UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐ |

Preliminary Proxy Statement |

| |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ |

Definitive Proxy Statement |

| |

☐ |

Definitive Additional Materials |

| |

☒ |

Soliciting Material Under Rule 14a-12 |

| ALCOA CORPORATION |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| (Name of Persons(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

☐ |

Fee paid previously with preliminary materials: |

| |

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

(1) |

Amount previously paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

Alcoa Corporation (“Alcoa”),

expects to file a preliminary proxy statement with the Securities and Exchange Commission (the “SEC”) to be used to solicit

proxies to approve the issuance of shares of common stock of Alcoa in connection with a proposed transaction to acquire all of the shares

of Alumina Limited (“Alumina”) in an all-stock transaction (the “Proposed Transaction”) at a special meeting of

its stockholders.

Item 1: On February 25, 2024,

Alcoa launched a website in connection with the Proposed Transaction. Copies of materials posted to the website are filed herewith as

Exhibit 1.

Item 2: On February 25, 2024,

Alcoa held a call with investors (the “Investors Call”). A copy of the transcript of the Investors Call is filed herewith

as Exhibit 2.

Item 3: On February 25, 2024,

Alcoa sent a communication to its employees, a copy of which is filed herewith as Exhibit 3.

Item 4: On February 25,

2024, Alcoa and William (Bill) Oplinger, Alcoa’s President & Chief Executive Officer, published messages on LinkedIn,

which are filed herewith as Exhibit 4.

Item 5: On February 25, 2024,

Alcoa published a message on X, which is filed herewith as Exhibit 5.

Caution Concerning Forward-Looking Statements

This communication contains statements that relate

to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those containing such words as “aims,” “ambition,” “anticipates,”

“believes,” “could,” “develop,” “endeavors,” “estimates,” “expects,”

“forecasts,” “goal,” “intends,” “may,” “outlook,” “potential,”

“plans,” “projects,” “reach,” “seeks,” “sees,” “should,” “strive,”

“targets,” “will,” “working,” “would,” or other words of similar meaning. All statements

by Alcoa Corporation (“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements, including, without limitation, statements regarding the proposed transaction; the

ability of the parties to negotiate, enter into and complete the proposed transaction; the expected benefits of the proposed transaction,

the competitive ability and position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite,

alumina, and aluminum, and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating

performance (including our ability to execute on strategies related to environmental, social and governance matters); statements about

strategies, outlook, and business and financial prospects; and statements about capital allocation and return of capital. These statements

reflect beliefs and assumptions that are based on Alcoa’s perception of historical trends, current conditions, and expected future

developments, as well as other factors that management believes are appropriate in the circumstances. Forward-looking statements are not

guarantees of future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult

to predict. Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions,

it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are

not limited to: (1) the outcome of any discussions between Alcoa and Alumina Limited with respect to the proposed transaction, including

the possibility that the parties will not agree to pursue a transaction or that the terms of any such transaction will be materially different

from those described herein, (2) the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or more closing conditions

to the proposed transaction; (3) the prohibition or delay of the consummation of the proposed transaction by a governmental entity; (4)

the risk that the proposed transaction may not be completed in the expected time frame or at all; (5) unexpected costs, charges or expenses

resulting from the proposed transaction; (6) uncertainty of the expected financial

performance following completion of the proposed transaction;

(7) failure to realize the anticipated benefits of the proposed transaction; (8) the occurrence of any event that could give rise to termination

of the proposed transaction; (9) potential litigation in connection with the proposed transaction or other settlements or investigations

that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and

liability; (10) the impact of global economic conditions on the aluminum industry and aluminum end-use markets; (11) volatility and declines

in aluminum and alumina demand and pricing, including global, regional, and product-specific prices, or significant changes in production

costs which are linked to LME or other commodities; (12) the disruption of market-driven balancing of global aluminum supply and demand

by non-market forces; (13) competitive and complex conditions in global markets; (14) our ability to obtain, maintain, or renew permits

or approvals necessary for our mining operations; (15) rising energy costs and interruptions or uncertainty in energy supplies; (16) unfavorable

changes in the cost, quality, or availability of raw materials or other key inputs, or by disruptions in the supply chain; (17) our ability

to execute on our strategy to be a lower cost, competitive, and integrated aluminum production business and to realize the anticipated

benefits from announced plans, programs, initiatives relating to our portfolio, capital investments, and developing technologies; (18)

our ability to integrate and achieve intended results from joint ventures, other strategic alliances, and strategic business transactions;

(19) economic, political, and social conditions, including the impact of trade policies and adverse industry publicity; (20) fluctuations

in foreign currency exchange rates and interest rates, inflation and other economic factors in the countries in which we operate; (21)

changes in tax laws or exposure to additional tax liabilities; (22) global competition within and beyond the aluminum industry; (23) our

ability to obtain or maintain adequate insurance coverage; (24) disruptions in the global economy caused by ongoing regional conflicts;

(25) legal proceedings, investigations, or changes in foreign and/or U.S. federal, state, or local laws, regulations, or policies; (26)

climate change, climate change legislation or regulations, and efforts to reduce emissions and build operational resilience to extreme

weather conditions; (27) our ability to achieve our strategies or expectations relating to environmental, social, and governance considerations;

(28) claims, costs and liabilities related to health, safety, and environmental laws, regulations, and other requirements, in the jurisdictions

in which we operate; (29) liabilities resulting from impoundment structures, which could impact the environment or cause exposure to hazardous

substances or other damage; (30) our ability to fund capital expenditures; (31) deterioration in our credit profile or increases in interest

rates; (32) restrictions on our current and future operations due to our indebtedness; (33) our ability to continue to return capital

to our stockholders through the payment of cash dividends and/or the repurchase of our common stock; (34) cyber attacks, security breaches,

system failures, software or application vulnerabilities, or other cyber incidents; (35) labor market conditions, union disputes and other

employee relations issues; (36) a decline in the liability discount rate or lower-than-expected investment returns on pension assets;

and (37) the other risk factors discussed in Part I Item 1A of Alcoa’s Annual Report on Form 10-K for the fiscal year ended December

