Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Novembro 2024 - 11:44AM

Edgar (US Regulatory)

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

—

99.1%

Aerospace

—

2.0%

16,500

Allient

Inc.

......................

$

313,335

1,000

L3Harris

Technologies

Inc.

...........

237,870

290,000

Rolls-Royce

Holdings

plc†

...........

2,044,036

1,500

Spirit

AeroSystems

Holdings

Inc.,

Cl. A†

.

48,765

6,000

Triumph

Group

Inc.†

...............

77,340

2,721,346

Agriculture

—

0.2%

4,000

American

Vanguard

Corp.

...........

21,200

12,000

Limoneira

Co.

....................

318,000

339,200

Automotive

—

3.3%

4,000

Blue

Bird

Corp.†

..................

191,840

4,000

Daimler

Truck

Holding

AG

...........

149,741

4,100

Ferrari

NV

......................

1,927,451

154,300

Iveco

Group

NV

..................

1,548,923

23,000

Traton

SE

.......................

752,712

4,570,667

Automotive:

Parts

and

Accessories

—

3.2%

50,013

Brembo

NV

.....................

547,423

102,000

Dana

Inc.

.......................

1,077,120

46,002

Garrett

Motion

Inc.†

...............

376,296

1,200

Linamar

Corp.

...................

55,987

16,100

Modine

Manufacturing

Co.†

..........

2,137,919

4,000

Monro

Inc.

......................

115,440

4,310,185

Aviation:

Parts

and

Services

—

1.6%

15,000

AAR

Corp.†

.....................

980,400

1,000

Curtiss-Wright

Corp.

...............

328,690

12,500

Ducommun

Inc.†

.................

822,875

2,131,965

Broadcasting

—

3.3%

7,000

Beasley

Broadcast

Group

Inc.,

Cl. A†

....

75,320

6,500

Cogeco

Inc.

.....................

287,500

35,000

Corus

Entertainment

Inc.,

Cl. B†

.......

4,399

540,000

Grupo

Televisa

SAB,

ADR

............

1,382,400

250,000

ITV

plc

.........................

267,557

500

Liberty

Broadband

Corp.,

Cl. A†

.......

38,410

103

Liberty

Broadband

Corp.,

Cl. C†

.......

7,961

97,500

Sinclair

Inc.

.....................

1,491,750

6,500

Sirius

XM

Holdings

Inc.

.............

153,736

54,500

TEGNA

Inc.

.....................

860,010

4,569,043

Building

and

Construction

—

1.8%

11,041

Arcosa

Inc.

......................

1,046,245

3,500

Bouygues

SA

....................

117,115

1,000

Carrier

Global

Corp.

...............

80,490

1,000

IES

Holdings

Inc.†

................

199,620

Shares

Market

Value

6,000

Johnson

Controls

International

plc

.....

$

465,660

5,000

Knife

River

Corp.†

.................

446,950

3,500

Masterbrand

Inc.†

.................

64,890

2,420,970

Business

Services

—

5.8%

33,500

Herc

Holdings

Inc.

................

5,340,905

68,500

JCDecaux

SE†

...................

1,532,640

13,500

Loomis

AB

......................

443,715

47,000

Rentokil

Initial

plc

.................

228,977

4,000

Rentokil

Initial

plc,

ADR

.............

99,720

4,000

Ströeer

SE

&

Co.

KGaA

.............

255,802

7,901,759

Cable

and

Satellite

—

1.6%

1,500

Cogeco

Communications

Inc.

.........

79,301

48,000

Liberty

Global

Ltd.,

Cl. A†

...........

1,013,280

40,500

Liberty

Global

Ltd.,

Cl. C†

...........

875,205

15,000

Megacable

Holdings

SAB

de

CV

.......

31,219

26,057

WideOpenWest

Inc.†

...............

136,799

2,135,804

Computer

Software

and

Services

—

0.4%

3,000

Donnelley

Financial

Solutions

Inc.†

.....

197,490

4,000

N-able

Inc.†

.....................

52,240

5,000

PAR

Technology

Corp.†

.............

260,400

510,130

Consumer

Products

—

3.4%

10,000

BellRing

Brands

Inc.†

..............

607,200

12,000

Edgewell

Personal

Care

Co.

..........

436,080

33,000

Energizer

Holdings

Inc.

.............

1,048,080

5,500

Essity

AB,

Cl. B

...................

171,620

11,500

Marine

Products

Corp.

.............

