false000152402500015240252024-06-062024-06-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________

FORM 8-K

_______________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 6, 2024

_______________________________________________

TILLY’S, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

Delaware | | 1-35535 | | 45-2164791 |

(State of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification Number) |

10 Whatney

Irvine, California 92618

(Address of Principal Executive Offices) (Zip Code)

(949) 609-5599

(Registrant’s Telephone Number, Including Area Code)

______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.001 par value per share | TLYS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 2.02 | Results of Operations and Financial Condition |

On June 6, 2024, Tilly's, Inc. (the "Company") issued an earnings press release for the first quarter ended May 4, 2024. The press release is furnished as Exhibit 99.1 and is incorporated herein by reference. The information furnished pursuant to this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

| | | | | |

Item 9.01 | Financials Statements and Exhibits |

The following exhibits are being furnished herewith.

(d) Exhibits.

| | | | | |

Exhibit No. | Exhibit Title or Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| TILLY’S, INC. |

| | |

| Date: June 6, 2024 | By: | /s/ Michael L. Henry |

| Name: | Michael L. Henry |

| Title: | Executive Vice President, Chief Financial Officer |

Exhibit 99.1

Tilly's, Inc. Reports Fiscal 2024 First Quarter Operating Results

GAAP Net Loss Per Share of $(0.65); Non-GAAP Net Loss Per Share of $(0.48)

Non-GAAP Net Loss Per Share in Middle of Outlook Range

Irvine, CA – June 6, 2024 – Tilly’s, Inc. (NYSE: TLYS, the "Company") today announced financial results for the first quarter of fiscal 2024 ended May 4, 2024.

"Our business continues to face many headwinds from the macro environment, but we believe we are making progress on improving our product margins and driving greater customer engagement through our marketing efforts," commented Hezy Shaked, Co-Founder and Interim President and Chief Executive Officer. "While we expect it to remain difficult to improve our sales results in the near term, we believe the efforts we are making now will produce benefits in the future when the current environment improves."

Operating Results Overview

Fiscal 2024 First Quarter Operating Results Overview

The following comparisons refer to the Company's operating results for the first quarter of fiscal 2024 ended May 4, 2024 versus the first quarter of fiscal 2023 ended April 29, 2023.

•Total net sales were $115.9 million, a decrease of $7.8 million or 6.3%, compared to $123.6 million last year. Total comparable net sales, including both physical stores and e-commerce ("e-com"), decreased by 9.4% relative to the 13-week period ended May 6, 2023.

◦Net sales from physical stores were $92.8 million, a decrease of $5.0 million or 5.1%, compared to $97.8 million last year, with a comparable store net sales decrease of 8.6%. Net sales from physical stores represented 80.1% of total net sales this year compared to 79.1% of total net sales last year. The Company ended the first quarter with 246 total stores compared to 248 total stores at the end of the first quarter last year.

◦Net sales from e-com were $23.0 million, a decrease of $2.8 million or 10.8%, compared to $25.8 million last year. E-com net sales represented 19.9% of total net sales this year compared to 20.9% of total net sales last year.

•Gross profit, including buying, distribution, and occupancy costs, was $24.3 million, or 21.0% of net sales, compared to $25.9 million, or 21.0% of net sales, last year. Product margins improved by 130 basis points primarily due to the combination of a lower markdown rate and improved initial markups. Buying, distribution, and occupancy costs deleveraged by 130 basis points collectively, despite being $0.8 million lower than last year, primarily due to carrying these costs against lower net sales this year.

•Selling, general and administrative ("SG&A") expenses were $45.1 million, or 38.9% of net sales, compared to $43.2 million, or 34.9% of net sales, last year. The $1.9 million increase in SG&A was primarily attributable to an increase in non-cash store asset impairment charges of $1.5 million and an increase in store payroll and related benefits of $1.0 million due primarily to average wage rate increases. These increases were partially offset by a variety of smaller expense decreases.

•Operating loss was $20.8 million, or 17.9% of net sales, compared to $17.3 million, or 14.0% of net sales, last year, due to the combined impact of the factors noted above.

