American Lithium Corp. (“

American Lithium” or the

“

Company”) (TSX-V:LI | NASDAQ:AML| Frankfurt:5LA1)

announces that it has completed its strategic investment (the

“

Investment”) in Surge Battery Metals Inc.

("

Surge"). The Investment of C$5,360,000

represents the full commitment from American Lithium and is the

cornerstone investment in the recently announced Surge private

placement. American Lithium now holds approximately 9.7% of the

total issued and outstanding shares of Surge.

In connection with the Investment, American

Lithium has been issued 13,400,000 units (each, a

"Unit") of Surge at a price of $0.40 per Unit with

each Unit being comprised of one common share and one share

purchase warrant (each, a "Warrant"). Each Warrant

is exercisable for a period of three years from the date of

issuance at a price of $0.55 per share. The securities comprising

the Units and any shares underlying the Warrants may not be sold

until October 10, 2023 (being four months and a day from their

issuance).

As part of its investment, American Lithium has

the right to elect a Director to the Surge Board of Directors and

has elected Ted O’Connor, its Executive Vice President, to

represent the Company and he has been appointed with immediate

effect. The Company has also entered into an Advisory Agreement

with Surge pursuant to which it will provide technical advice to

Surge in relation to the ongoing exploration and development of the

Nevada North Lithium Project and will be provided all relevant

data.

Simon Clarke, CEO of the Company commented, “we

are very pleased with this investment which will enable the

continued exploration and development of the Nevada North Lithium

Project, a claystone project which we believe is highly prospective

with the potential to be a large-scale, high-grade deposit. Our

team has over 6 years of claystone experience successfully

discovering, de-risking and developing the TLC Project and this

investment further reinforces our position as a leader in claystone

development in Nevada. We believe that the potential of the higher

quality Nevada claystone projects to provide near-term, high purity

lithium products, without the need for refining / upgrading

overseas, positions them as a key source of truly secure domestic

supply unlike many other sources of lithium across North

America.”

About American

Lithium

American Lithium is actively engaged in the

development of large-scale lithium projects within mining-friendly

jurisdictions throughout the Americas. The Company is currently

focused on the continued development of its strategically located

TLC Lithium Claystone Project in the richly mineralized Esmeralda

lithium district in Nevada, as well as continuing to advance its

Falchani Hard-rock Lithium Project and Macusani Uranium Project in

southeastern Peru. All three projects, TLC, Falchani and Macusani

have been through robust preliminary economic assessments, exhibit

strong significant expansion potential and enjoy strong community

support. Pre-feasibility work is well advanced at Falchani and has

commenced at TLC.

For more information, please contact the Company

at info@americanlithiumcorp.com or visit our website

at www.americanlithiumcorp.com for project update videos and

related background information.

Follow us

on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of

American Lithium Corp.

“Simon Clarke”CEO & DirectorTel: 604 428 6128

For Media Inquiries:

Nancy ThompsonVorticom, Inc.212-532-2208

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward

Looking InformationThis news release contains certain

forward-looking information and forward-looking statements

(collectively “forward-looking statements”) within the meaning of

applicable securities legislation. All statements, other than

statements of historical fact, are forward-looking statements.

