Ferrellgas Partners Misses Overall - Analyst Blog

02 Outubro 2012 - 5:15AM

Zacks

Ferrellgas Partners

LP (FGP) reported fourth quarter and fiscal 2012 results.

Pro forma loss for the quarter improved to 45 cents per unit versus

a loss of 53 cents per unit in the year-ago quarter. However, the

loss was above the Zacks Consensus Estimate of a loss of 39 cents

per unit.

During fiscal year 2012, the company reported a loss of 14 cents

per unit, which is a vast improvement versus the previous year loss

of 60 cents per unit. However, it fell below our expectation of

earnings of 30 cents per unit.

The year-over-year significant improvement denotes the company’s

cost control initiatives.

GAAP and pro forma earnings were identical due to absence of

one-time items.

Total Revenue

Ferrellgas reported quarterly revenue of $341.8 million, down 24%

from the year-ago figure of $449.7 million. The quarterly revenue

also missed the Zacks Consensus Estimate by $18.2 million. During

fiscal year 2012, the top-line revenue declined 3.5% to $2,339

million. The fiscal year figure also fell below the Zacks Consensus

Estimate by $100.2 million.

During the quarter, overall propane and other gas liquids sales

dropped to $310.5 million compared with $421.7 million in the

prior-year quarter.

Operational Highlights

Decline in cost of sales by 34.5% year over year in the fourth

quarter of 2012, resulted in a gross profit of $130 million, up 3%

from the year-ago period. Adjusted earnings before interest, tax,

depreciation and amortization (EBITDA) for the reported quarter

increased 79.2% year over year to $18.1 million from $10.1 million

in the year-ago comparable period.

Total operating expense dropped marginally by 0.6% to $100 million.

General and administrative expenses also declined by 34.5% to $8.5

million. As a result, operating loss during the quarter declined to

$13.9 million from $17.7 million in the year-ago quarter.

Financial Update

As of July 31, 2012, Ferrellgas had cash and cash equivalents of

$8.5 million versus $7.5 million as of July 31, 2011. At the end of

fiscal 2012, long-term debt was $1,059.1 million compared with

$1,050.9 million at the end of the year-ago quarter.

Our View

Ferrellgas Partners missed both top line and bottom line. Though

the company incurred a net loss, the expense and the gross profit

demonstrate that the company has taken appropriate steps for cost

control in this highly competitive operating environment. By the

end of fiscal 2013, the company expects to surpass its cost savings

goal of $20 million. It expects continuous organic gallon

growth.

Going forward, the partnership’s strong acquisition strategy, lower

cost of operation, debt minimization efforts and financial

flexibility would help to overcome this tough environment. Last

month, the company had acquired Capitol City Propane of Sacramento,

California. Besides adding to the company’s customer base, the

acquisition will strengthen the partnership's presence.

However, we remain concerned for highly competitive propane

distribution business environment, seasonal variance in the demand

for propane, reliance on few propane suppliers and higher degree of

competition from other energy sources. Moreover, we believe that an

increase in motor fuel prices is expected to negatively affect the

partnership’s financial performance in terms of higher propane

delivery costs. The company presently retains a short-term Zacks #3

Rank (Hold) that corresponds with our long-term Neutral

recommendation on the stock.

Ferrellgas Partners L.P., a master limited partnership (“MLP”), is

a leading distributor of propane and related equipment in the U.S.

The partnership is headquartered in Overland Park, Kansas.

Ferrellgas Inc. is the general partner and Ferrellgas L.P. is the

operating partner of Ferrellgas Partners L.P.

Some of its main competitors are Star Gas Partners,

L.P. (SGU) and Adams Resources & Energy

Inc. (AE).

(AE): ETF Research Reports

FERRELLGAS -LP (FGP): Free Stock Analysis Report

STAR GAS PTNRS (SGU): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

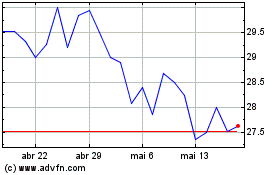

Adams Resources and Energy (AMEX:AE)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

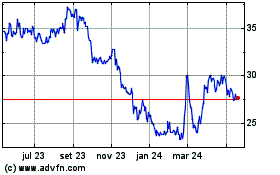

Adams Resources and Energy (AMEX:AE)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024