0001531152false00015311522024-05-232024-05-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 8-K

__________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 23, 2024

BJ’S WHOLESALE CLUB HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

__________________________________

| | | | | | | | |

| Delaware | 001-38559 | 45-2936287 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

| 350 Campus Drive | |

Marlborough, Massachusetts | 01752 |

| (Address of principal executive offices) | (Zip Code) |

(774) 512-7400

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 | BJ | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 23, 2024, BJ’s Wholesale Club Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the first quarter (thirteen weeks) of fiscal year 2024 ended May 4, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filings.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 23, 2024

| | | | | | | | |

| BJ’S WHOLESALE CLUB HOLDINGS, INC. | |

| | |

| By: | /s/ Laura Felice | |

| Name: | Laura Felice | |

| Title: | Executive Vice President and Chief Financial Officer | |

Exhibit 99.1

BJ’s Wholesale Club Holdings, Inc. Announces First Quarter Fiscal 2024 Results

First quarter marked by robust membership, traffic, and unit volumes

First Quarter Fiscal 2024 Highlights

•Comparable club sales increased by 1.6% year-over-year

•Comparable club sales, excluding gasoline sales, increased by 0.6% year-over-year led by strong traffic and unit growth

•Digitally enabled comparable sales growth was 21.0% year-over-year

•Membership fee income increased by 8.6% year-over-year to $111.4 million

•Merchandise gross margin rate decreased by 50 basis points year-over-year

•Earnings per diluted share of $0.83 and adjusted earnings per diluted share of $0.85

•The Company opened one new club and one new gas station

Marlborough, Mass. (May 23, 2024) – BJ’s Wholesale Club Holdings, Inc. (NYSE: BJ) (the "Company") today announced its financial results for the thirteen weeks ended May 4, 2024.

“During the first quarter, we delivered strong increases in membership, traffic and unit volumes. This resulted in revenue growth and market share gains in our clubs and at our gas stations. Our merchandising improvements and digital conveniences, grounded in delivering compelling value, are resonating with our members. We are also growing our footprint and remain on track for 12 new club openings this year,” said Bob Eddy, Chairman and Chief Executive Officer, BJ’s Wholesale Club. “I am proud of our team members for their continued dedication to our purpose of ‘taking care of the families who depend on us’. We remain confident in the long-term growth prospects of our Company.”

Key Measures for the Thirteen Weeks Ended May 4, 2024 (First Quarter of Fiscal 2024):

BJ'S WHOLESALE CLUB HOLDINGS, INC.

(Amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| 13 Weeks Ended May 4, 2024 | | 13 Weeks Ended April 29, 2023 | | %

Growth (Decline) | | | | | | |

| Net sales | $ | 4,807,129 | | | $ | 4,620,620 | | | 4.0 | % | | | | | | |

| Membership fee income | 111,390 | | | 102,522 | | | 8.6 | % | | | | | | |

| Total revenues | 4,918,519 | | | 4,723,142 | | | 4.1 | % | | | | | | |

| | | | | | | | | | | |

| Operating income | 160,755 | | | 186,770 | | | (13.9) | % | | | | | | |

| Income from continuing operations | 111,019 | | | 115,988 | | | (4.3) | % | | | | | | |

Adjusted EBITDA (a) (b) | 236,386 | | | 251,538 | | | (6.0) | % | | | | | | |

| Net income | 111,019 | | | 116,077 | | | (4.4) | % | | | | | | |

EPS (c) | 0.83 | | | 0.85 | | | (2.4) | % | | | | | | |

Adjusted net income (a) | 113,408 | | | 115,646 | | | (1.9) | % | | | | | | |

Adjusted EPS (a) | 0.85 | | | 0.85 | | | — | % | | | | | | |

| Basic weighted-average shares outstanding | 132,397 | | | 133,312 | | | | | | | | | |

| Diluted weighted-average shares outstanding | 134,111 | | | 135,902 | | | | | | | | | |

(a)See “Note Regarding Non-GAAP Financial Information.”

(b)Adjusted EBITDA for the 13 weeks ended April 29, 2023 has been recast to exclude adjustments for pre-opening expenses and non-cash rent expense to conform to the current period definition.

