UNI In Trouble? Key Indicators Cites Potential Drop Amid Market Downturn

13 Junho 2024 - 12:30PM

NEWSBTC

Uniswap (UNI), a prominent decentralized exchange token, is bracing

for further declines as the broader cryptocurrency market

experiences a significant downturn. Recent market trends indicate a

continuation of bearish momentum, which has impacted UNI’s price

negatively. Several factors, including macroeconomic

uncertainties, regulatory pressures, and shifts in investor

sentiment, are contributing to this extended downtrend. As

Uniswap’s price breaks key support levels, the likelihood of

additional losses increases. This article delves into UNI’s price

analysis with the help of technical indicators to determine the

anticipated decline and provide insights into what traders and

investors might expect in the coming days. The price of Uniswap has

increased by 4.60%, trading at about $9.873 in the last 24 hours,

with a market capitalization of more than $5.9 billion and a

trading volume of more than $356 million as of the time of writing.

UNI’s market cap and trading volume were also up by 4.28% and

19.98%, respectively. UNI Builds Bearish Sentiment On the 1-hour

chart, UNI is attempting to move below the 100-day Simple Moving

Average (SMA) as it has failed to move above the bearish trendline.

It can be suggested here that Uniswap might go bearish. The 1-hour

Composite Trend Oscillator also signals that the price of UNI might

break below the 100-day SMA and go bearish as both the signal line

and SMA crossed and are heading toward the zero line. From this

Relative Strength Index (RSI) formation, it can be considered that

UNI might go bearish if it moves below the 100-day SMA. Meanwhile,

in the 4-hour chart, UNI’s price trades below the trendline and the

100-day SMA. The price of UNI is also attempting to drop a bearish

4-hour candlestick. Although the 4-hour composite trend oscillator

indicates that UNI may go bullish, the price will certainly move

upward on a short-term note and begin to decline again. The signal

line and SMA line are heading toward the zero line, but this has

continued for a while. Support Levels To Watch Out For If the price

of UNI drops below the 1-hour 100-day simple moving average, it

will begin to move towards the $8.748 support level. It may even

decline more to test the $7.557 support level if it breaks below

the abovementioned level. However, if Uniswap were to change course

at any of the previously mentioned support levels, it would begin

to rise toward the resistance level of $10.381. If the price

breaches this resistance level, it might be poised to test the

$11.801 mark and perhaps much higher to test other levels. Featured

image from Adobe Stock, chart from Tradingview.com

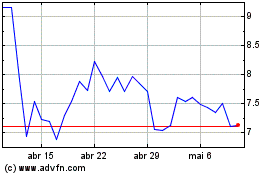

Uniswap (COIN:UNIUSD)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Uniswap (COIN:UNIUSD)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024