UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of: June 2024

Commission file number: 001-36578

ENLIVEX THERAPEUTICS LTD.

(Translation of registrant’s name into English)

14 Einstein Street, Nes Ziona, Israel 7403618

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

The

unaudited condensed consolidated financial statements for Enlivex Therapeutics Ltd., a company organized under the laws of the State of

Israel (“Enlivex”), as of and for the three month periods ended March

31, 2024 and 2023, and the Operating and Financial Review and Prospects of Enlivex for the

corresponding periods are furnished as Exhibits 99.1 and Exhibit 99.2, respectively, to this Report on Form 6-K and incorporated by reference

into Enlivex’s registration statements on Forms S-8, F-3 and F-3MEF (File No. 333-256799,

File No. 333-232413, File No. 333-232009,

File No. 333-252926 and File No. 333-264561),

filed with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Enlivex Therapeutics Ltd. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ Oren Hershkovitz |

| |

Name:

Title: |

Oren Hershkovitz

Chief Executive Officer |

Date: June 14, 2024

Exhibit 99.1

ENLIVEX THERAPEUTICS LTD.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF MARCH 31, 2024 AND DECEMBER 31, 2023

AND FOR THE THREE-MONTH PERIODS ENDED MARCH

31, 2024 AND 2023

ENLIVEX THERAPEUTICS LTD.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF MARCH 31, 2024 AND DECEMBER 31, 2023

AND FOR THE THREE-MONTH PERIODS ENDED MARCH

31, 2024 AND 2023

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

ENLIVEX THERAPEUTICS LTD.

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

U.S. dollars in thousands (except share data)

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 1,913 | | |

$ | 813 | |

| Short-term interest-bearing deposits | |

| 21,523 | | |

| 26,507 | |

| Prepaid expenses and other receivables | |

| 4,711 | | |

| 1,336 | |

| Assets classified as held for sale | |

| 229 | | |

| 5,108 | |

| Total Current Assets | |

| 28,376 | | |

| 33,764 | |

| | |

| | | |

| | |

| Non-Current Assets | |

| | | |

| | |

| Property and equipment, net | |

| 1,299 | | |

| 1,539 | |

| Other assets | |

| 1,372 | | |

| 1,528 | |

| Total Non-Current Assets | |

| 2,671 | | |

| 3,067 | |

| TOTAL ASSETS | |

$ | 31,047 | | |

$ | 36,831 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable trade | |

$ | 643 | | |

$ | 827 | |

| Accrued expenses and other liabilities | |

| 2,966 | | |

| 4,001 | |

| Liability classified as held for sale | |

| - | | |

| 1,233 | |

| Total Current Liabilities | |

| 3,609 | | |

| 6,061 | |

| | |

| | | |

| | |

| Non-Current Liabilities | |

| | | |

| | |

| Other long-term liabilities | |

| 587 | | |

| 686 | |

| Total Non-Current Liabilities | |

| 587 | | |

| 686 | |

| | |

| | | |

| | |

| Commitments and Contingent Liabilities | |

| | | |

| | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 4,196 | | |

| 6,747 | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

Ordinary shares of NIS 0.40 par value:

Authorized: 45,000,000 shares as of March 31, 2024 and December 31, 2023;

Issued and outstanding: 18,811,781 and 18,598,555 as of March 31, 2024 and December 31, 2023, respectively; | |

| 2,160 | | |

| 2,137 | |

| Additional paid in capital | |

| 139,823 | | |

| 138,939 | |

| Foreign currency translation adjustments | |

| 1,101 | | |

| 1,101 | |

| Accumulated deficit | |

| (116,233 | ) | |

| (112,093 | ) |

| TOTAL SHAREHOLDERS’ EQUITY | |

| 26,851 | | |

| 30,084 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 31,047 | | |

$ | 36,831 | |

The accompanying notes are an integral part of the condensed consolidated

financial statements.

ENLIVEX THERAPEUTICS LTD.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS AND COMPREHENSIVE LOSS (UNAUDITED)

U.S. dollars in thousands (except share and

per share data)

| | |

For the three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development expenses | |

| 2,857 | | |

| 5,176 | |

| General and administrative expenses | |

| 1,093 | | |

| 1,607 | |

| Loss on disposal group of assets held for sale | |

| 201 | | |

| - | |

| | |

| 4,151 | | |

| 6,783 | |

| | |

| | | |

| | |

| Operating loss | |

| (4,151 | ) | |

| (6,783 | ) |

| | |

| | | |

| | |

| Finance income (expense) | |

| 11 | | |

| (435 | ) |

| | |

| | | |

| | |

| Net loss | |

| (4,140 | ) | |

| (7,218 | ) |

| | |

| | | |

| | |

| Total comprehensive loss | |

$ | (4,140 | ) | |

$ | (7,218 | ) |

| | |

| | | |

| | |

| Basic & diluted loss per share | |

$ | (0.22 | ) | |

$ | (0.39 | ) |

| Weighted average number of shares outstanding | |

| 18,727,037 | | |

| 18,516,438 | |

The accompanying notes are an integral part of the condensed consolidated

financial statements.

ENLIVEX THERAPEUTICS LTD.

CONDENSED CONSOLIDATED STATEMENTS

OF CHANGES IN SHAREHOLDERS’ EQUITY (UNAUDITED)

U.S. dollars

in thousands (except share data)

| | |

Ordinary Shares | | |

Additional

paid in | | |

Currency

translation | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

capital | | |

reserve | | |

deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of December 31, 2023 | |

| 18,598,555 | | |

| 2,137 | | |

| 138,939 | | |

$ | 1,101 | | |

| (112,093 | ) | |

| 30,084 | |

| Changes during the three months period ended March 31, 2024: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restricted stock units vested | |

| 34,295 | | |

| 3 | | |

| (3 | ) | |

| | | |

| | | |

| - | |

| Issuance of shares for cash consideration of $540 net of $16 issuance costs | |

| 178,931 | | |

| 20 | | |

| 504 | | |

| - | | |

| | | |

| 524 | |

| Share based compensation | |

| | | |

| | | |

| 383 | | |

| - | | |

| | | |

| 383 | |

| Net loss | |

| | | |

| | | |

| | | |

| - | | |

| (4,140 | ) | |

| (4,140 | ) |

| Balance as of March 31, 2024 (unaudited) | |

| 18,811,781 | | |

| 2,160 | | |

| 139,823 | | |

$ | 1,101 | | |

| (116,233 | ) | |

| 26,851 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of December 31, 2022 | |

| 18,421,852 | | |

| 2,117 | | |

| 136,648 | | |

$ | 1,101 | | |

| (83,025 | ) | |

| 56,841 | |

| Changes during the three months period ended March 31, 2023: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Restricted stock units vested | |

| 34,295 | | |

| 3 | | |

| (3 | ) | |

| - | | |

| | | |

| - | |

| Issuance of shares for cash consideration of $470 net of $152 issuance costs | |

| 110,115 | | |

| 13 | | |

| 305 | | |

| | | |

| | | |

| 318 | |

| Share based compensation | |

| | | |

| | | |

| 633 | | |

| - | | |

| | | |

| 633 | |

| Net loss | |

| | | |

| | | |

| | | |

| - | | |

| (7,218 | ) | |

| (7,218 | ) |

| Balance as of March 31, 2023 (unaudited) | |

| 18,566,262 | | |

| 2,133 | | |

| 137,583 | | |

$ | 1,101 | | |

| (90,243 | ) | |

| 50,574 | |

The accompanying notes are an integral

part of the condensed consolidated financial statements.

