BP plc (NYSE:BP) – BP expects weak margins in

its refining business to impact its second-quarter profits by up to

$700 million. The decline in refining margins, due to excess

renewable diesel in the US, is the main cause. Shares fell 3.5% in

pre-market trading.

Morgan Stanley (NYSE:MS) – Mike Wilson, Chief

Investment Officer at Morgan Stanley, predicts a 10% drop in the

S&P 500 index before the US presidential elections, citing

uncertainties about the Federal Reserve’s monetary policy and the

weakening ability of companies to maintain high prices for their

products, which could lead to disappointing earnings results.

JPMorgan Chase (NYSE:JPM) – JPMorgan has

lowered its forecast for emerging market companies expected to

default due to a significant improvement in market stress prices

since 2016. Corporate default levels in 2024 are expected to be

below the historical average, with China and Latin America still

facing challenges.

Bank of America Corp. (NYSE:BAC), PNC

Financial (NYSE:PNC), KeyCorp (NYSE:KEY)

– UBS analysts highlighted Bank of America as the most interesting

bank as the second-quarter earnings season approaches. The bank may

benefit from a potential interest rate cut, boosting its net

interest income. UBS also adjusted its ratings for PNC Financial,

upgrading it to “Buy,” but downgraded KeyCorp due to concerns about

its capital position. Bank of America shares rose 0.7% in

pre-market trading.

Citigroup (NYSE:C) – Citigroup will end its

operations in Haiti due to low demand from institutional clients

and reduced international banking activity after more than five

decades in the country. This decision is part of a strategic review

and will not have a significant economic impact on Citi, which,

under CEO Jane Fraser, has focused on more profitable markets and

is preparing for an initial public offering of its consumer unit in

Mexico in 2025.

KKR & Co (NYSE:KKR), Kokusai

Electric (USOTC:KOKSF) – The private equity firm KKR plans

to reduce its stake in Kokusai Electric, selling about half of its

43% shares. Kokusai plans to repurchase shares on the market. Since

its IPO in 2018, shares of the deposition equipment manufacturer, a

former subsidiary of Hitachi, have tripled in value.

Bain Capital (NYSE:BCSF),

Envestnet (NYSE:ENV), Bapcor

(ASX:BAP) – Bain Capital is close to acquiring Envestnet, a US

financial software provider valued at about $3.5 billion. The deal,

expected this week, would value Envestnet near its current share

price, about $63. The company is facing a leadership transition

after the CEO announced his departure. Envestnet shares fell 0.40%

in pre-market trading. Elsewhere, Bapcor, an Australian automotive

parts retailer, rejected a $1.2 billion buyout offer from Bain

Capital, considering it low. The offer of A$5.40 per share does not

reflect fair value, according to the company, which also owns

Autobarn and the Midas network, among other brands.

Constellation Energy (NASDAQ:CEG),

Vistra (NYSE:VST) – The nuclear energy companies

Constellation Energy and Vistra lead the S&P 500 after Super

Micro and Nvidia, due to explosive growth in demand for clean

energy to support data centers and manufacturers amid the expansion

of artificial intelligence. Investors are betting on these nuclear

companies, driven by US government support for sustainable energy

investments. This year, Vistra is up 132% and Constellation Energy

81%. Constellation shares are stable in pre-market trading, while

Vistra shares rose 0.8%.

Exxon Mobil (NYSE:XOM) – Exxon Mobil indicated

that lower refining margins and reduced natural gas prices will

impact its second-quarter earnings, expected to be between $1.50

and $2.40 per share. Excluding the $60 billion acquisition of

Pioneer, additional production will not be reflected until the

third quarter. Shares are stable in pre-market trading.

Devon Energy (NYSE:DVN) – Devon Energy

announced on Monday the acquisition of Grayson Mill Energy’s

assets, focused on the Bakken, for $5 billion in cash and shares.

The deal will strengthen Devon’s multi-basin business, increasing

its position in the Williston Basin with 500 new wells. The

transaction is expected to close by the end of the third quarter.

Additionally, Devon’s board plans to expand share repurchases by

67% to $5 billion by mid-2026, while expecting the acquisition to

contribute to the company’s dividend payments starting in 2025.

Shares fell 0.8% in pre-market trading.