111,435

15,000

Mattel

Inc.†

.....................

285,750

45,000

Nintendo

Co.

Ltd.,

ADR

.............

599,400

7,700

Salvatore

Ferragamo

SpA

............

59,399

32,000

Scandinavian

Tobacco

Group

A/S

......

491,238

6,000

Shiseido

Co.

Ltd.

.................

161,767

7,000

Spectrum

Brands

Holdings

Inc.

.......

665,980

4,637,949

Consumer

Services

—

1.1%

11,500

Ashtead

Group

plc

................

889,593

500

Boyd

Group

Services

Inc.

............

75,774

350

Cie

de

L'Odet

SE

..................

612,455

1,577,822

Diversified

Industrial

—

7.3%

102,000

Ampco-Pittsburgh

Corp.†

...........

204,000

34,700

Ardagh

Group

SA†

................

167,081

3,500

AZZ

Inc.

........................

289,135

1,000

Barnes

Group

Inc.

.................

40,410

11,200

Enpro

Inc.

......................

1,816,416

33,000

Greif

Inc.,

Cl. A

...................

2,067,780

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Diversified

Industrial

(Continued)

9,500

Griffon

Corp.

....................

$

665,000

8,500

Jardine

Matheson

Holdings

Ltd.

.......

332,010

2,400

Moog

Inc.,

Cl. A

..................

484,848

25,000

Myers

Industries

Inc.

..............

345,500

5,000

Smiths

Group

plc

.................

112,103

22,000

Steel

Partners

Holdings

LP†

..........

900,900

8,200

Sulzer

AG

.......................

1,340,911

40,000

Toray

Industries

Inc.

...............

234,670

39,500

Tredegar

Corp.†

..................

287,955

12,000

Trinity

Industries

Inc.

...............

418,080

10,000

Velan

Inc.†

......................

60,631

7,000

Wartsila

OYJ

Abp

.................

156,620

9,924,050

Educational

Services

—

0.2%

13,500

Universal

Technical

Institute

Inc.†

......

219,510

Electronics

—

3.0%

4,000

Flex

Ltd.†

.......................

133,720

20,000

Mirion

Technologies

Inc.†

...........

221,400

10,000

Resideo

Technologies

Inc.†

..........

201,400

37,000

Sony

Group

Corp.,

ADR

.............

3,573,090

4,129,610

Energy

and

Utilities:

Alternative

Energy

—

0.2%

10,200

NextEra

Energy

Partners

LP

..........

281,724

Energy

and

Utilities:

Electric

—

1.2%

115,000

Algonquin

Power

&

Utilities

Corp.

......

628,378

35,000

Algonquin

Power

&

Utilities

Corp.,

New

York

.........................

190,750

7,500

Fortis

Inc.

......................

340,770

12,500

TXNM

Energy

Inc.

.................

547,125

1,707,023

Energy

and

Utilities:

Integrated

—

1.0%

21,000

Avista

Corp.

.....................

813,750

3,700

Emera

Inc.

......................

145,790

5,000

Hawaiian

Electric

Industries

Inc.†

......

48,400

100,000

Hera

SpA

.......................

398,730

1,406,670

Energy

and

Utilities:

Natural

Gas

—

1.7%

40,000

Innovex

International

Inc.†

...........

587,200

25,000

National

Fuel

Gas

Co.

..............

1,515,250

10,000

PrairieSky

Royalty

Ltd.

.............

203,261

2,305,711

Energy

and

Utilities:

Services

—

0.1%

1,500

Weatherford

International

plc

.........

127,380

Shares

Market

Value

Energy

and

Utilities:

Water

—

2.1%

70,000

Beijing

Enterprises

Water

Group

Ltd.

....

$

21,791

1,500

Consolidated

Water

Co.

Ltd.

..........

37,815

17,000

Mueller

Water

Products

Inc.,

Cl. A

.....

368,900

30,000

Primo

Water

Corp.

................

757,500

47,500

Severn

Trent

plc

..................

1,677,805

2,863,811

Entertainment

—

7.1%

30,000

Atlanta

Braves

Holdings

Inc.,

Cl. A†

....

1,264,500

27,011

Atlanta

Braves

Holdings

Inc.,

Cl. C†

....

1,075,038

227,000

Entain

plc

.......................

2,316,218

2,000

GAN

Ltd.†

......................

3,540

16,000

Golden

Entertainment

Inc.

...........

508,640

500

Liberty

Media

Corp.-Liberty

Live,

Cl. A†

..

