Grayscale abandons post-merger Ethereum PoW tokens

and explores new opportunities with Ethereum and Bitcoin ETFs

Cryptocurrency investment firm Grayscale has decided to

relinquish rights to proof-of-work (PoW) post-merger Ethereum

tokens (ETHPoW) on September 18. The decision came after

finding that these tokens did not reach relevant liquidity and the

lack of support from custodians. The company took six months

after the Ethereum merger to decide on PoW tokens. Meanwhile,

on September 19, Grayscale applied to the US Securities and

Exchange Commission (SEC) for approval of a new Ethereum futures

exchange-traded fund (ETF), as mentioned by the Wall Street

Journal. This request differs from the company’s previous

proposals. SEC’s previous approval of Bitcoin futures ETFs in 2021,

coupled with growing interest in cryptocurrency ETFs, has

encouraged asset managers including Grayscale, to expand their

offer. Meanwhile, Grayscale also aims to transform its GBTC

fund into a Bitcoin spot ETF.

Wormhole adds Circle cross-chain protocol support for USDC

Wormhole has now integrated Circle’s Cross-Chain Transfer

Protocol (CCTP), enabling the transfer of USD Coin (COIN:USDCUSD)

between Ethereum, Avalanche, Arbitrum, and Optimism via Wormhole

bridges. With the update, the Wormhole portal seeks to

minimize liquidity issues and user confusion when dealing with

multiple versions of USDC. This move simplifies the transfer

of USDC between networks, avoiding additional steps and

complexities, especially with the growing number of networks

supported by USDC. Other bridges, such as Wanchan, also plan

to adopt CCTP on their platforms.

Ledger controversy over key recovery

French company Ledger, known for its cryptocurrency hardware

wallets, has faced criticism from its customer base after

announcing a new service to help recover private keys. The

solution proposed dividing seed phrases into three fragments,

distributed between Ledger and two other companies. Many

customers, staunch defenders of privacy and autonomy, have

expressed concerns about the potential reconstruction and handover

of these keys on government demand. In response, Ledger

emphasized the optional nature of the service and promised greater

transparency, accelerating its open source plans.

Binance faces falling volume as crypto market shows mixed signals

In September, Binance experienced a significant 48% drop in

trading volume, with its monthly Bitcoin average dropping

57%. This trend, as noted by K33 Research, also revealed an 8%

drop in the last week. Analysts believe that the legal

challenges faced by Binance in the US may have discouraged

traders. In contrast, Coinbase (NASDAQ:COIN) saw a 9% increase

in Bitcoin volume. However, the market has seen a recovery in

Bitcoin (COIN:BTCUSD), with prices rising 8% in the last

week. Analysts also noted an increase in traders’ confidence

in CME, but remained cautious about Ether derivatives.

Binance CEO refutes claims about $250 million loan

Changpeng ‘CZ’ Zhao, CEO of Binance, disputed recent reports

suggesting he had taken a $250 million loan from BAM Management,

calling them “misinformation” in a post on X. The source of the

news, Decrypt, cited an SEC lawsuit, which questioned the transfer

of $183 million from Paxos to BAM Trading. In return, Zhao

stated that he was the one who lent the US$250 million to BAM

Management and has not yet received the amount back. The

relationship between Binance and its affiliate is currently under

scrutiny by the SEC.

BCB Group director will leave company at the end of September

Ian Moore, director of BCB Group, a financial services provider

in the cryptocurrency sector, is leaving on September 29 to explore

new opportunities. Moore joined BCB from Paysafe Group in 2022

and previously worked at Deutsche Bank (NYSE:DB) and Citi

(NYSE:C). His departure follows that of Noah Sharp, former

deputy CEO of the BCB, who recently became CEO of the Vodeno

banking platform.

Ripple CEO debates crypto regulation with lawmakers in DC

Ripple (COIN:XRPUSD) CEO Brad Garlinghouse was in Washington, DC

on September 19 to speak with unspecified members of the US

Congress about the need for clarity in cryptocurrency

regulation. In a post on platform X, he emphasized the

importance of direct dialogue with authorities. Ripple Chief

Legal Officer Stuart Alderoty mentioned his visit to the US Supreme

Court, highlighting the relevance of checks and

balances. Garlinghouse also visited SEC office but did not

meet with Chairman Gary Gensler. The regulatory issue in the

US continues to be discussed, with recent actions against large

crypto companies and new legislative proposals in development.