Petrobras (NYSE:PBR) – Petrobras announced on

Monday its first gasoline price increase in almost a year, also

raising the prices of gas used for cooking and heating. The 7%

increase in gasoline for distributors takes effect on Tuesday and

indicates a shift under new executive leadership.

Alphabet (NASDAQ:GOOGL) – The use of artificial

intelligence has driven tech stocks this year, but analysts are

cautious about Alphabet’s (Google) stock outlook. Although Wells

Fargo raised the price target to $187, maintaining an “Equal

Weight” rating, this still implies a 2% drop from Friday’s closing

price of $190.60. Alphabet closed down -0.8% on Monday. Shares rose

0.21% in pre-market trading.

Meta Platforms (NASDAQ:META),

Vodafone (NASDAQ:VOD) – Meta Platforms’

advertising sales have accelerated over the past four quarters,

boosting an optimistic revenue and stock forecast. Wedbush analyst

raised the price target for Meta shares to $570 due to strong

advertiser spending. Recently, Meta collaborated with Vodafone to

optimize the delivery of short videos on 11 European mobile

networks without significantly compromising viewing experience.

This was in response to the steady growth in data usage driven by

videos on platforms like Instagram, TikTok, and YouTube. The

optimization managed to reduce Meta’s data traffic on Vodafone’s UK

network, freeing up capacity in busy locations. Shares rose 0.55%

in pre-market trading.

Logitech International SA (NASDAQ:LOGI) –

Logitech rejected founder Daniel Borel’s attempt to replace board

chair Wendy Becker with Guy Gecht at the annual shareholders’

meeting. Gecht, who is already on the board, stated he had no

interest in being chair and supports Becker. Borel criticized the

company’s leadership and Becker’s technological competence, who

announced her resignation for 2025. Dissatisfied, Borel took the

issue to court. Meanwhile, the company recovered economically after

a post-pandemic decline. Shares fell 0.64% in pre-market

trading.

Intel (NASDAQ:INTC) – Intel shares closed with

a 6.2% gain on Monday after a Melius Research report highlighted

that Intel could perform well in the second half of the year. The

company has been up in six of the last seven sessions. Shares rose

4.24% in pre-market trading on Tuesday.

Helios Technologies (NYSE:HLIO) – Helios

Technologies’ board placed CEO and president Josef Matosevic on

paid leave to investigate allegations of a possible violation of

the company’s code of conduct and ethics. Helios stated that the

alleged conduct does not affect the company’s strategy or financial

reports. Shares fell 8.22% in pre-market trading.

Walt Disney (NYSE:DIS) – Disney announced plans

to launch a new cruise ship in Tokyo starting in 2028, in

partnership with the Oriental Land Company, operator of Tokyo

Disneyland. This ship, modeled after the “Wish,” will be the ninth

in Disney’s fleet, part of a 10-year, $60 billion expansion in the

company’s theme parks and cruise business. Shares rose 0.22% in

pre-market trading.

Paramount Global (NASDAQ:PARA) – David Ellison,

CEO of Skydance Media, outlined on Monday a vision for Paramount

Global as a hybrid technology and media company, amid competition

from tech giants in the entertainment sector. He highlighted the

importance of the merger with Paramount to better serve a

transformed market, emphasizing the use of artificial intelligence

and technology to enhance services like Paramount+. Shares fell

0.18% in pre-market trading.

AMC Entertainment Holdings (NYSE:AMC) – AMC

shares closed up 8.3% on Monday after a successful weekend since

the US Independence Day holiday, marking the busiest

Wednesday-to-Sunday period of 2024, with over four million

visitors. Additionally, merchandise sales for “Despicable Me 4”

were the second highest in AMC’s history, surpassed only by those

related to Taylor Swift. The film topped the box office, generating

significant revenue and demonstrating the strong appeal of summer

releases for the cinema chain. Shares fell 1.83% in pre-market

trading.

Cinemark Holdings (NYSE:CNK) – Surprising box

office success is driving shares of Cinemark Holdings, which are up

more than 55% this year, especially with the releases of major

animated sequels. Unlike rival AMC, Cinemark is profitable and

well-positioned financially, promising potential returns to

shareholders through share buybacks and dividends. Shares are

stable in pre-market trading.

Uber Technologies (NYSE:UBER) – Hong Kong plans

to regulate ride-hailing apps like Uber, which has operated

unregulated in the city for a decade. The proposal includes

licensing these platforms and introducing fleets of premium taxis,

but maintains the limited number of permits, which could leave many

drivers illegal. Shares rose 0.27% in pre-market trading.