31, 2023 and other reports filed by Alcoa with the SEC. These risks, as well as other risks associated with the proposed transaction,

will be more fully discussed in the proxy statement. Alcoa cautions readers not to place undue reliance upon any such forward-looking

statements, which speak only as of the date they are made. Alcoa disclaims any obligation to update publicly any forward-looking statements,

whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject

to the risks described above and other risks in the market. Neither Alcoa nor any other person assumes responsibility for the accuracy

and completeness of any of these forward-looking statements and none of the information contained herein should be regarded as a representation

that the forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This communication

does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates

to the proposed transaction. In connection with the proposed transaction, Alcoa plans to file with the SEC a proxy statement on Schedule

14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Alcoa

may file with the SEC and send to its shareholders in connection with the proposed transaction. The issuance of the stock consideration

in the proposed transaction will be submitted to Alcoa’s stockholders for their consideration. The Proxy Statement will contain

important information about Alcoa, the proposed transaction and related matters. Before making any voting decision, Alcoa’s stockholders

should read all

relevant documents filed or to be filed with the SEC completely and in their entirety, including the Proxy Statement,

as well as any amendments or supplements to those documents, when they become available, because they will contain important information

about Alcoa and the proposed transaction. Alcoa’s stockholders will be able to obtain a free copy of the Proxy Statement, as well

as other filings containing information about Alcoa, free of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement

and other documents filed by Alcoa with the SEC may be obtained, without charge, by contacting Alcoa through its website at https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other persons related

to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in connection with the proposed

transaction. Information about the directors and executive officers of Alcoa and their ownership of common stock of Alcoa is set forth

in the section entitled “Information about our Executive Officers” included in Alcoa’s annual report on Form

10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 21, 2024 (and which is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm),

and in the sections entitled “Director Nominees” and “Stock Ownership of Directors and Executive Officers”

included in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on March 16, 2023 (and which

is available at https://www.sec.gov/Archives/edgar/data/1675149/000119312523072587/d427643ddef14a.htm). Additional information regarding

the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, will be included in the Proxy Statement and other relevant materials to be filed

with the SEC in connection with the proposed transaction when they become available. Free copies of these documents may be obtained as

described in the preceding paragraph.

Exhibit 1

Forward-Looking

Statements

This

communication contains statements that relate to future events and expectations and as such constitute forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as

“aims,” “ambition,” “anticipates,” “believes,” “could,” “develop,”

“endeavors,” “estimates,” “expects,” “forecasts,” “goal,” “intends,”

“may,” “outlook,” “potential,” “plans,” “projects,” “reach,”

“seeks,” “sees,” “should,” “strive,” “targets,” “will,” “working,”

“would,” or other words of similar meaning. All statements by Alcoa Corporation (“Alcoa”) that reflect expectations,

assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without

limitation, statements regarding the proposed transaction; the ability of the parties to negotiate, enter into and complete the proposed

transaction; the expected benefits of the proposed transaction, the competitive ability and position following completion of the proposed

transaction; forecasts concerning global demand growth for bauxite, alumina, and aluminum, and supply/demand balances; statements, projections

or forecasts of future or targeted financial results, or operating performance (including our ability to execute on strategies related

to environmental, social and governance matters); statements about strategies, outlook, and business and financial prospects; and statements

about capital allocation and return of capital. These statements reflect beliefs and assumptions that are based on Alcoa’s perception

of historical trends, current conditions, and expected future developments, as well as other factors that management believes are appropriate

in the circumstances. Forward-looking statements are not guarantees of future performance and are subject to known and unknown risks,

uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa believes that the expectations reflected in

any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained

and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety

of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (1) the outcome of any discussions between

Alcoa and Alumina Limited with respect to the proposed transaction, including the possibility that the parties will not agree to pursue

a transaction or that the terms of any such transaction will be materially different from those described herein, (2) the non-satisfaction

or non-waiver, on a timely basis or otherwise, of one or more closing conditions to the proposed transaction; (3) the prohibition or

delay of the consummation of the proposed transaction by a governmental entity; (4) the risk that the proposed transaction may not be

completed in the expected time frame or at all; (5) unexpected costs, charges or expenses resulting from the proposed transaction; (6)

uncertainty of the expected financial performance following completion of the proposed transaction; (7) failure to realize the anticipated

benefits of the proposed transaction; (8) the occurrence of any event that could give rise to termination of the proposed transaction;

(9) potential litigation in connection with the proposed transaction or other settlements or investigations that may affect the timing

or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; (10) the impact

of global economic conditions on the aluminum industry and aluminum end-use markets; (11) volatility and declines in aluminum and alumina

demand and pricing, including global, regional, and product-specific prices, or significant changes in production costs which are linked

to LME or other commodities; (12) the disruption of market-driven balancing of

global

aluminum supply and demand by non-market forces; (13) competitive and complex conditions in global markets; (14) our ability to obtain,

maintain, or renew permits or approvals necessary for our mining operations; (15) rising energy costs and interruptions or uncertainty

in energy supplies; (16) unfavorable changes in the cost, quality, or availability of raw materials or other key inputs, or by disruptions

in the supply chain; (17) our ability to execute on our strategy to be a lower cost, competitive, and integrated aluminum production

business and to realize the anticipated benefits from announced plans, programs, initiatives relating to our portfolio, capital investments,

and developing technologies; (18) our ability to integrate and achieve intended results from joint ventures, other strategic alliances,

and strategic business transactions; (19) economic, political, and social conditions, including the impact of trade policies and adverse

industry publicity; (20) fluctuations in foreign currency exchange rates and interest rates, inflation and other economic factors in

the countries in which we operate; (21) changes in tax laws or exposure to additional tax liabilities; (22) global competition within

and beyond the aluminum industry; (23) our ability to obtain or maintain adequate insurance coverage; (24) disruptions in the global

economy caused by ongoing regional conflicts; (25) legal proceedings, investigations, or changes in foreign and/or U.S. federal, state,

or local laws, regulations, or policies; (26) climate change, climate change legislation or regulations, and efforts to reduce emissions

and build operational resilience to extreme weather conditions; (27) our ability to achieve our strategies or expectations relating to

environmental, social, and governance considerations; (28) claims, costs and liabilities related to health, safety, and environmental

laws, regulations, and other requirements, in the jurisdictions in which we operate; (29) liabilities resulting from impoundment structures,

which could impact the environment or cause exposure to hazardous substances or other damage; (30) our ability to fund capital expenditures;

