Futures Pointing To Extended Rebound On Wall Street

23 Abril 2024 - 10:11AM

IH Market News

The major U.S. index futures are currently pointing to higher

open on Tuesday, with stocks likely to extend the rebound seen in

the previous session.

Traders may continue to look to pick up stocks at relatively

reduced levels amid a positive reaction to some of the latest

corporate earnings news.

Shares of General Motors (NYSE:GM) are moving sharply higher in

pre-market trading after the auto giant reported first quarter

results that exceeded analyst estimates on both the top and bottom

lines.

Snack and beverage giant PepsiCo (NASDAQ:PEP) is also likely to

see initial strength after reporting better than expected first

quarter results.

On the other hand, shares of JetBlue (NASDAQ:JBLU) are seeing

substantial pre-market weakness after the airline reported a

narrower than expected first quarter loss but lowered its 2024

revenue forecast.

Delivery giant UPS (NYSE:UPS) may also move to the downside

after reporting first quarter earnings that beat analyst estimates

but weaker than expected sales.

U.S. stocks climbed higher on Monday, with those from the

technology sector turning in a fine performance, as traders

indulged in some bargain hunting after recent losses. Easing

worries about Middle East tensions helped underpin sentiment.

The major averages all closed on a firm note. The Dow ended with

a gain of 253.78 points or 0.7 percent at 38,239.98, more than 200

points off the day’s high of 38,447.16.

The S&P 500, which climbed to a high of 5,038.84, settled at

5,010.60, gaining 43.37 points or 0.9 percent, while the Nasdaq

ended higher by 169.30 points or 1.1 percent at 15,451.31, off the

day’s high of 15,539.00.

The market gained amid slightly easing fears of a wider Middle

East conflict after Iran and Israel completed ‘measured’

counterattacks that were calibrated to avoid any casualties. A bit

of bargain hunting is contributing as well to the market’s

rise.

Investors awaited a slew of key U.S. economic data this week,

including reports on new home sales, durable goods orders and

personal income and spending.

The Commerce Department’s personal income and spending report

includes readings on inflation said to be preferred by the Federal

Reserve.

Earnings season also starts to pick up steam this week, with

Tesla (NASDAQ:TSLA), Boeing (NYSE:BA), IBM (NYSE:IBM), Caterpillar

(NYSE:CAT), Honeywell (NASDAQ:HON), Alphabet (NASDAQ:GOOGL), Intel

(NASDAQ:INTC), Microsoft (NASDAQ:MSFT), Chevron (NYSE:CVX) and

Exxon Mobil (NYSE:XOM) among the companies due to report their

quarterly results.

Goldman Sachs and JPMorgan Chase climbed 3.3% percent and about

2%, respectively. Procter & Gamble gained 1.5 percent.

Amazon, McDonald, Chevron, Amgen and Walmart gained 1 to 1.5

percent.

Salesforce.com shares gained more than 1 percent after the

company backed away from its talks to acquire data-management

software firm Informatica.

Ford Motor rallied more than 6 percent. United Airlines Holdings

gained about 5 percent. Nvidia climbed 4.35 percent. Citigroup,

Delta Airlines, Seagate Technology, Moderna and American Airlines

also ended sharply higher.

Verizon ended 4.7 percent down. The company, which announced

weak profit and slightly higher revenues in its first quarter,

maintained its fiscal 2024 earnings outlook. For 2024, Verizon

continues to expect adjusted earnings per share of $4.50 to

$4.70.

Tesla drifted down 3.4 percent, on concerns over gross margins

after the company lowered prices in several markets.

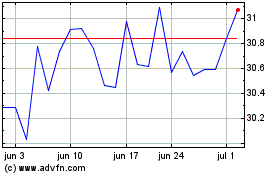

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024