Hertz Global (NASDAQ:HTZ), Delta Air

Lines (NYSE:DAL) – Gil West, CEO of Hertz and former COO

of Delta, has hired former Delta executives for senior positions at

Hertz, including Sandeep Dube as chief commercial officer. West

focuses on reversing losses by selling Tesla’s electric fleet and

raised $1 billion in debt for greater financial flexibility. Hertz

shares rose 1.11% in pre-market trading, while Delta shares rose

0.63%.

Tesla (NASDAQ:TSLA) – The price of Tesla shares

continued its nine-day climb, closing with a slight gain on Monday

despite opening lower. Analysts point to the high volatility of

Tesla’s shares, with a wide range of target prices. Unlike tech

giants, Tesla faced difficulties in 2024 but has recently

recovered, driven by vehicle sales that exceeded expectations.

Before the second-quarter earnings report, it is crucial to review

Tesla’s strategy in artificial intelligence (AI), especially in

autonomous driving, with the company investing in robust

infrastructure, including its supercomputer and plans to use 85,000

Nvidia GPUs. In related news, three law firms have requested $7

billion in fees for successfully challenging Elon Musk’s $56

billion compensation package at Tesla, encouraging lawyers to hold

corporate boards accountable. The debate over the appropriate

amount of these fees took place in a Delaware trial, with intense

discussions about the impact of this compensation. Shares are down

-0.41% in pre-market trading.

Lucid Group (NASDAQ:LCID) – Lucid Group shares

reached their highest level in two months on Monday after the

electric vehicle manufacturer reported a significant increase in

deliveries in the second quarter. Despite a slight drop in

production, this reduction may ease concerns about oversupply due

to slowing EV demand. Lucid delivered 2,394 EVs in the quarter, a

70.5% increase from the previous year, while production fell 2.9%.

The company will announce full second-quarter results on August 5.

Shares rose 0.6% in pre-market trading.

Stellantis (NYSE:STLA) – Stellantis plans to

expand its affordable hybrid vehicle lineup to 36 models in Europe

by 2026 due to increasing demand. The company, a result of the

merger between PSA and Fiat Chrysler, already offers 30 hybrid

models across nine of its 14 brands and will add six more in the

next two years. The company highlighted a 41% growth in sales of

these vehicles in Europe in the first half of this year. In Italy,

Stellantis’ car production fell 36% in the first half, impacted by

delays in government-promised electric vehicle subsidies. Total

production, including light vehicles, was 303,510 units, a 25%

reduction from the previous year. If the trend continues, annual

production will be far below the 751,000 vehicles of 2023. Shares

rose 1.1% in pre-market trading.

Honda Motor (NYSE:HMC) – Honda will end vehicle

production at its plant in Ayutthaya province, Thailand, by 2025,

consolidating production at its Prachinburi plant. The move

reflects the growing challenges for the Japanese brand with

aggressive competition from Chinese brands and increased demand for

electric vehicles. Shares are stable in pre-market trading.

Boeing (NYSE:BA) – Boeing agreed to plead

guilty to a charge of conspiracy to commit criminal fraud related

to two fatal 737 MAX crashes, in negotiations with the US

Department of Defense on the impact of this on its government

contracts. The Pentagon plans to evaluate Boeing’s improvement

plans and the agreement with the Department of Justice, which could

affect its ability to secure important contracts with the US

Department of Defense and NASA. Final agreement details are

expected by July 19. Meanwhile, the US Federal Aviation

Administration (FAA) has required inspections of 2,600 Boeing 737

planes due to an issue with the oxygen mask restraint belts, which

could fail in emergencies. The airworthiness directive demands

inspections and necessary corrections within up to 150 days,

varying by plane model. Shares are stable in pre-market

trading.

Southwest Airlines (NYSE:LUV) – Elliott

Investment Management announced on Monday its intention to launch a

proxy battle to change the leadership of Southwest Airlines in the

US. In a letter to Southwest’s board, Elliott demanded changes in

the board and criticized the company’s disappointing financial

results. Southwest said it is open to constructive conversations

but rejected Elliott’s personal criticisms of its leadership.

Shares are stable in pre-market trading.

