibitor of the PI3K / AKT / mTOR pathway, which is being developed to treat glioblastoma multiforme. Licensed from Genentech in late 2016,

GDC-0084

is anticipated to enter phase II clinical trials in 2017. A second clinical program,

TRXE-002-01

(Cantrixil) commenced a

phase I clinical trial in ovarian cancer in December 2016. In addition, the company has several preclinical programs in active development, the largest of which is substantially funded by a

CRC-P

grant from

the Australian Federal Government.

For more information, please visit:

www.novogen.com

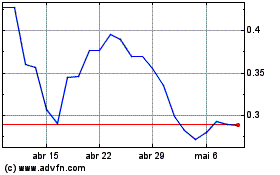

Kazia Therapeutics (NASDAQ:KZIA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Kazia Therapeutics (NASDAQ:KZIA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024