SolarEdge Technologies (NASDAQ:SEDG) –

SolarEdge Technologies faces a 13.1% drop in pre-market trading

after announcing the issuance of $300 million in senior convertible

notes due 2029 and revealing that PM&M Electric, a customer

owing $11.4 million, has declared bankruptcy under Chapter 7.

Novo Nordisk (NYSE:NVO) – Novo Nordisk

announced the approval of Wegovy in China, initially planning to

market it to patients who can afford the weekly injectable

treatment. While facing competition from Eli Lilly, the company is

mindful of the upcoming patent expiration of the key ingredient,

semaglutide, in less than two years in the country. Additionally,

Novo Nordisk unveiled a $4.1 billion investment in a new facility

in Clayton, North Carolina, to expand the production of Wegovy and

Ozempic injection pens. With completion expected between 2027 and

2029, this expansion will create 1,000 jobs and aims to meet the

growing global demand for obesity and diabetes treatments. Shares

rose 1.6% in pre-market trading.

Illumina (NASDAQ:ILMN), Grail

– Grail, newly spun off from Illumina, debuts on Nasdaq today with

the Galleri test, which aims to detect multiple types of cancer

early. With strategic partnerships in health, employment, and

insurance, it seeks to expand its global impact following clinical

trials and regulatory approvals in the U.S. and abroad.

Apple (NASDAQ:AAPL), Meta

Platforms (NASDAQ:META) – Apple rejected the integration

of Meta’s Llama chatbot into its devices due to privacy concerns,

according to Bloomberg. Conversations between Apple and Meta in

March did not progress to formal negotiations. Simultaneously,

Apple has partnered with OpenAI and Alphabet to incorporate their

AI technologies.

Nvidia (NASDAQ:NVDA) – Nvidia shares rose 2.30%

in pre-market trading. On Monday, Nvidia shares fell 6.7%, marking

their third negative session, accumulating a 13% drop over three

days. Nvidia entered correction territory, losing $430 billion in

market value, the largest three-day devaluation in history,

reflecting growing concerns about the sustainability of its high

valuation. The sell-off led investors to use technical analysis to

seek price support. The stock, now in technical correction, shows

signs of capitulation, with potential supports at $115 and $100.

Simona Jankowski, Nvidia’s VP of investor relations and strategic

finance, is leaving to become CFO of an unspecified startup. She

was instrumental in Nvidia’s financial growth during the AI boom,

working closely with CEO Jensen Huang since 2001.

Microsoft (NASDAQ:MSFT) – A White House

official said on Monday that Microsoft’s $1.5 billion investment in

G42 is seen positively as it steers the UAE company away from ties

with Huawei, promoting an alternative more aligned with U.S.

security interests.

Oracle (NYSE:ORCL) – Oracle warned of the

negative financial impact of new U.S. legislation that could ban

TikTok from using its internet hosting services. This could

significantly reduce its revenue associated with the app, estimated

between $480 million and $800 million annually.

Super Micro Computer (NASDAQ:SMCI) – Super

Micro Computer shares rose 1.7% in pre-market trading on Tuesday

after falling 8.7% in Monday’s session, its worst performance since

a 14% drop on May 1.

AT&T (NYSE:T) – AT&T CEO John Stankey

proposed that large technology companies contribute to the

Universal Service Fund, currently funded by telecommunications

subscribers’ fees. He argues that these companies should

participate to ensure equitable access to essential services.

Paramount Global (NASDAQ:PARA) – Paramount

Global is increasing subscription rates for its streaming services,

such as Paramount+ and Paramount+ Essential, by up to $2 per month,

aiming to restructure its business and pay down debt. This follows

the failure of merger talks with Skydance Media.

Warner Music Group (NASDAQ:WMG) – Record labels

Sony Music, Universal Music Group, and Warner Records sued Suno and

Udio for copyright infringement for using recordings to train AI

music generation systems, alleging direct impact on human artists

and demanding up to $150,000 per copied song in lawsuits filed in

New York and Massachusetts.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group, the company behind Donald

Trump’s Truth Social platform, saw its shares rise 10.4% in

pre-market trading. On Monday, the shares had already increased by

21%, marking the second-largest percentage gain since Trump Media

merged with Digital World Acquisition Corp. in late March.