ENLIVEX THERAPEUTICS LTD.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS (UNAUDITED)

U.S. dollars in thousands

| | |

For the three months ended

March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities | |

| | |

| |

| Net (loss) | |

$ | (4,140 | ) | |

$ | (7,218 | ) |

| Adjustments required to reflect net cash used in operating activities: | |

| | | |

| | |

| Income and expenses not involving cash flows: | |

| | | |

| | |

| Depreciation | |

| 188 | | |

| 209 | |

| Capital gain on sale of property and equipment | |

| (76 | ) | |

| - | |

| Loss on short-term bank deposits | |

| 65 | | |

| 1,392 | |

| Gain on assets and liabilities classified as held for sale | |

| (66 | ) | |

| - | |

| Non-cash operating lease expenses | |

| 98 | | |

| 208 | |

| Share-based compensation | |

| 383 | | |

| 633 | |

| Changes in operating asset and liability items: | |

| | | |

| | |

| Decrease in prepaid expenses and other receivables | |

| 355 | | |

| 492 | |

| Decrease in accounts payable trade | |

| (183 | ) | |

| (457 | ) |

| Decrease in accrued expenses and other liabilities | |

| (1,030 | ) | |

| (722 | ) |

| Operating lease liabilities | |

| (104 | ) | |

| (321 | ) |

| Net cash (used in) operating activities | |

| (4,510 | ) | |

| (5,784 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of property and equipment | |

| (43 | ) | |

| (162 | ) |

| Proceeds from sale of property and equipment | |

| 171 | | |

| - | |

| Proceeds from sale of assets as held for sale | |

| 53 | | |

| | |

| Investment in short-term interest-bearing bank deposits | |

| (8,483 | ) | |

| (31,184 | ) |

| Release of short-term interest-bearing bank deposits | |

| 13,400 | | |

| - | |

| Net cash provided by (used in) investing activities | |

| 5,098 | | |

| (31,346 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from issuance of shares net | |

| 524 | | |

| 318 | |

| Proceeds from exercise of options | |

| - | | |

| - | |

| Net cash provided by financing activities | |

| 524 | | |

| 318 | |

| | |

| | | |

| | |

| Increase (decrease) in cash and cash equivalents | |

| 1,112 | | |

| (36,812 | ) |

| Cash and cash equivalents - beginning of period | |

| 1,226 | | |

| 50,357 | |

| | |

| - | | |

| - | |

| Cash and cash equivalents - end of period | |

$ | 2,338 | | |

$ | 13,545 | |

| | |

| | |

| |

| Supplemental disclosures of cash flow information: | |

| | |

| |

| Cash paid for taxes | |

$ | - | | |

$ | - | |

| Cash paid (received) for interest, net | |

$ | 514 | | |

$ | 462 | |

The accompanying notes are an integral part of the condensed consolidated

financial statements.

ENLIVEX THERAPEUTICS LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31,

2024 (UNAUDITED)

NOTE 1 - GENERAL INFORMATION

Enlivex Therapeutics Ltd. (including

its consolidated subsidiaries, “we”, “us”, “our” or the “Company”) was originally incorporated

on January 22, 2012 under the laws of the State of Israel.

The Company is a clinical stage macrophage

reprogramming immunotherapy company, developing AllocetraTM, a universal, off-the-shelf cell therapy designed to reprogram

macrophages into their homeostatic state. Resetting non-homeostatic macrophages into their homeostatic state is critical for immune system

rebalancing and resolution of debilitating and life-threatening conditions. Non-homeostatic macrophages contribute significantly to the

severity of certain diseases, which include, sepsis, osteoarthritis and others.

AllocetraTM is based on

the discoveries of Professor Dror Mevorach, an expert on immune activity, macrophage activation and clearance of dying (apoptotic) cells,

in his laboratory in the Hadassah University Hospital located in the State of Israel.

The Company’s ordinary shares,

par value of NIS 0.40 per share (“Ordinary Shares”), are traded under the symbol “ENLV” on both the Nasdaq Capital

Market and on the Tel Aviv Stock Exchange.

The Company devotes substantially all

of its efforts toward research and development activities and raising capital to support such activities. The Company’s activities

are subject to significant risks and uncertainties, including failing to secure additional funding before the Company achieves sustainable

revenues and profit from operations.

Research and development activities

have required significant capital investment since the Company’s inception. The Company expects that its operations will require

additional cash investment to pursue the Company’s research and development activities, including preclinical studies, formulation

development, clinical trials and related drug manufacturing. The Company has not generated any revenues or product sales and has not achieved

profitable operations or positive cash flow from operations. The Company has incurred net losses since its inception, and, as of March

31, 2024, had an accumulated deficit of $116,233 thousand.

The Company expects to continue to

incur losses for at least the next several years, and the Company will need to raise additional debt or equity financing or enter into

partnerships to fund its development. If the Company is not able to achieve its funding requirements, it may be required to reduce discretionary

spending, may not be able to continue the development of its product candidates and may be required to delay its development programs,

which could have a material adverse effect on the Company’s ability to achieve its intended business objectives. There can be no

assurances that additional financing will be secured or, if secured, will be on favorable terms. The ability of the Company to transition

to profitability in the longer term is dependent on developing products and product revenues to support its expenses.

The Company’s management and

board of directors (the “Board”) are of the opinion that the Company’s current financial resources will be sufficient

to continue the development of the Company’s product candidates for at least twelve months from the filing of these financial statements

on Form 6-K. The Company may determine, however, to raise additional capital during such period as the Board deems prudent. The Company’s

management plans to finance its operations with issuances of the Company’s equity securities and, in the longer term, revenues.

There are no assurances, however, that the Company will be successful in obtaining the financing necessary for its long-term development.

The Company’s ability to continue to operate in the long term is dependent upon additional financial support.

ENLIVEX THERAPEUTICS LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31,

2024 (UNAUDITED)

NOTE 2 - SIGNIFICANT ACCOUNTING

POLICIES

Basis of Presentation

These unaudited condensed consolidated

financial statements include the accounts of the Company and have been prepared in accordance with U.S. generally accepted accounting

principles (“U.S. GAAP”) for interim financial information. Accordingly, certain information and footnote disclosures normally

included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. In the opinion of management, all

adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been made.

These unaudited condensed consolidated

financial statements should be read in conjunction with the Company’s audited annual financial statements and notes thereto included

in the Company’s 2023 Annual Report on Form 20-F, as filed with the SEC on April 30, 2024. The results of operations for the interim

periods presented herein are not necessarily indicative of the operating results for any future period. The December 31, 2023 financial

information has been derived from the Company’s audited financial statements.

Use of Estimates

The preparation of interim financial

statements in conformity with U.S. GAAP requires management to make certain estimates, judgments and assumptions that affect the reported

amounts in the consolidated balance sheets and statements of operations, it also requires that management exercise its judgment in applying

the Company’s accounting policies. On an ongoing basis, management evaluates its estimates, including estimates related to its stock-based

compensation expense and implicit interest rate on new lease liabilities. Significant estimates in these interim financial statements

include estimates made for accrued research and development expenses and stock-based compensation expenses.

Functional Currency and Translation

to The Reporting Currency

The functional currency of the Company

is the U.S. dollar because the U.S. dollar is the currency of the primary economic environment in which the Company operates and expects

to continue to operate in the foreseeable future.

Balances related to non-monetary assets

and liabilities are based on translated amounts as of the date of the change, and non-monetary assets acquired and liabilities were translated

at the approximate exchange rate prevailing at the date of the transaction. Transactions included in the statement of income were translated

at the approximate exchange rate in effect at the time of the applicable transaction.

1 U.S. dollar = 3.681 NIS and 3.627

NIS as of March 31, 2024 and December 31, 2023, respectively.

The U.S. dollar increased against the

NIS 1.49% and 2.73% in the three months ended March 31, 2024 and 2023, respectively.

Recently Adopted Accounting Standards

During the three months ended March

31, 2024, the Company was not required to adopt any recently issued accounting standards.

