US index futures are higher in pre-market trading on Wednesday,

the most anticipated day of the week, when the Federal Reserve will

release its monetary policy decision.

At 7:19 AM, Dow Jones futures (DOWI:DJI) rose by 79 points, or

0.23%. S&P 500 futures also increased by 0.23%, and Nasdaq-100

futures were up by 0.21%. The yield on 10-year Treasury bonds stood

at 4.347%.

In the commodities market, West Texas Intermediate crude oil for

October fell 0.66% to $90.60 per barrel. Brent oil for

November fell 0.63% to US$93.78 per barrel. Iron ore with a

concentration of 62% rose 0.46%, quoted at US$119.53 per ton, after

a sequence of declines, given doubts about demand in China.

At 07:00, the MBA mortgage index was released, indicating that

mortgage rates have risen in the last week. Refinancing

applications increased 13%, although 29% below the previous

year. The average interest rate for 30-year fixed mortgages

with balances up to $726,200 rose from 7.27% to 7.31%. Points

remained at 0.72, including the origination fee, for loans with a

20% down payment. The demand for refinancing may be linked to

concerns about future increases. Requests for purchasing a

home grew 2%. The average loan amount on a purchase order was

$416,800, the highest level in six weeks.

In the remainder of Wednesday’s U.S. economic agenda, investors

await the 10:30 AM release of the weekly oil inventory by the

Department of Energy, with a consensus expectation of a decline of

2.67 million.

Jerome Powell, president of the Fed, will comment on the

decision at 2:30 PM. Bank of America anticipates a balanced

message, similar to the statements in Jackson Hole, reflecting that

the outlook has remained consistent since August.

The global forecast is that the Federal Reserve will maintain

the interest rate between 5.25% and 5.50% at today’s

meeting. Although inflation is above the 2% target, the recent

weakening of the labor market may reduce inflationary concerns in

the medium term. In the last 12 meetings, Fed has raised rates

11 times. With this pause expected by the market, the Fed can

observe the impact of its previous decisions. Future interest

rate increases will be clarified in the statement.

Recently, ABN-Amro and Santander projected that Fed will

maintain the rate until March 2024. They predict that, with a

slowdown in employment and a drop in inflation, there could be a

reduction in interest rates in early 2024.

In Europe, investors analyze data on British inflation and

producer prices in Germany, which were below expectations, on the

eve of the Bank of England (BoE) interest rate decision.

In Asia, markets behaved differently, awaiting the Fed’s

resolution and reflecting the choice of the PBoC, China’s central

bank, to maintain the five-year prime rate at 4.20% per year and

the annual rate at 3.45%. The stability of interest rates in

China can have a double interpretation: supporting a fragile

economy and supporting the yuan, which has been losing value in

relation to the dollar.

In Japan, on the eve of the inflation announcement, a trade

deficit of 6.3 billion dollars was recorded in the previous

month. Exports fell 0.80% in August, and imports declined

17.80%, both numbers lower than expected. The Japanese trade

challenge highlights the crisis in global demand, most felt in

advanced countries, the main consumers of high-quality

products.

By Tuesday’s close, U.S. stocks were down, with nearly every

major segment of the S&P 500 declining. Dow Jones fell 106.57

points or 0.31% to 34,517.73 points. S&P 500 fell 9.58 points

or 0.22% to 4,443.95. Nasdaq fell 32.05 points or 0.23% to

13,678.19. Meanwhile, the price of oil continued to climb due

to production cuts by Russia and OPEC+, with Brent approaching

US$95 per barrel. This influenced a rise in inflation

forecasts, sending Treasury yields to their highest point in

several months. In Europe, the CPI index, which measures

consumer inflation, presented a value slightly below expectations

after the correction of the August data.

On Wednesday’s corporate earnings front, investors will be

watching reports from General Mills (NYSE:GIS), FedEx (NYSE:FDX)

and KB Home (NYSE:KBH).

