UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number

811-00487

Security Large Cap Value Fund

(Exact name of registrant as specified in

charter)

805 King Farm Boulevard, Suite 600

Rockville, Maryland

20850

(Address of principal executive offices)

(Zip code)

Donald C. Cacciapaglia, President

Security Large Cap Value Fund

805 King Farm Boulevard, Suite 600

Rockville, Maryland

20850

(Name and address of agent for service)

Registrant’s telephone number, including

area code:

301-296-5100

Date of fiscal year end:

September

30

Date of reporting period:

December

31, 2012

Form N-Q is to be used by management investment companies, other

than small business investment companies registered on Form N-5 (§§ 239.24 and 274.5 of this chapter), to file reports

with the Commission, not later than 60 days after the close of the first and third fiscal quarters, pursuant to rule 30b1-5 under

the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may use the information provided on Form N-Q in its regulatory,

disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified

by Form N-Q, and the Commission will make this information public. A registrant is not required to respond to the collection of

information contained in Form N-Q unless the Form displays a currently valid Office of Management and Budget (“OMB”)

control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions

for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609.

The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Schedule of Investments.

|

Large

Cap Value Fund

|

|

|

SCHEDULE OF INVESTMENTS

(Unaudited)

|

December 31, 2012

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

COMMON STOCKS

†

- 94.1%

|

|

Financials - 23.4%

|

|

|

|

|

|

|

|

|

|

Wells Fargo & Co.

|

|

|

51,462

|

|

|

$

|

1,758,972

|

|

|

Aon plc

|

|

|

25,220

|

|

|

|

1,402,232

|

|

|

Berkshire Hathaway, Inc. — Class A

*

|

|

|

10

|

|

|

|

1,340,600

|

|

|

American International Group, Inc.

*

|

|

|

32,961

|

|

|

|

1,163,523

|

|

|

JPMorgan Chase & Co.

|

|

|

25,593

|

|

|

|

1,125,325

|

|

|

Allstate Corp.

|

|

|

22,930

|

|

|

|

921,098

|

|

|

U.S. Bancorp

|

|

|

27,512

|

|

|

|

878,733

|

|

|

State Street Corp.

|

|

|

18,630

|

|

|

|

875,796

|

|

|

BB&T Corp.

|

|

|

22,792

|

|

|

|

663,475

|

|

|

Reinsurance Group of America, Inc. — Class A

|

|

|

8,730

|

|

|

|

467,230

|

|

|

Citigroup, Inc.

|

|

|

6,140

|

|

|

|

242,898

|

|

|

Total Financials

|

|

|

|

|

|

|

10,839,882

|

|

|

Energy - 17.5%

|

|

|

|

|

|

|

|

|

|

Chevron Corp.

|

|

|

15,400

|

|

|

|

1,665,357

|

|

|

Williams Companies, Inc.

|

|

|

38,380

|

|

|

|

1,256,561

|

|

|

McDermott International, Inc.

*

|

|

|

105,392

|

|

|

|

1,161,420

|

|

|

Apache Corp.

|

|

|

10,289

|

|

|

|

807,686

|

|

|

Halliburton Co.

|

|

|

21,860

|

|

|

|

758,323

|

|

|

Exxon Mobil Corp.

|

|

|

7,660

|

|

|

|

662,973

|

|

|

ConocoPhillips

|

|

|

9,920

|

|

|

|

575,261

|

|

|

Whiting Petroleum Corp.

*

|

|

|

10,000

|

|

|

|

433,700

|

|

|

Chesapeake Energy Corp.

|

|

|

18,250

|

|

|

|

303,315

|

|

|

Phillips 66

|

|

|

4,940

|

|

|

|

262,314

|

|

|

WPX Energy, Inc.

*

|

|

|

13,450

|

|

|

|

200,136

|

|

|

Total Energy

|

|

|

|

|

|

|

8,087,046

|

|

|

Industrials - 12.5%

|

|

|

|

|

|

|

|

|

|

URS Corp.

|

|

|

29,480

|

|

|

|

1,157,384

|

|

|

Republic Services, Inc. — Class A

|

|

|

34,890

|

|

|

|

1,023,324

|

|

|

United Technologies Corp.

|

|

|

11,640

|

|

|

|

954,596

|

|

|

Quanta Services, Inc.