Recently Issued Accounting Pronouncements

Not Yet Adopted

In November 2023, the FASB issued ASU

2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which is intended to provide enhanced segment

disclosures. The standard will require disclosures about significant segment expenses and other segment items and identifying the Chief

Operating Decision Maker and how they use the reported segment profitability measures to assess segment performance and allocate resources.

These enhanced disclosures are required for all entities on an interim and annual basis, even if they have only a single reportable segment.

The standard is effective for years beginning after December 15, 2023 and interim periods within annual periods beginning after December

15, 2024, and early adoption is permitted. The Company does not believe that adoption of this ASU will have a material impact on the Company’s

consolidated financial statements.

In December 2023, the FASB issued ASU

2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which is intended to provide enhancements to annual income

tax disclosures. The standard will require more detailed information in the rate reconciliation table and for income taxes paid, among

other enhancements. The standard is effective for years beginning after December 15, 2024, early adoption is permitted. The Company does

not believe that adoption of this ASU will have a material impact on the Company’s consolidated financial statements.

Significant Accounting Policies

There have been no material changes

to the significant accounting policies previously disclosed in the Company’s Annual Report on Form 20-F for the year ended December

31, 2023.

ENLIVEX THERAPEUTICS LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31,

2024 (UNAUDITED)

NOTE 3 – CASH, CASH EQUIVALENTS

AND RESTRICTED CASH

| | |

March 31, | | |

December 31, | |

| (in thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash held in banks | |

$ | 1,913 | | |

$ | 813 | |

| Total cash and cash equivalents | |

| 1,913 | | |

| 813 | |

| Restricted cash – current – Prepaid expenses and other receivables | |

| 113 | | |

| 113 | |

| Restricted cash – noncurrent – Other assets | |

| 312 | | |

| 300 | |

| Total cash, cash equivalents and restricted cash shown in the statement of cash flows | |

$ | 2,338 | | |

$ | 1,226 | |

NOTE 4 – SHORT TERM DEPOSITS

| | |

March 31, | | |

December 31, | |

| (in thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Bank deposits in U.S.$ (annual average interest rates 6.000% and 6.195%) | |

$ | 6,101 | | |

$ | 6,240 | |

| Bank deposits in NIS (annual average interest rates 4.410% and 4.568%) | |

| 15,422 | | |

| 20,267 | |

| Total short-term deposits | |

$ | 21,523 | | |

$ | 26,507 | |

NOTE 5 – PREPAID EXPENSES AND

OTHER RECEIVABLES

| | |

March 31, | | |

December 31, | |

| (in thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Prepaid expenses | |

$ | 896 | | |

$ | 1,107 | |

| Tax authorities | |

| 38 | | |

| 116 | |

| Others | |

| 3,777 | | |

| 113 | |

| | |

$ | 4,711 | | |

$ | 1,336 | |

ENLIVEX THERAPEUTICS LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31,

2024 (UNAUDITED)

NOTE 6 – PROPERTY AND EQUIPMENT

Property and equipment, net consists of the following:

| |

March 31, | | |

December 31, | |

| (in thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cost: | |

| | |

| |

| Laboratory equipment | |

$ | 2,132 | | |

$ | 2,412 | |

| Computers | |

| 408 | | |

| 380 | |

| Office furniture & equipment | |

| 186 | | |

| 186 | |

| Leasehold improvements | |

| 1,431 | | |

| 1,431 | |

| | |

| 4,157 | | |

| 4,409 | |

| Accumulated depreciation: | |

| | | |

| | |

| Laboratory equipment | |

| 1,802 | | |

| 1,891 | |

| Computers | |

| 278 | | |

| 263 | |

| Office furniture & equipment | |

| 43 | | |

| 40 | |

| Leasehold improvements | |

| 735 | | |

| 676 | |

| | |

| 2,858 | | |

| 2,870 | |

| Depreciated cost | |

$ | 1,299 | | |

$ | 1,539 | |

Depreciation expenses for the three months ended March

31, 2024 and 2023 were $188 and $209 thousand, respectively.

NOTE 7 – OTHER ASSETS

| | |

March 31, | | |

December 31, | |

| (in thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Restricted cash | |

$ | 312 | | |

$ | 300 | |

| Long Term Deposit | |

| 7 | | |

| 8 | |

| Long-term prepaid expenses | |

| 110 | | |

| 179 | |

| Right-of-Use assets, net | |

| 943 | | |

| 1,041 | |

| | |

$ | 1,372 | | |

$ | 1,528 | |

NOTE 8 – ACCRUED EXPENSES AND OTHER LIABILITIES

| | |

March 31, | | |

December 31, | |

| (in thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Vacation, convalescence and bonus accruals | |

$ | 351 | | |

| $341 1 | |

| Employees and payroll related | |

| 312 | | |

| 422 | |

| Short term operating lease liabilities | |

| 341 | | |

| 346 | |

| Accrued expenses and other | |

| 1,962 | | |

| 2,892 | |

| | |

$ | 2,966 | | |

$ | 4,001 | |

ENLIVEX THERAPEUTICS LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31,

2024 (UNAUDITED)

NOTE 9 – LEASES

The Company is a party to operating

leases for its corporate offices, laboratory space, plant space and vehicles.

| | |

Three months ended March 31, | |

| (in thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| The components of lease expense were as follows: | |

| | |

| |

| Operating leases expenses | |

$ | 112 | | |

$ | 252 | |

| Supplemental consolidated cash flow information related to operating leases follows: | |

| | | |

| | |

| Cash used in operating activities | |

$ | 108 | | |

$ | 257 | |

| | |

| | | |

| | |

| Non-cash activity: | |

| | | |

| | |

| Right of use assets obtained in exchange for new operating lease liabilities | |

$ | - | | |

$ | 145 | |

| | |

March 31, | | |

December 31, | |

| (in thousands) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Supplemental information related to operating leases, including location of amounts reported in the accompanying consolidated balance sheets, follows: | |

| | |

| |

| Other assets - Right-of-Use assets | |

$ | 1,773 | | |

$ | 2,161 | |

| Accumulated amortization | |

| 830 | | |

| 1,120 | |

| Operating lease Right-of-Use assets, net | |

$ | 943 | | |

$ | 1,041 | |

| Lease liabilities – current - Accounts payable and accrued liabilities | |

$ | 341 | | |

$ | 346 | |

| Lease liabilities – noncurrent | |

| 587 | | |

| 686 | |

| Total operating lease liabilities | |

$ | 928 | | |

$ | 1,032 | |

| Weighted average remaining lease term in years | |

| 3.14 | | |

| 3.3 | |

| Weighted average annual discount rate | |

| 6.8 | % | |

| 6.7 | % |

| Maturities of operating lease liabilities as of March 31, 2024, were as follows: | |

| |

| 2024 (after March 31) | |

$ | 297 | |

| 2025 | |

| 348 | |

| 2026 | |

| 194 | |

| 2027 | |

| 120 | |

| 2028 and onwards | |

| 89 | |

| Total undiscounted lease liability | |

| 1,048 | |

| Less: Imputed interest | |

| (120 | ) |

| Present value of lease liabilities | |

$ | 928 | |

NOTE 10 – COMMITMENTS AND CONTINGENT LIABILITIES

The Company is required to pay royalties

to the State of Israel (represented by the Israeli Innovation Authority (the “IIA”)), computed on the basis of proceeds

from the sale or license of products for which development was supported by IIA grants. These royalties are generally 3% - 5% of sales

until repayment of 100% of the grants (linked to the dollar) received by the Company plus annual interest at a SOFR-based rate.

The gross amount of grants received

by the Company from the IIA, including accrued interest, as of March 31, 2024 was approximately $9.7 million. As of March 31, 2024, the

Company had not paid any royalties to the IIA.