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple Store employee

unions in France called a strike during the launch of the iPhone

15, demanding a 7% salary increase to compensate for

inflation. Apple France proposed a 4.5%

increase. Protests are expected in Paris.

Amazon (NASDAQ:AMZN) – Amazon plans to

hire 250,000 seasonal workers in the U.S. for Christmas, a 67%

increase from previous years, due to the expansion of next-day

delivery. Other U.S. retailers expect to hire less compared to

previous years, anticipating lower consumer demand in 2023.

Additionally, Amazon’s hardware division, Lab126, faces low morale

following layoffs and financial crisis. Former employees

describe uncertain projects and concerns about the future of

devices with Alexa built-in. The company plans to launch new

devices and aims for greater adoption of Alexa, while facing

competition in AI.

Microsoft (NASDAQ:MSFT) – British minister

Kemi Badenoch disagreed with Microsoft president Brad Smith over

the Competition and Markets Authority’s blocking of the purchase of

Activision Blizzard (NASDAQ:ATVI). In response, Activision

will attempt to sell its streaming rights to gain approval.

Meta Platforms (NASDAQ:META) – Britain asked

Meta to only implement end-to-end encryption on Instagram and

Messenger with safeguards to protect children from

abuse. While Meta highlights the benefits of encryption, the

UK emphasizes child safety. In other news, the Chan Zuckerberg

Initiative, founded by Mark Zuckerberg and Priscilla Chan, will

develop an AI system for life sciences research. This system

will use open AI models to advance cell and disease

studies. Meta is also introducing a payment feature on

WhatsApp in India, allowing direct purchases via chat. After

launches in Brazil and Singapore, this expansion targets the Indian

market with 400 million WhatsApp users. Meta seeks to monetize

the popular app by charging companies for features and ads.

Pinterest (NYSE:PINS) – On Tuesday,

Pinterest shares rose 3% after executives predicted accelerated

revenue growth. To drive growth, new ad tools were launched,

integrating with Salesforce (NYSE:CRM)

and Adobe (NASDAQ:ADBE). Scott

Schenkel, formerly of eBay (NASDAQ:EBAY), was named to the

company’s board. Pinterest shares are up 0.3% in Wednesday

premarket trading.

Alphabet (NASDAQ:GOOGL) – Google has

appealed to the Court of Justice of the European Union seeking to

overturn a $2.6 billion EU antitrust fine. The company argues

that its practices were not anti-competitive and that different

treatment is not abusive. The decision is

pending. Furthermore,

after Apple (NASDAQ:AAPL) replaced

Google Maps with its own app, Google recovered 40% of its previous

mobile traffic, according to executive Michael Roszak in an

antitrust trial. The case argues that Google illegally

maintained a monopoly on online search by favoring its search

engine across devices and browsers, including paying Apple to be

the default on Safari.

Intel (NASDAQ:INTC) – Intel’s new “Meteor

Lake” chip will allow to run AI chatbots on laptops without relying

on data centers. Shown at a conference, it will enable the use

of technologies such as ChatGPT while keeping confidential data on

the device. The vision is to promote accessible and private

AI.

Oracle (NYSE:ORCL) – Oracle announced on

Tuesday that it will integrate chips from Ampere Computing into its

cloud service. Ampere, created by

former Intel leaders (NASDAQ:INTC),

focuses on efficient chips and is backed by Oracle. Recently,

Google Cloud also adopted Ampere chips. Additionally, Oracle

is prepared to support Canadian banks in open banking, according to

Sonny Singh, VP of Oracle Financial Services. Not yet

implemented in Canada, open banking facilitates secure transfers of

financial data. Oracle already serves Canadian banks with

cloud solutions.

Arm Holdings (NASDAQ:ARM) – Shares of Arm

Holdings fell 4.9% on Tuesday, marking its third drop in the first

four sessions following its IPO. The stock closed at $55.17,

down from a high of $69. The stocks are down -1.6% in Wednesday’s

pre-market trading.

