Oxbridge Re announces the rebranding of its Corporate Website

18 Dezembro 2023 - 10:30AM

Oxbridge Re (NASDAQ:

OXBR), (the

“Company”), and its subsidiaries which are engaged in the business

of tokenized Real-World Assets (“RWAs”), initially in the form of

Tokenized Reinsurance Securities, and reinsurance business

solutions to property and casualty insurers, today announced the

rebranding of its corporate website www.OxbridgeRe.com.

The rebranding of the website follows on from

the company announcing its intention to position itself to grow as

a RWA, Web3-focused company.

Previously Announced:

- SurancePlus Inc. (“SurancePlus”),

Oxbridge Re’s wholly owned Web3-focused subsidiary, issued DeltaCat

Re, the first tokenized reinsurance securities sponsored by a

subsidiary of a publicly-traded company. According to forecasts

from Boston Consulting Group, the tokenized RWA market is expected

to grow exponentially over the next decade, with estimates of $16

trillion by 2030. This comes as traditional financial institutions

and instruments, including fiat currencies, equities, government

bonds, and also real estate continue to adopt blockchain

technology.

- In August, the company announced

the successful merger of Oxbridge Acquisition Corporation with

Jet.AI. Oxbridge Re is one of the larger investors in the company.

Jet.Ai operates in two segments: Software and Aviation. It offers

fractional and whole jet sales, prepaid jet cards, charter,

brokerage, and service. Jet.Ai also has an artificial intelligence

(AI) booking platform, a carbon emission offset platform, and plans

to launch 3 additional high-margin software offerings by the end of

Q1 of 2024.

- SurancePlus announced the

successful close of its DeltaCat Re tokenized reinsurance security

offering in June of this year. Investors in DeltaCat Re are on

track to receive a 42% return.

About Oxbridge Re Holdings

Limited

Oxbridge Re Holdings Limited

(www.OxbridgeRe.com) (NASDAQ: OXBR, OXBRW) (“Oxbridge Re”) is

headquartered in the Cayman Islands. The company offers tokenized

Real-World Assets (“RWAs”) as Tokenized Reinsurance Securities and

reinsurance business solutions to property and casualty insurers,

through its wholly owned subsidiaries Oxbridge Reinsurance Limited,

Oxbridge Re NS, and SurancePlus Inc.

Insurance businesses in the Gulf Coast region of

the United States purchase property and casualty reinsurance

through our licensed reinsurers Oxbridge Reinsurance Limited and

Oxbridge Re NS.

Our new Web3-focused subsidiary, SurancePlus

Inc. (“SurancePlus”), has reimagined Oxbridge Re NS’s investment

product as Tokenized Reinsurance Securities, the first “on-chain”

reinsurance RWA of its kind to be sponsored by a subsidiary of a

publicly traded company. Investors complete the entire investment

process online on United States Securities and Exchange Commission

(“SEC”) and Financial Industry Regulatory Authority (“FINRA”)

regulated specialized digital platforms for the private market

sales and transfers of digital securities.

SurancePlus’ digital securities are implemented

using Web3 digital ecosystem technologies and fully comply with

United States securities laws. Tokenized Reinsurance Securities

embed Anti-Money Laundering and Know Your Customer controls that

complement organizational controls that safeguard the investment.

By digitizing reinsurance securities as on-chain RWAs, SurancePlus

has democratized the availability of reinsurance as an alternative

investment to both U.S. and non-U.S. investors.

Forward-Looking Statements

This press release may contain forward-looking

statements made pursuant to the Private Securities Litigation

Reform Act of 1995. Words such as “anticipate,” “estimate,”

“expect,” “intend,” “plan,” “project” and other similar words and

expressions are intended to signify forward-looking statements.

Forward-looking statements are not guarantees of future results and

conditions but rather are subject to various risks and

uncertainties. A detailed discussion of risks and uncertainties

that could cause actual results and events to differ materially

from such forward-looking statements is included in the section

entitled “Risk Factors” contained in our Form 10-K filed with the

Securities and Exchange Commission (“SEC”) on 30th March 2023. The

occurrence of any of these risks and uncertainties could have a

material adverse effect on the Company’s business, financial

condition and results of operations. Any forward-looking statements

made in this press release speak only as of the date of this press

release and, except as required by law, the Company undertakes no

obligation to update any forward-looking statement contained in

this press release, even if the Company’s expectations or any

related events, conditions or circumstances change.

Company Contact:Oxbridge Re Holdings LimitedJay

Madhu, CEO345-749-7570jmadhu@oxbridgere.com

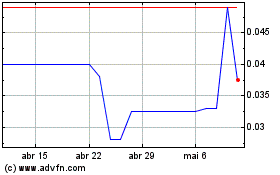

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

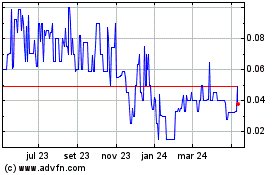

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024