Founder of Curve Finance faces liquidation after CRV token drop

Michael Egorov, the founder of Curve Finance (COIN:CRVUSD),

faced liquidation after the CRV token hit an all-time low of $0.22.

Approximately 100 million CRV were liquidated, totaling $27

million, but Egorov still holds 39.35 million CRV securely. This

situation triggered widespread liquidations, causing concern among

investors. Despite this, Curve Finance praised its soft liquidation

mechanism during the recent market turmoil, highlighting its

resilience against adverse events like the UwU hack.

Gary Gensler predicts approval of Ether ETFs by the end of Q3

Cryptocurrency markets faced continued pressure during

Thursday’s US trading session, following a drop initiated after the

Fed indicated a single rate cut this year. During a hearing before

the US Senate Appropriations Committee, SEC Chairman Gary Gensler

indicated that Ether exchange-traded funds (ETFs) could be approved

by the end of the third quarter. He mentioned that issuers are

progressing with the registration process and approval to list

these ETFs could happen in the coming months. These ETFs would

allow investors to trade Ether without directly holding the

cryptocurrency. Despite a brief recovery spurred by Gensler’s

optimistic comments, Ethereum (COIN:ETHUSD) fell by -2.7% to

$3,463. Bitcoin (COIN:BTCUSD) also dropped by 2.3%, trading near

$66,703.

Bitcoin ETFs see $100.8 million inflow after previous outflows

On June 12, Bitcoin ETFs experienced a positive turnaround, with

an inflow of $100.8 million after two consecutive days of outflows.

Notably, Fidelity’s ETF (AMEX:FBTC) led with $50.6 million in

inflows, followed by BlackRock’s ETF (NASDAQ:IBIT) with $15.6

million and Bitwise’s ETF (AMEX:BITB) with $14.5 million. This

shift was driven by the recent increase in Bitcoin’s price and

favorable US economic data.

SEC may receive little from multibillion-dollar settlement with

Terraform Labs

Chris Amani, CEO of Terraform Labs, announced the company’s

closure following a $4.47 billion settlement with the US SEC. The

plan includes selling projects and transferring control to the

community. This decision follows the collapse of the UST stablecoin

in 2022. The community reacted mixedly, and Terra (COIN:LUNAUSD)

and Terra Luna Classic (COIN:LUNCUSD) prices fell after the

announcement, underscoring the importance of regulatory compliance

and governance in the crypto space. The SEC is likely to receive a

fraction of the amount due to the company’s bankruptcy process,

which shows $430.1 million in assets against $450.9 million in

liabilities. Bankruptcy payment priorities place government fines

and penalties, like those from the SEC, behind secured

creditors.

Growth and rotation in the digital asset market in 2024

So far, the digital asset sector has accumulated $12 billion in

net inflows in 2024, with projections from JPMorgan Chase

(NYSE:JPM) indicating this could reach $26 billion by year-end. The

report highlights that spot bitcoin ETFs are the main contributors,

attracting $16 billion of these inflows. However, a significant

portion of these inflows appears to be a reallocation of funds from

digital wallets on exchanges to the new ETFs, rather than new

capital entering the crypto market.

MicroStrategy seeks $500 million to buy more Bitcoin

MicroStrategy (NASDAQ:MSTR) plans to issue $500 million in

senior convertible notes to finance new Bitcoin (COIN:BTCUSD)

acquisitions. Targeted at qualified institutional buyers, the

private offering aims to bolster the company’s position in a

volatile market. With 214,400 BTC currently in its portfolio,

valued at around $15 billion, MicroStrategy will offer the option

to purchase up to an additional $75 million in notes. The notes

will mature in 2032, and investors can convert them into cash,

MicroStrategy common stock, or a combination of both, aligning with

Michael Saylor’s Bitcoin-focused growth strategy.

P2P.org launches crypto staking services for institutional clients

in collaboration with OKX

P2P.org, specializing in institutional validation, has

introduced cryptocurrency staking services for large clients in

partnership with the OKX exchange. This service is part of the

staking-as-a-business (SaaB) model, allowing enterprise clients to

use staking on a range of crypto assets like Polkadot, Kusama,

Celestia, and Cardano. This collaboration with OKX facilitates

yield generation without the complexities of setting up new nodes.

Notably, technical difficulties and operational costs have been

significant barriers for institutions entering this sector. P2P.org

has also achieved a total value locked of $7.5 billion and

presented its staking business model to reduce these obstacles for

institutions.

Privado ID rebrands and separates from Polygon Labs to expand in

digital identity market

Privado ID, formerly known as Polygon ID, has separated from

Polygon Labs (COIN:MATICUSD) to operate independently in the

growing digital identity market. According to the company, this

change aims to meet the rising demand for digital identity

solutions, both online and on-chain, forecasting the market to grow

to $101.37 billion by 2030. Privado ID plans to offer its solutions

across various Ethereum Virtual Machine (EVM)-compatible

blockchains, expanding its reach beyond the Polygon network.

Film.io and VillageDAO drive decentralization in the film industry

Film.io, led by Bryan Hertz, is the first official partner of

VillageDAO, a smart contract framework within ConsenSys. Film.io

uses blockchain to democratize the Hollywood studio system,

allowing filmmakers to create and fund independent projects. The

partnership aims to provide a better-managed environment than

traditional platforms like Discord, promoting advanced technology,

efficient funding, and robust community support. The certified

“Community Expert” program will help integrate new members and

strengthen the Film.io community within VillageDAO.