ENLIVEX THERAPEUTICS LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31,

2024 (UNAUDITED)

NOTE 11 – EQUITY

| a) | All Company warrants are classified as a component of shareholders’

equity because such warrants are free standing financial instruments that are legally detachable, separately exercisable, do not embody

an obligation for the Company to repurchase its own shares, permit the holders to receive a fixed number of Ordinary Shares upon exercise,

require physical settlement and do not provide any guarantee of value or return. |

| | |

Number of

Warrants | | |

Weighted average exercise price | |

| Outstanding January 1, 2024 | |

| 202,251 | | |

$ | 23.31 | |

| Outstanding and exercisable March 31, 2024 | |

| 202,251 | | |

$ | 23.31 | |

Composed of the following:

| Number of Warrants | | |

Exercise Price Per Share | | |

Issuance date | |

Expiration date |

| | 22,750 | | |

$ | 10 | | |

February 26, 2020 | |

February 24, 2025 |

| | 160,727 | | |

$ | 25 | | |

February 12, 2021 | |

February 9, 2026 |

| | 18,774 | | |

$ | 25 | | |

February 17, 2021 | |

February 9, 2026 |

| | 202,251 | | |

| | | |

| |

|

| b) | During the three months ended March 31, 2024 the Company issued

178,931 Ordinary Shares under its ATM agreement, dated December 30, 2022, with Cantor Fitzgerald

& Co. and JMP Securities LLC (the “ATM Agreement”), for gross consideration of $540 net of $16 of issuance expenses. |

NOTE 12 – SHARE-BASED COMPENSATION

| a) | As of March 31, 2024, 5,028,704 Ordinary Shares were authorized

for issuance to employees, directors and consultants under the 2019 Equity Incentive Plan, of which 978,983 shares were available for

future grant. |

| b) | The following table contains information concerning options

granted under the existing equity incentive plans: |

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

Number of options | | |

Weighted average exercise price | | |

Number of options | | |

Weighted average exercise price | |

| Outstanding at beginning of period | |

| 2,842,496 | | |

$ | 5.63 | | |

| 2,939,434 | | |

$ | 5.85 | |

| Granted | |

| 250,000 | | |

$ | 3.21 | | |

| - | | |

$ | - | |

| Forfeited and expired | |

| (84,872 | ) | |

$ | 5.76 | | |

| (9,566 | ) | |

$ | 7.76 | |

| Exercised | |

| - | | |

$ | - | | |

| - | | |

$ | - | |

| Outstanding at end of period | |

| 3,007,624 | | |

$ | 5.41 | | |

| 2,929,868 | | |

$ | 5.84 | |

| Exercisable at end of period | |

| 2,235,323 | | |

$ | 5.54 | | |

| 2,053,017 | | |

$ | 5.58 | |

ENLIVEX THERAPEUTICS LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31,

2024 (UNAUDITED)

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

Number of options | | |

Weighted average exercise price | | |

Number of options | | |

Weighted average exercise price | |

| Non-vested at beginning of period | |

| 596,503 | | |

$ | 5.53 | | |

| 986,005 | | |

$ | 6.46 | |

| Granted | |

| 250,000 | | |

$ | 3.21 | | |

| - | | |

$ | - | |

| Vested | |

| (63,639 | ) | |

$ | 6.75 | | |

| (107,654 | ) | |

$ | 6.16 | |

| Forfeited | |

| (10,563 | ) | |

$ | 6.69 | | |

| (1,500 | ) | |

$ | 5.12 | |

| Non-vested at the end of period | |

| 772,301 | | |

$ | 4.67 | | |

| 876,851 | | |

$ | 6.48 | |

During the three months ended March

31, 2024 and 2023, the Company recognized $223 thousand and $530 thousand, respectively, of share-based compensation expenses related

to stock options.

As of March 31, 2024, the total

unrecognized estimated compensation cost related to outstanding non-vested stock options was $1,336 thousand, which is expected to be

recognized over a weighted average period of 1.61 years.

| c) | Set forth below is data regarding the range of exercise prices

and remaining contractual life for all options outstanding at March 31, 2024: |

| Exercise price | | |

Number of options outstanding | | |

Remaining contractual Life (in years) | | |

Intrinsic Value of Options Outstanding (in thousands) | | |

No. of options exercisable | |

| $ | 2.69 | | |

| 649,591 | | |

| 1.17 | | |

$ | 715 | | |

| 649,591 | |

| $ | 3.21 | | |

| 250,000 | | |

| 9.88 | | |

| 145 | | |

| - | |

| $ | 3.53 | | |

| 53,192 | | |

| 9.60 | | |

| 14 | | |

| - | |

| $ | 3.66 | | |

| 250,000 | | |

| 6.09 | | |

| 32 | | |

| 250,000 | |

| $ | 4.68 | | |

| 35,438 | | |

| 6.00 | | |

| - | | |

| 35,438 | |

| $ | 5.34 | | |

| 166,250 | | |

| 8.00 | | |

| - | | |

| 84,000 | |

| $ | 5.34 | | |

| 442,410 | | |

| 8.64 | | |

| - | | |

| 178,176 | |

| $ | 5.96 | | |

| 150,000 | | |

| 8.64 | | |

| - | | |

| 37,500 | |

| $ | 6.22 | | |

| 553,124 | | |

| 2.92 | | |

| - | | |

| 553,124 | |

| $ | 8.19 | | |

| 150,000 | | |

| 5.64 | | |

| - | | |

| 150,000 | |

| $ | 8.23 | | |

| 5,000 | | |

| 7.64 | | |

| - | | |

| 5,000 | |

| $ | 9.02 | | |

| 40,500 | | |

| 6.63 | | |

| - | | |

| 30,375 | |

| $ | 10.12 | | |

| 10,649 | | |

| 4.68 | | |

| - | | |

| 10,649 | |

| $ | 12.23 | | |

| 250,000 | | |

| 7.16 | | |

| - | | |

| 250,000 | |

| $ | 21.40 | | |

| 970 | | |

| 5.32 | | |

| - | | |

| 970 | |

| $ | 90.16 | | |

| 500 | | |

| 0.67 | | |

| - | | |

| 500 | |

| | | | |

| 3,007,624 | | |

| | | |

$ | 906 | | |

| 2,235,323 | |

ENLIVEX THERAPEUTICS LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31,

2024 (UNAUDITED)

| d) | The following table contains information concerning restricted

stock units granted under the 2019 Equity Incentive Plan: |

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

Number of shares | | |

Weighted average grant date fair value | | |

Number of shares | | |

Weighted average grant date fair value | |

| Nonvested at beginning of period | |

| 621,135 | | |

$ | 3.14 | | |

| 157,560 | | |

$ | 10.02 | |

| Forfeited | |

| (9,069 | ) | |

$ | 3.48 | | |

| (125 | ) | |

$ | 14.67 | |

| Granted | |

| - | | |

$ | - | | |

| - | | |

$ | - | |

| Vested | |

| (40,606 | ) | |

$ | 9.86 | | |

| (43,106 | ) | |

$ | 10.14 | |

| Nonvested at end of period | |

| 571,460 | | |

$ | 2.65 | | |

| 114,329 | | |

$ | 9.97 | |

The Company estimates the fair

value of restricted stock units based on the closing sales price of the Ordinary Shares on the date of grant (or the closing bid price,

if no sales were reported). For the three months ended March 31, 2024 and 2023, the Company recognized $160 thousand and $103 thousand,

respectively, of share-based compensation expense related to restricted stock units. Total share-based compensation expense related to

restricted stock units not yet recognized as of March 31, 2024 was $818 thousand, which is expected to be recognized over a weighted average

period of 1.52 years.