•Income tax benefit was $13,000 or 0.1% of pre-tax loss, compared to $4.2 million, or 26.1% of pre-tax loss, last year. The decrease in this quarter's effective income tax rate was primarily attributable to the continuing impact of a full, non-cash deferred tax asset valuation allowance (the "valuation allowance"). On a non-GAAP basis, excluding the valuation allowance, income tax benefit was $5.2 million, or 26.4% of pre-tax loss.

•Net loss was $19.6 million, or $0.65 net loss per share, compared to $12.0 million, or $0.40 net loss per share, last year. On a non-GAAP basis, excluding the valuation allowance, this year's net loss was $14.5 million, or $0.48 net loss per share. Weighted average shares were 30.0 million this year compared to 29.8 million shares last year.

Non-GAAP Financial Measures

In addition to reporting financial measures in accordance with generally accepted accounting principles ("GAAP"), the Company is providing certain non-GAAP financial measures including "non-GAAP income tax benefit," "non-GAAP net loss," and "non-GAAP net loss per share." These amounts are not in accordance with, and should not be construed as an alternative to, the most directly comparable corresponding GAAP measure. The Company’s management believes that these measures help provide investors with insight into the underlying comparable financial results, excluding items that may not be indicative of, or are unrelated to, the Company’s core day-to-day operating results.

For a description of these non-GAAP financial measures and reconciliations of these non-GAAP financial measures to the most directly comparable corresponding financial measures prepared in accordance with GAAP, please see the accompanying table titled “Supplemental Financial Information; Reconciliation of Select GAAP Financial Measures to Non-GAAP Financial Measures” contained in this press release.

Balance Sheet and Liquidity

As of May 4, 2024, the Company had $68.0 million of cash, cash equivalents and marketable securities and no debt outstanding compared to $93.4 million and no debt outstanding as of April 29, 2023. Total inventories increased 1.8% as of May 4, 2024 compared to April 29, 2023. Total year-to-date capital expenditures at the end of the first quarter were $2.1 million this year compared to $4.3 million last year.

Fiscal 2024 Second Quarter Outlook

Total comparable net sales for fiscal May ended June 1, 2024, decreased by (8.4)% relative to the comparable four-week period last year. Based on current quarter-to-date comparable net sales results and current and historical trends, the Company currently estimates the following for the second quarter of fiscal 2024:

•Net sales to be in the range of approximately $160 million to $165 million, translating to an estimated comparable net sales decrease in the range of approximately (10)% to (7)%, respectively, relative to the comparable 13-week period last year;

•SG&A expenses to be in the range of $48 million to $49 million in the absence of any non-cash store asset impairment charges;

•Effective income tax rate of near-zero due to the continuing impact of the valuation allowance;

•After-tax results to be in the range of a net loss of approximately $(3.9) million to $(0.9) million, respectively; and

•Per share results to be in the range of a net loss of $(0.13) to $(0.03), respectively, with estimated weighted average shares of approximately 29.9 million.

The Company currently expects to have 247 total stores open at the end of the second quarter of fiscal 2024 compared to 246 at the end of last year's second quarter.

Conference Call Information

A conference call to discuss these financial results is scheduled for today, June 6, 2024, at 4:30 p.m. ET (1:30 p.m. PT). Investors and analysts interested in participating in the call are invited to dial (877) 300-8521 (domestic) or (412) 317-6026 (international). The conference call will also be available to interested parties through a live webcast at www.tillys.com. Please visit the website and select the “Investor Relations” link at least 15 minutes prior to the start of the call to register and download any necessary software. A telephone replay of the call will be available until June 13, 2024, by dialing (844) 512-2921 (domestic) or (412) 317-6671 (international) and entering the conference identification number: 10188068.

About Tillys

Tillys is a leading, destination specialty retailer of casual apparel, footwear, accessories and hardgoods for young men, young women, boys and girls with an extensive selection of iconic global, emerging, and proprietary brands rooted in an active, outdoor and social lifestyle. Tillys is headquartered in Irvine, California and currently operates 246 total stores across 33 states, as well as its website, www.tillys.com.