*

|

|

|

33,950

|

|

|

|

926,496

|

|

|

Equifax, Inc.

|

|

|

16,840

|

|

|

|

911,381

|

|

|

Parker Hannifin Corp.

|

|

|

9,530

|

|

|

|

810,622

|

|

|

Total Industrials

|

|

|

|

|

|

|

5,783,803

|

|

|

Information Technology - 10.9%

|

|

|

|

|

|

|

|

|

|

Computer Sciences Corp.

|

|

|

36,940

|

|

|

|

1,479,448

|

|

|

TE Connectivity Ltd.

|

|

|

37,960

|

|

|

|

1,409,075

|

|

|

Cisco Systems, Inc.

|

|

|

48,780

|

|

|

|

958,527

|

|

|

Hewlett-Packard Co.

|

|

|

34,701

|

|

|

|

494,489

|

|

|

NetApp, Inc.

*

|

|

|

10,240

|

|

|

|

343,552

|

|

|

Euronet Worldwide, Inc.

*

|

|

|

10,034

|

|

|

|

236,802

|

|

|

Mercury Systems, Inc.

*

|

|

|

10,920

|

|

|

|

100,464

|

|

|

Total Information Technology

|

|

|

|

|

|

|

5,022,357

|

|

|

Health Care - 9.7%

|

|

|

|

|

|

|

|

|

|

Aetna, Inc.

|

|

|

39,380

|

|

|

|

1,823,294

|

|

|

Covidien plc

|

|

|

16,060

|

|

|

|

927,304

|

|

|

Forest Laboratories, Inc.

*

|

|

|

19,350

|

|

|

|

683,442

|

|

|

UnitedHealth Group, Inc.

|

|

|

11,200

|

|

|

|

607,488

|

|

|

Teva Pharmaceutical Industries Ltd. ADR

|

|

|

11,520

|

|

|

|

430,157

|

|

|

Total Health Care

|

|

|

|

|

|

|

4,471,685

|

|

|

Consumer Staples - 7.4%

|

|

|

|

|

|

|

|

|

|

CVS Caremark Corp.

|

|

|

26,550

|

|

|

|

1,283,693

|

|

|

Wal-Mart Stores, Inc.

|

|

|

14,500

|

|

|

|

989,335

|

|

|

Mondelez International, Inc. — Class A

|

|

|

22,770

|

|

|

|

579,952

|

|

|

Kraft Foods Group, Inc.

|

|

|

7,590

|

|

|

|

345,117

|

|

|

Costco Wholesale Corp.

|

|

|

2,320

|

|

|

|

229,146

|

|

|

Total Consumer Staples

|

|

|

|

|

|

|

3,427,243

|

|

|

Consumer Discretionary - 5.9%

|

|

|

|

|

|

|

|

|

|

Time Warner, Inc.

|

|

|

31,720

|

|

|

|

1,517,167

|

|

|

Lowe's Companies, Inc.

|

|

|

24,910

|

|

|

|

884,803

|

|

|

DeVry, Inc.

|

|

|

13,020

|

|

|

|

308,965

|

|

|

Total Consumer Discretionary

|

|

|

|

|

|

|

2,710,935

|

|

|

Utilities - 3.3%

|

|

|

|

|

|

|

|

|

|

Edison International

|

|

|

33,220

|

|

|

|

1,501,212

|

|

|

Materials - 2.7%

|

|

|

|

|

|

|

|

|

|

Dow Chemical Co.

|

|

|

38,040

|

|

|

|

1,229,453

|

|

|

Telecommunication Services - 0.8%

|

|

|

|

|

|

|

|

|

|

Windstream Corp.

