Apple (NASDAQ:AAPL) – At today’s Apple

Developer Conference (WWDC 2024) kicking off today, the company

will demonstrate its prowess in the advanced field of artificial

intelligence. Despite being an early adopter of AI with products

like Siri, Apple now faces a perception of trailing behind

competitors following innovations like ChatGPT. Throughout the

event, Apple will unveil significant AI improvements, including a

new version of Siri and expanded functionalities for digital

content processing.

Microsoft (NASDAQ:MSFT) – Microsoft has decided

to keep its new Recall feature, which logs user activities on PCs

to streamline data organization, disabled by default. This decision

comes after security concerns arose regarding the potential for

hackers to access these logs. The company will also require

additional authentication to activate the feature. Additionally,

Microsoft showcased fully digital versions of the Xbox Series X and

S consoles at the Xbox Games Showcase, along with game trailers

like the new edition of “Call of Duty”. The event takes place

amidst a period of sluggish sales and economic challenges in the

gaming industry.

Nvidia (NASDAQ:NVDA) – Nvidia will commence

trading at a lower price today following a 10-for-1 stock split.

Wall Street remains bullish on Nvidia’s valuation increase, which

has surged by 144% this year. Evercore analysts believe Nvidia

could represent up to 15% of the S&P 500 in the future.

Advanced Micro Devices (NASDAQ:AMD) – Morgan

Stanley analysts downgraded AMD to neutral, citing elevated

investor expectations for its AI segment, especially when compared

to competitors like Nvidia and Broadcom. They see limited potential

for upward revisions for AMD, despite a rebound in its core

business and an anticipated increase in AI chip sales.

Snowflake (NYSE:SNOW) – Snowflake is

encouraging its clients to implement stricter security controls,

such as multi-factor authentication (MFA), after hackers targeted

customer accounts using malware and purchased credentials. This

follows security incidents involving clients like Live Nation

(NYSE) and Advanced Auto Parts (NYSE), raising concerns about data

security in the cloud.

Oracle (NYSE:ORCL) – Oracle’s primary medical

records client, the US Department of Veterans Affairs (VA),

reported that Oracle’s software is not improving patient care as

expected. Less than 20% of VA physicians and nurses believe the

software enables “high-quality care”. The VA is renegotiating its

$16 billion contract with Oracle, which acquired Cerner in 2022,

aiming to enhance the electronic medical records system.

Netflix (NASDAQ:NFLX) – Netflix plans to drive

its next growth phase by investing in live events and sports,

following the success of its ad-supported offering. The strategy,

mirroring the traditional TV model, could propel stocks back to

2021 record highs, benefiting from increased visibility and

advertising revenue potential.

Walmart (NYSE:WMT) – Walmart opposes New York’s

new legislation requiring panic buttons in stores, arguing it may

trigger too many false alarms. The law was passed to enhance retail

worker safety in response to rising violence and thefts. In other

related news, Walmart forecasts its US e-commerce business to be

profitable within the next two years. The company is focused on

cost reduction and order fulfillment, capitalizing on the 22% surge

in online sales in the last quarter.

Yelp (NYSE:YELP) – Yelp may sue ReviewVio for

falsely advertising that it can remove negative reviews from the

Yelp website, alleging trademark infringement and unfair

competition. Judge William Alsup in San Francisco allowed the

lawsuit to proceed, highlighting potential confusion about the

relationship between the companies and the impact on Yelp’s

advertising services.

Tesla (NASDAQ:TSLA) – Tesla CEO Elon Musk

announced that there won’t be an updated version of the Model Y

this year, despite ongoing improvements to vehicles. Upgrades to

Tesla’s older models have been sluggish due to high interest rates

and competition from more affordable models in China. Additionally,

Tesla shareholders will soon vote on a controversial $56 billion

compensation package for Elon Musk. With approximately 90% of

retail shareholders seemingly in favor, approval seems likely

despite opposition from major funds and recommendations against

from proxy advisors. Norway’s $1.7 trillion sovereign wealth fund

will vote against Elon Musk’s $56 billion pay package at Tesla,

after a judge deemed it unfair to shareholders. Tesla also argues

that the legal team that nullified Elon Musk’s pay package in

January deserves only a fraction of the $5.6 billion in fees

sought, as the case brought little benefit to the company. The

automaker proposes to pay $13.6 million for legal services.

Stellantis (NYSE:STLA) – Stellantis has

preemptively expanded the recall of potentially faulty airbags in

Europe, Africa, and the Middle East to include more Citroen, DS,

and Opel models. The recall now covers Citroën C4, DS4, DS5 models,

and some Opel vehicles, albeit less restrictive than the initial

recall, which included Citroën C3 and DS3.

Southwest Airlines (NYSE:LUV)- Elliott

Investment Management, an activist investor, has acquired a nearly

$2 billion stake in Southwest Airlines. They plan to press the

airline for strategic changes to rectify its underperforming

performance.

Spirit Airlines (NYSE:SAVE) – Spirit Airlines

dismisses the possibility of bankruptcy and is optimistic about its

plan following the failure of the merger with JetBlue (NASDAQ). CEO

Ted Christie expressed this confidence at the annual shareholder

meeting, despite a recent decline in the company’s shares and

operational challenges, including aircraft groundings.

Boeing (NYSE:BA) – Boeing’s CST-Starliner space

taxi successfully docked with the International Space Station,

bringing its first astronauts, Sunita Williams and Barry Wilmore.

This test flight is crucial for both NASA and Boeing, especially

after multiple delays and technical setbacks.

