Medallion Financial Corp. Announces Completion of Amended and Restated Private Placement of $17.5 Million of Senior Notes

25 Junho 2024 - 5:01PM

Medallion Financial Corp. (NASDAQ: MFIN, “Medallion” or the

“Company”), a specialty finance company that originates and

services loans in various consumer and commercial industries, along

with offering loan origination services to fintech strategic

partners, announced today that it has completed a private placement

of $17.5 million aggregate principal amount of senior unsecured

notes to a certain institutional investor, by amending and

restating its existing 9.00% senior notes due 2033. The notes now

mature on June 30, 2039, and bear a fixed interest rate of 8.875%

per year, paid semi-annually commencing June 30, 2024. The notes

received an investment grade rating of A- by Egan-Jones.

As disclosed via a Current Report on Form 8-K

filed on December 28, 2023, the Company initially completed a

private placement of $12.5 million aggregate principal amount of

senior unsecured notes to a certain institutional investor. At that

time, the notes were to mature on December 30, 2033, and bear a

fixed interest rate of 9.00% per year, paid semi-annually, with the

initial payment expected on June 30, 2024. On June 24, 2024, the

Company completed a private placement amending and restating such

9.00% senior notes due 2033 with the same institutional investor.

The primary changes were to increase the principal amount from

$12.5 million to $17.5 million, or an increase of $5.0 million,

extend the maturity date from December 30, 2033 to June 30, 2039,

and decrease the fixed interest rate from 9.00% to 8.875%. The net

proceeds will be used for general corporate purposes.

“We are pleased with the closing of our expanded

private placement with an investment grade rating, which is another

strong sign of the quality of our assets. We continue to build on

the strength of our Company, improved balance sheet, and

flexibility of our capital structure,” stated Andrew Murstein,

President and COO of Medallion. “We achieved our three primary

objectives – we increased the amount, extended the term, and

lowered the rate. That is a great combination and will help us

continue to deliver long-term shareholder value.”

About Medallion Financial Corp.

Medallion Financial Corp. (NASDAQ:MFIN) and its

subsidiaries originate and service a growing portfolio of consumer

loans and mezzanine loans in various industries. Key industries

served include recreation (towable RVs and marine) and home

improvement (replacement roofs, swimming pools, and windows).

Medallion Financial Corp. is headquartered in New York City, NY,

and its largest subsidiary, Medallion Bank, is headquartered in

Salt Lake City, Utah. For more information, please visit

www.medallion.com.

Forward-Looking

StatementsPlease note that this press release contains

forward-looking statements that involve risks and uncertainties

relating to business performance, cash flow, net interest income

and expenses, other expenses, earnings, growth, and our growth

strategy. These statements are often, but not always, made using

words or phrases such as “will” and “continue” or the negative

version of those words or other comparable words or phrases of a

future or forward-looking nature. These statements relate to future

public announcements of our earnings, the impact of the pending SEC

litigation, expectations regarding our loan portfolio, including

collections on our medallion loans, the potential for future asset

growth, and market share opportunities. Medallion’s actual results

may differ significantly from the results discussed in such

forward-looking statements. For example, statements about the

effects of the current economy, whether inflation or the risk of

recession, operations, financial performance and prospects

constitute forward-looking statements and are subject to the risk

that the actual impacts may differ, possibly materially, from what

is reflected in those forward-looking statements due to factors and

future developments that are uncertain, unpredictable and in many

cases beyond Medallion’s control. In addition to risks

relating to the current economy, for a description of certain risks

to which Medallion is or may be subject, including risks related to

the pending SEC litigation, please refer to the factors discussed

under the heading “Risk Factors” in Medallion’s 2023 Annual Report

on Form 10-K.

Company Contact:Investor

Relations212-328-2176InvestorRelations@medallion.com

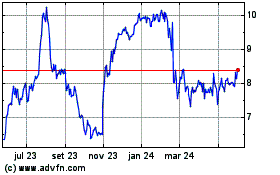

Medallion Financial (NASDAQ:MFIN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

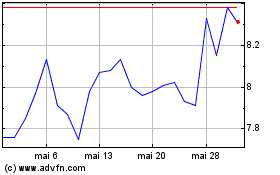

Medallion Financial (NASDAQ:MFIN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024