(31) deterioration in our credit profile or increases in interest rates; (32) restrictions on our current and future operations due to

our indebtedness; (33) our ability to continue to return capital to our stockholders through the payment of cash dividends and/or the

repurchase of our common stock; (34) cyber attacks, security breaches, system failures, software or application vulnerabilities, or other

cyber incidents; (35) labor market conditions, union disputes and other employee relations issues; (36) a decline in the liability discount

rate or lower-than-expected investment returns on pension assets; and (37) the other risk factors discussed in Part I Item 1A of Alcoa’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and other reports filed by Alcoa with the SEC. These risks, as

well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement. Alcoa cautions readers

not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made. Alcoa disclaims

any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise,

except as required by applicable law. Market projections are subject to the risks described above and other risks in the market. Neither

Alcoa nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements and none

of the information contained herein should be regarded as a representation that the forwardlooking statements contained herein will be

achieved.

Additional

Information and Where to Find It

This communication does not

constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities. This communication relates to the proposed

transaction. In connection with the proposed transaction, Alcoa plans to file with the SEC a proxy statement on Schedule 14A (the “Proxy

Statement”). This communication is not a substitute for the Proxy Statement or any other document that Alcoa may file with the

SEC and send to its stockholders in connection with the proposed transaction. The issuance of the stock consideration in the proposed

transaction will be submitted to Alcoa’s stockholders for their consideration. The Proxy Statement will contain important information

about Alcoa, the proposed transaction and related matters. Before making any voting decision, Alcoa’s stockholders should read

all relevant documents filed or to be filed with the SEC completely and in their entirety, including the Proxy Statement, as well as

any amendments or supplements to those documents, when they become available, because they will contain important information about Alcoa

and the proposed transaction.

Alcoa’s stockholders will

be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about Alcoa, free of charge, at

the SEC’s website (www.sec.gov). Copies of the Proxy Statement and other documents filed by Alcoa with the SEC may be obtained,

without charge, by contacting Alcoa through its website at https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other persons related to Alcoa may be deemed to be participants

in the solicitation of proxies from Alcoa’s stockholders in connection with the proposed transaction. Information about the directors

and executive officers of Alcoa and their ownership of common stock of Alcoa is set forth in the section entitled “Information

about our Executive Officers” included in Alcoa’s annual report on Form 10-K for the fiscal year ended December 31, 2023,

which was filed with the SEC on February 21, 2024 (and which is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024

018069/aa-20231231.htm), and in the sections entitled “Director Nominees” and “Stock Ownership of Directors and Executive

Officers” included in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on March 16,

2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1675149/000119312523072587/d427643ddef1 4a.htm). Additional information

regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise, will be included in the Proxy Statement and other relevant materials

to be filed with the SEC in connection with the proposed transaction when they become available. Free copies of these documents may be

obtained as described in the preceding paragraph.

FAQ

What was announced?

| • | Alcoa entered into an agreement with Alumina Limited on terms and process to acquire Alumina Limited, its

minority joint venture partner in Alcoa World Alumina and Chemicals (AWAC), in an all-stock transaction. |

What are the terms of the agreement?

| • | Alcoa and Alumina Limited have entered into an exclusivity and transaction process deed. |

| • | The Alumina Limited Board of Directors has confirmed that, subject to entry into a scheme implementation

agreement, it intends to recommend the transaction to Alumina Limited shareholders. |

| • | Under the all-scrip, or all-stock transaction, Alumina Limited shareholders would

receive consideration of 0.02854 Alcoa shares for each Alumina Limited share. |

| • | This consideration would imply a value of A$1.15 per

Alumina Limited share, based on Alcoa’s closing share price on the NYSE on February 23, 2024 of $26.52.1 |

| • | This represents a premium of 13.1% to the closing price of Alumina Limited’s shares on

February 23, 2024. |

| • | Upon completion of the proposed transaction, Alumina

Limited shareholders would own 31.25 percent, and Alcoa shareholders would own 68.75 percent of the combined company.2 |

What is Alcoa World Alumina and Chemicals (AWAC)? How is it currently

structured?

| • | Alcoa is the sole operator of AWAC, its joint venture with Alumina Limited. |

| • | AWAC consists of a number of affiliated entities that own, operate or have an interest

in bauxite mines and alumina refineries in Australia, Brazil, Spain, Saudi Arabia and Guinea. |

| • | AWAC also has a 55 percent interest in the Portland aluminum smelter in Victoria, Australia. |

| • | Alcoa owns 60 percent and Alumina Limited owns 40 percent of the AWAC entities, respectively,

directly or indirectly. |

What are the benefits of the transaction to Alumina shareholders?

| • | The transaction would provide Alumina Limited shareholders the opportunity to participate in the upside potential of a stronger, better-capitalized

company with a larger and more diversified portfolio. Alumina Limited shareholders would gain access to the benefits of Alcoa’s

leading pure-play upstream aluminum business. |

| • | With ownership of the combined entity, Alumina Limited shareholders will exchange their shares in a non-operating

passive investment vehicle for an ownership position in Alcoa. As part of this transition, Alumina Limited shareholders would participate

in Alcoa’s capital returns program, including the current dividend, and would have access to a larger, strong balance sheet that

will be better able to fund portfolio actions, maintenance capital, and growth capital. |

| • | With a centralized management team and strategy, Alcoa will be better positioned to execute operational

and strategic decisions on an accelerated basis. In addition, a simplified corporate structure will result in efficiencies through a reduction

in corporate costs. |

What are the benefits of the transaction to Alcoa shareholders?

| • | This transaction is underpinned by strong industrial logic that would deliver significant

value to Alcoa shareholders. |

| • | The proposed transaction would increase Alcoa's financial flexibility, enabling more

efficient funding and capital allocation decisions, as well as liability management. |

| • | With a centralized management team and strategy, Alcoa will be better positioned

to execute operational and strategic decisions on an accelerated basis. |

| • | In addition, a simplified corporate structure will result in efficiencies through

a reduction in corporate costs. |

| 1Based

on the prevailing AUD / USD exchange rate of 0.656 as of February 23, 2024. |

| 2Based

on fully diluted shares outstanding for Alcoa and Alumina Limited as of February 23, 2024.