(c)EPS represents net income per diluted share.

Additional Highlights:

•Total comparable club sales increased by 1.6% in the first quarter of fiscal 2024 compared to the first quarter of fiscal 2023. Excluding the impact of gasoline sales, comparable club sales increased by 0.6% in the first quarter of fiscal 2024 compared to the same period in fiscal 2023.

•Gross profit increased to $883.4 million in the first quarter of fiscal 2024 from $880.0 million in the first quarter of fiscal 2023 driven by growth in membership fee income. Merchandise gross margin rate, which excludes gasoline sales and membership fee income, decreased by 50 basis points over the same quarter of fiscal 2023, primarily driven by lower ancillary income.

•Selling, general and administrative expenses ("SG&A") increased to $721.8 million in the first quarter of fiscal 2024 compared to $689.3 million in the first quarter of fiscal 2023. The increase was primarily driven by increased labor and occupancy costs as a result of new club and gas station openings in addition to other investments to drive strategic priorities.

•Income from continuing operations before income taxes decreased to $146.8 million in the first quarter of fiscal 2024 compared to $172.1 million in the first quarter of fiscal 2023.

•Income tax expense decreased to $35.8 million in the first quarter of fiscal 2024 compared to $56.1 million in the first quarter of fiscal 2023. The decrease in income tax expense is primarily driven by higher tax benefits from stock-based compensation.

•Net income decreased to $111.0 million in the first quarter of fiscal 2024 compared to $116.1 million in the first quarter of fiscal 2023.

•Adjusted EBITDA decreased to $236.4 million in the first quarter of fiscal 2024 compared to $251.5 million in the first quarter of fiscal 2023.

•Under its existing share repurchase program, the Company repurchased 405,110 shares of common stock, totaling $30.2 million, inclusive of associated costs, in the first quarter of fiscal 2024.

Fiscal 2024 Ending February 1, 2025 Outlook

“As we look ahead to the rest of the year, we remain confident in our ability to maintain our strength in traffic, unit volumes and market share led by our continued focus on delivering value to our members and executing on our strategic priorities,” said Laura Felice, Executive Vice President, Chief Financial Officer, BJ's Wholesale Club. “Our outlook remains unchanged for fiscal 2024.”

Conference Call Details

A conference call to discuss the first quarter of fiscal 2024 financial results is scheduled for today, May 23, 2024, at 8:30 A.M. Eastern Time. The live audio webcast of the call can be accessed under the “Events & Presentations” section of the Company’s investor relations website at https://investors.bjs.com and will remain available for one year. Participants may also dial (833) 470-1428 within the U.S. or +1 (929) 526-1599 outside the U.S. and reference conference ID 968183.

About BJ’s Wholesale Club Holdings, Inc.

BJ’s Wholesale Club Holdings, Inc. (NYSE: BJ) is a leading operator of membership warehouse clubs focused on delivering significant value to its members and serving a shared purpose: “We take care of the families who depend on us.” The Company provides a wide assortment of fresh foods, produce, a full-service deli, fresh bakery, household essentials and gas. In addition, BJ’s offers the latest technology, home decor, apparel, seasonal items and more to deliver unbeatable value to smart-saving families. Headquartered in Marlborough, Massachusetts, the Company pioneered the warehouse club model in New England in 1984 and currently operates 244 clubs and 176 BJ's Gas® locations in 20 states. For more information, please visit us at www.bjs.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding our strategic priorities; our anticipated fiscal 2024 outlook; and our future progress, as well as statements that include the words “expect,” “intend,” “plan,” “confident,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: uncertainties in the financial markets, including, without limitation, as a result of disruptions and instability in the banking and financial services industries or as a result of wars and global political conflicts, consumer and small business spending patterns and debt levels; our dependence on having a large and loyal membership; domestic and international economic conditions, including inflation and exchange rates; our ability to procure the merchandise we sell at the best possible prices; the effects of competition and regulation; our dependence on vendors to supply us with quality merchandise at the right time and at the right price; breaches of security or privacy of member or business information; conditions affecting the acquisition, development, ownership or use of real estate; our capital spending; actions of vendors; our ability to attract and retain a qualified management team and other team members; costs associated with employees (generally including health care costs), energy and certain commodities, geopolitical conditions (including tariffs); changes in our product mix or in our revenues from gasoline sales; our failure to successfully maintain a relevant omnichannel experience for our members; risks related to our growth strategy to open new clubs; risks related to our e-commerce business; our ability to grow our BJ's One Mastercard® program; and other important factors discussed under the caption “Risk Factors” in our Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 18, 2024, and subsequent filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, unless required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Thus, one should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Non-GAAP Financial Measures