Amazon (NASDAQ:AMZN) – Whole Foods, owned by

Amazon, is betting on “little luxuries” – gourmet foods in small

portions as an emerging trend, perfect for consumers seeking

moderate indulgences. Jason Buechel highlighted this trend at the

Summer Fancy Food Show, exemplifying with Petit Pot’s organic

puddings. Simultaneously, Whole Foods plans to expand with smaller

convenience stores called Daily Shop, starting in Manhattan.

Shopify (NYSE:SHOP) – Shopify expanded access

to Sidekick and AI tools, allowing image editing on smartphones for

customers. This initiative strengthens its e-commerce platform,

which faces recent challenges with inflation and economic

uncertainty, despite its growth during the pandemic.

Target (NYSE:TGT) – Target is collaborating

with Shopify to expand its marketplace, Target Plus, allowing

Shopify sellers to offer products on the Target site. This

partnership aims to increase the variety of available merchandise,

competing with Amazon and Walmart, while maintaining a selective

product curation model.

Nike (NYSE:NKE) – Nike is expanding its

presence in China with a 1,000-square-meter store in Beijing

dedicated to Michael Jordan. This space will not only sell

exclusive products and collaborations with local artists but also

aims to strengthen ties with Chinese basketball. The strategy seeks

to revitalize the brand amid declining sales and rising consumer

nationalism.

Birkenstock (NYSE:BIRK) – Birkenstock’s largest

shareholder, L Catterton, will sell 14 million shares in a

secondary public offering. Despite the drop, shares have risen

22.7% this year. The offering aims to increase the investor base

and liquidity of the shares.

Abercrombie & Fitch (NYSE:ANF) –

Abercrombie & Fitch shares have outperformed Nvidia in terms of

stock growth. Over the past 12 months, Abercrombie shares rose

357%, compared to Nvidia’s 191%, and over two years, 816% compared

to 630%. Abercrombie has benefited from a successful recovery

strategy that resonates with younger consumers.

Pool Corp. (NASDAQ:POOL) – The pool equipment

distributor raised concerns about a slowdown in the leisure sector

after cutting its profit forecasts due to weak demand for new pool

construction, impacted by high costs and unfavorable macroeconomic

conditions.

Boeing (NYSE:BA) – Families of the victims of

the Boeing 737 MAX crashes have requested a U.S. judge appoint an

independent monitor to oversee the company’s safety procedures,

citing concerns about regulatory violations and recent incidents.

The judge will decide after the Department of Justice considers new

legal actions against Boeing.

Spirit AeroSystems (NYSE:SPR) – Boeing has

proposed buying Spirit AeroSystems for about $35 per share, a 6%

premium over the recent closing value, according to Bloomberg. The

offer is stock-based, with possible inclusion of cash, and an

agreement could be announced soon.

Toyota Motor (NYSE:TM) – Toyota sold $2 billion

in cross-shareholdings in the last fiscal year, reducing the number

of its holdings from 141 to 124. The company completely divested

from ANA Holdings, Japan Airlines, and East Japan Railway, which

did not hold Toyota shares.

Tesla (NASDAQ:TSLA) – Tesla CEO Elon Musk

promised a new “Master Plan 4,” potentially revolutionizing

robotics, following mixed success in previous plans. Despite

criticism for unmet promises, his supporters see immense future

value in innovations such as robots and autonomous taxis. The

plan’s revelation remains undefined.

Rivian (NASDAQ:RIVN) – Rivian streamlined its

manufacturing process, removing over 100 steps in battery

production and 52 pieces of equipment, resulting in significant

material cost reductions. The company aims to improve profitability

while facing financial challenges and production delays.

