Abbott Laboratories Reports Strong Q1 Sales Growth Amid Earnings Decline, Raises Full-Year Guidance

17 Abril 2024 - 12:37PM

IH Market News

Abbott Laboratories (NYSE:ABT) reported on Wednesday a notable

increase in its first quarter sales for 2024, which rose by 2.2% to

reach $9.9 billion, surpassing analysts’ expectations. However, the

company experienced a decline in net earnings, which fell by 7.0%

to $1.2 billion, and diluted earnings per share (EPS) decreased by

6.7% to $0.70.

Despite the downturn in profitability, the healthcare giant has

adjusted its financial outlook upwards for the year. Abbott now

forecasts a full-year diluted EPS on a GAAP basis to be between

$3.25 and $3.40. Additionally, the company’s full-year 2024 organic

sales growth guidance is projected to range from 8.5% to 10.0%.

Chairman and CEO Robert B. Ford expressed optimism about the

company’s performance, stating, “Our first-quarter results reflect

a strong start to the year, and we are raising our full-year sales

and EPS guidance […] This was the fifth consecutive quarter that we

delivered double-digit organic sales growth in our underlying base

business.” This statement highlights the company’s confidence in

its operational strength and its ability to sustain growth amidst

challenging market conditions.

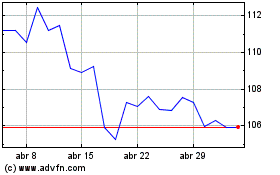

Abbott Laboratories (NYSE:ABT)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

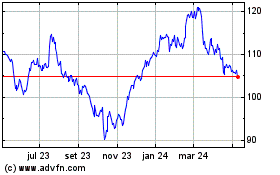

Abbott Laboratories (NYSE:ABT)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024