24,755

47

Liberty

Media

Corp.-Liberty

Live,

Cl. C†

..

2,413

600

Madison

Square

Garden

Entertainment

Corp.†

.......................

25,518

4,600

Madison

Square

Garden

Sports

Corp.†

..

957,996

24,000

Manchester

United

plc,

Cl. A†

.........

388,320

113,750

Ollamani

SAB†

...................

214,675

40,500

Paramount

Global,

Cl. A

.............

885,330

6,000

Sphere

Entertainment

Co.†

..........

265,080

18,500

Ubisoft

Entertainment

SA†

...........

207,992

15,000

Universal

Music

Group

NV

...........

392,385

75,000

Vivendi

SE

......................

866,587

30,000

Warner

Bros

Discovery

Inc.†

.........

247,500

9,646,487

Environmental

Services

—

1.1%

18,000

Renewi

plc

......................

153,536

6,000

Stericycle

Inc.†

...................

366,000

20,000

TOMRA

Systems

ASA

..............

294,704

3,700

Waste

Connections

Inc.

.............

661,634

1,475,874

Equipment

and

Supplies

—

6.0%

23,200

Commercial

Vehicle

Group

Inc.†

.......

75,400

1,200

Federal

Signal

Corp.

...............

112,152

31,500

Flowserve

Corp.

..................

1,628,235

10,500

Graco

Inc.

......................

918,855

17,000

Interpump

Group

SpA

..............

792,518

48,500

Mueller

Industries

Inc.

..............

3,593,850

500

Snap-on

Inc.

....................

144,855

4,500

Watts

Water

Technologies

Inc.,

Cl. A

....

932,355

8,198,220

Financial

Services

—

4.2%

750

Credit

Acceptance

Corp.†

............

332,565

6,200

EXOR

NV

.......................

663,582

51,000

FinecoBank

Banca

Fineco

SpA

........

872,849

100

First

Citizens

BancShares

Inc.,

Cl. A

....

184,095

41,500

Flushing

Financial

Corp.

.............

605,070

6,500

FTAI

Aviation

Ltd.

.................

863,850

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Financial

Services

(Continued)

215,000

GAM

Holding

AG†

.................

$

49,384

5,000

I3

Verticals

Inc.,

Cl. A†

.............

106,550

7,500

Janus

Henderson

Group

plc

..........

285,525

8,000

Kinnevik

AB,

Cl. A

.................

65,294

13,000

Kinnevik

AB,

Cl. B

.................

105,707

1,800

PROG

Holdings

Inc.

...............

87,282

70,000

Resona

Holdings

Inc.

..............

485,872

22,200

Synovus

Financial

Corp.

............

987,234

5,694,859

Food

and

Beverage

—

11.9%

3,500

Britvic

plc

......................

59,661

280

Chocoladefabriken

Lindt

&

Spruengli

AG

.

3,609,381

70,000

ChromaDex

Corp.†

................

255,500

3,000

Corby

Spirit

and

Wine

Ltd.,

Cl. A

.......

28,304

135,000

Davide

Campari-Milano

NV

..........

1,142,092

12,000

Fevertree

Drinks

plc

...............

132,358

9,000

Fomento

Economico

Mexicano

SAB

de

CV,

ADR

.........................

888,390

1,000

Heineken

Holding

NV

...............

75,471

42,000

ITO

EN

Ltd.

.....................

997,363

16,000

Kameda

Seika

Co.

Ltd.

..............

498,174

10,000

Kerry

Group

plc,

Cl. A

..............

985,138

185,000

Kikkoman

Corp.

..................

2,095,530

6,500

Luckin

Coffee

Inc.,

ADR†

............

172,185

90,500

Maple

Leaf

Foods

Inc.

..............

1,482,180

250,000

Nissin

Foods

Co.

Ltd.

..............

146,645

15,000

Nomad

Foods

Ltd.

................

285,900

4,000

Post

Holdings

Inc.†

................

463,000

190,000

Premier

Foods

plc

.................

465,874

9,000

Remy

Cointreau

SA

................

699,782

900

Symrise

AG

.....................

124,328

500

The

Boston

Beer

Co.

Inc.,

Cl. A†

.......

144,570

8,000

The

Hain

Celestial

Group

Inc.†

........

69,040

2,000

The

Simply

Good

Foods

Co.†

.........

69,540

9,000

Treasury

Wine

Estates

Ltd.

...........