Instacart (NASDAQ:CART) – In its Nasdaq

debut, Instacart shares rose 12% after being priced at the top of

the $28 to $30 range, raising $660 million. Apoorva Mehta,

co-founder of Instacart, accumulates $1.1 billion after the

company’s IPO. Mehta, after 11 years, handed over the role of

CEO of Instacart to Fidji Simo. The company, which had a peak

valuation of US$39 billion, debuted on the stock market valued at

US$9.9 billion. Mehta now leads Cloud Health Systems, which

focuses on chronic disease care. CART shares are down 4.0% in

Wednesday pre-market trading.

Klaviyo – Klaviyo, a digital marketing

platform, priced its IPO at $30 per share, exceeding

expectations. Founded in 2012 and based in Boston, Klaviyo

helps online businesses optimize customer engagement. The

company has more than 130,000 customers, partnerships with

e-commerce companies such

as Shopify (NYSE:SHOP), and will be

listed on the New York Stock Exchange as “KVYO”. Its IPO

follows solid financial performance, including a path to

profitability. Klaviyo faces competition from big players, but

its close relationship with Shopify stands out as a relevant factor

in its success.

Walt Disney (NYSE:DIS) – Walt Disney

announced it will double spending on its parks business to $60

billion over the next 10 years. Revealed at a meeting in

Orlando, the parks have been a stable source of profit, offsetting

losses from Disney+ streaming.

Warner Bros. Discovery (NASDAQ:WBD) –

Warner Bros. Discovery will launch “Bleacher Report Sports

Add-On” on its Max streaming service for an additional $9.99

monthly starting October 5th. The service includes US

baseball, hockey, basketball and football. Free until February

29th, the service aims to strengthen Max platform and compete in

the streaming market.

Starbucks (NASDAQ:SBUX) – Long waits drive

customers away from Starbucks, with more than a third waiting more

than five minutes. The vast variety of drink combinations

overwhelms workers. The company, led by Howard Schultz and now

Laxman Narasimhan, seeks innovations to improve efficiency and

speed. They emphasize keeping the experience cozy, although

modernization and a focus on quick sales challenge that view.

Target (NYSE:TGT) – Target plans to hire

100,000 employees for the holiday season and will offer discounts

starting in October. Forecasts point to lower sales growth due

to high prices.

Dollar General (NYSE:DG) – JPMorgan

downgraded Dollar General from “Neutral” to “Underweight,” lowering

its price target from $132 to $116. This decision came following

statements from CFO Kelly Dilts in a event in London promoted by

the bank. Now, JPMorgan anticipates steady growth in the

store’s sales, given that Dollar General’s core clientele, mostly

low-income, faces recession-like economic conditions. Dollar

GEneral shares are down -2.3% in Wednesday pre-market trading.

nCino (NASDAQ:NCNO) – nCino shares are

down -4.8% in Wednesday’s pre-market trading at $31.50 after Morgan

Stanley cut the technology company’s rating from “Equal Weight” to

“Underweight”. The target price remained at US$24.

Steelcase (NYSE:SCS) – Steelcase Inc. saw

its shares rise 3.1% in premarket trading Wednesday after

forecasting “significantly improved” profit for the third quarter

as more workers return to the office. In the second quarter,

Steelcase reported a profit of $27.5 million (23 cents per share),

compared to $19.6 million (17 cents per share) a year

earlier. Revenues decreased to $854.6 million from $863.3

million in the same period last year. Factoring in

adjustments, the company had a profit of 31 cents per

share. FactSet analysts had forecast adjusted earnings of 20

cents per share and sales of $829 million.

FedEx (NYSE:FDX) – FedEx has seen its

shares rise 75% since implementing a $6 billion cost reduction

plan. While UPS (NYSE:UPS) faced

labor challenges and agreed to a costly deal, FedEx is preparing to

report positive results despite lower sales expectations.