|

|

|

42,286

|

|

|

|

350,128

|

|

|

Total Common Stocks

|

|

|

|

|

|

(Cost $35,884,783)

|

|

|

|

|

|

|

43,423,744

|

|

|

EXCHANGE TRADED FUNDS

†

- 3.0%

|

|

|

|

|

|

|

|

|

|

iShares Russell 1000 Value Index Fund

|

|

|

18,720

|

|

|

|

1,363,190

|

|

|

Total Exchange Traded Funds

|

|

|

|

|

|

|

|

|

|

(Cost $1,341,294)

|

|

|

|

|

|

|

1,363,190

|

|

|

Total Investments - 97.1%

|

|

|

|

|

|

|

|

|

|

(Cost $37,226,077)

|

|

|

|

|

|

$

|

44,786,934

|

|

|

Other Assets & Liabilities, net - 2.9%

|

|

|

|

|

|

|

1,355,054

|

|

|

Total Net Assets - 100.0%

|

|

|

|

|

|

$

|

46,141,988

|

|

|

*

|

Non-income producing security.

|

|

†

|

Value determined based on Level 1 inputs — See Note 2.

|

|

ADR

|

American Depositary Receipt

|

|

plc

|

Public Limited Company

|

|

|

|

Large

Cap Value Institutional Fund

|

|

|

SCHEDULE OF INVESTMENTS

(Unaudited)

|

December 31, 2012

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

COMMON STOCKS

†

- 94.8%

|

|

Financials - 22.4%

|

|

|

|

|

|

|

|

|

|

Wells Fargo & Co.

|

|

|

3,133

|

|

|

$

|

107,087

|

|

|

Aon plc

|

|

|

1,660

|

|

|

|

92,296

|

|

|

American International Group, Inc.

*

|

|

|

2,191

|

|

|

|

77,342

|

|

|

Berkshire Hathaway, Inc. — Class B

*

|

|

|

710

|

|

|

|

63,688

|

|

|

JPMorgan Chase & Co.

|

|

|

1,416

|

|

|

|

62,262

|

|

|

Allstate Corp.

|

|

|

1,530

|

|

|

|

61,460

|

|

|

State Street Corp.

|

|

|

1,240

|

|

|

|

58,292

|

|

|

U.S. Bancorp

|

|

|

1,811

|

|

|

|

57,843

|

|

|

BB&T Corp.

|

|

|

1,591

|

|

|

|

46,314

|

|

|

Reinsurance Group of America, Inc. — Class A

|

|

|

560

|

|

|

|

29,971

|

|

|

Citigroup, Inc.

|

|

|

390

|

|

|

|

15,428

|

|

|

Total Financials

|

|

|

|

|

|

|

671,983

|

|

|

Energy - 17.8%

|

|

|

|

|

|

|

|

|

|

Chevron Corp.

|

|

|

1,030

|

|

|

|

111,385

|

|

|

Williams Companies, Inc.

|

|

|

2,560

|

|

|

|

83,814

|

|

|

McDermott International, Inc.

*

|

|

|

6,913

|

|

|

|

76,181

|

|

|

Apache Corp.

|

|

|

668

|

|

|

|

52,437

|

|

|

Halliburton Co.

|

|

|

1,400

|

|

|

|

48,566

|

|

|

Exxon Mobil Corp.

|

|

|

490

|

|

|

|

42,410

|

|

|

ConocoPhillips

|

|

|

670

|

|

|

|

38,853

|

|

|

Whiting Petroleum Corp.

*

|

|

|

650

|

|

|

|

28,191

|

|

|

Chesapeake Energy Corp.

|

|

|

1,140

|

|

|

|

18,947

|

|

|

Phillips 66

|

|

|

340

|

|

|

|

18,054

|

|

|

WPX Energy, Inc.

*

|

|

|

893

|

|

|

|

13,288

|

|

|

Total Energy

|

|

|

|

|

|

|

532,126

|

|

|

Industrials - 12.7%

|

|

|

|

|

|

|

|

|

|

URS Corp.

|

|

|

1,965

|

|

|

|

77,145

|

|

|

Republic Services, Inc. — Class A

|

|

|

2,210

|

|

|

|

64,819

|

|

|

United Technologies Corp.

|

|

|

780

|

|

|

|

63,968

|

|

|

Equifax, Inc.

|

|

|

1,115

|

|

|

|

60,344

|

|

|

Quanta Services, Inc.