Forward-looking statements in this news release include, but are

not limited to, statements regarding the ability to appeal the

judicial ruling, the anticipated timing for completion of the PEA,

and any other statements regarding the business plans, expectations

and objectives of American Lithium. Forward-looking statements are

frequently identified by such words as "may", "will", "plan",

"expect", "anticipate", "estimate", "intend", “indicate”,

“scheduled”, “target”, “goal”, “potential”, “subject”, “efforts”,

“option” and similar words, or the negative connotations thereof,

referring to future events and results. Forward-looking statements

are based on the current opinions and expectations of management

and are not, and cannot be, a guarantee of future results or

events. Although American Lithium believes that the current

opinions and expectations reflected in such forward-looking

statements are reasonable based on information available at the

time, undue reliance should not be placed on forward-looking

statements since American Lithium can provide no assurance that

such opinions and expectations will prove to be correct. All

forward-looking statements are inherently uncertain and subject to

a variety of assumptions, risks and uncertainties, including risks,

uncertainties and assumptions related to: American Lithium’s

ability to achieve its stated goals;, which could have a material

adverse impact on many aspects of American Lithium’s businesses

including but not limited to: the ability to access mineral

properties for indeterminate amounts of time, the health of the

employees or consultants resulting in delays or diminished

capacity, social or political instability in Peru which in turn

could impact American Lithium’s ability to maintain the continuity

of its business operating requirements, may result in the reduced

availability or failures of various local administration and

critical infrastructure, reduced demand for the American Lithium’s

potential products, availability of materials, global travel

restrictions, and the availability of insurance and the associated

costs; the judicial appeal process in Peru, and any and all future

remedies pursued by American Lithium and its subsidiary Macusani to

resolve the title for 32 of its concessions; the ongoing ability to

work cooperatively with stakeholders, including but not limited to

local communities and all levels of government; the potential for

delays in exploration or development activities; the interpretation

of drill results, the geology, grade and continuity of mineral

deposits; the possibility that any future exploration, development

or mining results will not be consistent with our expectations;

risks that permits will not be obtained as planned or delays in

obtaining permits; mining and development risks, including risks

related to accidents, equipment breakdowns, labour disputes

(including work stoppages, strikes and loss of personnel) or other

unanticipated difficulties with or interruptions in exploration and

development; risks related to commodity price and foreign exchange

rate fluctuations; risks related to foreign operations; the

cyclical nature of the industry in which American Lithium operates;

risks related to failure to obtain adequate financing on a timely

basis and on acceptable terms or delays in obtaining governmental

approvals; risks related to environmental regulation and liability;

political and regulatory risks associated with mining and

exploration; risks related to the uncertain global economic

environment and the effects upon the global market generally, any

of which could continue to negatively affect global financial

markets, including the trading price of American Lithium’s shares

and could negatively affect American Lithium’s ability to raise

capital and may also result in additional and unknown risks or

liabilities to American Lithium. Other risks and uncertainties

related to prospects, properties and business strategy of American

Lithium are identified in the “Risk Factors” section of American

Lithium’s Management’s Discussion and Analysis filed on May 29,

2023, and in recent securities filings available at www.sedar.com.

Actual events or results may differ materially from those projected

in the forward-looking statements. American Lithium undertakes no

obligation to update forward-looking statements except as required

by applicable securities laws. Investors should not place undue

reliance on forward-looking statements.

Cautionary Note Regarding Macusani

ConcessionsThirty-two of the 169 concessions held by

American Lithium’s subsidiary Macusani, are currently subject to

Administrative and Judicial processes (together, the “Processes”)

in Peru to overturn resolutions issued by INGEMMET and the Mining

Council of MINEM in February 2019 and July 2019, respectively,

which declared Macusani’s title to 32 of the concessions invalid

due to late receipt of the annual validity payments. In November

2019, Macusani applied for injunctive relief on 32 concessions in a

Court in Lima, Peru and was successful in obtaining such an

injunction on 17 of the concessions including three of the four

concessions included in the Macusani Uranium Project PEA. The grant

of the Precautionary Measure (Medida Cautelar) has restored the

title, rights and validity of those 17 concessions to Macusani

until a final decision is obtained at the last stage of the

judicial process. A Precautionary Measure application was made at

the same time for the remaining 15 concessions and was ultimately

granted by a Court in Lima, Peru on March 2, 2021 which has also

restored the title, rights and validity of those 15 remaining

concessions to Macusani, with the result being that all 32

concessions are now protected by Precautionary Measure (Medida

Cautelar) until a final decision on this matter is obtained at the

last stage of the judicial process. The favourable judge’s ruling

confirming title to all 32 concessions from November 3, 2021

represents the final stage of the current judicial process.

However, this ruling has recently been appealed by MINEM and

INGEMMET. American Lithium has no assurance that the outcome of

these appeals will be in the Company’s favour.

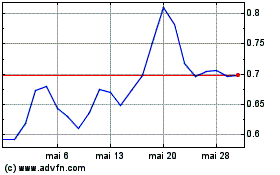

American Lithium (NASDAQ:AMLI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

American Lithium (NASDAQ:AMLI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024