Forward-Looking Statements

Certain statements in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, statements regarding our current operating expectations in light of historical results, the impacts of inflation and potential recession on us and our customers, including on our future financial condition or operating results, expectations regarding changes in the macro-economic environment, customer traffic, our supply chain, our ability to properly manage our inventory levels, and any other statements about our future cash position, financial flexibility, expectations, plans, intentions, beliefs or prospects expressed by management are forward-looking statements. These forward-looking statements are based on management’s current expectations and beliefs, but they involve a number of risks and uncertainties that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including, but not limited to the impact of inflation on consumer behavior and our business and operations, supply chain difficulties, and our ability to respond thereto, our ability to respond to changing customer preferences and trends, attract customer traffic at our stores and online, execute our growth and long-term strategies, expand into new markets, grow our e-commerce business, effectively manage our inventory and costs, effectively compete with other retailers, attract talented employees, or enhance awareness of our brand and brand image, general consumer spending patterns and levels, including changes in historical spending patterns, the markets generally, our ability to satisfy our financial obligations, including under our credit facility and our leases, and other factors that are detailed in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”), including those detailed in the section titled “Risk Factors” and in our other filings with the SEC, which are available on the SEC’s website at www.sec.gov and on our website at www.tillys.com under the heading “Investor Relations”. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We do not undertake any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. This release should be read in conjunction with our financial statements and notes thereto contained in our Form 10-K.

Tilly’s, Inc.

Consolidated Balance Sheets

(In thousands, except par value)

(unaudited)

| | | | | | | | | | | | | | | | | | | |

| May 4,

2024 | | February 3,

2024 | | April 29,

2023 | | |

| ASSETS | | | | | | | |

| Current assets: | | | | | | | |

| Cash and cash equivalents | $ | 19,880 | | | $ | 47,027 | | | $ | 43,686 | | | |

| Marketable securities | 48,142 | | | 48,021 | | | 49,695 | | | |

| Receivables | 7,135 | | | 5,947 | | | 12,973 | | | |

| Merchandise inventories | 78,535 | | | 63,159 | | | 77,182 | | | |

| Prepaid expenses and other current assets | 9,742 | | | 11,905 | | | 9,332 | | | |

| Total current assets | 163,434 | | | 176,059 | | | 192,868 | | | |

| Operating lease assets | 199,613 | | | 203,825 | | | 216,385 | | | |

| Property and equipment, net | 45,442 | | | 48,063 | | | 49,438 | | | |

| Deferred tax assets, net | — | | | — | | | 12,728 | | | |

| Other assets | 1,522 | | | 1,598 | | | 1,765 | | | |

| TOTAL ASSETS | $ | 410,011 | | | $ | 429,545 | | | $ | 473,184 | | | |

| | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

| Current liabilities: | | | | | | | |

| Accounts payable | $ | 22,013 | | | $ | 14,506 | | | $ | 24,730 | | | |

| Accrued expenses | 12,712 | | | 13,063 | | | 14,253 | | | |

| | | | | | | |

| Deferred revenue | 14,127 | | | 14,957 | | | 14,792 | | | |

| Accrued compensation and benefits | 8,457 | | | 9,902 | | | 9,056 | | | |

| Current portion of operating lease liabilities | 52,662 | | | 48,672 | | | 49,567 | | | |

| Current portion of operating lease liabilities, related party | 3,194 | | | 3,121 | | | 2,908 | | | |

| Other liabilities | 253 | | | 336 | | | 446 | | | |

| Total current liabilities | 113,418 | | | 104,557 | | | 115,752 | | | |

| Long-term liabilities: | | | | | | | |

| Noncurrent portion of operating lease liabilities | 151,875 | | | 160,531 | | | 169,791 | | | |

| Noncurrent portion of operating lease liabilities, related party | 18,438 | | | 19,267 | | | 21,633 | | | |

| Other liabilities | 278 | | | 321 | | | 487 | | | |

| Total long-term liabilities | 170,591 | | | 180,119 | | | 191,911 | | | |

| Total liabilities | 284,009 | | | 284,676 | | | 307,663 | | | |

| Stockholders’ equity: | | | | | | | |

| Common stock (Class A) | 23 | | | 23 | | | 23 | | | |

| Common stock (Class B) | 7 | | | 7 | | | 7 | | | |

| Preferred stock | — | | | — | | | — | | | |

| Additional paid-in capital | 173,197 | | | 172,478 | | | 170,608 | | | |

| Accumulated deficit | (47,583) | | | (27,962) | | | (5,438) | | | |

| Accumulated other comprehensive income | 358 | | | 323 | | | 321 | | | |

| Total stockholders’ equity | 126,002 | | | 144,869 | | | 165,521 | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 410,011 | | | $ | 429,545 | | | $ | 473,184 | | | |

Tilly’s, Inc.

