U.S. Index Futures Indecisive Ahead of Banking Earnings, Oil Prices Surge

12 Abril 2024 - 8:07AM

IH Market News

U.S. index futures show no clear direction in pre-market trading

this Friday as investors eagerly await the financial results of

major banking corporations.

At 6:18 AM, Dow Jones futures (DOWI:DJI) rose 21 points, or

0.05%. S&P 500 futures fell 0.16%, and Nasdaq-100 futures lost

0.35%. The yield on 10-year Treasury bonds stood at 4.54%.

In the commodities market, West Texas Intermediate crude oil for

May rose 1.32% to $86.14 per barrel. Brent crude oil for June rose

1.13%, nearing $90.75 per barrel. Iron ore traded on the Dalian

exchange rose 3.12% to $116.56 per metric ton.

The economic schedule for Friday begins at 8:30 AM with the

release of the Department of Labor’s import and export price

numbers for March. Subsequently, at 10 AM, attention will turn to

the April consumer sentiment index, a joint preliminary reading

from the University of Michigan and Thomson Reuters.

European markets are showing gains today as investors assess

recent economic data from the UK and consider bleak projections for

inflation in the United States. The UK’s Gross Domestic Product

(GDP) grew by 0.1% in February, confirming expectations and

signaling continued moderate economic growth for this year.

Meanwhile, the European Central Bank decided to keep interest rates

unchanged last Thursday, marking the fifth consecutive session

without changes and signaling more definitively the possibility of

a rate cut soon, even amid uncertainties about future actions by

the Federal Reserve.

Asian markets closed mostly in negative territory, influenced

mainly by unfavorable performance in Hong Kong. The Hang Seng Index

experienced a significant drop of 2.18%, closing at 16,721.69

points, reacting to discouraging Chinese trade balance data. The

numbers, released with a delay, revealed a surprising 7.5% decline

in Chinese exports in March, contrary to expectations of a slight

increase of 0.1%. Imports also fell short of forecasts,

contributing to cautious sentiment among investors. Meanwhile,

other Asian indices such as the Shanghai SE in China, Kospi in

South Korea, and Australia’s ASX 200 also recorded losses, while

Japan’s Nikkei showed a slight increase of 0.21%.

The closing of the US market on Thursday marked a day of

recovery, especially for technology stocks, leading Wall Street to

a strong upward movement. The highlight was the Nasdaq, which

reached a new record closing high of 16,442.18 points, even after

retreating from its highs during the day. The Dow Jones performed

steadily, with a slight decrease of 0.01%, while the S&P 500

experienced an increase of 0.74%.

The positive market movement coincided with the results of a

thirty-year Treasury bond auction, which, despite revealing average

demand, seemed to influence investor sentiment. This auction was of

particular interest given the attention to Treasury yields, which

retreated from their highs after the announcement. Additionally,

the day was marked by the analysis of inflation data with the

Producer Price Index report.

In March, the Producer Price Index for final demand in the

United States recorded a moderate increase of 0.2%, following a

stronger advance of 0.6% in February, aligning with market

projections. Notably, the annual inflation rate for producer prices

accelerated significantly, reaching 2.1% in March, a considerable

jump from the 1.6% recorded in February. This annual increase is

the most significant since the peak of 2.3% observed in April of

the previous year, indicating an upward trend in producer-level

inflation, albeit slightly below economists’ expectations of

2.2%.

On the quarterly results front, before trading begins, financial

giants such as Citigroup (NYSE:C),

JPMorgan Chase (NYSE:JPM), Wells

Fargo (NYSE:WFC), BlackRock (NYSE:BLK),

the holding State Street (NYSE:STT), and insurer

Progressive (NYSE:PGR) are scheduled to present

reports.

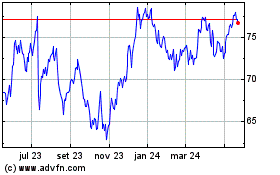

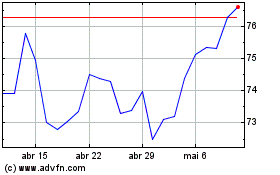

State Street (NYSE:STT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

State Street (NYSE:STT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024