74,666

40,000

Tsingtao

Brewery

Co.

Ltd.,

Cl. H

.......

312,844

215,000

Vitasoy

International

Holdings

Ltd.

.....

152,942

36,000

Yakult

Honsha

Co.

Ltd.

.............

831,338

16,262,196

Health

Care

—

6.0%

18,237

Avantor

Inc.†

....................

471,791

15,000

Bausch

+

Lomb

Corp.†

.............

289,350

29,000

Bausch

Health

Cos.

Inc.†

............

236,640

600

Bio-Rad

Laboratories

Inc.,

Cl. A†

......

200,748

150

Bio-Rad

Laboratories

Inc.,

Cl. B†

......

50,179

6,500

Catalent

Inc.†

....................

393,705

500

Charles

River

Laboratories

International

Inc.†

........................

98,485

400

Chemed

Corp.

...................

240,388

Shares

Market

Value

500

DaVita

Inc.†

.....................

$

81,965

12,500

DENTSPLY

SIRONA

Inc.

............

338,250

15,000

Evolent

Health

Inc.,

Cl. A†

...........

424,200

5,000

Halozyme

Therapeutics

Inc.†

.........

286,200

4,400

Henry

Schein

Inc.†

................

320,760

1,750

ICU

Medical

Inc.†

.................

318,885

5,500

Idorsia

Ltd.†

.....................

9,696

20,000

InfuSystem

Holdings

Inc.†

...........

134,000

3,000

Integer

Holdings

Corp.†

.............

390,000

3,000

Lantheus

Holdings

Inc.†

............

329,250

12,000

Option

Care

Health

Inc.†

............

375,600

10,000

Owens

&

Minor

Inc.†

..............

156,900

28,000

Patterson

Cos.

Inc.

................

611,520

35,000

Perrigo

Co.

plc

...................

918,050

700

STERIS

plc

......................

169,778

3,000

SurModics

Inc.†

..................

116,340

4,000

Tenet

Healthcare

Corp.†

.............

664,800

10,000

Teva

Pharmaceutical

Industries

Ltd.,

ADR†

180,200

1,600

The

Cooper

Companies

Inc.†

.........

176,544

7,500

Treace

Medical

Concepts

Inc.†

........

43,500

15,000

Viemed

Healthcare

Inc.†

............

109,950

8,137,674

Hotels

and

Gaming

—

2.6%

3,000

Caesars

Entertainment

Inc.†

..........

125,220

901

Flutter

Entertainment

plc†

...........

211,707

26,000

Full

House

Resorts

Inc.†

............

130,520

40,000

International

Game

Technology

plc

.....

852,000

656,250

Mandarin

Oriental

International

Ltd.

....

1,115,625

9,000

MGM

Resorts

International†

.........

351,810

250,000

The

Hongkong

&

Shanghai

Hotels

Ltd.

..

184,272

5,700

Wynn

Resorts

Ltd.

................

546,516

3,517,670

Machinery

—

4.2%

24,500

Astec

Industries

Inc.

...............

782,530

356,000

CNH

Industrial

NV,

New

York

.........

3,951,600

2,400

Tennant

Co.

.....................

230,496

13,000

Twin

Disc

Inc.

....................

162,370

5,000

Xylem

Inc.

......................

675,150

5,802,146

Manufactured

Housing

and

Recreational

Vehicles

—

0.5%

1,700

Cavco

Industries

Inc.†

..............

728,008

Metals

and

Mining

—

1.1%

1,500

ATI

Inc.†

.......................

100,365

24,750

Cameco

Corp.

....................

1,182,060

4,000

Metallus

Inc.†

....................

59,320

35,000

Sierra

Metals

Inc.†

................

19,950

3,000

Wheaton

Precious

Metals

Corp.

.......

183,240

1,544,935

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Publishing

—

0.9%

1,400

Graham

Holdings

Co.,

Cl. B

..........

$

1,150,408

15,000

The

E.W.

Scripps

Co.,

Cl. A†

..........

33,675

1,184,083

Real

Estate

—

0.3%

20,000

Starwood

Property

Trust

Inc.,

REIT

.....

407,600

30,000

Trinity

Place

Holdings

Inc.†

..........

1,200

408,800

Retail

—

2.4%

300

Advance

Auto

Parts

Inc.

.............

11,697

5,000

AutoNation

Inc.†

..................

894,600

9,000

BBB

Foods

Inc.,

Cl. A†

..............