Consolidated Statements of Operations

(In thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | | | | |

| | May 4,

2024 | | April 29,

2023 | | | | | |

| Net sales | $ | 115,856 | | | $ | 123,637 | | | | | | |

| | | | | | | | |

| Cost of goods sold (includes buying, distribution, and occupancy costs) | 90,612 | | | 96,768 | | | | | |

| Rent expense, related party | 931 | | | 931 | | | | | |

| Total cost of goods sold (includes buying, distribution, and occupancy costs) | 91,543 | | | 97,699 | | | | | |

| Gross profit | 24,313 | | | 25,938 | | | | | |

| | | | | | | | |

| Selling, general and administrative expenses | 44,968 | | | 43,066 | | | | | |

| Rent expense, related party | 133 | | | 133 | | | | | |

| Total selling, general and administrative expenses | 45,101 | | | 43,199 | | | | | |

| | | | | | | | |

| Operating loss | (20,788) | | | (17,261) | | | | | |

| Other income, net | 1,154 | | | 1,064 | | | | | |

| Loss before income taxes | (19,634) | | | (16,197) | | | | | |

| Income tax benefit | (13) | | | (4,229) | | | | | |

| Net loss | $ | (19,621) | | | $ | (11,968) | | | | | | |

| Basic net loss per share of Class A and Class B common stock | $ | (0.65) | | | $ | (0.40) | | | | | | |

| Diluted net loss per share of Class A and Class B common stock | $ | (0.65) | | | $ | (0.40) | | | | | | |

| Weighted average basic shares outstanding | 29,962 | | | 29,798 | | | | | | |

| Weighted average diluted shares outstanding | 29,962 | | | 29,798 | | | | | | |

Tilly’s, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(unaudited) | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | |

| | May 4,

2024 | | April 29,

2023 | | |

| Cash flows from operating activities | | | | | |

| Net loss | $ | (19,621) | | | $ | (11,968) | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| Depreciation and amortization | 3,095 | | | 3,214 | | | |

| Stock-based compensation expense | 566 | | | 522 | | | |

| Impairment of assets | 1,663 | | | 154 | | | |

| (Gain) loss on disposal of assets | (16) | | | 16 | | | |

| Gain on maturities of marketable securities | (708) | | | (295) | | | |

| Deferred income taxes | — | | | (4,231) | | | |

| Changes in operating assets and liabilities: | | | | | |

| Receivables | (822) | | | (3,683) | | | |

| Merchandise inventories | (15,376) | | | (15,065) | | | |

| Prepaid expenses and other assets | 2,690 | | | 8,162 | | | |

| Accounts payable | 7,480 | | | 8,765 | | | |

| Accrued expenses | 14 | | | 441 | | | |

| Accrued compensation and benefits | (1,445) | | | 873 | | | |

| Operating lease liabilities | (2,254) | | | (1,616) | | | |

| Deferred revenue | (830) | | | (1,311) | | | |

| Other liabilities | (126) | | | (173) | | | |

| Net cash used in operating activities | (25,690) | | | (16,195) | | | |

| | | | | |

| Cash flows from investing activities | | | | | |

| Purchases of marketable securities | (29,496) | | | (24,524) | | | |

| Purchases of property and equipment | (2,137) | | | (4,255) | | | |

| Proceeds from maturities of marketable securities | 30,000 | | | 15,081 | | | |

| | | | | |

| | | | | |

| Proceeds from sale of property and equipment | 23 | | | — | | | |

| | | | | |

| Net cash used in investing activities | (1,610) | | | (13,698) | | | |

| | | | | |

| Cash flows from financing activities | | | | | |

| Proceeds from exercise of stock options | 153 | | | 53 | | | |

| Net cash provided by financing activities | 153 | | | 53 | | | |

| | | | | |

| Change in cash and cash equivalents | (27,147) | | | (29,840) | | | |

| Cash and cash equivalents, beginning of period | 47,027 | | | 73,526 | | | |

| Cash and cash equivalents, end of period | $ | 19,880 | | | $ | 43,686 | | | |

Tilly’s, Inc.