| e) | The following table summarizes share-based compensation expenses

related to grants under the 2019 Equity Incentive Plan included in the statements of operations: |

| | |

Three months ended March 31, | |

| (in thousands) | |

2024 | | |

2023 | |

| | |

| | | |

| | |

| Research & development | |

$ | 124 | | |

$ | 196 | |

| General & administrative | |

| 259 | | |

| 437 | |

| Total | |

$ | 383 | | |

$ | 633 | |

NOTE 13 – FAIR VALUE MEASUREMENT

The Company’s financial assets and liabilities measured

at fair value on a recurring basis consisted of the following types of instruments as of March 31, 2024 and December 31, 2023:

| |

March 31, 2024 | |

| (in thousands) | |

Total | | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| Cash and cash equivalents | |

$ | 1,913 | | |

$ | 1,913 | | |

$ | - | | |

$ | - | |

| Short term deposits | |

| 21,523 | | |

| 21,523 | | |

| - | | |

| - | |

| Long term deposits | |

| - | | |

| - | | |

| | | |

| | |

| Restricted cash | |

| 425 | | |

| 425 | | |

| - | | |

| - | |

| Total financial assets | |

$ | 23,861 | | |

$ | 23,861 | | |

$ | - | | |

$ | - | |

| |

December 31, 2023 | |

| (in

thousands) | |

Total | | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| Cash and cash equivalents | |

$ | 813 | | |

$ | 813 | | |

$ | - | | |

$ | - | |

| Short term deposits | |

| 26,507 | | |

| 26,507 | | |

| - | | |

| - | |

| Restricted cash | |

| 413 | | |

| 413 | | |

| - | | |

| - | |

| Total financial assets | |

$ | 27,733 | | |

$ | 27,733 | | |

$ | - | | |

$ | - | |

ENLIVEX THERAPEUTICS LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS MARCH 31,

2024 (UNAUDITED)

NOTE 14 – EVENTS SUBSEQUENT TO THE BALANCE

SHEET DATE

The Company evaluated all events and

transactions that occurred subsequent to the balance sheet date and prior to the date on which these unaudited condensed consolidated

financial statements were issued and determined that the following subsequent event necessitated disclosure:

| 1. | During the second quarter

of 2024 the Company issued 1,776 Ordinary Shares under the ATM Agreement |

| 2. | In April 2024, we announced the 28-day topline data from

the Phase II trial evaluating AllocetraTM in patients with sepsis. |

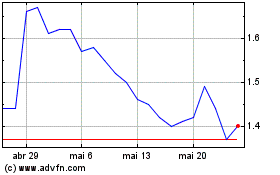

| 3. | On May 27, 2024, the Company entered into a securities purchase

agreement with a single institutional investor in connection with the issuance and sale by the Company in a registered direct offering

(the “Offering”) of (i) 2,060,000 Ordinary Shares, (ii) pre-funded warrants

to purchase up to 1,511,429 Ordinary Shares (the “Pre-Funded Warrants”),

(iii) Series A warrants to purchase up to 3,571,429 Ordinary Shares (the “Series

A Warrants”) and (iv) Series B warrants to purchase up to 3,571,429 Ordinary Shares

(the “Series B Warrants” and, together with the Series A Warrants, the “Investor Warrants”),

at a combined purchase price of (a) $1.40 per Ordinary Share and the associated Investor

Warrants, each to purchase one Ordinary Share, and (b) $1.399 per Pre-Funded Warrant and

the associated Investor Warrants, each to purchase one Ordinary Share, pursuant to the Company’s

effective shelf registration statement on Form F-3 (File No. 333-264561) and a related base prospectus, together with the related prospectus

supplement, dated as of May 27, 2024, filed with the SEC. |

Each Investor Warrant has an exercise

price of $1.40 per Ordinary Share and is immediately exercisable. The Series A Warrants expire upon the earlier of 18 months following

the issuance date and 60 days following the Company’s public announcement of positive topline results from the ENX-CL-05-001 trial

of AllocetraTM for the treatment of moderate-to-severe knee osteoarthritis. The Series B warrants expire upon the earlier of

five and one-half years following the issuance date and 60 days following the Company’s public announcement of its filing with the

U.S. Food and Drug Administration (the “FDA”) for approval for AllocetraTM’s osteoarthritis related indication.

Each Pre-Funded Warrant has an exercise price of $0.001 per Ordinary Share, is immediately exercisable and may be exercised at any time

and has no expiration date. The Investor Warrants and the Pre-Funded Warrants are subject to customary adjustments; however, no such warrants

contain any “ratchet” or other financial antidilution provisions. None of the Investor Warrants may be exercised if the aggregate

number of Ordinary Shares beneficially owned by the holder thereof would exceed 4.99% immediately after exercise thereof, subject to increase

to 9.99% at the option of the holder. None of the Pre-Funded Warrants may be exercised if the aggregate number of Ordinary Shares beneficially

owned by the holder thereof would exceed 9.99% immediately after exercise thereof.

H.C. Wainwright & Co. (“Wainwright”)

acted as placement agent in connection with Offering, and in consideration therefor the Company agreed to register and issue to Wainwright

warrants (the “Placement Agent Warrants”) to purchase up to 250,000 of Ordinary Shares pursuant to the above noted registration

statement. The Placement Agent Warrants comprise Series A Warrants to purchase 125,000 Ordinary Shares and Series B Warrants to purchase

125,000 Ordinary Shares, containing the same terms as the Investor Warrants, except that they are exercisable at a price of $1.75 per

Ordinary Share, and the Series B Warrants will expire upon the earlier of five years following the commencement of the sale of the securities

offered in the Offering and 60 days following the public announcement of the Company’s filing with the FDA for approval for AllocetraTM’s

osteoarthritis related indication. The net proceeds from the Offering were approximately $4.5 million after deducting Wainwright’s

fees and other expenses relating to the Offering. The Company intends to use the net proceeds from the Offering for working capital and

other general corporate purposes.

Exhibit 99.2

OPERATING

AND FINANCIAL REVIEW AND PROSPECTS

This Operating and Financial Review and Prospects

contains forward-looking statements, which may be identified by words such as “expects,” “plans,” “projects,”

“will,” “may,” “anticipates,” “believes,” “should,” “would”, “could”,

“intends,” “estimates,” “suggests,” “has the potential to” and other words and phrases

of similar meaning, including, without limitation, statements regarding expected cash balances, market opportunities for the results of

current clinical studies and preclinical experiments, and the effectiveness of, and market opportunities for, ALLOCETRATM programs,

all of which statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Investors are cautioned that forward-looking statements involve risks and uncertainties that may affect Enlivex’s business and prospects,

including the risks that Enlivex may not succeed in generating any revenues or developing any commercial products; that the products in

development may fail, may not achieve the expected results or effectiveness and/or may not generate data that would support the approval

or marketing of these products for the indications being studied or for other indications; that ongoing studies may not continue to show

substantial or any activity; and other risks and uncertainties that may cause results to differ materially from those set forth in the

forward-looking statements. The results of clinical trials in humans may produce results that differ significantly from the results of

clinical and other trials in animals. The results of early-stage trials may differ significantly from the results of more developed, later-stage

trials. The development of any products using the ALLOCETRATM product line could also be affected by a number of other

factors, including unexpected safety, efficacy or manufacturing issues, additional time requirements for data analyses and decision making,

the impact of pharmaceutical industry regulation, the impact of competitive products and pricing and the impact of patents and other proprietary

rights held by competitors and other third parties. In addition to the risk factors described above, investors should consider the economic,

competitive, governmental, technological and other factors discussed in Enlivex’s filings with the Securities and Exchange Commission,

including in its Annual Report on Form 20-F for the year ended December 31, 2023. The forward-looking statements contained in this

Operating and Financial Review and Prospects speak only as of the date the statements were made, and we do not undertake any obligation

to update forward-looking statements, except as required under applicable law.

