U.S. Futures Fall Ahead of CPI Report; Oil Prices Rise on Falling Inventories and Stronger Demand

11 Julho 2024 - 7:21AM

IH Market News

U.S. index futures registered a decline in pre-market trading

this Thursday, ahead of the release of an important inflation

report, which could reinforce expectations of an interest rate cut

as early as September.

At 5:39 AM, Dow Jones futures (DOWI:DJI) fell 50 points, or

0.12%. S&P 500 futures retreated 0.11%, and Nasdaq-100 futures

lost 0.10%. The 10-year Treasury yield stood at 4.277%.

In the commodities market, oil prices rose due to a drop in

crude oil inventories following increased refinery processing in

the U.S. and a reduction in gasoline inventories, indicating

stronger demand. West Texas Intermediate crude for August rose

0.16% to $82.23 per barrel. Brent crude for September increased

0.26%, near $85.30 per barrel. The most traded iron ore contract on

the Dalian Commodity Exchange (DCE) rose 0.8% to $113.9 per metric

ton.

On the U.S. economic calendar, the Department of Labor will

release the June Consumer Price Index (CPI) at 08:30 AM. Economists

expect the annual consumer price growth rate to slow to 3.1% in

June, from 3.3% in May, while the annual core consumer price growth

rate is expected to remain at 3.4%. At the same time, data on

unemployment insurance claims for the week ending last Saturday

will also be released.

Asia-Pacific markets mostly rose on Wednesday, except for South

Korea’s Kosdaq, which fell 0.71%. The Kospi increased by 0.81%.

Hong Kong’s Hang Seng saw a rise of 1.96%. Australia’s S&P/ASX

200 climbed 0.93%. In China, the CSI 300 and the Shanghai Composite

rose 1.14% and 1.06%, respectively. Japan’s Nikkei 225 surpassed

the 42,000 mark for the first time, closing up 0.94%.

Annual machinery orders in Japan grew 10.8%, exceeding

expectations, while monthly orders fell 3.2%. In India, Japanese

automaker Toyota Motor (NYSE:TSM) benefited from

tax exemptions in Uttar Pradesh, reducing hybrid car prices by

10%.

European markets are on the rise, driven by consumer goods

stocks, while investors await the U.S. inflation reading. In the

UK, the economy grew 0.4% in May, surpassing the forecast of 0.2%

and recovering from stagnation in April. The pound rose 0.1%

against the dollar, reaching its highest level in four months. Last

week, Goldman Sachs (NYSE:GS) raised its growth

forecast for the UK following the Labour Party’s election

victory.

U.S. stocks saw strong gains throughout Wednesday’s trading

session. The S&P 500 closed up 1.02%, above 5,600 points for

the first time in history, while the Dow Jones and Nasdaq posted

gains of 1.09% and 1.18%, respectively. The rally was driven by the

strength of tech stocks and optimism about interest rates ahead of

the inflation data release. Among individual stocks, the rise in

tech shares was boosted by an unexpected increase in Taiwan

Semiconductor Manufacturing‘s (NYSE:TSM) second-quarter

sales, resulting in a 3.5% increase in the company’s shares.

In quarterly reports, PepsiCo (NASDAQ:PEP),

Delta Air Lines (NYSE:DAL), Conagra

Brands (NYSE:CAG), Bank7 Corporation

(NASDAQ:BSVN), and Methode Electronics (NYSE:MEI)

will report before the market opens.

After the close, numbers from Vista Energy

(NYSE:VIST) will be awaited.

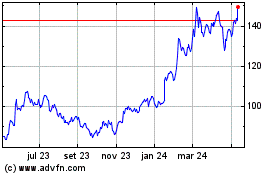

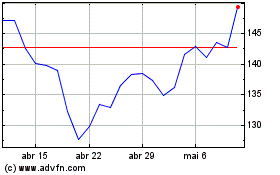

Taiwan Semiconductor Man... (NYSE:TSM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024