Supplemental Financial Information

Reconciliation of Select GAAP Financial Measures to Non-GAAP Financial Measures

(In thousands)

(unaudited)

Definitions of certain non-GAAP financial measures included in the tables below are as follows:

•We define "non-GAAP income tax benefit" as loss before income tax multiplied by an effective income tax rate of 26.3%.

| | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | | | |

| May 4,

2024 | | April 29,

2023 | | | | |

| Income tax benefit | $ | (13) | | | $ | (4,229) | | | | | |

| Non-cash valuation allowance on deferred tax assets | (5,164) | | | — | | | | | |

| Non-GAAP income tax benefit | $ | (5,177) | | | $ | (4,229) | | | | | |

| | | | | | | |

•We define "non-GAAP net loss" as net loss less non-cash valuation allowance on deferred tax assets.

•We define "non-GAAP basic net loss per share" and "non-GAAP diluted net loss per share" as non-GAAP net loss divided by the weighted average shares outstanding on a basic and diluted basis, respectively.

| | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | | | |

| May 4,

2024 | | April 29,

2023 | | | | |

| Net loss | $ | (19,621) | | | $ | (11,968) | | | | | |

| Non-cash valuation allowance on deferred tax assets | (5,164) | | | — | | | | | |

| Non-GAAP net loss | $ | (14,457) | | | $ | (11,968) | | | | | |

| | | | | | | |

| Basic net loss per share of Class A and Class B common stock | $ | (0.65) | | | $ | (0.40) | | | | | |

| Diluted net loss per share of Class A and Class B common stock | $ | (0.65) | | | $ | (0.40) | | | | | |

| Non-GAAP basic net loss per share of Class A and Class B common stock | $ | (0.48) | | | $ | (0.40) | | | | | |

| Non-GAAP diluted net loss per share of Class A and Class B common stock | $ | (0.48) | | | $ | (0.40) | | | | | |

| Weighted average basic shares outstanding used to compute GAAP and non-GAAP basic net loss per share | 29,962 | | | 29,798 | | | | | |

| Weighted average diluted shares outstanding used to compute GAAP and non-GAAP diluted net loss per share | 29,962 | | | 29,798 | | | | | |

| | | | | | | |

Tilly's, Inc.

Store Count and Square Footage

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Store

Count at

Beginning of Quarter | | New Stores

Opened

During Quarter | | Stores

Permanently Closed

During Quarter | | Store Count at

End of Quarter | | Total Gross

Square Footage

End of Quarter

(in thousands) |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| 2023 Q1 | 249 | | 1 | | 2 | | 248 | | 1,809 |

| 2023 Q2 | 248 | | — | | 2 | | 246 | | 1,792 |

| 2023 Q3 | 246 | | 3 | | — | | 249 | | 1,810 |

| 2023 Q4 | 249 | | 3 | | 4 | | 248 | | 1,801 |

| 2024 Q1 | 248 | | 2 | | 4 | | 246 | | 1,784 |

| | | | | | | | | |

Investor Relations Contact:

Michael Henry, Executive Vice President, Chief Financial Officer

(949) 609-5599, ext. 17000

irelations@tillys.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

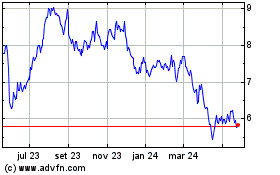

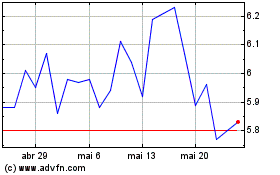

Tillys (NYSE:TLYS)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Tillys (NYSE:TLYS)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024