0000002178FALSE00000021782024-07-162024-07-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 16, 2024

ADAMS RESOURCES & ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-7908 | 74-1753147 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

| 17 South Briar Hollow Lane, Suite 100, Houston, Texas | 77027 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 881-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.10 par value | | AE | | NYSE American LLC |

| | | | | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | Emerging growth company | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 1.01 Entry into a Material Definitive Agreement.

On July 16, 2024, Adams Resources & Energy, Inc. (the “Company”) entered into Amendment No. 2 (the “Second Amendment”) to the Credit Agreement dated October 27, 2022 (the “Credit Agreement”), by and among the Company, GulfMark Asset Holdings, LLC and Service Transport Company, each a wholly-owned subsidiary of the Company, as borrowers, Cadence Bank N.A., as administrative agent, swingline lender and issuing lender, and the other lenders party thereto, as amended by Amendment No. 1 to Credit Agreement dated as of August 2, 2023 (the “First Amendment”). All capitalized words used in the below description of the Second Amendment, but not defined herein, have the meanings assigned to them in the Credit Agreement, which was included as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 1, 2022, or in the First Amendment, which was included as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on August 2, 2023, as applicable.

The Second Amendment amends and restates the definitions of the Fixed Charge Coverage Ratio and Consolidated Fixed Charges in order (i) to remove the inclusion of Operating Lease Expenses paid in cash from both the numerator and denominator in the calculation of the Consolidated Fixed Charge Coverage Ratio, and (ii) to clarify that only Consolidated Interest Expense paid in cash is included in the denominator of the Fixed Charge Coverage Ratio. These amendments apply to the financial covenant calculations for the period ending June 30, 2024 and thereafter.

The foregoing summary description of certain terms of the Second Amendment does not purport to be complete, and is qualified in its entirety by reference to the full text of the Second Amendment, a copy of which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 10.1 | Amendment No. 2 dated July 16, 2024 to Credit agreement dated October 27, 2022 by and among Adams Resources & Energy, Inc., GulfMark Asset Holdings, LLC, Service Transport Company, and Cadence Bank, as administrative agent, swingline lender and issuing lender, and the other lenders party thereto. |

| |

| 104 | Cover Page Interactive Data File — the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | ADAMS RESOURCES & ENERGY, INC. |

| | | |

| | | |

| | | |

| Date: | July 16, 2024 | By: | /s/ Tracy E. Ohmart |

| | | Tracy E. Ohmart |

| | | Chief Financial Officer |

| | | (Principal Financial Officer and |

| | | Principal Accounting Officer) |

AMENDMENT NO. 2 TO CREDIT AGREEMENT

This AMENDMENT NO. 2 TO CREDIT AGREEMENT (this “Amendment”) entered into and dated as of July 16, 2024 (the “Amendment Effective Date”) is among Adams Resources & Energy, Inc., a Delaware corporation (the “Parent”), GulfMark Asset Holdings, LLC, a Texas limited liability company (“GulfMark Holdings”), Service Transport Company, a Texas corporation (“Service,” and together with Parent and GulfMark Holdings, the “Borrowers” and each individually, an “Borrower”), the subsidiaries of the Borrowers party hereto (each a “Guarantor” and collectively, the “Guarantors”), the Lenders (as defined below) party hereto, and Cadence Bank, as administrative agent (in such capacity, the “Administrative Agent”) for the Lenders and as Swingline Lender (as defined in the Credit Agreement) and Issuing Lender (as defined in the Credit Agreement).

RECITALS

A.The Borrowers, the Administrative Agent, the Issuing Lender, and the financial institutions party thereto from time to time as lenders (collectively, the “Lenders”), are parties to that certain Credit Agreement dated as of October 27, 2022 (as amended by Amendment No. 1 to Credit Agreement dated as of August 2, 2023, the “Existing Credit Agreement,” and the Existing Credit Agreement as amended by this Amendment and as otherwise amended, restated, amended and restated or otherwise modified from time to time, the “Credit Agreement”).

B.Subject to the terms and conditions set forth herein, effective as of the Amendment Effective Date, the parties hereto wish to make certain amendments to the Existing Credit Agreement, all as provided herein.

NOW THEREFORE, in consideration of the premises and the mutual covenants, representations and warranties contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

Section 1.Defined Terms. As used in this Amendment, each of the terms defined in the opening paragraph and the Recitals above shall have the meanings assigned to such terms therein. Each term defined in the Credit Agreement and used herein without definition shall have the meaning assigned to such term in the Credit Agreement, unless expressly provided to the contrary.