United Airlines (NASDAQ:UAL) – On Monday, a

United Airlines plane lost a landing gear wheel upon takeoff from

Los Angeles but landed safely in Denver, its planned destination,

without injuries. The wheel was recovered in Los Angeles, and

United is investigating the causes of the

incident. Shares are stable in pre-market trading.

Nike (NYSE:NKE), Foot Locker

(NYSE:FL) – Nike has rehired Tom Peddie, a retired senior

executive, to oversee retail partnerships after issues with sneaker

sellers and declining sales. Peddie, who worked at Nike for 30

years before retiring in 2020, returns as vice president of market

partners. Nike seeks to improve relations with retailers like Foot

Locker after prioritizing its own stores, e-commerce, and apps.

Nike’s stock fell 33% this year due to continued declining sales.

Shares of Nike rose 0.6% in pre-market trading.

Koss Corp. (NASDAQ:KOSS) – Koss Corp. shares

fell 21.4% in regular trading on Monday, after a 25.6% increase on

Friday, amid rumors that trader Keith Gill might be buying shares.

Speculations on social media drove the company into a meme-stock

frenzy, resulting in a significant 213.1% rise in 2024. Koss Corp.

shares fell 6.6% in pre-market trading.

Vista Outdoor (NYSE:VSTO) – Vista Outdoor

rejected a final $3.2 billion buyout offer from MNC Capital,

claiming undervaluation, opting for an increased offer for its

ammunition unit from Czechoslovak Group (CSG). The deal with CSG

was raised to $2.1 billion, expected to close later this month.

Corning (NYSE:GLW) – Corning shares rose 12% on

Monday after the company raised its second-quarter forecasts ahead

of its earnings report. Sales are expected to be around $3.6

billion, with earnings per share at the high end of the 42-46 cents

range, driven by strong demand for optical connectivity products

for artificial intelligence. Corning shares rose 1.3% in pre-market

trading.

Abbott (NYSE:ABT) – Abbott will face trial over

allegations that its formula for premature babies causes

necrotizing enterocolitis. The case in St. Louis is the second of

hundreds in the US, arguing that the product contributed to the

fatal disease. Abbott defends that its formulas are essential in

standard medical care for preterm infants.

Raw – Josh Kesselman, founder of cigarette

paper manufacturer Raw, plans to take the company public without

compromising its culture. With annual revenue of about $120 million

and celebrity support from rapper Lil Wayne, he seeks an

alternative public offering to maintain family and philanthropic

control, inspired by examples like the Green Bay Packers and

Spotify.

HilleVax (NASDAQ:HLVX) – HilleVax saw its

shares plummet yesterday after halting the development of a

norovirus vaccine for infants, whose trial did not meet primary

endpoints. The company, which went public in April 2022 at $17 per

share, closed at $1.75 on Monday. Shares rose 5.5% in pre-market

trading.

Kymera Therapeutics (NASDAQ:KYMR),

Sanofi (NASDAQ:SNY) – Kymera Therapeutics

announced that Sanofi plans to expand its Phase 2 clinical trials

for Hidradenitis Suppurativa and Atopic Dermatitis, aiming to

quickly advance to pivotal studies.

Eli Lilly (NYSE:LLY), Morphic

Holding (NASDAQ:MORF) – Eli Lilly agreed on Monday to buy

Morphic Holding for $3.2 billion in cash, strengthening its

portfolio of inflammatory bowel disease (IBD) drugs and expanding

its presence in a multi-billion-dollar market. The $57 per share

offer represents a 79% premium over Morphic’s last Friday closing

price. The acquisition is expected in the third quarter of 2024.

Morphic shares closed up 75.1% on Monday, while Eli Lilly rose

0.38%. In pre-market trading on Tuesday, Morphic shares rose 1.45%,

while Eli Lilly shares rose 0.7%.

Thermo Fisher Scientific (NYSE:TMO),

Olink Holding AB (NASDAQ:OLK) – The UK competition

regulator approved on Monday the acquisition of Swedish

biotechnology company Olink Holding AB by American medical

equipment manufacturer Thermo Fisher Scientific, in a $3.1 billion

deal.

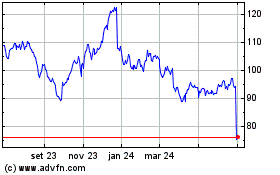

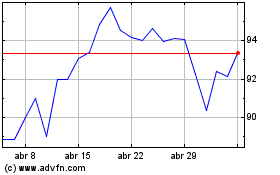

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024