Ford Motor (NYSE:F) – Ford reached an

agreement with Unifor, avoiding a walkout in Canada, as the UAW

union in the US prepared to expand its strikes. The union now

negotiates with General Motors (NYSE:GM)

and Stellantis (NYSE:STLA). In the

USA, the strike affected the production of popular

models. Ford is preparing contingency plans for possible

strikes in the US and continues negotiations with the UAW, which is

demanding higher wages and benefits. Shares of Ford and

General Motors returned to the levels they had before the

strike. However, with the United Auto Workers deadline coming

up on Friday, these stocks could come under pressure again

soon.

Tesla (NASDAQ:TSLA) – Federal

investigators are expanding their probe into benefits provided by

Tesla to CEO Elon Musk since 2017. Elsewhere, Tesla’s global

expansion has led countries to court Elon Musk for

investment. The Turkish president has requested a factory,

while Saudi Arabia is negotiating with Tesla. Musk envisions a

new location by the end of 2023. India and Mexico are also

considered. Additionally, the Commonwealth Bank of Australia

has partnered with Tesla for electric vehicle

financing. Customers can apply for loans through the Tesla

website at 5.49% per year. CBA seeks to drive sustainable

purchasing with affordable financing.

Nio (NYSE:NIO) – Nio Inc raised $1 billion

through convertible bonds to pay down debt and strengthen its

balance sheet. With interest ranging between 3.875% and

4.625%, it plans to use part of the money to repurchase existing

debt.

Boeing (NYSE:BA) – Boeing raised its

forecast for plane deliveries to China to 8,560 by 2042, due to

economic growth and demand for domestic travel. The company

remains optimistic about the Chinese market despite challenges with

the 737 MAX.

TotalEnergies (NYSE:TTE) – TotalEnergies

SE and Adani Green Energy Ltd. have formed a $300 million joint

venture to expand clean energy projects. The deal comes after

allegations of fraud against the Adani Group. Total will own

50% of the company, strengthening its presence in the Indian

renewable energy market.

Goldman Sachs (NYSE:GS) – Goldman Sachs is

in talks to sell its GreenSky unit to investors

including Sixth

Street (NYSE:TSLX), Pacific Investment

Management and KKR (NYSE:KKR)

for about $500 million, a significant drop from the U.S. $1.7

billion paid 18 months ago. The move comes after less

profitable efforts in consumer banking. Goldman shares are

flat in premarket trading Wednesday.

HSBC (NYSE:HSBC) – HSBC has hired eight

former Credit Suisse professionals to expand its global equities

business in locations including London, New York and Hong

Kong. The hires include Simon Farquharson and Tiffany Chiu,

aiming to compete with Wall Street rivals.

Paypal (NASDAQ:PYPL), Block (NYSE:SQ)

– PayPal and Square (Owned by Block) are undergoing changes, with

new CEOs set to take over soon. Despite declining stock prices in

recent years, these changes are expected to drive the companies

forward. PayPal had plans to expand its services but shifted focus

towards profitability. PayPal’s CEO, Dan Schulman, will be replaced

by Alex Chris, while Jack Dorsey will take the helm at Square

following Alyssa Henry’s departure. Reactions to the changes have

been mixed, but analysts see long-term potential. Both companies

have stocks trading below historical averages, indicating potential

value or future risks.

Coinbase (NASDAQ:COIN) – Coinbase

intensified campaign for regulatory clarity. The

cryptocurrency exchange is releasing ads and encouraging users to

pressure Congress to pass crypto legislation. On September 27,

executives from 35 crypto companies will meet at the Capitol.

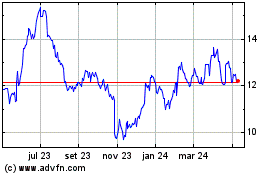

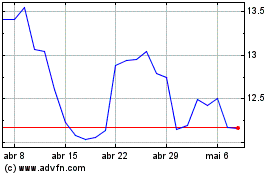

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024