Section 2.Other Definitional Provisions. Unless otherwise specified herein: (a) the definitions of terms herein shall apply equally to the singular and plural forms of the terms defined, (b) whenever the context may require, any pronoun shall include the corresponding masculine, feminine and neuter forms, (c) the words “include,” “includes” and “including” shall be deemed to be followed by the phrase “without limitation,” (d) the word “will” shall be construed to have the same meaning and effect as the word “shall,” (e) any reference herein to any Person shall be construed to include such Person’s successors and assigns, (f) the words “herein,” “hereof” and “hereunder,” and words of similar import, shall be construed to refer to this Amendment in its entirety and not to any particular provision hereof, (g) all references herein to Articles, Sections, Exhibits and Schedules shall be construed to refer to Articles and Sections of, and Exhibits and Schedules to, this Amendment, (h) the words “asset” and “property” shall be construed to have the same meaning and effect and to refer to any and all tangible and intangible assets and properties, including cash, securities, accounts and contract rights, (i) the term “documents” includes any and all instruments, documents, agreements, certificates, notices, reports, financial statements and other writings, however evidenced, whether in physical or electronic form and (j) in the computation of periods of time from a specified date to a later specified date, the word “from” means “from and including;” the words “to” and “until” each mean “to but excluding;” and the word “through” means “to and including.”

Section 3.Amendments to Credit Agreement. Effective as of the Amendment Effective Date, the Existing Credit Agreement is amended as follows:

(a)Section 1.1 of the Existing Credit Agreement is amended to amend and restate the definitions of “Consolidated Fixed Charge Coverage Ratio” and “Consolidated Fixed Charges” in their entirety as follows, and the following defined terms shall apply to the financial covenant calculations included in the Compliance Certificate for the period ending June 30, 2024 and thereafter:

“Consolidated Fixed Charge Coverage Ratio” means, as of any date of determination, the ratio of (a)(i) Consolidated EBITDA for the most recently completed Reference Period, minus (ii) cash dividends and distributions (excluding the Restricted Payments specified on Schedule 9.6), minus (iii) federal, state, local and foreign income taxes paid in cash to (b) Consolidated Fixed Charges for the most recently completed Reference Period.

“Consolidated Fixed Charges” means, for any period, the sum of the following determined on a Consolidated basis for such period, without duplication, for Parent and its Subsidiaries in accordance with GAAP: (a) Consolidated Interest Expense paid in cash, plus (b) scheduled principal payments with respect to Indebtedness.

Section 4.Representations and Warranties. Each Credit Party hereby represents and warrants, as of the date hereof, that:

(a)before and immediately after giving effect to this Amendment, the representations and warranties contained in the Existing Credit Agreement and the representations and warranties contained in each of the other Loan Documents are true and correct in all material respects (except for any representation and warranty that is qualified by materiality or reference to Material Adverse Effect, which such representation and warranty shall be true and correct in all respects) on and as of the date hereof, as though made on and as of such date (except for any such representation and warranty that by its terms is made only as of an earlier date, which representation and warranty shall remain true and correct in all material respects as of such earlier date, except for any representation and warranty that is qualified by materiality or reference to Material Adverse Effect, which such representation and warranty shall be true and correct in all respects as of such earlier date);

(b)before and immediately after giving effect to this Amendment, no Default or Event of Default has occurred and is continuing;

(c)the execution, delivery and performance of this Amendment by such Credit Party, as applicable, are within its corporate, partnership, or limited liability company power and authority, as applicable, and have been duly authorized by all necessary corporate, partnership, or limited liability company action, as applicable;

(d)this Amendment constitutes the legal, valid and binding obligation of such Credit Party, as applicable, enforceable in accordance with its terms, except as limited by bankruptcy, insolvency, reorganization, moratorium or similar state or federal Debtor Relief Laws which affect the enforcement of creditors’ rights in general and the availability of equitable remedies;

(e)there are no governmental or other third party consents, licenses and approvals required in connection with the execution, delivery, performance, validity and enforceability of this Amendment;

(f)the Collateral is unimpaired by this Amendment and the Credit Parties have granted to the Administrative Agent a valid and perfected first priority security interest in the Collateral covered by the Security Documents, and such Liens are not subject to avoidance, subordination, recharacterization, recovery, attack, offset, counterclaim, or defense of any kind; and

(g)no action, suit, investigation or other proceeding by or before any arbitrator or any Governmental Authority is threatened or pending and no preliminary or permanent injunction or order by a state or federal court has been entered in connection with this Amendment or any other Loan Document.

