Form 8-K - Current report

05 Março 2024 - 8:09AM

Edgar (US Regulatory)

0000064803false00000648032024-03-052024-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported): | March 5, 2024 |

CVS HEALTH CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-01011 | 05-0494040 |

| (State or other jurisdiction of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | |

One CVS Drive, Woonsocket, Rhode Island 02895

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (401) 765-1500

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CVS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 7.01 Regulation FD Disclosure.

On March 5, 2024, members of CVS Health Corporation’s (“CVS Health,” the “Company,” “we” or “our”) senior management team will meet with investors and Executive Vice President and Chief Financial Officer Tom Cowhey will participate in a webcast at 9:50 a.m. (Eastern Time). During the meetings and webcast, the senior management team will reaffirm the Company’s previously announced full-year 2024 GAAP diluted earnings per share (“EPS”) guidance of at least $7.06, its full-year 2024 Adjusted EPS guidance of at least $8.30, and its full-year 2024 cash flow from operations guidance of at least $12.0 billion. In addition, during the webcast Mr. Cowhey will provide updates on recent business trends and initiatives.

An audio webcast of the presentation will be broadcast simultaneously for all interested parties through the Investor Relations portion of the CVS Health website at http://investors.cvshealth.com, and a replay of the webcast will be archived for one year.

Non-GAAP Financial Measures

This Current Report on Form 8-K includes projected Adjusted EPS, which represents a non-GAAP financial measure. The Company uses non-GAAP financial measures to analyze underlying business performance and trends. The Company believes that providing non-GAAP financial measures enhances the Company’s and investors’ ability to compare the Company’s past financial performance with its current performance. Non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. The Company’s definitions of its non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. The most directly comparable GAAP measure is projected GAAP diluted EPS.

Projected GAAP diluted EPS and projected Adjusted EPS, respectively, are calculated by dividing projected net income attributable to CVS Health and projected adjusted income attributable to CVS Health, respectively, by the Company’s projected weighted average diluted shares outstanding. The Company defines adjusted income attributable to CVS Health as net income attributable to CVS Health (GAAP measure) excluding the impact of amortization of intangible assets, net realized capital gains or losses and other items, if any, that neither relate to the ordinary course of the Company’s business nor reflect the Company’s underlying business performance, such as acquisition-related integration costs, as well as the corresponding tax benefit or expense related to the items excluded from adjusted income attributable to CVS Health.

The following is a reconciliation of projected GAAP diluted EPS to projected Adjusted EPS:

| | | | | | | | | | | | |

| Year Ending

December 31, 2024 |

| At Least | | | | | | | |

| Per Common Share |

| Net income attributable to CVS Health (GAAP measure) | $ | 7.06 | | | | | | | | |

| Non-GAAP adjustments: | | | | | | | | |

| Amortization of intangible assets | 1.58 | | | | | | | | |

| | | | | | | | |

Acquisition-related integration costs (1) | 0.18 | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Tax impact of non-GAAP adjustments (2) | (0.52) | | | | | | | | |

| | | | | | | | |

| Adjusted income attributable to CVS Health | $ | 8.30 | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

_____________________________________________

(1)Acquisition-related integration costs relate to the acquisitions of Signify Health, Inc. (“Signify Health”) and Oak Street Health, Inc. (“Oak Street Health”).

(2)Represents the corresponding tax benefit or expense related to the items excluded from Adjusted EPS above. The nature of each non-GAAP adjustment is evaluated to determine whether a discrete adjustment should be made to the adjusted income tax provision.

Cautionary Statement Concerning Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or on behalf of CVS Health Corporation. Statements in this Current Report on Form 8-K that are forward-looking include, but are not limited to, references to CVS Health’s estimates for certain financial metrics for full-year 2024 presented in this Current Report on Form 8-K, which are preliminary. By their nature, all forward-looking statements are not guarantees of future performance or results and are subject to risks and uncertainties that are difficult to predict and/or quantify. Actual results may differ materially from those contemplated by the forward-looking statements due to the risks and uncertainties described in our Securities and Exchange Commission filings, including those set forth in the Risk Factors section and under the heading “Cautionary Statement Concerning Forward-Looking Statements” in our most recently filed Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

You are cautioned not to place undue reliance on CVS Health’s forward-looking statements. CVS Health’s forward-looking statements are and will be based upon management’s then-current views and assumptions regarding preliminary financial estimates and projections, future events and operating performance, and are applicable only as of the dates of such statements. CVS Health does not assume any duty to update or revise forward-looking statements, whether as a result of new information, future events, uncertainties or otherwise.

The information in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”) or otherwise subject to the liabilities of that Section, and shall not be or be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | CVS HEALTH CORPORATION |

| | | |

| Date: | March 5, 2024 | By: | /s/ Thomas F. Cowhey |

| | | Thomas F. Cowhey |

| | | Executive Vice President and Chief Financial Officer |

| | | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

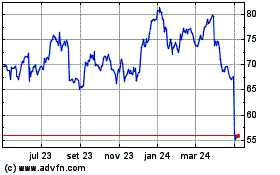

CVS Health (NYSE:CVS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

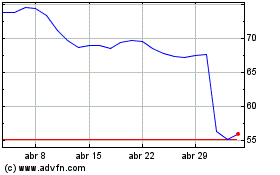

CVS Health (NYSE:CVS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024