Overview

Enlivex Therapeutics, Ltd.,

a company organized under the laws of the State of Israel (including its consolidated subsidiaries, “we”, “us”,

“our” or the “Company”), is a clinical-stage macrophage

reprogramming immunotherapy company, developing AllocetraTM, a universal, off-the-shelf cell therapy designed to reprogram

macrophages into their homeostatic state. Resetting non-homeostatic macrophages into their homeostatic state is critical for immune system

rebalancing and resolution of life-threatening conditions. Non-homeostatic macrophages contribute significantly to the severity of the

respective diseases. By restoring macrophage homeostasis, Allocetra™ has the potential to provide a novel immunotherapeutic mechanism

of action for debilitating and life-threatening clinical indications that are defined as “unmet medical needs,” as a stand-alone

therapy or in combination with leading therapeutic agents.

We believe the Company’s

primary innovative immunotherapy, AllocetraTM, represents a paradigm shift in macrophage

reprogramming, moving from targeting a specific subset of macrophages or a specific pathway affecting macrophages activity, to a fundamental

view of macrophage homeostasis. Restoring macrophage homeostasis may induce the immune system to rebalance itself to normal levels of

operation, thereby promoting disease resolution.

The

Company is focused on two clinical program verticals as its main inflammatory and autoimmune indications: sepsis and osteoarthritis. Additionally,

the Company is seeking external collaborations or out-licensing opportunities for the development of Allocetra™ as a next-generation

solid cancer immunotherapy. The Company believes that negatively-reprogrammed macrophages may be key contributors to disease severity

across the Indications, and thus effective reprogramming of these previously negative-reprogrammed macrophages into their respective homeostatic

states may provide diseases resolution for these Indications, some of which are considered “unmet medical needs”.

Financial Overview

Since inception, we have incurred

significant losses in connection with our research and development and have not generated any revenue. We have funded our operations primarily

through grants from the IIA and the sale of equity and equity linked securities in public and private offerings. As of March 31, 2024,

we had approximately $23.4 million in cash and cash equivalents and short-term bank deposits and had an accumulated deficit of approximately

116.2 million, see “—Liquidity and Capital Resources” below.

In

September 2023, we announced a strategic reprioritization plan, pursuant to which we determined to increase our existing focus on inflammatory

and autoimmune indications. As part of the strategic reprioritization plan, in addition to the ongoing Phase II trial of AllocetraTM

in patients with sepsis, the Company initiated a clinical program in osteoarthritis, which is a degenerative disease with low grade

inflammation and an indication with a substantial unmet medical need that potentially represents a multibillion dollar commercial market.

Within the osteoarthritis program, the Company announced the dosing of the first patient in a Phase I/II investigator-initiated clinical

trial enrolling patients with severe knee osteoarthritis who had been indicated for knee replacement surgeries and are offered to inject

AllocetraTM locally into the diseased knee as a potential alternative for pain resolution and knee functionality in lieu of

replacement surgery. In addition to this Phase I/II trial, following receipt of the approval of the IMOH in January 2024, the Company

initiated a multi-country randomized, controlled Phase I/II clinical trial evaluating AllocetraTM in patients with moderate

knee osteoarthritis in early 2024. In April 2024, we announced that the Danish Medicines Agency authorized the expansion of this

trial into Denmark, as well as the dosing of the first two patients in the trial. This Phase I/II

clinical trial is expected to enroll up to 160 patients and is designed to be a multi-center, multi-country, double-blinded, placebo-controlled

and statistically-powered study to evaluate efficacy as well as safety of AllocetraTM, and potentially allow the Company to

design and initiate a clinical registrational trial upon its completion.

The

Company’s revised strategy is targeted at obtaining a topline data readout from the randomized, controlled Phase I/II trial in up

to 160 patients with moderate knee osteoarthritis by the third quarter of 2025 and from the Phase I/II investigator-initiated clinical

trial in 12 patients with severe knee osteoarthritis who had been indicated for knee replacement surgeries by the end of the third quarter

of 2024.

Pursuant

to the strategic reprioritization plan, and in light of the new guidelines and regulatory initiatives set by the FDA for drug development

in oncology, which may result in longer clinical development cycles as foundations for regulatory approvals, the Company ceased the internal

clinical development of its various oncology indications and plans to seek external collaborations or out-licensing opportunities for

the development of Allocetra™ as a next-generation solid cancer immunotherapy.

As

a result of the Company’s reprioritization of its clinical indications and focus on the inflammatory and auto-immune verticals,

the Company reduced its workforce by approximately 50%. The workforce reductions and the savings associated with the reclassification

of the oncology indications as candidates for external collaborations or out-licensing opportunities in lieu of internal development are

expected to result in a substantial extension of the Company’s cash runway through the end of 2025. The revised, extended cash runway

is expected to support the timeline for the topline data readouts of the end-stage knee osteoarthritis Phase I/II trial as well as the

randomized, controlled Phase II clinical trial in osteoarthritis.

We expect that we will continue to incur operating

losses, which may be substantial over the next several years, and we may need to obtain additional funds to further develop our research

and development programs

Recent Developments In Israel

In October 2023, Hamas terrorists

infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian and military targets. Hamas

also launched extensive rocket attacks on the Israeli population and industrial centers located along Israel’s border with the Gaza

Strip and in other areas within the State of Israel. These attacks resulted in thousands of deaths and injuries, and Hamas additionally

kidnapped many Israeli civilians and soldiers. Following the attack, Israel’s security cabinet declared war against Hamas and commenced

a military campaign against Hamas. We cannot currently predict the intensity or duration of Israel’s war against Hamas, nor can

we predict how this war will ultimately affect our business and operations.

Costs and Operating Expenses

Our current costs and operating

expenses consist of two components: (i) research and development expenses; and (ii) general and administrative expenses.

Research and Development

Expenses

Our research and development

expenses consist primarily of research and development activities at our laboratory in Israel, including drug and laboratory supplies

and costs for facilities and equipment, outsourced development expenses, including the costs of regulatory consultants and certain other

service providers, salaries and related personnel expenses (including share based compensation) and fees paid to external service providers

and the costs of preclinical studies and clinical trials. We charge all research and development expenses to operations as they are incurred.

We expect our research and development expenses to remain our primary expenses in the near future as we continue to develop our product

candidates. Increases or decreases in research and development expenditures are attributable to the number and duration of our preclinical

and clinical studies.

We expect that a large percentage

of our research and development expenses in the future will be incurred in support of our current and future preclinical and clinical

development projects. Due to the inherently unpredictable nature of preclinical and clinical development processes, we are unable to estimate

with any certainty the costs we will incur in the continued development of our product candidates in our pipeline for potential commercialization.

Furthermore, although we expect to apply for additional grants from the IIA, we cannot be certain that we will obtain such grants. Clinical

development timelines, the probability of success and development costs can differ materially from expectations. We expect to continue

to test our product candidates in preclinical studies for toxicology, safety and efficacy and to conduct additional clinical trials for

our product candidates.

While we are currently focused

on advancing our product development, our future research and development expenses will depend on the clinical success of our product

candidates, as well as ongoing assessments of each candidate’s commercial potential. As we obtain results from clinical trials,

we may elect to discontinue or delay clinical trials for our product candidates in certain of the Indications in order to focus our resources

on more promising indications for any such product candidate. Completion of clinical trials may take several years or more, but the length

of time generally varies according to the type, complexity, novelty and intended use of a product candidate.

We expect our research and

development expenses to increase in the future as we continue the advancement of our clinical product development for the Indications

and as we potentially pursue additional indications. The lengthy process of completing clinical trials and seeking regulatory approval

for our product candidates requires the expenditure of substantial resources. Any failure or delay in completing clinical trials, or in

obtaining regulatory approvals, could cause a delay in generating product revenue and cause our research and development expenses to increase

and, in turn, have a material adverse effect on our operations.