|

What would a transaction mean for Alcoa or AWAC customers / partners?

| • | Business partner interactions, from negotiations to the delivery of materials, will continue to be managed by Alcoa, and it remains

business as usual. Our customers and other business partners will continue to be a priority. |

| • | With a centralized management team and strategy, Alcoa will be better positioned

to execute operational and strategic decisions on an accelerated basis. |

| • | The acquisition would build on Alcoa’s industry-leading position and reinforces our commitment to the regions we serve, providing

benefits to customers, host communities, and others who rely on the continuing success of our global business. |

What are the benefits for stakeholders as a result of this announcement?

| • | The agreement with Alumina would increase Alcoa’s economic interest in its core business and simplify

governance by acquiring the minority partner in its AWAC JV, resulting in greater operational flexibility and strategic optionality. |

| • | It would also allow Alumina Limited shareholders to participate in the upside potential of a stronger,

better-capitalized company with a larger and more diversified portfolio while offering exposure to Alcoa’s upstream aluminum business. |

| • | This acquisition would build on our commitment to Western Australia, and provides significant benefits

to employees, customers, host communities, and others who rely on the continuing success of our global business. |

What are the next steps?

| • | Alcoa expects to be in a position to announce a scheme implementation agreement detailing

the full details of the transaction in the near-term. |

What are the conditions to complete the transaction?

| • | The transaction would be subject to the satisfaction of certain customary conditions and regulatory approval,

including entry into a scheme implementation agreement, a recommendation from Alumina Limited’s Board of Directors that Alumina

Limited shareholders vote in favor in the absence of a superior proposal, and an independent expert concluding (and continuing to conclude)

that the proposed transaction is in the best interests of Alumina Limited's shareholders, approval by Australia's Foreign Investment Review

Board, Alumina Limited's shareholders approving the transaction and Alcoa shareholders approving the issue of the new Alcoa shares under

the NYSE rules. |

| • | The transaction is not conditional on due diligence or financing. |

Exhibit 2

1

Alcoa Corporation

Alcoa Agreement with Alumina Limited Conference Call

February 25, 2024, 6:00 PM

CORPORATE PARTICIPANTS

James Dwyer - Vice President, Investor Relations & Pension

Investments

William Oplinger - President & Chief

Executive Officer

Molly Beerman - Executive

Vice President & Chief Financial Officer

Alcoa Corporation

February 25, 2024, 6:00 PM

PRESENTATION

Operator

Welcome to the Alcoa

Agreement with Alumina Limited Conference Call. All participants will be in listen-only mode. Should you need assistance, please signal

a conference specialist by pressing the star key followed by zero. After today’s presentation, there will be an opportunity to

ask questions by phone. To ask a question, please dial in or click the link on the webcast to connect your phone. You may then press

star then one on your telephone keypad. To withdraw your question, please press star then two. Please note, this event is being recorded.

I'd now like to

turn the conference over to James Dwyer, Vice President, Investor Relations and Pension Investments. Please go ahead.

James Dwyer

Thank you everyone

for joining us on short notice to discuss our announcement that we have entered into an agreement with Alumina Limited on terms and process

for the acquisition of Alumina Limited in an all-stock transaction, subject to entry into a scheme implementation agreement. I'm joined

today by William Oplinger, Alcoa Corporation President and Chief Executive Officer, and Molly Beerman, Executive Vice President and Chief

Financial Officer. We will take your questions after comments by Bill.

As a reminder, today's

discussion will contain forward-looking statements relating to future events and expectations that are subject to various assumptions

and caveats. Factors that may cause the company's actual results to differ materially from these statements are included in today's presentation

and in our SEC filings.

A press release

regarding this announcement and the referenced slide presentation are both available on the investor relations section of our website

and on a microsite, www.strongawacfuture.com, all one word.

With that, here's

Bill.

William Oplinger

Thanks, Jim, and

welcome everyone. I'm excited to announce that we have entered into an agreement on terms and process to acquire Alumina Limited in an

all-stock transaction. We believe the acquisition is in the best interest of Alcoa and Alumina Limited shareholders. This proposal would

give Alcoa full 100% ownership in the Alcoa World Alumina and Chemicals, or AWAC, Joint Venture.

I'll start by taking

you through an overview of our agreement, an overview of our AWAC Joint Venture, and then get into the strategic and financial benefits

of this transaction. Molly and I will take questions at the end.

We have entered

into an exclusivity and transaction process deed, and the Alumina Limited Board of Directors has confirmed that, subject to entry into

a scheme implementation agreement, it intends to recommend the transaction to Alumina Limited shareholders. Under the all-scrip, or all-stock

transaction, Alumina Limited shareholders would receive consideration of 0.02854 Alcoa shares for each Alumina Limited share.

Alcoa Corporation

February 25, 2024, 6:00 PM

Based on Alcoa’s

closing share price as of February 23, 2024, the agreed ratio implies an equity value of approximately $2.2 billion for Alumina Limited.

This also represents a premium of 13.1% to the closing price of Alumina Limited’s shares on February 23, 2024. Upon completion

of the agreement, Alumina Limited shareholders would own 31.25%, and Alcoa shareholders would own 68.75% of the combined company.

We believe the acquisition

would deliver significant value for both companies’ shareholders. The transaction would increase Alcoa’s economic interest

in its core business and simplify governance, resulting in greater operational flexibility and strategic optionality. It would also allow

Alumina Limited shareholders to participate in the upside potential of a stronger, better-capitalized company with a larger and more

diversified portfolio.

Other key points

are that under the terms of the transaction, two new mutually agreed upon directors from Alumina Limited’s Board would be appointed

to Alcoa’s Board of Directors upon closing. We also see a clear path for executing and completing the transaction. Additionally,

Alcoa would apply to establish a secondary listing on the Australian Securities Exchange to allow Alumina Limited shareholders to trade

Alcoa common stock via CHESS Depositary Interests, CDIs, on the ASX.

Before I move on,

I want to highlight that Allan Gray Australia, Alumina Limited’s largest holder, has entered into an agreement with us to give

Alcoa the right to acquire up to 19.9 percent of Alumina Limited for 0.02854 Alcoa shares for each Alumina Limited share. Allan Gray’s

support of our proposal underscores our mutual belief in the value creation potential of this transaction.