Exploring the potential of blockchains to fund public good

While many see crypto as merely a wealth opportunity, the

technology is also driving innovations in public financing. At a

Consensus 2024 talk, an industry expert highlighted how blockchains

are creating scalable and transparent ways to fund social and

environmental projects. Although still in its infancy, these

mechanisms promise to transform resource distribution globally,

challenging traditional economic and governance paradigms.

European Commission selects Iota for Web3 identification solution

The European Commission has chosen Iota’s (COIN:IOTAUSD) Web3

identification solution for its European Blockchain Sandbox (EBSI)

initiative. The project aims to revamp traditional KYC through DLT

and tokenization. Iota plans to use its participation to explore

privacy and KYC regulations in the Web3 environment, crucial for

the evolution of decentralized finance (DeFi). The EBSI provides a

controlled environment for blockchain technology testing, focusing

on facilitating interaction between projects and EU regulators.

BNB Chain launches incubation alliance for Web3 projects

BNB Chain (COIN:BNBUSD) has unveiled a new initiative in

collaboration with Binance Labs: the BNB Incubation Alliance (BIA),

aimed at supporting early-stage blockchain projects. The program

offers a 10-week accelerator, grants, investments, and launch

services for builders and developers. Participant selection will

occur through global events, focusing on early-stage blockchain

ventures. The first edition of the BIA will launch during the

Ethereum Community Conference in Brussels.

Joe Biden plans crypto donations despite proposed high taxes for

mining

Joe Biden’s campaign team is exploring the possibility of

accepting crypto donations via Coinbase Commerce, aiming to attract

support from the crypto community. This initiative comes after a

period of strained regulatory relations between the Biden

administration and the crypto sector. Additionally, the Biden

administration’s recent proposal suggests a new 30% tax

specifically for cryptocurrency miners, part of the next fiscal

year’s budget. This initiative contrasts with former President

Trump’s pro-crypto policies, which recently encouraged US dominance

in bitcoin mining. The measure aims to address environmental

concerns and regulate the industry, but critics argue it would

stifle sector growth, discourage innovation, and could be

unconstitutional due to its focus on a single industry.

Tether CEO claims Bitcoin is the only decentralized asset

The CEO of Tether (COIN:USDTUSD), Paolo Ardoino, emphasized

Bitcoin’s uniqueness in terms of decentralization. While most

cryptocurrencies rely on developer groups for updates and monetary

policy changes, Bitcoin is governed solely by mathematical

algorithms. Its limited and predictable supply, with halvings every

four years, provides certainty to investors. Ardoino acknowledged

that his view might be controversial, especially regarding Tether’s

centralization. He also expressed skepticism about memecoins and

participated in BTC Prague, an event focused exclusively on

Bitcoin.

Paxos cuts staff to focus on tokenization and stablecoins

Paxos (COIN:PAXGUST) laid off 65 employees, about 20% of its

workforce, to concentrate on tokenization and stablecoins. CEO

Charles Cascarilla stated that the layoffs would strengthen the

company’s ability to capitalize on opportunities in these sectors.

Despite previous regulatory challenges, including restrictions on

Binance’s BUSD, Paxos maintains a robust financial position with

over $500 million in corporate assets. The company plans to

gradually wind down settlement services to focus exclusively on

developing tokenization and stablecoin solutions.

Swiss digital bank focused on crypto declares bankruptcy

FlowBank, a Swiss digital bank focused on cryptocurrencies, has

been declared bankrupt and closed by the Swiss Financial Market

Supervisory Authority (FINMA) due to capital insufficiency and

severe violations of minimum requirements. The institution, which

began operations in 2020 and offered crypto-related services, now

faces liquidation with no prospects of restructuring, while

customers with guaranteed deposits await fund returns.

Manta Network establishes $50 million fund for development

ecosystem

Manta Network launched a $50 million fund to boost projects on

its modular layer 2 network, focusing on zero-knowledge

applications. This funding will be distributed over a year through

direct investments, grants, and support for hackathons. Despite a

decline in total value locked following a crypto yield program,

Manta remains resilient after a previous DDoS attack. The fund aims

to catalyze innovation and sustainable growth within the Manta

ecosystem.

Nuffle Labs receives $13 million to develop NEAR data layer

The NEAR Foundation launched Nuffle Labs, an independent entity,

securing $13 million in strategic funding. Nuffle Labs will focus

on developing the NEAR Data Availability Layer (NEAR DA) and other

modular NEAR products. Funding came from the NEAR Foundation,

Electric Capital, and other investors. The company aims to enhance

the competitiveness of NEAR products and leverage the strengths of

various platforms to strengthen the ecosystem. The NEAR token

(COIN:NEARUSD) is currently priced at $6.08.

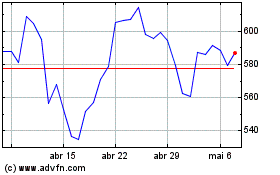

Binance Coin (COIN:BNBUSD)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Binance Coin (COIN:BNBUSD)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024