*

|

|

|

2,200

|

|

|

|

60,038

|

|

|

Parker Hannifin Corp.

|

|

|

610

|

|

|

|

51,887

|

|

|

Total Industrials

|

|

|

|

|

|

|

378,201

|

|

|

Information Technology - 11.0%

|

|

|

|

|

|

|

|

|

|

Computer Sciences Corp.

|

|

|

2,410

|

|

|

|

96,521

|

|

|

TE Connectivity Ltd.

|

|

|

2,500

|

|

|

|

92,800

|

|

|

Cisco Systems, Inc.

|

|

|

3,090

|

|

|

|

60,719

|

|

|

Hewlett-Packard Co.

|

|

|

2,405

|

|

|

|

34,271

|

|

|

NetApp, Inc.

*

|

|

|

660

|

|

|

|

22,143

|

|

|

Euronet Worldwide, Inc.

*

|

|

|

644

|

|

|

|

15,198

|

|

|

Mercury Systems, Inc.

*

|

|

|

730

|

|

|

|

6,716

|

|

|

Total Information Technology

|

|

|

|

|

|

|

328,368

|

|

|

Health Care - 9.6%

|

|

|

|

|

|

|

|

|

|

Aetna, Inc.

|

|

|

2,550

|

|

|

|

118,065

|

|

|

Covidien plc

|

|

|

1,080

|

|

|

|

62,359

|

|

|

Forest Laboratories, Inc.

*

|

|

|

1,140

|

|

|

|

40,265

|

|

|

UnitedHealth Group, Inc.

|

|

|

700

|

|

|

|

37,968

|

|

|

Teva Pharmaceutical Industries Ltd. ADR

|

|

|

730

|

|

|

|

27,258

|

|

|

Total Health Care

|

|

|

|

|

|

|

285,915

|

|

|

Consumer Staples - 8.6%

|

|

|

|

|

|

|

|

|

|

CVS Caremark Corp.

|

|

|

1,750

|

|

|

|

84,613

|

|

|

Wal-Mart Stores, Inc.

|

|

|

1,000

|

|

|

|

68,230

|

|

|

Mondelez International, Inc. — Class A

|

|

|

2,200

|

|

|

|

56,033

|

|

|

Kraft Foods Group, Inc.

|

|

|

726

|

|

|

|

33,011

|

|

|

Costco Wholesale Corp.

|

|

|

145

|

|

|

|

14,322

|

|

|

Total Consumer Staples

|

|

|

|

|

|

|

256,209

|

|

|

Consumer Discretionary - 6.0%

|

|

|

|

|

|

|

|

|

|

Time Warner, Inc.

|

|

|

2,090

|

|

|

|

99,965

|

|

|

Lowe's Companies, Inc.

|

|

|

1,640

|

|

|

|

58,253

|

|

|

DeVry, Inc.

|

|

|

880

|

|

|

|

20,882

|

|

|

Total Consumer Discretionary

|

|

|

|

|

|

|

179,100

|

|

|

Utilities - 3.3%

|

|

|

|

|

|

|

|

|

|

Edison International

|

|

|

2,180

|

|

|

|

98,514

|

|

|

Materials - 2.7%

|

|

|

|

|

|

|

|

|

|

Dow Chemical Co.

|

|

|

2,500

|

|

|

|

80,800

|

|

|

Telecommunication Services - 0.7%

|

|

|

|

|

|

|

|

|

|

Windstream Corp.

|

|

|

2,590

|

|

|

|

21,445

|

|

|

Total Common Stocks

|

|

|

|

|

|

(Cost $2,344,315)

|

|

|

|

|

|

|

2,832,661

|

|

|

EXCHANGE TRADED FUNDS

†

- 3.0%

|

|

|

|

|

|

|

|

|

|

iShares Russell 1000 Value Index Fund

|

|

|

1,230

|

|

|

|

89,569

|

|

|

Total Exchange Traded Funds

|

|

|

|

|

|

|

|

|

|

(Cost $87,158)

|

|

|

|

|

|

|

89,569

|

|

|

Total Investments - 97.8%

|

|

|

|

|

|

|

|

|

|

(Cost $2,431,473)

|

|

|

|

|

|

$

|

2,922,230

|

|

|

Other Assets & Liabilities, net - 2.2%

|

|

|

|

|

|

|

67,228

|

|

|

Total Net Assets - 100.0%

|

|

|

|

|

|

$

|

2,989,458

|

|

|

*

|

Non-income producing security.

|

|

†

|

Value determined based on Level 1 inputs — See Note 2.

|

|

ADR

|

American Depositary Receipt

|

|

plc

|

Public Limited Company

|

|

|

|

NOTES TO SCHEDULE OF INVESTMENTS

(Unaudited)

|

|

|

|

|

1. Significant Accounting Policies

The following significant accounting policies are in conformity

with U.S. generally accepted accounting principles ("U.S. GAAP") and are consistently followed by the Trust. This

requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure

of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from these estimates. All time references are based on Eastern Time.