We refer to certain financial measures that are not recognized under United States generally accepted accounting principles (“GAAP”). Please see “Note Regarding Non-GAAP Financial Information” and “Reconciliation of GAAP to Non-GAAP Financial Information” below for additional information and a reconciliation of the Non-GAAP financial measures to the most comparable GAAP financial measures.

BJ'S WHOLESALE CLUB HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | |

| Thirteen Weeks Ended May 4, 2024 | | Thirteen Weeks Ended April 29, 2023 | | | | |

| Net sales | $ | 4,807,129 | | | $ | 4,620,620 | | | | | |

| Membership fee income | 111,390 | | | 102,522 | | | | | |

| Total revenues | 4,918,519 | | | 4,723,142 | | | | | |

| Cost of sales | 4,035,129 | | | 3,843,150 | | | | | |

| Selling, general and administrative expenses | 721,771 | | | 689,328 | | | | | |

| Pre-opening expenses | 864 | | | 3,894 | | | | | |

| Operating income | 160,755 | | | 186,770 | | | | | |

| Interest expense, net | 13,951 | | | 14,690 | | | | | |

| Income from continuing operations before income taxes | 146,804 | | | 172,080 | | | | | |

| Provision for income taxes | 35,785 | | | 56,092 | | | | | |

| Income from continuing operations | 111,019 | | | 115,988 | | | | | |

| Income from discontinued operations, net of income taxes | — | | | 89 | | | | | |

| Net income | $ | 111,019 | | | $ | 116,077 | | | | | |

| Income per share attributable to common stockholders - basic: | | | | | | | |

| Income from continuing operations | $ | 0.84 | | | $ | 0.87 | | | | | |

| Income from discontinued operations | — | | | — | | | | | |

| Net income | $ | 0.84 | | | $ | 0.87 | | | | | |

| Income per share attributable to common stockholders - diluted: | | | | | | | |

| Income from continuing operations | $ | 0.83 | | | $ | 0.85 | | | | | |

| Income from discontinued operations | — | | | — | | | | | |

| Net income | $ | 0.83 | | | $ | 0.85 | | | | | |

| Weighted-average number of shares outstanding: | | | | | | | |

| Basic | 132,397 | | | 133,312 | | | | | |

| Diluted | 134,111 | | | 135,902 | | | | | |

BJ'S WHOLESALE CLUB HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | |

| May 4, 2024 | | April 29, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 35,094 | | | $ | 23,387 | |