270,000

530

Biglari

Holdings

Inc.,

Cl. A†

..........

441,151

8,000

Camping

World

Holdings

Inc.,

Cl. A

....

193,760

22,000

Hertz

Global

Holdings

Inc.,

New

York†

..

72,600

5,500

MarineMax

Inc.†

..................

193,985

6,000

Movado

Group

Inc.

................

111,600

1,500

Penske

Automotive

Group

Inc.

........

243,630

10,000

PetIQ

Inc.†

......................

307,700

16,000

Pets

at

Home

Group

plc

.............

65,329

9,000

Rush

Enterprises

Inc.,

Cl. B

..........

431,550

120,000

Sun

Art

Retail

Group

Ltd.

............

27,631

3,265,233

Specialty

Chemicals

—

1.9%

4,500

Ashland

Inc.

.....................

391,365

50,000

Element

Solutions

Inc.

..............

1,358,000

13,547

Huntsman

Corp.

..................

327,837

2,500

Novonesis

(Novozymes)

B

...........

180,018

14,000

SGL

Carbon

SE†

..................

83,843

6,000

T.

Hasegawa

Co.

Ltd.

...............

136,720

2,000

Takasago

International

Corp.

.........

76,674

700

Treatt

plc

.......................

4,197

2,558,654

Telecommunications

—

1.4%

8,250

Eurotelesites

AG†

.................

43,897

5,000

Gogo

Inc.†

......................

35,900

6,000

Hellenic

Telecommunications

Organization

SA,

ADR

......................

51,510

100,000

Pharol

SGPS

SA†

.................

4,920

33,000

Telekom

Austria

AG

................

323,259

15,800

Telephone

and

Data

Systems

Inc.

......

367,350

9,000

Telesat

Corp.†

...................

118,530

92,000

Vodafone

Group

plc,

ADR

...........

921,840

1,867,206

Transportation

—

1.6%

64,000

Bollore

SE

......................

426,381

17,000

FTAI

Infrastructure

Inc.

.............

159,120

Shares

Market

Value

12,000

GATX

Corp.

.....................

$

1,589,400

2,174,901

Wireless

Communications

—

1.4%

40,000

Millicom

International

Cellular

SA,

SDR†

.

1,086,270

14,000

United

States

Cellular

Corp.†

.........

765,100

1,851,370

TOTAL

COMMON

STOCKS

.........

135,110,645

PREFERRED

STOCKS

—

0.2%

Health

Care

—

0.2%

10,000

XOMA

Royalty

Corp.,

Ser.

A,

8.625%

...

261,800

RIGHTS

—

0.0%

Energy

and

Utilities:

Services

—

0.0%

13,750

Pineapple

Energy

Inc.,

CVR†

.........

14,509

Health

Care

—

0.0%

1,500

Tobira

Therapeutics

Inc.,

CVR†(a)

......

0

TOTAL

RIGHTS

................

14,509

WARRANTS

—

0.0%

Diversified

Industrial

—

0.0%

64,000

Ampco-Pittsburgh

Corp.,

expire

08/01/25†

6,560

Principal

Amount

U.S.

GOVERNMENT

OBLIGATIONS

—

0.7%

$

900,000

U.S.

Treasury

Bills,

4.627%

to

4.862%††,

12/12/24

to

03/13/25

......................

887,694

TOTAL

INVESTMENTS

—

100.0%

....

(Cost

$98,946,214)

..............

$

136,281,208

(a)

Security

is

valued

using

significant

unobservable

inputs

and

is

classified

as

Level

3

in

the

fair

value

hierarchy.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

ADR

American

Depositary

Receipt

CVR

Contingent

Value

Right

REIT

Real

Estate

Investment

Trust

SDR

Swedish

Depositary

Receipt

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Geographic

Diversification

%

of

Total

Investments

Market

Value

United

States

........................

53.7

%

$

73,195,619

Europe

..............................

30.6

41,755,452

Japan

...............................

7.1

9,690,597

Canada

..............................

4.6

6,274,430

Latin

America

.......................

2.1

2,824,499

Asia/Pacific

.........................

1.9

2,540,611

Total

Investments

...................

100.0%

$

136,281,208

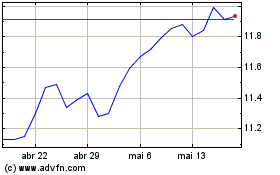

Gabelli Global Small and... (NYSE:GGZ)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Gabelli Global Small and... (NYSE:GGZ)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024