Virgin Galactic (NYSE:SPCE) – Virgin Galactic

successfully conducted its second spaceflight this year on

Saturday, carrying Turkish, American, and Italian tourists to the

edge of space. Galactic Mission 07 reached approximately 55 miles

in altitude on a flight lasting just over an hour, departing and

returning to Spaceport America in New Mexico.

BP plc (NYSE:BP) – BP updated its conflict of

interest policy, requiring employees to disclose any intimate

relationships with colleagues. The change follows the dismissal of

former CEO Bernard Looney for failing to disclose such

relationships, emphasizing total transparency to avoid conflicts of

interest, under the threat of dismissal.

Occidental Petroleum (NYSE:OXY),

Berkshire Hathaway (NYSE:BRK.A) – Warren Buffett’s

Berkshire Hathaway acquired about 2.57 million shares of Occidental

Petroleum from June 5 to 7, investing over $150 million. This

raised its total stake in the company to approximately 250.6

million shares, representing about 28% of Occidental.

US Steel (NYSE:X) – Takahiro Mori, vice

president of Nippon Steel, returned to the US to promote the

acquisition proposal for US Steel, receiving positive feedback from

employees and community leaders. Despite regulatory scrutiny and

union opposition, the Japanese company aims to conclude the $14.9

billion merger, already approved outside the US.

Diamond Offshore Drilling (NYSE:DO),

Noble Corporation (NYSE:NE) – Diamond Offshore

Drilling has agreed to be acquired by Noble Corp. for approximately

$1.6 billion in a cash and stock deal. Under the agreement, Diamond

Offshore’s shares were valued at $15.52 based on Friday’s closing

price. Diamond Offshore Drilling shares rose 4.6% in pre-market

trading to $14.57.

CrowdStrike (NASDAQ:CRWD), KKR &

Co (NYSE:KKR), GoDaddy (NYSE:GDDY) –

S&P Dow Jones Indices announced that KKR & Co, CrowdStrike,

and GoDaddy will be added to the S&P 500 index on June 24,

replacing Robert Half (NYSE:RHI),

Comerica (NYSE:CMA), and Illumina

(NASDAQ:ILMN).

Blackstone (NYSE:BX) – Nadeem Meghji, global

co-head of Blackstone’s real estate sector, noted that liquidity is

returning to the real estate market, with high-quality assets

attracting more interest. He observed an increase in the number of

bidders for apartment buildings, attributing this to falling

capital costs and new supply.

KKR & Co (NYSE:KKR) – KKR & Co.

invested $50 million in one of its main real estate funds and

committed to supporting its valuation amidst commercial real estate

market instability. The company also plans to repurchase up to 7.7

million shares if the fund’s valuation falls below $27 per share by

2027, ensuring value for shareholders and demonstrating confidence

in the real estate market’s recovery.

PowerSchool Holdings (NYSE:PWSC), Bain

Capital (NYSE:BCSF) – Bain Capital will acquire

PowerSchool Holdings in a deal valuing the educational software

company at $5.6 billion. Bain will pay $22.80 per share, a 37%

premium over the previous closing price. Vista Equity and Onex will

retain minority stakes post-acquisition.

Visa (NYSE:V), Mastercard

(NYSE:MA)- Visa and Mastercard will face new lawsuits in London

after a court allowed collective proceedings on behalf of merchants

to proceed. The companies are accused of overcharging interchange

fees, with many lawsuits already underway in London’s Competition

Appeal Tribunal.

Waystar (WAY) – Waystar shares fell on Friday

in their Nasdaq debut after raising $968 million in their initial

public offering, one of the largest IPOs of the year. The shares

opened at $21, below the IPO price of $21.50, and closed at $20.70,

valuing the company at $3.50 billion.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens Boots Alliance is considering an initial public offering

for its Boots pharmacy network in the UK, while continuing sale

negotiations. The company has informally discussed with potential

buyers, including private equity firms, without yet making a final

decision on Boots’ sale.

Pfizer (NYSE:PFE) – A study by Stanford

University found that a 15-day treatment with Pfizer’s antiviral

Paxlovid did not alleviate long Covid symptoms. Despite hopes based

on anecdotal reports, the study involving 155 participants showed

no significant improvement in symptoms like fatigue and mental

confusion.

Moderna (NASDAQ:MRNA) – Moderna announced that

its combined Covid-19 and flu vaccine is more effective than

individual vaccines, based on a late-stage trial. Being the first

to release positive phase three data, the company plans to seek

regulatory approval in the US soon, targeting a 2025 launch.

Express (NYSE:EXPR) – Express is selling its

business for $160 million to a consortium including mall owners and

investment firms. The sale, still open to better offers, also

includes assuming $38 million in liabilities. This move averts the

risk of liquidation and protects jobs and stores.

GameStop (NYSE:GME) – GameStop shares rose 6.6%

in pre-market trading after closing down 39% on Friday, marking its

worst day since February 4, 2021. This occurred despite Keith Gill,

the infamous meme trader known as Roaring Kitty, scarcely

mentioning GameStop in his live stream on Friday, although he

reiterated his bullish stance on the company.

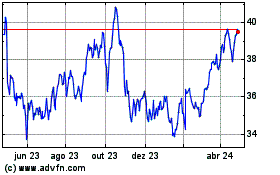

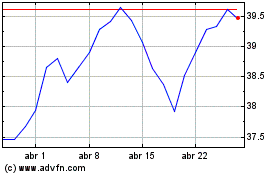

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024