Form SC14D9C - Written communication relating to third party tender offer

21 Maio 2024 - 5:57PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14D-9

(RULE

14d-101)

SOLICITATION/RECOMMENDATION

STATEMENT

UNDER

SECTION 14(D)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

OVERSEAS

SHIPHOLDING GROUP, INC.

(Name

of Subject Company)

OVERSEAS

SHIPHOLDING GROUP, INC.

(Name

of Person(s) Filing Statement)

Class

A Common Stock, $0.01 par value per share

(Title

of Class of Securities)

69036R863

(CUSIP

Number of Class of Securities)

Samuel

H. Norton

Chief

Executive Officer

Overseas

Shipholding Group, Inc.

Two

Harbor Place

302

Knights Run Avenue, Suite 1200

Tampa,

Florida 33602

(813)

209-0600

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications

on

Behalf of the Person(s) Filing Statement)

With

a Copy to:

Philip

Richter

Ryan

Messier

Fried,

Frank, Harris, Shriver & Jacobson LLP

One

New York Plaza

New

York, New York 10004

(212)

859-8000

☒

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

This

Schedule 14D-9 filing relates solely to preliminary communications made before the commencement of a planned tender offer (the “Offer”)

by Seahawk MergeCo., Inc. (“Merger Sub”), a wholly owned subsidiary of Saltchuk Resources, Inc. (“Saltchuk”),

for all of the outstanding shares of Class A common stock, par value $0.01 per share of Overseas Shipholding Group, Inc. (the “Company”),

to be commenced pursuant to the terms of the Agreement and Plan of Merger, dated as of May 19, 2024, by and among the Company, Saltchuk

and Merger Sub. If successful, the Offer will be followed by a merger of Merger Sub with and into the Company (the “Merger”).

This

Schedule 14D-9 filing consists of the following information and documents relating to the Offer and the Merger:

Cautionary

Notice Regarding Forward-Looking Statements

Statements

contained in this communication regarding matters that are not historical facts are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believes,” “estimates,” “expects,”

“focused,” “continuing to,” “seeking,” “will” and similar expressions (as well as other

words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These

statements include those related to: the ability of the Company and Saltchuk to complete the transactions contemplated by the Merger

Agreement, including the parties’ ability to satisfy the conditions to the consummation of the tender offer contemplated thereby

and the other conditions set forth in the Merger Agreement, statements about the expected timetable for completing the transactions.

Because such statements deal with future events and are based on the Company and Saltchuk’s current expectations, they are subject

to various risks and uncertainties and actual results could differ materially from those described in or implied by the statements in

this communication. These forward-looking statements are subject to risks and uncertainties, including, without limitation, risks and

uncertainties associated with: the timing of the tender offer and the subsequent merger; uncertainties as to how many shares of the Company

will be tendered into the tender offer; the risk that competing offers or acquisition proposals will be made; the possibility that various

conditions to the consummation of the tender offer and the subsequent merger may not be satisfied or waived; the occurrence of any event,

change or other circumstance that could give rise to the termination of the Merger Agreement and other risks and uncertainties affecting

the Company, including those discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with

the Securities and Exchange Commission (the “SEC”) on March 11, 2024, as amended by a filing with the SEC on March 25, 2024,

subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings and reports that the Company makes from time

to time with the SEC. Except as may be required by law, neither the Company nor Saltchuk assumes any obligation to update these forward-looking

statements, which speak only as of the date they are made, or to update the reasons if actual results differ materially from those anticipated

in the forward-looking statements.

Additional

Information and Where to Find It

The

tender offer for the outstanding shares of Class A common stock of the Company referenced in this communication has not yet commenced.

This communication is for informational purposes only, is not a recommendation and is neither an offer to purchase nor a solicitation

of an offer to sell shares of the Company or any other securities. This communication is also not a substitute for the tender offer materials

that Saltchuk will file with the SEC upon commencement of the tender offer. At the time the tender offer is commenced, Saltchuk will

file with the SEC a Tender Offer Statement on Schedule TO, and the Company will file with the SEC a Solicitation/Recommendation Statement

on Schedule 14D-9.

THE

COMPANY’S SHAREHOLDERS ARE URGED TO READ THE TENDER OFFER STATEMENT (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL

AND CERTAIN OTHER TENDER OFFER DOCUMENTS), THE SOLICITATION / RECOMMENDATION STATEMENT AND ALL OTHER FILINGS MADE BY THE COMPANY AND

SALTCHUK WITH THE SEC IN CONNECTION WITH THE TENDER OFFER WHEN SUCH DOCUMENTS BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

THAT SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER.

When

filed, the Company’s stockholders and other investors can obtain the Tender Offer Statement, the Solicitation/Recommendation Statement

and other filed documents for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by the Company

and Saltchuk will be available free of charge under “SEC Filings” on the Investors page of the Company’s website, www.osg.com.

In addition, the Company’s stockholders may obtain free copies of the tender offer materials by contacting the information agent

for the tender offer that will be named in the Offer to Purchase included in the Tender Offer Statement.

Exhibit 99.1

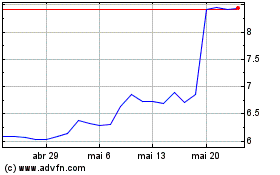

Overseas Shipholding (NYSE:OSG)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Overseas Shipholding (NYSE:OSG)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024