To better understand

the value creation of this transaction for Alcoa and Alumina Limited shareholders, let’s review the current ownership structure

of AWAC. This joint venture was formed in 2002 and the Alumina Limited-Alcoa relationship dates back to 1961. AWAC is one of the world’s

largest producers of alumina, the feedstock for producing aluminum, as well as miners of bauxite. Alumina Limited is an ASX-listed company

and its sole investment is in AWAC as a non-operating, non-controlling interest.

Today, Alcoa owns

60 percent and Alumina Limited owns 40 percent of the AWAC joint venture. Alcoa is the operator of AWAC and AWAC’s financial results

are fully consolidated by Alcoa. So it is more than fair to say we know this asset extremely well. You can see the specific assets AWAC

owns on our slide presentation. The proposed transaction will collapse and substantially simplify this structure so that Alcoa is the

100% owner of AWAC.

We believe this

transaction, which is underpinned by strong industrial logic, is the right path forward for Alcoa, Alumina Limited, and AWAC. For Alumina

Limited shareholders, the transaction would diversify their ownership to a large-scale, global upstream aluminum company through a meaningful

position in Alcoa.

Alcoa Corporation

February 25, 2024, 6:00 PM

For Alcoa shareholders,

the acquisition would advance our strength, stability, and flexibility even further to create a better investment. Alcoa shareholders

would also benefit from the reduced complexity at AWAC, opening up opportunities for greater operational efficiency while also enabling

more efficient funding and capital allocation decisions. Ultimately, those are what will drive our stockholder returns.

With ownership in

the combined entity, Alumina Limited shareholders will be entitled to the same ownership benefits that are available to Alcoa shareholders.

Alumina Limited shareholders will exchange their shares in a non-operating passive investment vehicle for an ownership position in Alcoa.

The simplified structure enables Alumina Limited shareholders an opportunity to gain exposure to the wider Alcoa portfolio.

Today, Alumina Limited

shareholders have exposure to 40% of only AWAC’s bauxite, alumina and aluminum assets. This exposure comes through an extremely

complex ownership at a sub-segment level in Alcoa’s structure.

This transaction

would change that structure substantially. Upon completion, Alumina Limited ownership would be completely streamlined. Alumina Limited

shareholders would elevate their ownership to the combined company level, owning 31.25% of the pro forma combined company.

This is a unique

opportunity for Alumina Limited shareholders. Operationally, Alumina Limited shareholders will gain exposure to a globally diversified

business mix across bauxite, alumina and aluminum. In addition, Alcoa is a sector innovation leader with a full suite of low-carbon and

recycled content products and long-term technology projects under development to address the upstream aluminum value chain.

From a financial

perspective, Alumina Limited shareholders would own shares in a larger scaled business and have stock with meaningfully greater trading

liquidity. Alumina Limited shareholders would also participate in Alcoa’s capital returns program, including the current dividend,

and would have access to a larger, stronger balance sheet that will be better able to fund portfolio actions, maintenance capital, and

growth capital.

This transaction

would provide exposure to our low carbon smelting portfolio. Today, Alcoa is a top five global producer, excluding China, with smelters

in close proximity to major customer markets. It has 87% of smelting tonnes powered by renewables energy and our carbon emission intensity

is currently less than one third the industry average.

Turning to the next

slide, the acquisition would advance our leading position as the global, pure play upstream aluminum company. A combination of Alcoa

and Alumina Limited enhances Alcoa’s vertical integration across the value chain with leading positions across mining, refining,

and smelting, with tier 1 assets at every step. The increased vertical integration in a combined company also provides more stability

throughout the commodity cycle.

With a strong balance

sheet and the financial flexibility to self-fund both upcoming capital requirements and our pipeline of technology development projects,

we are well positioned to navigate volatile market conditions.

Alcoa Corporation

February 25, 2024, 6:00 PM

AWAC’s mining

operations are strategically located proximate to Alcoa’s refineries and major Atlantic and Pacific markets. The proposal enables

us to be a sector leader as the largest bauxite miner among publicly listed pure plays and second largest globally, the largest alumina

producer among publicly listed pure plays and third largest globally, excluding China, and the second largest aluminum producer among

publicly-listed pure plays and fifth largest globally, excluding China.

Alumina Limited

is an Australian company, so I want to take a moment to discuss our history in Australia. For the past 60 years, Alcoa has been a

responsible, long-term investor -- [interruption] -- sorry, we had an alert here, so I just wanted to make sure that we go back.

It’s an important point because we’re addressing Australia.

For the past 60

years, Alcoa has been a responsible, long-term investor and operator in Australian bauxite mining and alumina processing, as well as

aluminum smelting. Our annual spend in Australia is more than A$3 billion locally through wages, taxes, royalties, procurement, and community

investment. In addition, our Australian business was the first mining company to receive recognition from the United Nations for rehabilitation

excellence.

We believe now is

the right time to consolidate ownership in AWAC, which would build on our commitment to the region and provide significant benefits to

employees, customers, host communities, and others who rely on the continued success of our global business.

Following this transaction,

we would be better positioned to continue, and have intention of continuing, our long-term plan of investing in Australian bauxite mining

and alumina refining. Upon completion of the proposed transaction, we would unite Alcoa’s core bauxite and alumina business. The

consolidation of the AWAC joint venture would substantially increase Alcoa’s economic interest in AWAC’s production of the

pro forma company.

This proposal would

strengthen our portfolio of tier 1 bauxite and alumina assets. Following completion of the transaction, Alcoa would significantly increase

its ownership in five of the 20 largest bauxite mines and five of the 20 largest alumina refineries globally, excluding China. Both the

bauxite mines and alumina refineries are currently in the first quartile of cash costs for bauxite assets and alumina assets, respectively.

Alcoa and Alumina

Limited shareholders will benefit from a simplified structure and governance. Going forward, we would be able to be more efficient in

executing decisions with a view to maximizing returns. The benefits would include tangible near-term cost synergies with potential for

further organizational optimization, expanded scope of future strategic options, centralized decision-making, allowing critical operational

and financial decisions to take place on an accelerated basis, and access to 100% of cash flow from AWAC for Alcoa shareholders.

