Adams Resources Announces Second Quarter Earnings

11 Agosto 2004 - 1:58PM

PR Newswire (US)

Adams Resources Announces Second Quarter Earnings HOUSTON, Aug. 11

/PRNewswire-FirstCall/ -- Adams Resources & Energy, Inc.,

(AMEX:AE), announced second quarter 2004 unaudited net earnings of

$1,118,000 or $.27 per common share. Revenues for the quarter

totaled $495,616,000. Current earnings compared to unaudited second

quarter 2003 net earnings of $1,430,000 or $.34 per common share.

For the six-month period ended June 30, 2004, net earnings were

$2,056,000 compared to $1,778,000 for the six-month period in 2003.

Chairman, K. S. "Bud" Adams, Jr. attributed the reduced quarterly

earnings to weaker margins within the Company's crude oil marketing

business. Although world crude oil prices were generally increasing

during the quarter, the Company experienced the unusual situation

of narrowing margins due to adequate domestic crude oil supplies.

Mr. Adams noted that reduced marketing margins were substantially

offset by strong results from the Company's transportation sector.

The Company's chemical transportation business is presently

operating at or near full capacity and this strong demand condition

is expected to continue through at least year-end. A summary of

operating results is as follows: Second Quarter 2004 2003 Operating

Earnings Marketing $ 1,193,000 $ 3,284,000 Transportation 1,692,000

631,000 Oil and gas 661,000 984,000 General & administrative

expenses (1,851,000) (1,566,000) Interest, net (10,000) 86,000

Income tax provision (567,000) (1,334,000) Earnings from continuing

operations 1,118,000 2,085,000 Loss from discontinued operations,

net of tax --- (655,000) Net earnings $ 1,118,000 $ 1,430,000 The

information in this release includes certain forward-looking

statements that are based on assumptions that in the future may

prove not to have been accurate. A number of factors could cause

actual results or events to differ materially from those

anticipated. Such factors include, among others, (a) general

economic conditions, (b) fluctuations in hydrocarbon prices and

margins, (c) variations between crude oil and natural gas contract

volumes and actual delivery volumes, (d) unanticipated

environmental liabilities or regulatory changes, (e) counterparty

credit default, (f) inability to obtain bank and/or trade credit

support, (g) availability and cost of insurance, (h) changes in tax

laws, and (i) the availability of capital, among others (j) changes

in regulations, (k) results of current items of litigation, (l)

uninsured items of litigation or losses, (m) uncertainty in reserve

estimates and cash flows, (n) ability to replace oil and gas

reserves, (o) security issues related to drivers and terminal

facilities, (p) commodity price volatility and (q) successful

completion of drilling activity. These and other risks are

described in the Company's reports that are on file with the

Securities and Exchange Commission. UNAUDITED CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS (In thousands, except per

share data) Six Months Ended Three Months Ended June 30, June 30,

2004 2003 2004 2003 Revenues $ 956,931 $ 900,257 $ 495,616 $

426,967 Costs, expenses and other (953,427) (892,820) (493,931)

(423,548) Income tax provision (1,195) (2,859) (567) (1,334)

Earnings from continuing operations 2,309 4,578 1,118 2,085 Loss

for discontinued operation, net of tax (253) (2,708) --- (655)

Cumulative effect of accounting change, net of tax --- (92) --- ---

Net earnings $ 2,056 $ 1,778 $ 1,118 $ 1,430 Earnings (loss) per

share From continuing operations $ .55 $ 1.08 $ .27 $ .49 From

discontinued operation (.06) (.64) --- (.15) Cumulative effect of

accounting change --- (.02) --- --- Basic and diluted net earnings

per common share $ .49 $ .42 $ .27 $ .34 Dividends per common share

$ --- $ --- $ --- $ --- UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEET (In thousands) June 30, December 31, 2004 2003 ASSETS Cash $

17,562 $ 28,342 Other current assets 173,016 157,309 Total current

assets 190,578 185,651 Net property & equipment 24,943 24,407

Other assets 182 203 $ 215,703 $ 210,261 LIABILITIES AND EQUITY

Total current liabilities $ 156,023 $ 152,665 Long-term debt 11,475

11,475 Deferred taxes and other 3,917 3,889 Shareholders' equity

44,288 42,232 $ 215,703 $ 210,261 CONTACT: Jim Smith (713)881-3662

DATASOURCE: Adams Resources & Energy, Inc. CONTACT: Jim Smith

of Adams Resources & Energy, Inc., +1-713-881-3662

Copyright

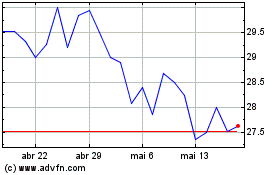

Adams Resources and Energy (AMEX:AE)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

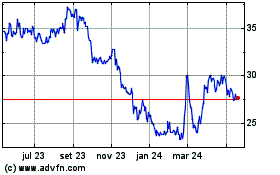

Adams Resources and Energy (AMEX:AE)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024