| Accounts receivable, net | 225,199 | | | 217,866 | |

| Merchandise inventories | 1,533,310 | | | 1,532,006 | |

| Prepaid expense and other current assets | 85,048 | | | 69,048 | |

| Total current assets | 1,878,651 | | | 1,842,307 | |

| | | |

| Operating lease right-of-use assets, net | 2,159,955 | | | 2,124,621 | |

| Property and equipment, net | 1,620,255 | | | 1,364,815 | |

| Goodwill | 1,008,816 | | | 1,008,816 | |

| Intangibles, net | 106,001 | | | 113,536 | |

| Deferred income taxes | 2,693 | | | 6,728 | |

| Other assets | 48,356 | | | 33,672 | |

| Total assets | $ | 6,824,727 | | | $ | 6,494,495 | |

| | | |

| LIABILITIES | | | |

| Current liabilities: | | | |

| Short-term debt | $ | 270,000 | | | $ | 400,000 | |

| Current portion of operating lease liabilities | 156,914 | | | 178,939 | |

| Accounts payable | 1,264,873 | | | 1,281,676 | |

| Accrued expenses and other current liabilities | 834,053 | | | 758,724 | |

| Total current liabilities | 2,525,840 | | | 2,619,339 | |

| | | |

| Long-term operating lease liabilities | 2,069,587 | | | 2,037,844 | |

| Long-term debt | 398,509 | | | 448,004 | |

| Deferred income taxes | 74,804 | | | 66,699 | |

| Other non-current liabilities | 228,567 | | | 190,883 | |

| | | |

| STOCKHOLDERS' EQUITY | 1,527,420 | | | 1,131,726 | |

| Total liabilities and stockholders' equity | $ | 6,824,727 | | | $ | 6,494,495 | |

BJ'S WHOLESALE CLUB HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | |

| Thirteen Weeks Ended May 4, 2024 | | Thirteen Weeks Ended April 29, 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income | $ | 111,019 | | | $ | 116,077 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 63,422 | | | 54,190 | |

| Amortization of debt issuance costs and accretion of original issue discount | 277 | | | 324 | |

| | | |

| Stock-based compensation expense | 8,590 | | | 10,007 | |

| Deferred income tax provision | 1,409 | | | 14,445 | |

| Changes in operating leases and other non-cash items | 2,922 | | | (750) | |

| Increase (decrease) in cash due to changes in: | | | |

| Accounts receivable, net | 3,491 | | | 21,871 | |

| Merchandise inventories | (78,488) | | | (153,455) | |

| Accounts payable | 81,592 | | | 85,979 | |

| Accrued expenses and other current liabilities | 19,316 | | | (4,977) | |

| Other operating assets and liabilities, net | (12,703) | | | (24,579) | |

| Net cash provided by operating activities | 200,847 | | | 119,132 | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Additions to property and equipment, net of disposals | (105,741) | | | (92,084) | |

| | | |

| Net cash used in investing activities | (105,741) | | | (92,084) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| | | |

| | | |

| | | |

| Proceeds from revolving lines of credit | 193,000 | | | 149,000 | |

| Payments on revolving lines of credit | (242,000) | | | (154,000) | |

| | | |

| Net cash received from stock option exercises | 5,865 | | | 1,675 | |

| | | |

| Acquisition of treasury stock | (57,256) | | | (42,369) | |

| Proceeds from financing obligations | 6,044 | | | 9,104 | |

| Other financing activities | (1,714) | | | (986) | |

| Net cash used in financing activities | (96,061) | | | (37,576) | |

| Net decrease in cash and cash equivalents | (955) | | | (10,528) | |

| Cash and cash equivalents at beginning of period | 36,049 | | | 33,915 | |

| Cash and cash equivalents at end of period | $ | 35,094 | | | $ | 23,387 | |

Note Regarding Non-GAAP Financial Information

This press release includes financial measures that are not calculated in accordance with GAAP, including adjusted net income, adjusted net income per diluted share (“adjusted EPS”), adjusted EBITDA, adjusted free cash flow, net debt and net debt to last twelve months (“LTM”) adjusted EBITDA.

We define adjusted net income as net income as reported, adjusted for non-recurring, infrequent, or unusual changes, including restructuring charges, and other adjustments that the Company believes appropriate, net of the tax impact of such adjustments. Prior period adjusted net income presentations have been or will be recast to include the impact of restructuring charges.

We define adjusted EPS as adjusted net income divided by the weighted-average diluted shares outstanding.

We define adjusted EBITDA as income from continuing operations before interest expense, net, provision for income taxes and depreciation and amortization, adjusted for the impact of certain other items, including: stock-based compensation expense; restructuring and other adjustments. Prior period adjusted EBITDA presentations have been or will be recast to exclude pre-opening expenses and non-cash rent expense, and include the impact of restructuring charges.

We define adjusted free cash flow as net cash provided by operating activities less additions to property and equipment, net of disposals, plus proceeds from sale-leaseback transactions.

We define net debt as total debt outstanding less cash and cash equivalents.

We define net debt to LTM adjusted EBITDA as net debt at the balance sheet date divided by adjusted EBITDA for the trailing twelve-month period.

