Interest Rate Optimism May Lead To Continued Strength On Wall Street

10 Maio 2024 - 10:09AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Friday, with stocks likely to extend the advance seen over

the course of the previous session.

The markets may continue to benefit from renewed optimism about

the outlook for interest rates, which has helped drive the Dow to a

seven-day winning streak.

Recent data has pointed to some softness in the U.S. labor

market, increasing investor confidence the Federal Reserve will

lower interest rates in the coming months.

While the Fed is still widely expected to leave interest rates

unchanged in June, the chances rates will be lower by September

have reached 85.4 percent, according to CME Group’s FedWatch

Tool.

However, early trading activity may be somewhat subdued ahead of

the release of the University of Michigan’s preliminary reading on

consumer sentiment in the month of May.

The consumer sentiment index is expected to dip to 76.0 in May

after falling to 77.2 in April, although traders may pay closer

attention to the readings on inflation expectations.

Following the lackluster performance seen over the two previous

sessions, stocks moved mostly higher during trading on Thursday.

The Dow extended its winning streak to seven sessions, once again

reaching its best closing level in over a month.

The major averages ended the day just off their highs of the

session. The Dow jumped 331.37 points or 0.9 percent to 39,387.76,

the S&P 500 climbed 26.41 points or 0.5 percent to 5,214.08 and

the Nasdaq rose 43.51 points or 0.3 percent to 16,346.26.

The strength on Wall Street came following the release of a

Labor Department report showing a much bigger than expected

increase by first-time claims for U.S. unemployment benefits in the

week ended May 4th.

The report said initial jobless claims climbed to 231,000, an

increase of 22,000 from the previous week’s revised level of

209,000.

Economists had expected jobless claims to inch up to 210,000

from the 208,000 originally reported for the previous week.

With the much bigger than expected increase, jobless claims

reached their highest level since hitting 234,000 in week ended

August 26th.

The data added to recently renewed optimism that the Federal

Reserve will lower interest rates in the coming months.

Among individual stocks, shares of AppLovin (NASDAQ:APP)

skyrocketed after the mobile technology company reported first

quarter results that beat expectations on both the top and bottom

lines.

Glasses retailer Warby Parker (NYSE:WRBY) also showed a

substantial move to the upside after reporting a narrower than

expected first quarter loss on revenues that exceeded

estimates.

On the other hand, shares of Airbnb (NASDAQ:ABNB) moved sharply

lower after the vacation rental company reported better than

expected first quarter results but provided disappointing

guidance.

Telecom stocks moved sharply higher over the course of the

trading session, resulting in a 4.2 percent spike by the NYSE Arca

North American Telecom Index.

Significant strength was also visible among gold stocks, as

reflected by the 2.5 percent jump by the NYSE Arca Gold Bugs Index.

The strength in the sector came amid an increase by the price of

gold.

Commercial real estate stocks also showed a strong move to the

upside on the day, driving the Dow Jones U.S. Real Estate Index up

by 2.1 percent.

Oil service, housing and steel stocks also saw considerable

strength, moving higher along with most of the other major

sectors.

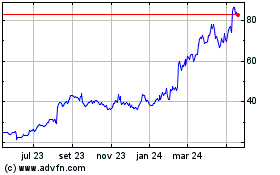

Applovin (NASDAQ:APP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

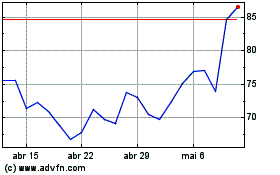

Applovin (NASDAQ:APP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024