Equity securities listed on an exchange (New York Stock Exchange

(“NYSE”) or American Stock Exchange) are valued at the last quoted sales price as of the close of business on the NYSE,

usually 4:00 p.m. on the valuation date. Equity securities listed on the NASDAQ market system are valued at the NASDAQ Official

Closing Price on the valuation date.

Investments for which market quotations are not readily

available are fair valued as determined in good faith by Guggenheim Investments under the direction of the Board of Directors using

methods established or ratified by the Board of Directors. These methods include, but are not limited to: (i) obtaining

general information as to how these securities and assets trade; (ii) in connection with options thereupon, and other

derivative investments, information as to how (a) these contracts and other derivative investments trade in other derivative

markets, respectively, and (b) the securities underlying these contracts and other derivative investments trade in the cash

market; and (iii) obtaining other information and considerations, including current values in related markets.

2. Fair Value Measurement

In accordance with U.S. GAAP, fair value is defined as

the price that the Fund would receive to sell an investment or pay to transfer a liability in an orderly transaction with an independent

buyer in the principal market, or in the absence of a principal market the most advantageous market for the investment or liability.

A three-tier hierarchy is utilized to distinguish between (1) inputs that reflect the assumptions market participants would use

in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable

inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would

use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs)

and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the

value of the Funds’ investments. The inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical

securities.

Level 2 — other significant observable inputs (including

quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — significant unobservable inputs (including

the fund’s own assumptions used to determine the fair value of investments).

The inputs or methodologies used for valuing securities are

not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes the inputs used to value the

Funds’ net assets at December 31, 2012:

|

|

|

|

|

|

|

|

|

Level 1

Investments

In Securities

|

|

|

|

Level 2

Investments

In Securities

|

|

|

|

Level 3

Investments

In Securities

|

|

|

|

Total

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large Cap Value Fund

|

|

$

|

44,786,934

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

44,786,934

|

|

|

Large Cap Value Institutional Fund

|

|

|

2,922,230

|

|

|

|

–

|

|

|

|

–

|

|

|

|

2,922,230

|

|

For the period ended December 31, 2012, there were no transfers

between levels.

Item 2. Controls and Procedures.

(a) The registrant’s principal executive officer and principal

financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have

concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information

required to be disclosed by the registrant in this Form N-Q was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal

financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during

the registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the

registrant’s internal control over financial reporting.

Item 3. Exhibits.

A separate certification

for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment

Company Act (17 CFR 270.30a-2(a)), exactly as set forth below.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

(Registrant)

Security Large Cap Value Fund

|

By (Signature and Title)*

|

/s/ Donald C. Cacciapaglia

|

|

|

Donald C. Cacciapaglia, President

|

Date

February 22, 2013

Pursuant to the requirements of the Securities Exchange Act

of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant

and in the capacities and on the dates indicated.

|

By (Signature and Title)*

|

/s/ Donald C. Cacciapaglia

|

|

|

Donald C. Cacciapaglia, President

|

Date

February 22, 2013

|

By (Signature and Title)*

|

/s/ Nikolaos Bonos

|

|

|

Nikolaos Bonos, Treasurer

|

Date

February 22, 2013

* Print the name and title of each signing officer under his

or her signature.

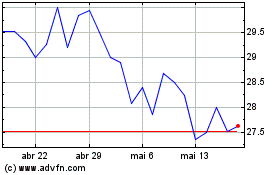

Adams Resources and Energy (AMEX:AE)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

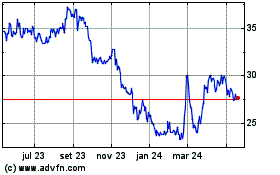

Adams Resources and Energy (AMEX:AE)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024