Section 5.Conditions to Amendment Effective Date. This Amendment shall become effective on the Amendment Effective Date and enforceable against the parties hereto upon the occurrence of the following conditions which may occur prior to or concurrently with the closing of this Amendment:

(a)This Amendment. The Administrative Agent shall have received (i) this Amendment executed by duly authorized officers of each Borrower, each Guarantor, the Administrative Agent, the Issuing Lender and the

Required Lenders, and (ii) that certain Amendment No. 2 Fee Letter dated of even date herewith among the Borrowers and the Administrative Agent (the “Amendment Fee Letter”).

(b)Fees and Expenses. The Borrowers shall have paid all fees and expenses due and payable under the Loan Documents, including (i) the fees and expenses of the Administrative Agent’s outside legal counsel payable in accordance with Section 13.3(a) of the Existing Credit Agreement pursuant to all invoices presented for payment on or prior to the Amendment Effective Date, and (ii) the amendment fee required to be paid by Borrower under the Amendment Fee Letter for the ratable benefit of the Lenders party to this Amendment.

Section 6.Acknowledgments and Agreements.

(a)Each Credit Party acknowledges that, on the date hereof, all outstanding Obligations are payable in accordance with their terms and each Credit Party waives any defense, offset, counterclaim or recoupment (other than a defense of payment or performance) with respect thereto.

(b)Each Credit Party does hereby adopt, ratify, and confirm the Existing Credit Agreement, as amended by this Amendment, and acknowledges and agrees that the Existing Credit Agreement, as so amended, is and remains in full force and effect, and acknowledges and agrees that their respective liabilities and obligations under the Existing Credit Agreement, as so amended, the Guaranty Agreement, the Security Documents and the other Loan Documents are not impaired in any respect by this Amendment.

(c)Nothing herein shall constitute a waiver or relinquishment of (i) any Default or Event of Default under any of the Loan Documents, (ii) any of the agreements, terms or conditions contained in any of the Loan Documents, (iii) any rights or remedies of the Administrative Agent or any Lender with respect to the Loan Documents, or (iv) the rights of the Administrative Agent, the Issuing Lender, or any Lender to collect the full amounts owing to them under the Loan Documents.

(d)From and after the Amendment Effective Date, all references to the Existing Credit Agreement shall mean the Existing Credit Agreement, as amended by this Amendment. This Amendment is a Loan Document for the purposes of the provisions of the other Loan Documents.

Section 7.Reaffirmation of Security Documents. Each Credit Party (a) reaffirms the terms of and its obligations (and the security interests granted by it) under each Security Document to which it is a party, and agrees that each such Security Document will continue in full force and effect to secure the Secured Obligations as the same may be amended, extended, supplemented, or otherwise modified from time to time, and (b) acknowledges, represents, warrants and agrees that the Liens and security interests granted by it pursuant to the Security Documents are valid, enforceable and subsisting and create a security interest to secure the Secured Obligations.

Section 8.Reaffirmation of the Guaranty Agreement. Each Credit Party hereby ratifies, confirms, acknowledges and agrees that its obligations under the Guaranty Agreement are in full force and effect and that such Credit Party, as applicable, continues to unconditionally and irrevocably guarantee the full and punctual payment, when due, whether at stated maturity or earlier by acceleration or otherwise, all of the Guaranteed Obligations (as defined in the Guaranty Agreement), as such Guaranteed Obligations may have been amended, extended or modified by this Amendment, and its execution and delivery of this Amendment does not indicate or establish an approval or consent requirement by such Credit Party under the Guaranty Agreement, in connection with the execution and delivery of amendments, consents or waivers to the Credit Agreement or any of the other Loan Documents.

Section 9.Counterparts. This Amendment may be signed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which, taken together, constitute one and the same agreement. Delivery of an executed counterpart of a signature page of this Amendment by facsimile or by e-mail “PDF” copy shall be effective as delivery of a manually executed counterpart of this Amendment.

Section 10.Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns permitted pursuant to the Credit Agreement.

Section 11.Invalidity. In the event that any one or more of the provisions contained in this Amendment shall be held invalid, illegal or unenforceable in any respect under any applicable law, the validity, legality, and enforceability of the remaining provisions contained herein shall not be affected or impaired thereby.

Section 12.Governing Law. This Amendment and any claim, controversy, dispute or cause of action (whether in contract or tort or otherwise) based upon, arising out of or relating to this Amendment or any other Loan Document (except, as to any other Loan Document, as expressly set forth therein) and the transactions contemplated hereby and thereby shall be governed by, and construed in accordance with, the law of the State of New York.

Section 13.Entire Agreement. THIS WRITTEN AGREEMENT AND THE OTHER LOAN DOCUMENTS REPRESENT THE FINAL AGREEMENT AMONG THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES.

THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG THE PARTIES.