We present adjusted net income, adjusted EPS and adjusted EBITDA, which are not recognized financial measures under GAAP, because we believe such measures assist investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance.

We believe that adjusted net income, adjusted EPS and adjusted EBITDA are helpful in highlighting trends in our core operating performance compared to other measures, which can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate and capital investments. We use adjusted net income, adjusted EPS and adjusted EBITDA to supplement GAAP measures of performance in the evaluation of the effectiveness of our business strategies; to make budgeting decisions; and to compare our performance against that of other peer companies using similar measures. We also use adjusted EBITDA in connection with establishing annual incentive compensation.

We present adjusted free cash flow, which is not a recognized financial measure under GAAP, because we use it to report to our Board of Directors and we believe it assists investors and analysts in evaluating our liquidity. Adjusted free cash flow should not be considered as an alternative to cash flows from operations as a liquidity measure. We present net debt and net debt to LTM adjusted EBITDA, which are not recognized as financial measures under GAAP, because we use them to report to our Board of Directors and we believe they assist investors and analysts in evaluating our borrowing capacity. Net debt to LTM adjusted EBITDA is a key financial measure that is used by management to assess the borrowing capacity of the Company.

You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating adjusted net income, adjusted EPS, adjusted EBITDA and net debt to LTM adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or like some of the adjustments in our presentation of these metrics. Our presentation of adjusted net income, adjusted EPS, adjusted EBITDA, adjusted free cash flow, net debt and net debt to LTM adjusted EBITDA should not be considered as alternatives to any other measure derived in accordance with GAAP and they should not be construed as an inference that the Company’s future results will be unaffected by unusual or non-recurring items. There can be no assurance that we will not modify the presentation of adjusted net income, adjusted EPS, adjusted EBITDA or net debt to LTM adjusted EBITDA in the future, and any such modification may be material. In addition, adjusted net income, adjusted EPS, adjusted EBITDA, adjusted free cash flow, net debt and net debt to LTM adjusted EBITDA may not be comparable to similarly titled measures used by other companies in our industry or across different industries. Additionally, adjusted net income, adjusted EPS, adjusted EBITDA, adjusted free cash flow, net debt and net debt to LTM

adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP.

In reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K, the Company does not provide a reconciliation for non-GAAP estimates on a forward-looking basis, including of its projected range for adjusted EPS for Fiscal 2024 to net income per diluted share, which is the most directly comparable GAAP measure, under "Fiscal 2024 Ending February 1, 2025" above, where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items or there are no meaningful adjustments to be presented in the reconciliation and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact net income per diluted share, if any. This includes items that have not yet occurred, are out of the Company's control, cannot be reasonably predicted and/or for which there would not be any meaningful adjustment or difference. For the same reasons, the Company is unable to address the probable significance of the unavailable information. The information under "Fiscal 2024 Ending February 1, 2025" above, including expectations about adjusted EPS reflects management’s view of current and future market conditions. To the extent actual results differ from our current expectations, the Company’s results may differ materially from the expectations set forth above. Other factors, as referenced elsewhere in this press release, may also cause the Company’s results to differ materially from the expectations set forth above.

Reconciliation of GAAP to Non-GAAP Financial Information

BJ'S WHOLESALE CLUB HOLDINGS, INC.

Reconciliation of net income to adjusted net income and adjusted EPS

(Amounts in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | |

| 13 Weeks Ended May 4, 2024 | | 13 Weeks Ended April 29, 2023 | | | | |

| Net income as reported | $ | 111,019 | | | $ | 116,077 | | | | | |

| Adjustments: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Restructuring (a) | 3,307 | | | — | | | | | |

Other adjustments (b) | — | | | (601) | | | | | |

Tax impact of adjustments to net income (c) | (918) | | | 170 | | | | | |

| Adjusted net income | $ | 113,408 | | | $ | 115,646 | | | | | |

| | | | | | | |

| Weighted-average diluted shares outstanding | 134,111 | | | 135,902 | | | | | |

Adjusted EPS (d) | $ | 0.85 | | | $ | 0.85 | | | | | |

(a)Represents charges related to the restructuring of certain corporate functions including costs for severance, retention, outplacement, consulting fees, and other third-party fees.