Cryptocurrency tool None Trading shuts down after exploitation

After facing a critical failure in its infrastructure, None

Trading, a cryptocurrency and NFT trading platform on Discord, was

forced to halt its operations. In a statement released on

September 20, the team reported major financial losses and the

departure of key members. As a result, all official

communication channels were disabled and the value of the company’s

token plummeted by 80%, falling to US$0.074. Founded in May,

None Trading had a market value of US$16.5 million and was seen as

an innovative solution on Discord for trading.

CoinEx restarts deposits and withdrawals after $70 million hacker

attack

After being the victim of an attack that resulted in a loss of

US$70 million due to the compromise of private keys, cryptocurrency

platform CoinEx is ready to restart deposits and withdrawals on

September 21st. CoinEx advised users not to use old addresses

and announced the generation of new deposit addresses. Even

after the incident, the company ensures that users’ assets remain

intact and that the CoinEx User Asset Security Foundation will

compensate for any losses. Analysis suggests that North

Korea’s Lazarus Group may be behind the attack, although

investigations are still ongoing.

Celsius Network creditors under new phishing attacks during

bankruptcy proceedings

As Celsius Network’s bankruptcy proceedings progress, its

creditors face an increase in phishing attacks. Last week,

there were reports on social media about fraudsters posing as the

bankruptcy services platform, Stretto. Several users received

fake emails with malicious links. A deceptive website, similar

to the original Stretto URL, tricks users into connecting their

wallets, allowing attackers to access their crypto

assets. Experts advise caution, especially since phishing

attacks can intensify as the bankruptcy case nears completion.

Stanford reevaluates donations after allegations linked to FTX

Stanford University may return donations received from failed

cryptocurrency exchange FTX following allegations against founder

Sam Bankman-Fried’s parents. Barbara Fried and Joseph Bankman,

both with connections to Stanford, are believed to have used their

influence to funnel millions to the university. The defense

refutes the accusations, calling them false and attempts at

intimidation. Documents reveal confusion about the origin of

donations, while FTX, now under new management, is described as a

“family company”, accused of embezzling funds. Sam

Bankman-Fried denied his parents’ involvement in the company’s

material matters.

South Koreans hold 70% of declared cryptocurrency assets abroad

According to South Korea’s National Tax Service, South Korean

citizens hold around $99 billion in digital assets in foreign

accounts. The tax service said the value corresponds to 70% of

total assets declared abroad. 1,432 entities, including

individuals and companies, reported holding such cryptographic

assets. Recently, the country introduced a mandatory

declaration of virtual assets abroad, anticipating the

implementation of taxes on profits in cryptocurrencies, scheduled

for 2025.

Brazil updates legislation to protect cryptocurrencies from debtors

Brazilian legislators are moving forward to classify

cryptocurrencies as assets defended from debtors in favor of

creditors, recognizing them as tradable properties. Bill

4,420/2021 initially did not mention digital assets, but now there

are efforts to integrate them into legislation. With the Civil

Procedure Code being revised, debtors will have their savings

protected up to a limit of 40 minimum wages against actions by

creditors. Deputy Felipe Francischini signaled an agreement

for this inclusion following suggestions from Deputy Fernando

Marangoni. This legislative move complements Brazil’s already

proactive in the cryptocurrency space, which has a growing

population of users and companies focused on blockchain.

Freatic raises $3.6 million to create decentralized market

information protocol

Freatic project, which had been operating in stealth mode,

announced it had raised $3.6 million in funding led by

a16z. The platform, developed by a specialized team, aims to

use blockchain and game theory to improve the circulation of market

information. Investors such as Anagram, Archetype, Not3Lau

Capital and others participated in the round. Prior to this,

the team behind Freatic has offered crypto insights in both

centralized and decentralized ways, having connections with

HotNewCrypto since 2020. Freatic’s future vision is to create a

decentralized system for discovering and sharing market

insights.

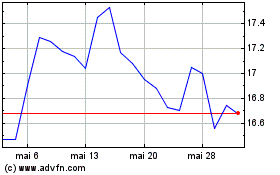

Deutsche Bank Aktiengese... (NYSE:DB)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Deutsche Bank Aktiengese... (NYSE:DB)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024