General and Administrative

Expenses

General and administrative

expenses consist primarily of compensation (including share-based compensation) for employees in executive and operational roles, including

accounting, finance, investor relations, information technology and human resources. Our other significant general and administrative

expenses include facilities costs, professional fees for outside accounting and legal services, including legal work in connection with

patent applications, travel costs and insurance premiums. We expect that our general and administrative expenses will increase over time,

as we currently expect increases in the number of our executive, accounting and administrative personnel due to our anticipated growth.

Other expenses, net

Other expenses, net consists

of bank fees, exchange rate differences and gains and losses resulting from our investments in bank deposits and marketable securities.

Critical Accounting Policies and Estimates

The preparation of financial

statements in accordance with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates

and assumptions that affect the amounts reported in our financial statements and accompanying notes. Management bases its estimates on

historical experience, market and other conditions, and various other assumptions it believes to be reasonable. Although these estimates

are based on management’s best knowledge of current events and actions that may impact us in the future, the estimation process

is, by its nature, uncertain given that estimates depend on events over which we may not have control. If market and other conditions

change from those that we anticipate, our financial statements may be materially affected. In addition, if our assumptions change, we

may need to revise our estimates, or take other corrective actions, either of which may also have a material effect in our financial statements.

We review our estimates, judgments, and assumptions used in our accounting practices periodically and reflect the effects of revisions

in the period in which they are deemed to be necessary. We believe that these estimates are reasonable; however, our actual results may

differ from these estimates.

We believe the following accounting

policies to be the most critical to the judgments and estimates used in the preparation of our financial statements. For additional detail

regarding our significant accounting policies, please see the notes to our audited consolidated financial statements contained in our

Annual Report on Form 20-F for the year ended December 31, 2023 as filed with the U.S. Securities and Exchange Commission (the “SEC”)

on April 30, 2024.

Share-Based Compensation

We have issued restricted

stock units and options to purchase our ordinary shares. Share-based compensation cost is measured at the grant date based on the fair

value of the award and is recognized as an expense over the requisite service/vesting period. Determining the appropriate fair value model

and calculating the fair value of share-based payment awards require the use of highly subjective assumptions, including the expected

life of the share-based payment awards and share price volatility.

We estimate the grant date

fair value of share options and the related compensation expense, using the Black-Scholes option valuation model. This option valuation

model requires the input of subjective assumptions including: (1) expected life (estimated period of time outstanding) of the options

granted, (2) volatility, (3) risk-free rate and (4) dividends. In general, the assumptions used in calculating the fair value of share-based

payment awards represent management’s best estimates, but the estimates involve inherent uncertainties and the application of management

judgment.

Preclinical and clinical

trial accruals

The Company makes estimates

of its accrued expenses as of each balance sheet date in the financial statements based on the facts and circumstances known at that time.

Accrued expenses for preclinical studies and clinical trials are based on estimates of costs incurred and fees that may be associated

with services provided by contract research organizations, clinical trial sites and other clinical trial-related activities. Payments

under certain contracts with such parties depend on factors such as successful enrollment of patients, site initiation and the completion

of clinical trial milestones. If possible, the Company obtains information regarding unbilled services directly from these service providers.

However, the Company may be required to estimate these services based on other available information. If the Company underestimates or

overestimates the activities or fees associated with a study or service at a given point in time, adjustments to research and development

expenses may be necessary in future periods. Historically, estimated accrued liabilities have approximated actual expense incurred.

Results of Operations

Three-Months

Ended March 31, 2024 Compared to Three-Months Ended March 31, 2023

The table below provides our results of operations

for the three months ended March 31, 2024 and March 31, 2023:

| | |

Three Months Ended

March 31 | |

| | |

2024 | | |

2023 | |

| | |

(In thousands, except per share data)

(unaudited) | |

| Research and development expenses | |

$ | 2,857 | | |

$ | 5,176 | |

| General and administrative expenses | |

| 1,093 | | |

| 1,607 | |

| Loss on disposal group of assets held for sale | |

| 201 | | |

| - | |

| Operating (loss) | |

| (4,151 | ) | |

| (6,783 | ) |

| Finance income (expenses), net | |

| 11 | | |

| (435 | ) |

| Operating loss post other expenses, net | |

| (4,140 | ) | |

| (7,218 | ) |

| Taxes on income | |

| - | | |

| - | |

| Net loss | |

| (4,140 | ) | |

| (7,218 | ) |

| | |

| | | |

| | |

| Basic loss per share | |

$ | (0.22 | ) | |

$ | (0.39 | ) |

| Diluted loss per share | |

$ | (0.22 | ) | |

$ | (0.39 | ) |

Research and Development

Expenses

For the three months ended

March 31, 2024 and 2023, we incurred research and development expenses in the aggregate of $2,857,000 and $5,176,000, respectively. The

decrease of $2,319,000, or 45%, in research and development expenses for the three months ended March 31, 2024 as compared to the first

quarter of 2023 was primarily due $741,000 decrease in salaries as a result of the reduction in

workforce as part of the strategic reprioritization plan, a $1,288,000 decrease in

expenses for clinical studies and pre-clinical studies and purchase of materials due to a decrease in the number of AllocetraTM doses

that were manufactured, and by a $170,000 decrease in lease and overhead expenses .

General and Administrative

Expenses

For the three months ended

March 31, 2024 and 2023, we incurred general and administrative expenses in the aggregate of $1,093,000 and $1,607,000, respectively.

The decrease of $514,000, or 32%, in general and administrative expenses for the first quarter of 2024 as compared to the comparable 2023

period was primarily due to a $178,000 decrease in expense with respect to equity awards granted to directors, officers and employees,

a $105,000 decrease in insurance expenses (due to the decrease in the directors’ and officer’s liability insurance premium)

a $86,000 decrease in lease and overhead expense, and a $48,000 decrease in salaries.

Loss on Disposal Group of Assets Held for

Sale

During 2023, the Company adopted

its strategic reprioritization plan, as described above, as part of which the Company determined to sell its manufacturing plant facility

in Yavne, Israel. Therefore, the right of use of the manufacturing plant, the lease liability relating to the manufacturing plant and

the leasehold improvements installed in the leased plant were classified as assets held for sale and liability held for sale (as applicable).

As a result, for the year ended December 31, 2023, we recognized a loss of $4,244,000 on the group of assets held for sale. On the first

quarter of 2024 we recorded an additional $201,000 loss on the group of assets held for sale.

In September 2021, we entered

into the Lease Agreement for a 2,500 square meter property in Yavne, Israel to construct a new 1,600 square meter facility for the manufacture

of Allocetra™, which was completed in the fourth quarter of 2022. As part of our strategic

reprioritization plan, we determined to sell such leased manufacturing facility, together with the Equipment, and assign the Lease Agreement.

On March 31, 2024, we entered into the Yavne Facility Sale Agreement with the purchaser, pursuant to which the purchaser agreed to acquire

the Equipment and assume all of our obligations under the Lease Agreement, effective as of April 1, 2024. The Purchase Price payable to

the Company of 13.0 million NIS (approximately $3.5 million), which is payable in installments, consisting of an initial payment of NIS

4.0 million (approximately $1.08 million), which was paid on April 2, 2024, and 24 equal monthly installment payments of NIS 375,000 (approximately

$102,000), commencing on April 1, 2024. Pursuant to the Yavne Facility Sale Agreement, title to the Equipment will transfer to the purchaser

only upon full payment of the total Purchase Price, but risk of loss to the Equipment passed to the purchaser on April 1, 2024. Subject

to certain conditions, the purchaser may, in its sole discretion, prior to October 1, 2025, prepay (i) all of the remaining outstanding

Purchase Price at a 4% discount, or (ii) a portion of the remaining outstanding Purchase Price, in an amount of not less than NIS 4.0

million (approximately $1.08 million), at a 2% discount, in which case, the Purchase Price remaining outstanding thereafter shall continue

to be paid in monthly instalments of NIS 375,000 each (approximately $102,000).