(b)Other non-cash items related to the reclassification into earnings of accumulated other comprehensive income / loss associated with the de-designation of hedge accounting and other adjustments.

(c)Represents the tax effect of the above adjustments at a statutory tax rate of approximately 28%.

(d)Adjusted EPS is measured using weighted-average diluted shares outstanding.

BJ'S WHOLESALE CLUB HOLDINGS, INC.

Reconciliation to Adjusted EBITDA

(Amounts in thousands)

(Unaudited) | | | | | | | | | | | | | | | |

| 13 Weeks Ended May 4, 2024 | | 13 Weeks Ended April 29, 2023 | | | | |

| Income from continuing operations | $ | 111,019 | | | $ | 115,988 | | | | | |

| Interest expense, net | 13,951 | | | 14,690 | | | | | |

| Provision for income taxes | 35,785 | | | 56,092 | | | | | |

| Depreciation and amortization | 63,422 | | | 54,190 | | | | | |

| Stock-based compensation expense | 8,590 | | | 10,007 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Restructuring (a) | 3,307 | | | — | | | | | |

| | | | | | | |

Other adjustments (b) | 312 | | | 571 | | | | | |

Adjusted EBITDA (c) | $ | 236,386 | | | $ | 251,538 | | | | | |

(a)Represents charges related to the restructuring of certain corporate functions including costs for severance, retention, outplacement, consulting fees, and other third-party fees.

(b)Other non-cash items, including non-cash accretion on asset retirement obligations and obligations associated with our post-retirement medical plan.

(c)Adjusted EBITDA for the 13-weeks ended April 29, 2023 has been recast to exclude adjustments for pre-opening expenses and non-cash rent expense to conform to the current period definition.

BJ'S WHOLESALE CLUB HOLDINGS, INC.

Reconciliation to Adjusted Free Cash Flow

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | | | | | |

| 13 Weeks Ended May 4, 2024 | | 13 Weeks Ended April 29, 2023 | | | | |

| Net cash provided by operating activities | $ | 200,847 | | | $ | 119,132 | | | | | |

| Less: Additions to property and equipment, net of disposals | (105,741) | | | (92,084) | | | | | |

| Plus: Proceeds from sale-leaseback transactions | — | | | — | | | | | |

| Adjusted free cash flow | $ | 95,106 | | | $ | 27,048 | | | | | |

BJ'S WHOLESALE CLUB HOLDINGS, INC.

Reconciliation of Net Debt and Net Debt to LTM adjusted EBITDA

(Amounts in thousands)

(Unaudited)

| | | | | |

| May 4, 2024 |

| Total debt | $ | 668,509 | |

| Less: Cash and cash equivalents | 35,094 | |

| Net debt | $ | 633,415 | |

| |

| Income from continuing operations | $ | 518,683 | |

| Interest expense, net | 63,788 | |

| Provision for income taxes | 191,933 | |

| Depreciation and amortization | 236,928 | |

| Stock-based compensation expense | 37,604 | |

| |

| |

| |

| |

| Restructuring | 17,247 | |

| Other adjustments | 794 | |

| Adjusted EBITDA | $ | 1,066,977 | |

| |

| Net debt to LTM adjusted EBITDA | 0.6x |

See descriptions of adjustments in the “Reconciliation to Adjusted EBITDA (unaudited)” table above.

Investor Contact:

Catherine Park

Vice President, Investor Relations

cpark@bjs.com

774-512-6744

Media Contact:

Kirk Saville

Head of Corporate Communications

ksaville@bjs.com

774-512-5597

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

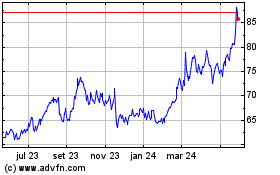

BJs Wholesale Club (NYSE:BJ)

Gráfico Histórico do Ativo

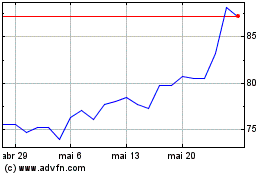

De Mai 2024 até Jun 2024

BJs Wholesale Club (NYSE:BJ)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024