[SIGNATURES BEGIN ON NEXT PAGE]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective officers thereunto duly authorized as of the day and year first above written.

| | | | | | | | | | | |

| | BORROWERS: |

| | | |

| | ADAMS RESOURCES & ENERGY, INC. |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Executive Vice President, Chief Financial Officer, and Treasurer |

| | | |

| | GULFMARK ASSET HOLDINGS, LLC |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Chief Financial Officer and Treasurer |

| | | |

| | SERVICE TRANSPORT COMPANY |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Chief Financial Officer |

| | | |

Signature Page to Amendment No. 2 to Credit Agreement (Adams Resources & Energy, Inc.)

| | | | | | | | | | | |

| | GUARANTORS: |

| | ARE CAPTIVE, INC. |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Vice President and Treasurer |

| | | |

| | ADAMS RESOURCES MEDICAL MANAGEMENT, INC. |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | President |

| | | |

| | VICTORIA EXPRESS PIPELINE, L.L.C. |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Chief Financial Officer |

| | | |

| | GULFMARK TERMINALS, LLC |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Chief Financial Officer |

| | | |

| | GULFMARK ENERGY, INC. |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Chief Financial Officer |

| | | |

| | RED RIVER VEHICLE HOLDINGS LLC |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Chief Financial Officer |

| | | |

Signature Page to Amendment No. 2 to Credit Agreement (Adams Resources & Energy, Inc.)

| | | | | | | | | | | |

| | FIREBIRD BULK CARRIERS, INC. |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Secretary and Treasurer |

| | | |

| | PHOENIX OIL, INC. |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | Secretary and Treasurer |

| | | |

| | ADA CRUDE OIL COMPANY |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | President |

| | | |

| | ADA MINING CORPORATION |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | President and Treasurer |

| | | |

| | ADA RESOURCES, INC. |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | President and Chief Financial Officer |

| | | |

| | CLASSIC COAL CORPORATION |

| | By: | /s/ Tracy E. Ohmart |

| | Name: | Tracy E. Ohmart |

| | Title: | President and Treasurer |

| | | |

Signature Page to Amendment No. 2 to Credit Agreement (Adams Resources & Energy, Inc.)

| | | | | | | | | | | |

| | ADMINISTRATIVE AGENT AND LENDER: |

| | CADENCE BANK, |

| | as Administrative Agent, Issuing Lender, and Lender |

| | By: | /s/ Emily Loomis |

| | Name: | Emily Loomis |

| | Title: | Senior Vice President |

| | | |

Signature Page to Amendment No. 2 to Credit Agreement (Adams Resources & Energy, Inc.)

| | | | | | | | | | | |

| | LENDERS: |

| | VERITEX COMMUNITY BANK |

| | |

| | By: | /s/ Michael Martin |

| | Name: | Michael Martin |

| | Title: | Executive Vice President |

| | | |

Signature Page to Amendment No. 2 to Credit Agreement (Adams Resources & Energy, Inc.)

| | | | | | | | | | | |

| | |

| | ORIGIN BANK |

| | |

| | By: | /s/ John Henderson |

| | Name: | John Henderson |

| | Title: | Vice President |

| | | |

Signature Page to Amendment No. 2 to Credit Agreement (Adams Resources & Energy, Inc.)

| | | | | | | | | | | |

| | |

| | CENTURY BANK |

| | |

| | By: | /s/ Martin Gonzalez |

| | Name: | Martin Gonzalez |

| | Title: | Vice President |

| | | |

Signature Page to Amendment No. 2 to Credit Agreement (Adams Resources & Energy, Inc.)

| | | | | | | | | | | |

| | |

| | AMERANT BANK |

| | |

| | By: | |

| | Name: | |

| | Title: | |

| | | |

Signature Page to Amendment No. 2 to Credit Agreement (Adams Resources & Energy, Inc.)

Cover Page

|

Jul. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 16, 2024

|

| Entity Registrant Name |

ADAMS RESOURCES & ENERGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-7908

|

| Entity Tax Identification Number |

74-1753147

|

| Entity Address, Address Line One |

17 South Briar Hollow Lane

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77027

|

| City Area Code |

713

|

| Local Phone Number |

881-3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

AE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000002178

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

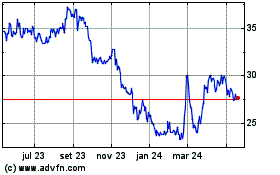

Adams Resources and Energy (AMEX:AE)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

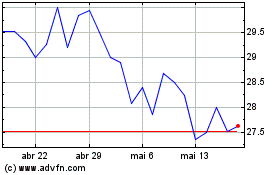

Adams Resources and Energy (AMEX:AE)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024