Airbnb (NASDAQ:ABNB) – Airbnb’s shares fell

8.4% in pre-market trading despite surpassing first-quarter

expectations with earnings per share of 41 cents, compared to the

expected 24 cents, and a revenue of $2.14 billion, beating the

forecast of $2.06 billion. However, the company provided a less

optimistic outlook for the future. Airbnb projected second-quarter

revenue to be between $2.68 billion and $2.74 billion, while

analysts, according to LSEG, expected a figure at the higher end of

this range, at $2.74 billion.

Bumble (NASDAQ:BMBL) – Bumble’s shares rose

14.1% in pre-market trading after beating Wall Street’s revenue

expectations for the first quarter, driven by growth in paying

users. Their marketing efforts attracted younger users and women,

resulting in an 18% increase in global downloads. Quarterly revenue

reached $267.8 million, 10.2% above estimates, while earnings per

share were 19 cents, compared to the expected 7 cents. The company

expects second-quarter revenue between $269 million and $275

million, maintaining the outlook for the year.

TripAdvisor (NASDAQ:TRIP) – In the first

quarter, the company reported a net loss of $59 million or 43 cents

per share. Adjusted earnings were 12 cents per share, beating

FactSet’s forecast of 4 cents. Total revenue of $395 million grew

6% year-over-year and was nearly in line with the consensus of

$395.1 million. Previously, there had been discussions about

selling the company, but after a more detailed analysis, a special

committee concluded that none of the proposals received were

favorable to the company’s interests. CEO Matthew Goldberg

explained that the committee will continue to evaluate

alternatives.

AppLovin (NASDAQ:APP) – AppLovin saw a

pre-market increase of 15.7% after reporting that first-quarter

earnings reached 67 cents per share and revenue hit $1.06 billion.

These results surpassed analysts’ expectations, who had forecast

earnings of 57 cents per share and revenue of $974 million.

Duolingo (NASDAQ:DUOL) – Duolingo’s shares fell

12.9% in pre-market trading after the quarterly report showed a

slower growth in daily active users since 2022. The 31.4 million

DAUs, above the average projection of 31.1 million, disappointed

investors despite first-quarter earnings of 57 cents per share,

double the consensus estimate. The company raised its revenue

outlook to up to $735.5 million, citing an expansion of its

subscription levels.

The Trade Desk (NASDAQ:TTD) – The Trade Desk

exceeded earnings expectations last quarter, driven by growth in

connected TV ads. Net income rose to $32 million, or 6 cents per

share, while revenue increased to $491 million. Analysts’ estimates

were $480 million in revenue. The company expects strong continued

performance, with projected revenues of at least $575 million for

the next quarter. Shares rose 1.1% in pre-market trading.

Six Flags (NYSE:SIX) – Six Flags reported a

larger loss in the first quarter and revenue below expectations.

The net loss was $83 million, or 98 cents per share, with revenue

of $133 million, below the $137 million estimate. Total spending

per guest dropped to $74.35. The company noted an increase in 2024

season pass sales but still faces revenue challenges. Shares were

stable in pre-market trading.

AMC Entertainment (NYSE:AMC) – AMC exceeded

first-quarter revenue estimates but expects a weaker current

quarter due to strikes delaying film releases. The company raised

$124.1 million through stock sales, reducing debt. First-quarter

revenue was $951.4 million, slightly below the previous year’s

revenue. The net loss decreased to $163.5 million, compared with

$235.5 million in the same period last year. Shares fell 3.5% in

pre-market trading.

Fox Corporation (NASDAQ:FOX) – Fox exceeded

profit expectations in the third quarter, driven by reduced

operating expenses despite a more than 15% drop in advertising

revenue. Reporting an adjusted profit of $1.09 per share, the

company also posted a net profit of $666 million. Total revenue was

$3.45 billion, in line with estimates. Shares rose 1% in pre-market

trading.

New York Times (NYSE:NYT) – The New York Times

exceeded revenue and profit estimates in the first quarter, driven

by its bundled content offering. Revenue reached $594 million, with

an adjusted profit of 31 cents per share. Although it added 210,000

digital subscribers, total advertising revenue fell 2.4%.

Arm Holdings (NASDAQ:ARM) – Arm’s shares fell

8.3% in pre-market trading, even after the company reported a

year-over-year revenue increase of 21%, reaching $928 million.

Non-GAAP earnings were 36 cents per share, exceeding the company’s

own estimates of 28 to 32 cents. The chip manufacturer also

released its full-year revenue expectations, projecting between

$3.8 billion and $4.1 billion, while Wall Street forecasts,

according to LSEG, were around $3.99 billion.

Equinix (NASDAQ:EQIX) – Equinix announced

revenues of $2.13 billion and quarterly funds from operations (FFO)

of $8.86 per share in the first quarter. The company also reported

an EBITDA of $992 million, surpassing analysts’ expectations from

FactSet, who anticipated $981.3 million.

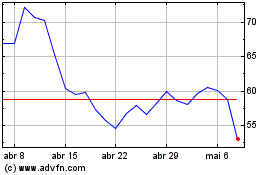

SolarEdge (NASDAQ:SEDG) – Shares of solar

energy company SolarEdge plummeted 9.3% in pre-market trading after

reporting a first-quarter loss greater than expected, at $1.90 per

share, exceeding projections of a $1.57 per share loss. Revenue of

$204.4 million surpassed consensus estimates of $194.18 million.

However, the revenue forecast for the second quarter was

discouraging, ranging between $250 million and $280 million, below

analysts’ expectations of $306 million.

Robinhood Markets (NASDAQ:HOOD) – Robinhood’s

shares rose about 5.3% in pre-market trading after reporting a

profit of 18 cents per share and revenue of $618 million in the

first quarter, surpassing analysts’ predictions from LSEG, who

expected a profit of 6 cents per share and revenue of $549 million.

Revenue from cryptocurrency transactions contributed $126 million

for the quarter. Robinhood also reported an increase of 810,000 in

its number of funded accounts, totaling 23.9 million. Additionally,

assets under custody grew 65% year over year, reaching $129.6

billion.

Klaviyo (NYSE:KVYO) – Klaviyo announced

optimistic projections for the second quarter, forecasting revenue

between $211 million and $213 million, surpassing analysts’

expectations from LSEG, who projected $210 million. For the full

year, Klaviyo revised its operating profit forecast upwards for

2024, now estimating between $97 million and $105 million. In the

first quarter, the company reported revenue of $210 million,

marking a 35% growth from the previous year.

Beyond Meat (NASDAQ:BYND) – Beyond Meat’s

shares fell 13.5% in pre-market trading after reporting a

larger-than-expected quarterly loss in the first quarter, with an

18% decline in revenue. The downturn is attributed to higher-priced

plant-based meat products, which impacted sales volumes. Revenue

was $75.6 million, slightly above the average analyst estimate of

$75.2 million. The company reported an adjusted loss per share of

72 cents, compared to estimates of a 67 cent per share loss. Annual

revenue and gross margin forecasts were maintained.

BRF SA (NYSE:BRFS) – BRF SA, one of the world’s

leading chicken suppliers, recorded its highest profit since 2022,

driven by lower costs and higher prices, surpassing analysts’

estimates. Earnings before interest and taxes more than tripled

compared to the previous year, reaching $414 million, exceeding

market expectations. BRF also reduced its net debt to the lowest

level in eight years.

SolarEdge Technologies (NASDAQ:SEDG)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

SolarEdge Technologies (NASDAQ:SEDG)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024