Operating Loss

Due to a decrease in research

and development expenses and decrease in General and administrative expenses for the three months ended March 31, 2024, our operating

loss was $4,151,000 representing a decrease of $2,632,000, or 39%, as compared to our operating loss of $6,783,000 for the three months

ended March 31, 2023. This decrease resulted primarily from decrease in research and development expenses, including expenses relating

to conducting studies and trials, and decrease in salaries as a result of the reduction in workforce as part of the strategic reprioritization

plan

Finance income (expense),

net

Finance income (expense),

net consists of the following:

| ● | Interest

earned on our cash and cash equivalents and bank deposits; and |

| ● | Expenses

or income resulting from fluctuations of the NIS and Euro, in which a portion of our assets and liabilities are denominated, against

the U.S. dollar; |

For the three months ended March

31, 2024 and 2023, we recorded finance income (expenses), net of $11,000 and $(435,000), respectively. The increase of $446,000, or 103%,

in finance income , net for the three months ended March 31, 2024, as compared to finance expenses, net in the three months ended March

31, 2023 was primarily due to a loss of $260,000 from exchange differences in the first quarter of 2024 as compared to $899,000 in 2023

which was offset by $274,000 income from interest on cash equivalents and bank deposits in 2024 as compared to $461,000 in 2023

Net Loss

For the three months ended March 31, 2024, our

net loss was $4,140,000, representing a decrease of $3,078,000, or 43%, as compared to our net loss of $7,218,000 for the comparable

prior year period. This decrease resulted primarily from a decrease in clinical and pre-clinical studies, material consumption and

salaries, and from increase in finance income, net,

Cash Flows

Three Months Ended March

31, 2024 Compared to Three Months Ended March 31, 2023

For the three months ended

March 31, 2024 and 2023, net cash used in operations was$4,510,000 and $5,784,000, respectively. The decrease in net cash used in operations

for 2024 was primarily due to a decrease in payments to suppliers, service providers and employees as result of a decrease in payroll

expenses, and insurance expenses, as well as decrease in research and development expenses, mainly from decreased costs of clinical and

pre-clinical studies.

For the three months ended

March 31, 2024 and 2023, net cash (used in) provided by investing activities was $5,098,000 and $(31,346,000) respectively. The increase

in net cash provided by investing activities for 2024 as compared to 2023 resulted primarily from release net of investments in bank deposits

of $8,483,000 in 2024 as compared to net investment in bank deposit of $31,184,000 in the comparable prior year period.

For the three months ended

March 31, 2024 and 2023, net cash provided by financing activities was $524,000 and $318,000, respectively. This increase in cash provided

by financing activities for 2024 as compared to 2023 resulted primarily from net proceeds of $524,000 from our issuance of ordinary shares

under the ATM Agreement (as defined below) as compared to proceeds of $318,000 from our issuance of ordinary shares under the ATM Agreement

in the comparable prior year period.

Liquidity and Capital Resources

We have incurred substantial

losses since our inception. As of March 31, 2024, we had an accumulated deficit of approximately 116.2 million and working capital (current

assets less current liabilities) of approximately 24.7 million. We expect to incur losses from operations for the foreseeable future.

Developing product candidates,

conducting clinical trials and commercializing products are expensive, and we will need to raise substantial additional funds to achieve

our strategic objectives. We believe that our existing cash resources will be sufficient to fund our projected cash requirements approximately

through the end of 2025. As described above, in September 2023, we adopted a strategic reprioritization program designed to extend our

cash runway until the end of 2025. Nevertheless, we will require significant additional financing in the future to fund our operations,

including if and when we progress into additional clinical trials, obtain regulatory approval for any of our product candidates and commercialize

the same. We believe that we will need to raise significant additional funds before we have any cash flow from operations, if at all.

Our future capital requirements will depend on many factors, including:

| |

● |

the progress and costs of our preclinical studies, clinical trials and other research and development activities; |

| |

● |

the scope, prioritization and number of our clinical trials and other research and development programs; |

| |

● |

the amount of revenues and contributions we receive under future licensing, development and commercialization arrangements with respect to our product candidates; |

| |

● |

the costs of the development and expansion of our operational infrastructure; |

| |

● |

the costs and timing of obtaining regulatory approval for our product candidates; |

| |

● |

the costs of filing, prosecuting, enforcing and defending patent claims and other intellectual property rights; |

| |

● |

the costs and timing of securing manufacturing arrangements for clinical or commercial production; |

| |

● |

the costs of contracting with third parties to provide sales and marketing capabilities for us; |

| |

● |

the costs of acquiring or undertaking development and commercialization efforts for any future products, product candidates or platforms; |

| |

|

|

| |

● |

the receipt of additional government grants; |

| |

|

|

| |

● |

the magnitude of our general and administrative expenses; and |

| |

● |

any cost that we may incur under future in-

and out-licensing arrangements relating to our product candidates. |

Other than under our ATM Agreement,

we currently do not have any agreements for future external funding. In the future, we will need to raise additional funds, and we may

decide to raise additional funds even before we need such funds if the conditions for raising capital are favorable. Until we can generate

significant recurring revenues, we expect to satisfy our future cash needs through debt or equity financings, credit facilities or by

out-licensing applications of our product candidates. The sale of equity, including under our ATM Agreement, or convertible debt securities

may result in dilution to our existing shareholders. The incurrence of indebtedness would result in increased fixed obligations and could

also subject us to covenants that restrict our operations. We cannot be certain that additional funding, whether through grants from the

IIA, financings, credit facilities or out-licensing arrangements, will be available to us on acceptable terms, if at all. If sufficient

funds are not available, we may be required to delay, reduce the scope of or eliminate research or development plans for, or commercialization

efforts with respect to, one or more applications of our product candidates, or obtain funds through arrangements with collaborators or

others that may require us to relinquish rights to certain potential products that we might otherwise seek to develop or commercialize

independently.

ATM Agreement

On December 30, 2022, we entered

into an agreement (the “ATM Agreement”) with Cantor Fitzgerald & Co. and JMP Securities LLC (each referred to as

an “Agent”, and together, the “Agents”), as sales agents, pursuant to which we may elect to sell,

but are not obligated to sell, ordinary shares having an aggregate offering price of up to $100,000,000 from time to time through the

Agents. Our offer and sale of ordinary shares under the ATM Agreement may be made in transactions deemed to be “at-the-market”

offerings as defined in Rule 415 under the Securities Act, including sales made directly on or through the Nasdaq Capital Market,

or any other existing trading market in the United States for the ordinary shares, sales made to or through a market maker other than

on an exchange or otherwise, directly to an Agent as principal, in negotiated transactions, or in any other method permitted by law, which

may include block trades. We have agreed to pay the Agents an aggregate commission of 3.0% of the gross sales price from each sale of

ordinary shares under the ATM Agreement. Any sale of ordinary shares under the ATM Agreement will be made pursuant to our effective shelf

registration statement on Form F-3, including the prospectus contained therein (File No. 333-264561). During the first quarter of 2024,

we received aggregate net proceeds of approximately $524,000 from the sale of 178,931 ordinary shares under the ATM Agreement.

Financing During 2024

On May 27, 2024, we entered

into a securities purchase agreement with a single institutional investor in connection with the issuance and sale by the Company in a

registered direct offering (the “Offering”) of (i) 2,060,000 of our ordinary shares, (ii) pre-funded warrants to purchase