In addition, by

simplifying the corporate structure, we will align interests among Alcoa and Alumina Limited shareholders, replace the complex JV arrangement

with a single ownership structure, reduce governance complexity and administrative costs, and simplify financial reporting. The upside

potential for AWAC as a simpler organization is clear and unlocks value for shareholders.

Lastly and importantly,

Alcoa and our shareholders will benefit from increased efficiency in financial decisions. Our all-stock transaction preserves Alcoa’s

balance sheet strength going forward and provides more capital structure flexibility. As one company, we will continue to have opportunities

to pay distributions to shareholders while also better transforming the portfolio and positioning ourselves for growth.

Alcoa Corporation

February 25, 2024, 6:00 PM

With a transformed

portfolio, Alcoa would have increased exposure to what has historically been our highest margin and highest return on capital business.

It would also reduce volatility of our earnings profile and provide improved flexibility in managing liabilities. Then, with the ability

to make autonomous decisions with completely aligned interests, enhanced financial flexibility, and de-risked funding obligations related

to AWAC portfolio actions, we look forward to accelerating our growth.

We remain fully

committed to our capital allocation framework to maintain a strong balance sheet through the cycle while expending capital to sustain

and improve our existing operations. And then when we have excess cash, in no particular order, we'll use it for portfolio actions, preparing

for growth, and returning cash to shareholders. Of course, we will deploy capital to what we believe reflects the best opportunity to

maximize value creation.

To conclude, this

is the right deal for Alumina Limited shareholders and Alcoa shareholders. Alcoa’s agreement on the terms and process to acquire

Alumina Limited would provide significant and long-term benefits to both Alcoa and Alumina Limited shareholders and our broader stakeholders

and communities. We are confident the transaction would enable us to build on our industry-leading position and better allow Alcoa to

execute on our long-term growth strategy.

With that I’ll

open it up for questions. Operator?

QUESTION AND

ANSWER

Operator

Thank you very much.

We will now begin the question and answer session. To ask a question please dial in or click the link on the webcast to connect your

phone. You may press star then one on your telephone keypad. If you are using a speakerphone, please pick up your handset before pressing

the keys. To withdraw your question, please press star then two.

Our first question

comes from Timna Tanners with Wolfe Research. Please go ahead.

Timna Tanners

Hey, thanks for

all the great detail.

William Oplinger

Hi, Timna.

Timna Tanners

Hey. Just wondering

if you could explain a little bit more. Why now, first off, and then any way to quantify any of these cost savings, synergies. You already

operate the asset so just trying to understand what really changes from that vantage point. Thank you.

Alcoa Corporation

February 25, 2024, 6:00 PM

William Oplinger

So let me address

the why now. You have followed us for a long time. And since separation, we have taken significant steps to improve the company. The

first was really handling the pension/OPEB and debt related liabilities that we had. And we significantly improved the balance sheet over time.

The second was dealing with legacy assets. And you've seen us deal with legacy assets over the last seven years, and we continue to do

so.

To me, really the

third was to try to streamline this structure. When investors look at this structure, they don't always understand it. It can be complex.

And so we're really looking at the opportunity now to do that. And the Alumina Limited team engaged in really meaningful discussion that

allowed a transaction to be agreed upon that creates value for both sets of shareholders.

As far as the synergies

go, clearly, you can look at their overhead costs. And I think that's about $12 million a year. So we would be looking at eliminating

duplication of overhead. There would potentially be financial synergies in the way we handle our capital structure. So could be tax synergies

associated with debt in certain jurisdictions in the world. So those would be the two big ones. Molly, anything else you would want

to say?

Molly Beerman

No, you covered it.

Timna Tanners

Hey, thanks. And

just to wrap up, I guess streamlining and --

William Oplinger

We can barely hear

you, Timna.

James Dwyer

Timna, can you speak up?

Timna Tanners

Sorry about that.

Is that better?

William Oplinger

A little bit. Yeah.

Timna Tanners

Okay, sorry. So

appreciate the streamlining and simplification, always helpful. But we would expect this similar operating footprint and anything to

change there about how you would operate the assets. I know, we've had some updates with Kwinana and San Ciprián. And you've talked

about, but is it expected that you would continue to kind of keep the same operating footprint?

William Oplinger

Yes. And so, you

know, we've operated the assets -- we’re the operating partner of the asset, so the footprint wouldn't necessarily change. However,

as we look forward, this gives us a tremendous amount of flexibility on how we can manage the operations. So, you know, as we look forward

to growth opportunities, for instance, the streamlining of this venture allows us to grow more easily.

Timna Tanners

Okay, great. Thank

you.

William Oplinger

Thank you.

Alcoa Corporation

February 25, 2024, 6:00 PM

Operator

Thank you. The next

question comes from Curt Woodworth with UBS. Please go ahead.

Curt Woodworth

Yeah. Thank you.

Hey, good morning. Good afternoon. So Bill, in terms of thinking about strategically what your maybe would like to do differently or

how you're would approach managing these assets on a consolidated basis. Like, I get in the near term, you know, what would be some of

the differences you would look to do? And then with respect to -- Timna kind of took my question, but in terms of changing the scope

or growth, how do you see that playing out and respective still, you know, transitioning from the low bauxite grade and trying to pivot

into North Myara. Thank you.

William Oplinger

Curt, as I said

to Timna, you know, we've been the operating partner for quite a while. But you have seen recently some of the real progress that we've

made in the joint venture. For instance, at the end of the year, we got our WA permits. So that we continue to operate in WA. We've announced

the Kwinana curtailment, and that's a hard announcement to make, but Kwinana based on its age and its complexity is a high cost facility,

and we needed to make that announcement. In addition, you see that we are taking action in Spain. We've begun to engage the stakeholders

in Spain to determine a path forward there. So we've made a lot of progress.

As I look forward

to growth, I probably won't give you any specifics, but look at our footprint globally. We have a very strong footprint in Western Australia,

we have a strong footprint in Europe, and I'm specifically speaking just about the AWAC assets now, strong footprint in Brazil, and mining

in Guinea, and obviously in Spain. It gives us the opportunity to choose growth programs over the years and so we have the ability, that

geographic diversity, to be able to choose where we want to grow and have been successful in those jurisdictions over a long period of

time.

Curt Woodworth

Okay. Thank you.

And I guess I'm not totally familiar with some of the off balance sheet or pension, ARO as specific to AWAC so what do you view as the

kind of the total enterprise value of what you're paying for?