BYD Co. (USOTC:BYDDY) – BYD launched its third

electric vehicle, the Seal sedan, in Japan at a competitive price

to attract consumers in a market that favors hybrids and local

brands.

Uber Technologies (NYSE:UBER),

Lyft (NASDAQ:LYFT) – The U.S. Court of Appeals

rejected a class-action lawsuit against Uber, claiming its policy

of firing drivers with low ratings is not racially discriminatory.

The decision highlighted the lack of solid statistical evidence

that non-white drivers were deactivated in greater numbers than

white drivers with similar ratings. Additionally, Bloomberg

reported that Uber and Lyft are blocking drivers in New York during

low-demand periods to combat a minimum wage rule that requires

payment for idle time between rides. This has reduced drivers’

earnings by up to 50%, causing criticism and strike threats. The

companies blame regulations that they say unfairly penalize their

operations.

Chevron (NYSE:CVX) – Chevron expects a

reduction of 65,000 barrels of oil equivalent per day in

second-quarter production due to shutdowns in Kazakhstan and the

Gulf of Mexico. Additionally, it expects a $300-400 million impact

on earnings due to refinery maintenance in California.

Goldman Sachs (NYSE:GS), Hess

Corp (NYSE:HES) – John Hess, CEO of Hess Corp, has been

named an independent director on the Goldman Sachs board, also

joining the compensation, governance, and risk committees. This

addition comes as Hess Corp is in the process of being sold to

Chevron and involved in arbitration with Exxon Mobil and CNOOC.

JPMorgan Chase (NYSE:JPM) – Oliver Cox, manager

of the JPMorgan SAR Asian Fund, highlights that chip stocks in Asia

are undervalued compared to their U.S. counterparts, predicting a

recovery due to continued demand for artificial intelligence. He

points out that lower valuations offer growth opportunities,

especially for companies like TSMC and Samsung.

Citigroup (NYSE:C) – Citigroup faces challenges

with its living will, deemed invalid by regulatory authorities due

to deficiencies in derivatives. This implies additional consulting

and legal costs, increasing pressure on management already dealing

with other issues, including litigation and data management.

Moody’s highlights the need to improve crisis resolution and

regulatory compliance.

HSBC (NYSE:HSBC) – FundPark, a Hong Kong

fintech, secured a $250 million private loan from HSBC, focusing on

technology and healthcare in the region. This is the second

significant loan this year, strengthening its role in financing

small and medium-sized e-commerce businesses in China.

PacifiCorp (USOTC:PPWLO), Berkshire

Hathaway (NYSE:BRK.A) – PacifiCorp, owned by Berkshire

Hathaway, agreed to pay $150 million to settle claims related to

the Slater Fire, which affected areas of California and Oregon in

2020. This is part of a larger effort to resolve litigation that

includes accusations of not shutting off power lines during

storms.

KKR & Co (NYSE:KKR) – KKR is seeking $20

billion for its new North American private equity fund, facing a

challenging fundraising market. The North America Fund XIV aims for

a high-teens net internal rate of return (IRR), following a

predecessor with a 20.5% net IRR through March.

Riot Platforms (NASDAQ:RIOT),

Bitfarms (NASDAQ:BITF) – Riot is seeking three

board seats at Bitfarms after withdrawing its $950 million

acquisition offer. The dispute has intensified with mutual

accusations of poor governance as both companies prepare for a

board battle over Bitfarms’ strategic future.

TWFG – TWFG announced a 27% increase in annual

net profit and is preparing for its initial public offering (IPO)

in the U.S. TWFG joins other recent companies, such as Bowhead

Specialty, in listing its shares in a hot IPO market in 2024,

encouraged by a stable economy.

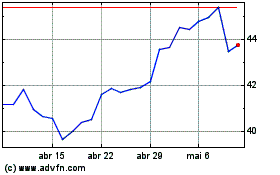

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

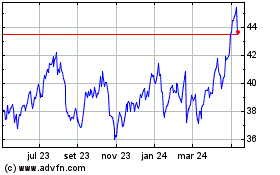

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024