Molly Beerman

So, Curt, the pension

obligations and OPEB obligations, there are practically none in AWAC. So you will see the debts that Alumina Limited is carrying, it's

about 300 million, just shy of that.

Curt Woodworth

So the combination

enterprise value would be around $2.5 billion?

Molly Beerman

Yes.

Curt Woodworth

Understood. Thank

you.

Alcoa Corporation

February 25, 2024, 6:00 PM

William Oplinger

Thank you, Curt.

Operator

Thank you. The next

question comes from Glyn Lawcock with Barrenjoey. Please go ahead.

Glyn Lawcock

Good afternoon,

Bill. Bill, I'm guess I'm gonna come at it from the AWC side a little bit. I mean, firstly, just was there any consideration to the

franking credits. I think there's like 450 million of franking credits trapped on the AWAC balance sheet. Is there any thought to getting

that to AWC shareholders at all?

William Oplinger

The franking credits

will remain with the combined entity and we will be able to use them higher up in the organization and the organizational structure.

So it will remain -- they will remain within the new entity.

Glyn Lawcock

All right. So you

don't think there's any chances are the Australian shareholders could benefit from that in this deal or is the deal finalized at the

current rate?

William Oplinger

We have an agreement

with Alumina Limited and the agreement with Alumina Limited is to proceed towards a scheme implementation, and they have agreed that

their Board will support the exchange ratio that we have agreed to,

Glyn Lawcock

Okay. I guess, obviously

shareholders will get a vote on it no doubt. Secondly, you've obviously spoken to Allan Gray, the other major shareholder is CITIC. Have

you had similar discussions or any discussions with CITIC?

William Oplinger

We've engaged with

CITIC in this process. Yes, we've engaged with CITIC, and Alumina Limited obviously is engaged with CITIC in the process also.

Glyn Lawcock

Any comments you

can offer from those discussions? So like, yeah, we'll see Allan Gray's accepted. Any comments you can offer from the CITIC discussions?

William Oplinger

No comments from

a CITIC perspective, you would have to ask CITIC. They have a process and procedure of getting approval for these types of transactions.

And I'm sure they will go through that process.

Alcoa Corporation

February 25, 2024, 6:00 PM

CONCLUSION

Operator

Thank you. This

concludes our question and answer session. I would like to turn the conference back over to Bill Oplinger for closing remarks.

William Oplinger

Thank you, operator.

I appreciate everyone getting on this call fairly quickly. I know we didn't give you a whole lot of notice on a Sunday afternoon. If

you can't tell, we're extremely excited about this opportunity. We think that this positions the company for the long term. We think

it's the right transaction for both Alcoa and the Alumina Limited shareholders. And I appreciate you taking the time on your Sunday afternoon

to listen to the benefits of the transaction. So thank you very much. That concludes my remarks. Operator?

Operator

Thank you. The conference

has now concluded. Thank you for attending today's presentation. You may now disconnect your lines.

Alcoa Corporation

February 25, 2024, 6:00 PM

Exhibit 3

Fellow employees,

I want to let you know about some news that

Alcoa announced a few moments ago to better position our Company. We have entered into an agreement on process and terms to acquire Alumina

Limited, our minority joint venture partner in Alcoa World Alumina and Chemicals. Under the Process Deed, Alumina Limited and Alcoa intend

to finalize and enter into a scheme implementation agreement for the all-scrip transaction.

The press release is linked

here with details, including a dedicated web site.

This acquisition would

provide many positive financial and strategic opportunities, but I want to emphasize that it does not have any current impact on any of

our Alcoa employees, customers, partners, or stakeholders.

Many of you know that AWAC owns, operates or has interests

in bauxite mines and aluminum refineries in Australia, Brazil, Spain, Saudi Arabia and Guinea. Alcoa is the sole operator of AWAC and

have always been. We currently own 60 percent, and Alumina Limited owns the remaining percentage, although it has no operational control

and does not hold any assets outside of the AWAC joint venture. Alcoa continues to fully operate AWAC and all of its operations, processes

and relationships remain unchanged.

As we continue to better position Alcoa for

the future and execute on our strategic objectives, we believe now is the right time for consolidated ownership of AWAC. This agreement

would give us 100 percent ownership of AWAC, offering greater ability to implement operational and strategic decisions on an accelerated

basis.

This acquisition also reinforces our commitment

to Western Australia, strengthens our alignment with shareholders, and provides significant benefits to employees, customers, host communities,

and others who rely on the continuing success of our global business.

Importantly, keep in mind that this agreement is

just the first step in the potential transaction with Alumina Limited. We have a small team working on this corporate-level

transaction, supported by an

experienced group of advisors.

For everyone else, it is experienced group of advisors. For everyone else, it is business as usual. Please do keep in mind, however,

that this public announcement may generate increased interest from media and investors regarding Alcoa. Consistent with company policy,

please direct inquiries from the media to Corporate Communications via Jim Beck at [***********] and any inquiries from investors or

other third parties to Investor Relations via Jim Dwyer at [***********].

Thank you all for your hard work on behalf

of Alcoa. Please remain focused first, and foremost, on safety and operating with excellence.

Bill Oplinger

President and Chief Executive Officer

Forward-Looking Statements

This communication contains statements that relate to future events

and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward -looking statements include those containing such words as “aims,” “ambition,” “anticipates,”

“believes,” “could,” “develop,” “endeavors,” “estimates,” “expects,”

“forecasts,” “goal,” “intends,” “may,” “outlook,” “potential,”

“plans,” “projects,” “reach,” “seeks,” “sees,” “should,” “strive,”

“targets,” “will,” “working,” “would,” or other words of similar meaning. All statements

by Alcoa Corporation (“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements, including, without limitation, statements regarding the proposed transaction; the

ability of the parties to negotiate, enter into and complete the proposed transaction; the expected benefits of the proposed transaction,

the competitive ability and position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite,

alumina, and aluminum, and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating

performance (including our ability to execute on strategies related to environmental, social and governance matters); statements about

strategies, outlook, and business and financial prospects; and statements about capital allocation and return of capital. These statements

reflect beliefs and assumptions that are based on Alcoa’s perception of historical trends, current conditions, and expected future

developments, as well as other factors that management believes are appropriate in the circumstances. Forward-looking statements are not

guarantees of future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult

to predict. Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions,

it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are

not limited to: (1) the outcome of any discussions between Alcoa and Alumina Limited with respect to the proposed transaction, including

the possibility that the parties will not agree to pursue a transaction or that the terms of any such transaction will be materially different

from those described herein, (2) the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or more closing conditions

to the proposed transaction; (3) the prohibition or delay of the consummation of the proposed transaction by a governmental entity; (4)

the risk that the proposed transaction may not be completed in the expected time frame or at all; (5) unexpected costs, charges or expenses

resulting from the proposed transaction; (6) uncertainty of the expected financial performance following completion of the proposed transaction;

(7) failure to realize the anticipated benefits of the proposed transaction; (8) the occurrence of any event that could give rise to termination

of the proposed transaction; (9) potential litigation in connection with the proposed transaction or other settlements or investigations

that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and

liability; (10) the impact of global economic conditions on the aluminum industry and aluminum end-use markets; (11) volatility and declines

in aluminum and alumina demand and pricing, including global, regional, and product-specific prices, or significant changes in production

costs which are linked to LME or other commodities; (12) the disruption of market-driven balancing of global aluminum supply and demand

by non-market forces; (13) competitive and complex conditions in global markets; (14) our ability to obtain, maintain, or renew permits

or approvals necessary for our mining operations; (15) rising energy costs and interruptions or uncertainty in energy supplies; (16) unfavorable

changes in the cost, quality, or availability of raw materials or other key inputs, or by disruptions in the supply chain; (17) our ability

to execute on our strategy to be a lower cost, competitive, and integrated aluminum production business and to realize the anticipated

benefits from announced plans, programs, initiatives relating to our portfolio, capital investments, and developing technologies; (18)

our ability to integrate and achieve intended results from joint ventures, other strategic alliances, and strategic business transactions;

(19) economic, political, and social conditions, including the impact of trade policies and adverse industry publicity; (20) fluctuations

in foreign currency exchange rates and interest rates, inflation and other economic factors in the countries in which we operate; (21)

changes in tax laws or exposure to additional tax liabilities; (22) global competition within and beyond the aluminum industry; (23) our

ability to obtain or maintain adequate insurance coverage; (24) disruptions in the global economy caused by ongoing regional conflicts;

(25) legal proceedings, investigations, or changes in foreign and/or U.S. federal, state, or local laws, regulations, or policies; (26)

climate change, climate change legislation or regulations, and efforts to reduce emissions and build operational resilience to extreme

weather conditions; (27) our ability to achieve our strategies or expectations relating to environmental, social, and governance considerations;

(28) claims, costs and liabilities related to health, safety, and environmental laws, regulations, and other requirements, in the jurisdictions

in which we operate; (29) liabilities resulting from impoundment structures, which could impact the environment or cause exposure to hazardous

substances or other damage; (30) our ability to fund capital expenditures; (31) deterioration in our credit profile or increases in interest

rates; (32) restrictions on our current and future operations due to our indebtedness; (33) our ability to continue to return capital

to our stockholders through the payment of cash dividends and/or the repurchase of our common stock; (34) cyber attacks, security breaches,

system failures, software or application vulnerabilities, or other cyber incidents; (35) labor market conditions, union disputes and other

employee relations issues; (36) a decline in the liability discount rate or lower-

than-expected investment returns on pension assets; and (37) the other

risk factors discussed in Part I Item 1A of Alcoa’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and other

reports filed by Alcoa with the SEC. These risks, as well as other risks associated with the proposed transaction, will be more fully

discussed in the proxy statement. Alcoa cautions readers not to place undue reliance upon any such forward-looking statements, which speak

only as of the date they are made. Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response

to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks described

above and other risks in the market. Neither Alcoa nor any other person assumes responsibility for the accuracy and completeness of any

of these forward-looking statements and none of the information contained herein should be regarded as a representation that the forward-looking

statements contained herein will be achieved.

Additional Information and Where to Find It

This communication does not constitute an offer to buy or sell

or the solicitation of an offer to buy or sell any securities. This communication relates to the proposed transaction. In connection with

the proposed transaction, Alcoa plans to file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”). This

communication is not a substitute for the Proxy Statement or any other document that Alcoa may file with the SEC and send to its stockholders

in connection with the proposed transaction. The issuance of the stock consideration in the proposed transaction will be submitted to

Alcoa’s stockholders for their consideration. The Proxy Statement will contain important information about Alcoa, the proposed transaction

and related matters. Before making any voting decision, Alcoa’s stockholders should read all relevant documents filed or to be filed

with the SEC completely and in their entirety, including the Proxy Statement, as well as any amendments or supplements to those documents,

when they become available, because they will contain important information about Alcoa and the proposed transaction.

Alcoa’s stockholders will be able to obtain a free copy

of the Proxy Statement, as well as other filings containing information about Alcoa, free of charge, at the SEC’s website (www.sec.gov).

Copies of the Proxy Statement and other documents filed by Alcoa with the SEC may be obtained, without charge, by contacting Alcoa through

its website at investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other persons related

to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in connection with the proposed

transaction. Information about the directors and executive officers of Alcoa and their ownership of common stock of Alcoa is set forth

in the section entitled “Information about our Executive Officers” included in Alcoa’s annual report on Form 10 -K for

the fiscal year ended December 31, 2023, which was filed with the SEC on February 21, 2024 (and which is available here),

and in the sections entitled “Director Nominees” and “Stock Ownership of Directors and Executive Officers” included

in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on March 16, 2023 (and which is available

here). Additional information regarding the persons who may, under the rules of the SEC, be

deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise,

will be included in the Proxy Statement and other relevant materials to be filed with the SEC in connection with the proposed transaction

when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

Exhibit 4

Exhibit 5

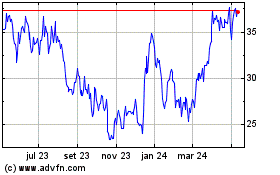

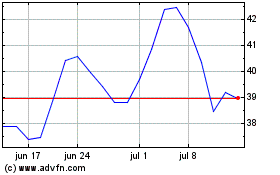

Alcoa (NYSE:AA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Alcoa (NYSE:AA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024